Nevada Withdrawal of Partner

Description

How to fill out Withdrawal Of Partner?

US Legal Forms - one of the largest repositories of legal documents in the USA - offers a vast selection of legal document templates that you can download or print. By using the website, you can acquire thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can quickly access the latest versions of documents such as the Nevada Withdrawal of Partner. If you already have a subscription, Log In and retrieve the Nevada Withdrawal of Partner from the US Legal Forms library. The Download button appears on each document you view. You can also access all previously stored forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are some simple steps to help you get started: Ensure you’ve selected the correct form for your city/region. Click the Preview button to review the content of the form. Check the form outline to confirm that you have picked the right document.

Every template you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the document you need.

Access the Nevada Withdrawal of Partner with US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal requirements.

- If the form does not satisfy your needs, use the Search field at the top of the page to find one that does.

- If you are satisfied with the document, confirm your selection by clicking the Purchase now button.

- Then, choose your preferred pricing plan and enter your details to register for an account.

- Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Select the format and download the document to your device.

- Make adjustments. Fill out, modify, print, and sign the saved Nevada Withdrawal of Partner.

Form popularity

FAQ

Yes, Nevada does have partnership filing requirements, but they may vary depending on your partnership type. General partnerships do not need to file with the state, while limited partnerships must file a certificate of limited partnership. Furthermore, understanding these requirements is essential for anyone navigating the Nevada Withdrawal of Partner, as proper compliance can help avoid legal complications. Utilizing resources like US Legal Forms can streamline the process and ensure you meet all necessary obligations.

Whether your partnership dissolves upon the withdrawal of a partner in Nevada depends on the terms outlined in your partnership agreement. If the agreement specifies that a partner's exit triggers dissolution, then yes, the partnership will dissolve. However, if the agreement allows for other partners to continue after a withdrawal, the partnership can remain intact. Consider reviewing your partnership agreement and possibly consulting legal advice to navigate the Nevada Withdrawal of Partner process.

To change ownership of your business, first review your business structure to determine the steps needed. This may involve drafting new agreements, informing clients and vendors, and possibly submitting forms to state authorities. In cases of Nevada Withdrawal of Partner, it's crucial to officially document the transition and communicate openly with your team. Utilizing platforms like uslegalforms can simplify the paperwork and ensure compliance.

Changing ownership of an LLC in Nevada begins with updating your operating agreement to reflect the new ownership structure. After a Nevada Withdrawal of Partner, you must inform the state by filing the appropriate forms and paying any necessary fees. Additionally, ensure that all members of the LLC agree to the changes to maintain clarity and avoid disputes. Using uslegalforms can help streamline the documentation process.

Terminating a domestic partnership in Nevada involves filing a termination declaration with the Secretary of State. This process ensures that you complete the legal requirements after a Nevada Withdrawal of Partner. You may need to divide shared property and debts as part of the termination process. For accurate guidance, consider seeking legal assistance to navigate the specifics.

To change ownership of an LLC with the IRS, you need to update your LLC's information on Form 8832. This step is essential when you experience a Nevada Withdrawal of Partner or welcome a new member. Additionally, inform the IRS about the changes by providing the name, address, and tax identification number of the new owners. It's helpful to consult with a tax professional to ensure you comply with all requirements.

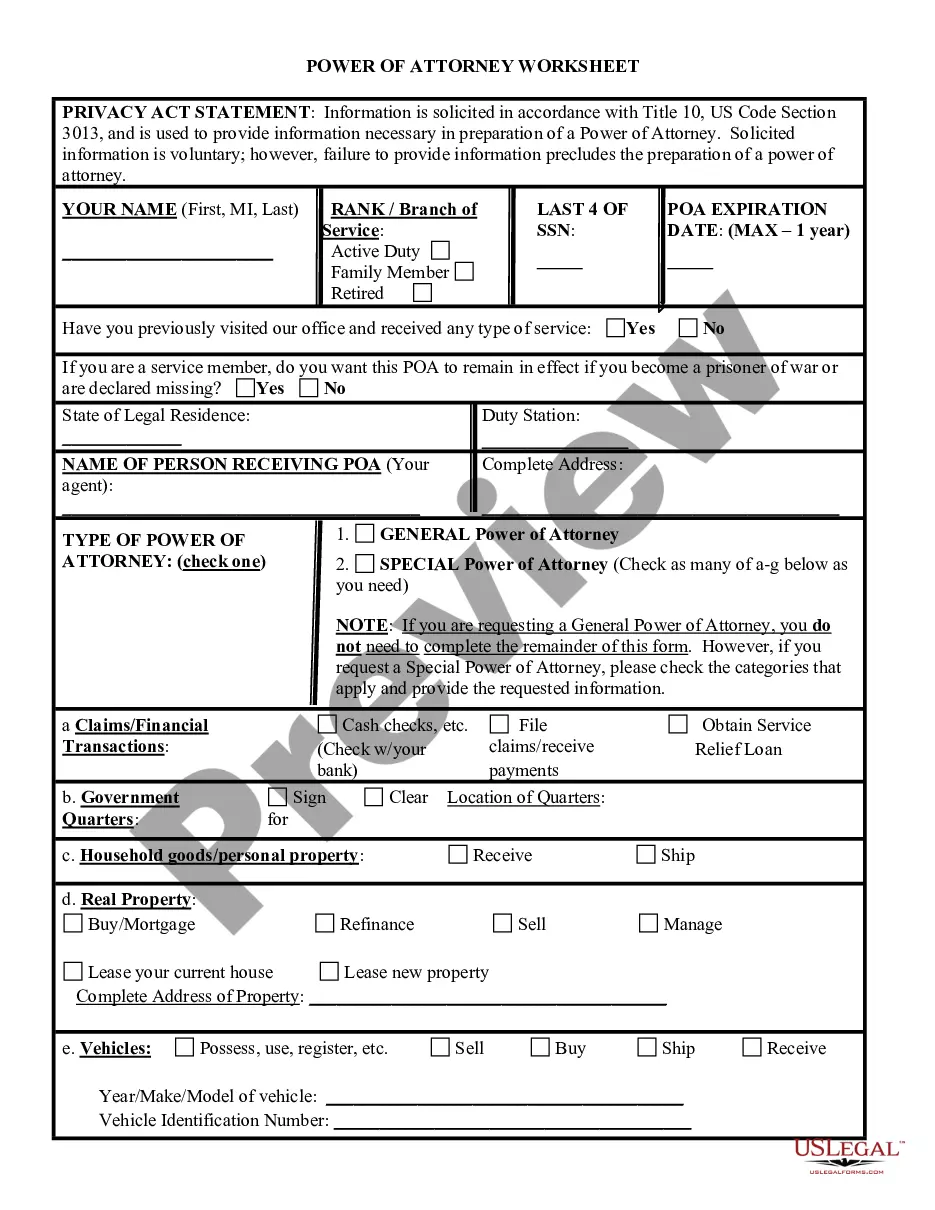

Filling out a partnership form typically requires basic information about each partner, including names, addresses, and the partnership’s purpose. This form plays a crucial role in the Nevada Withdrawal of Partner proceedings. Make sure to provide accurate details to prevent any delays. Uslegalforms offers comprehensive resources to guide you through this process smoothly.

Canceling a Nevada LLC involves filing the Articles of Dissolution with the Secretary of State. This is an important aspect of your Nevada Withdrawal of Partner journey. Ensure that all business taxes and debts are settled beforehand, as this will streamline the cancellation process. It's beneficial to consult a legal expert to navigate this effectively.

To cancel your LLC in Nevada, you need to complete and submit the Articles of Dissolution to the Secretary of State. This act signifies the formal end of your business entity and is a vital part of the Nevada Withdrawal of Partner process. Additionally, make sure to wrap up financial obligations and notify all relevant stakeholders. Clear communication helps in avoiding misunderstandings during this transition.

To officially close an LLC, you must follow a series of steps, including filing Articles of Dissolution with the Nevada Secretary of State. This is a critical part of the Nevada Withdrawal of Partner procedure. After filing, ensure that you notify all creditors and settle any outstanding debts. It's also wise to maintain records of all transactions related to the dissolution.