Nevada Retirement Cash Flow

Description

How to fill out Retirement Cash Flow?

If you wish to acquire, secure, or create legitimate document templates, utilize US Legal Forms, the top collection of legal documents available online.

Employ the site's straightforward and user-friendly search to locate the documents you require. A range of templates for commercial and personal purposes are organized by categories and jurisdictions, or keywords.

Use US Legal Forms to obtain the Nevada Retirement Cash Flow with just a few clicks.

Every legal document template you purchase belongs to you forever. You have access to every document you downloaded in your account. Click the My documents section and choose a document to print or download again.

Complete and download, and print the Nevada Retirement Cash Flow using US Legal Forms. There are countless professional and state-specific templates available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to access the Nevada Retirement Cash Flow.

- You can also retrieve documents you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow these instructions.

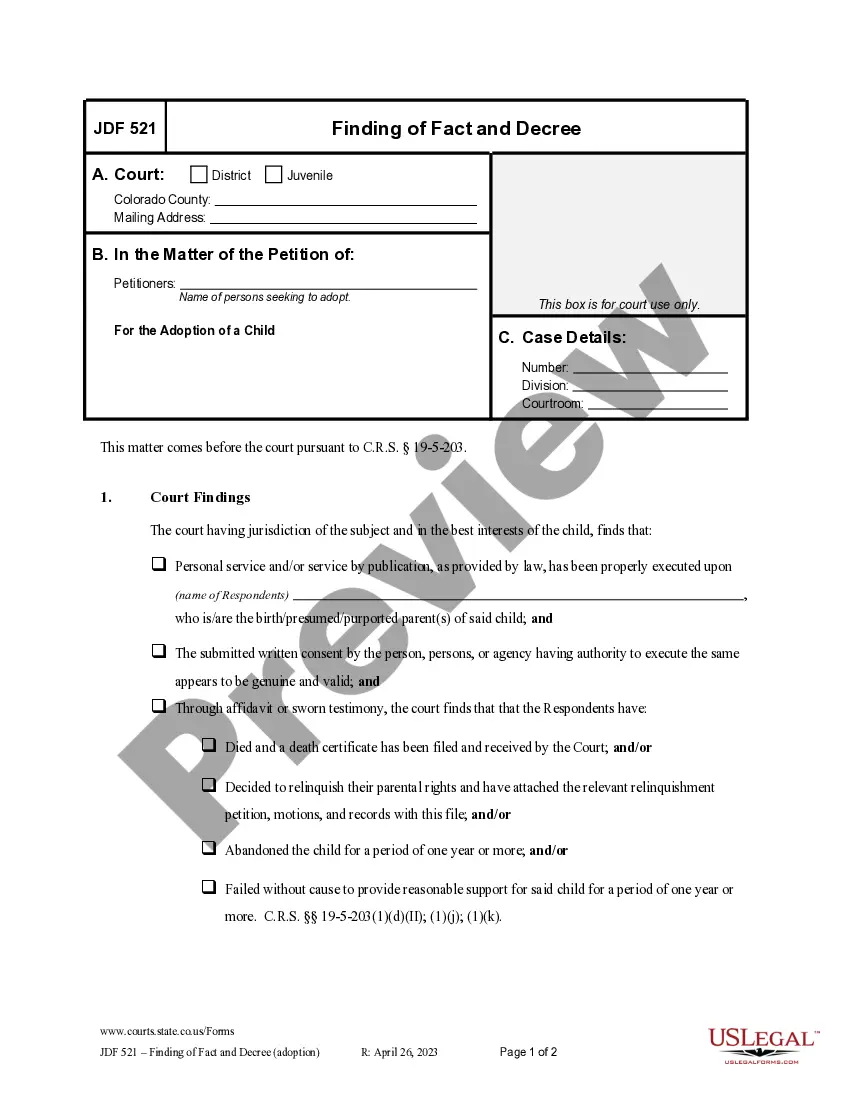

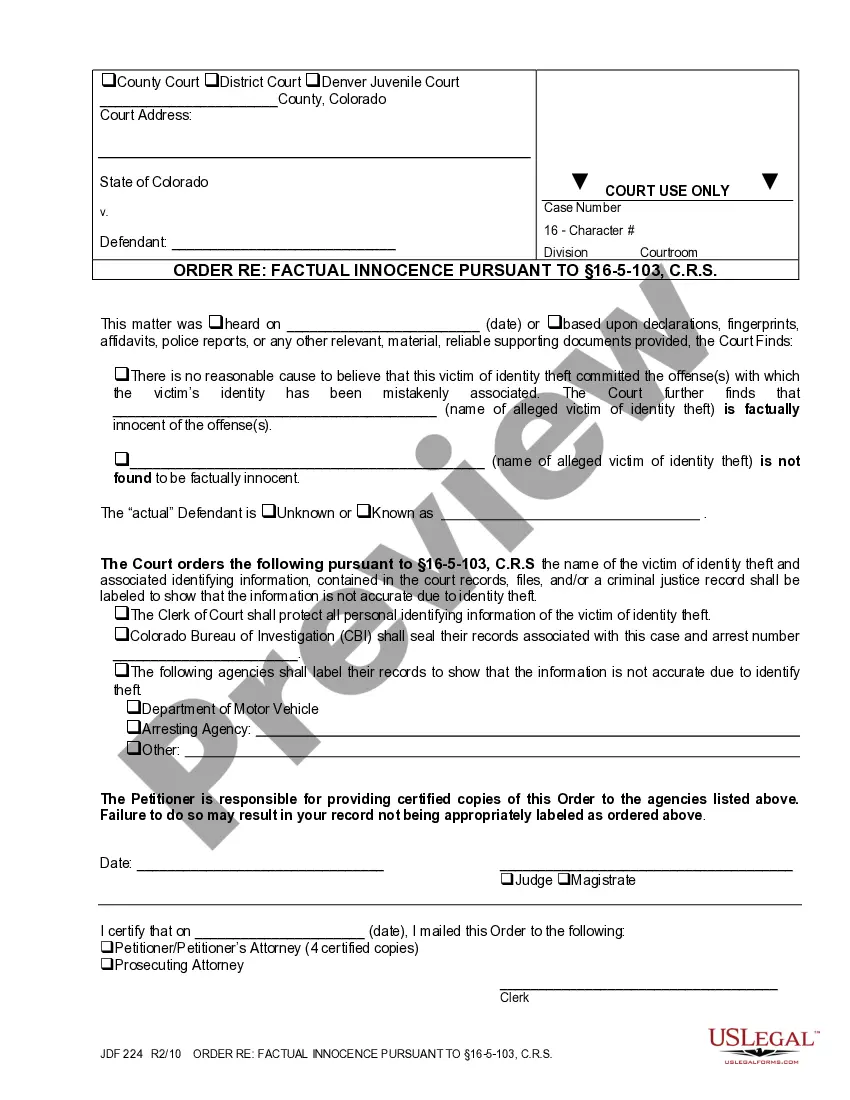

- Step 1. Ensure you’ve selected the form for the correct city/state.

- Step 2. Use the Preview button to review the document's content. Be sure to read the description.

- Step 3. If you are not satisfied with the document, utilize the Search field at the screen's top to find alternative versions of the legal document template.

- Step 4. Once you have located the required form, click on the Purchase now button. Choose the pricing plan that suits you and provide your details to create an account.

- Step 5. Complete the transaction. You can use your Мisa, Ьastercard, or PayPal account to finalize the payment.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Nevada Retirement Cash Flow.

Form popularity

FAQ

A lifetime benefit is paid to the spouse or registered domestic partner or survivor beneficiary with or without additional payees. Dependent children are paid their benefit until they reach age 18 or 23 if they remain unmarried, full-time students.

While you may have the ability to access some of your investments, such as a 401(k), this isn't possible for the funds in your CalPERS pension account. There is only one instance where you can access your CalPERS pension contributions when you leave CalPERS employment.

If you contribute under the employee/ employer contribution plan, you may withdraw your employee contributions if you terminate all employment for which a contribution is required or if you are employed in a position ineligible for membership for at least 90 days.

2019 POPULAR ANNUAL FINANCIAL REPORT The fair value of PERS' investment assets at the end of fiscal year 2019 was $43.8 billion.

Part-time members of PERS earn service credit based on the percentage of full-time hours they work. For example, if you work exactly half-time for one calendar year, you earn six months of service credit. However, special vesting rules apply for part-time employees.

The funded ratio increased to 75.3% as of June 30, 2019, compared to a funding ratio of 75.1% as of June 30, 2018. The funded ratio of PERS has been relatively stable during the volatile market cycle.

Once CalPERS membership is terminated, you no longer are entitled to any CalPERS benefits, including retirement. You are eligible for a refund only if you are not entering employment with another CalPERS-covered employer. Applicable state and federal taxes will be withheld from your refund.

Vesting is a term that refers to how long you must work in order to have the right to pension under the system. In Nevada, a worker must have worked for five years in order to be vested in the system and get a retirement pension.

You and your employer share equally in the contribution to PERS, currently 15.50% each. Your after tax contribution is refundable upon termination of employment, if you do not elect to receive a monthly retirement benefit.