Nevada General Form of Application for Warehouse License

Description

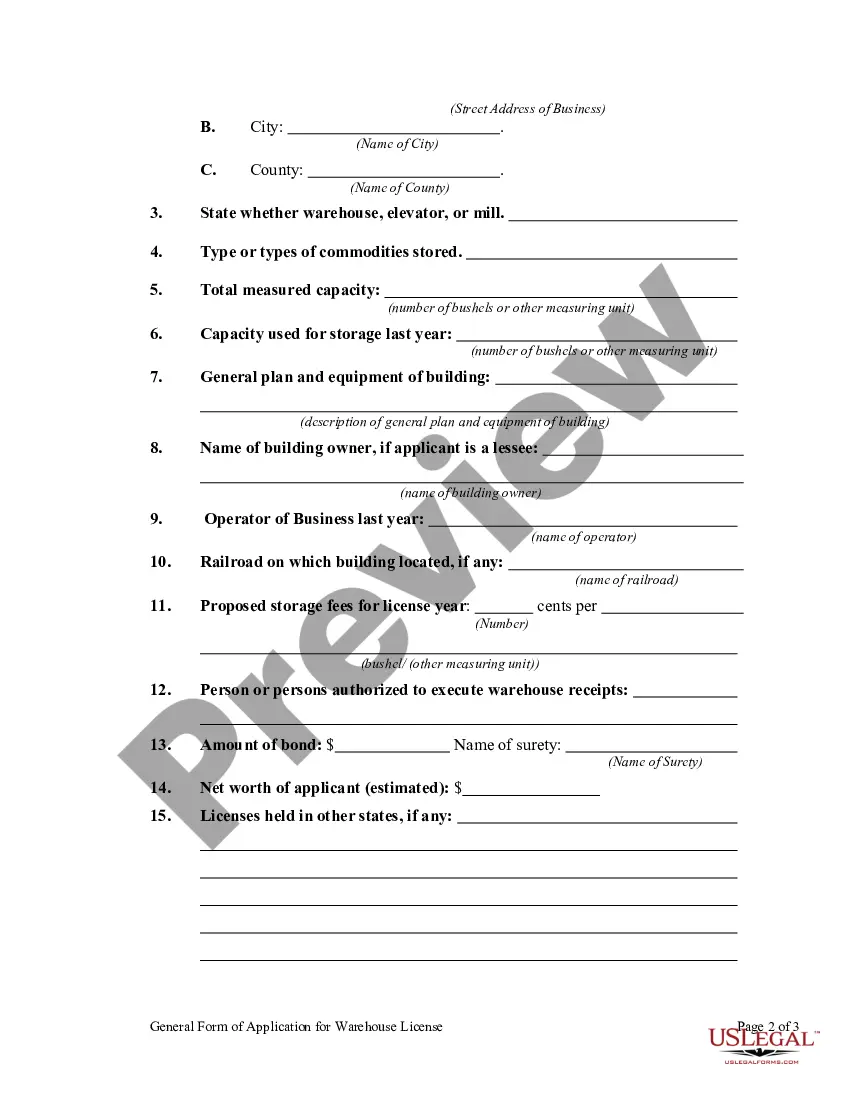

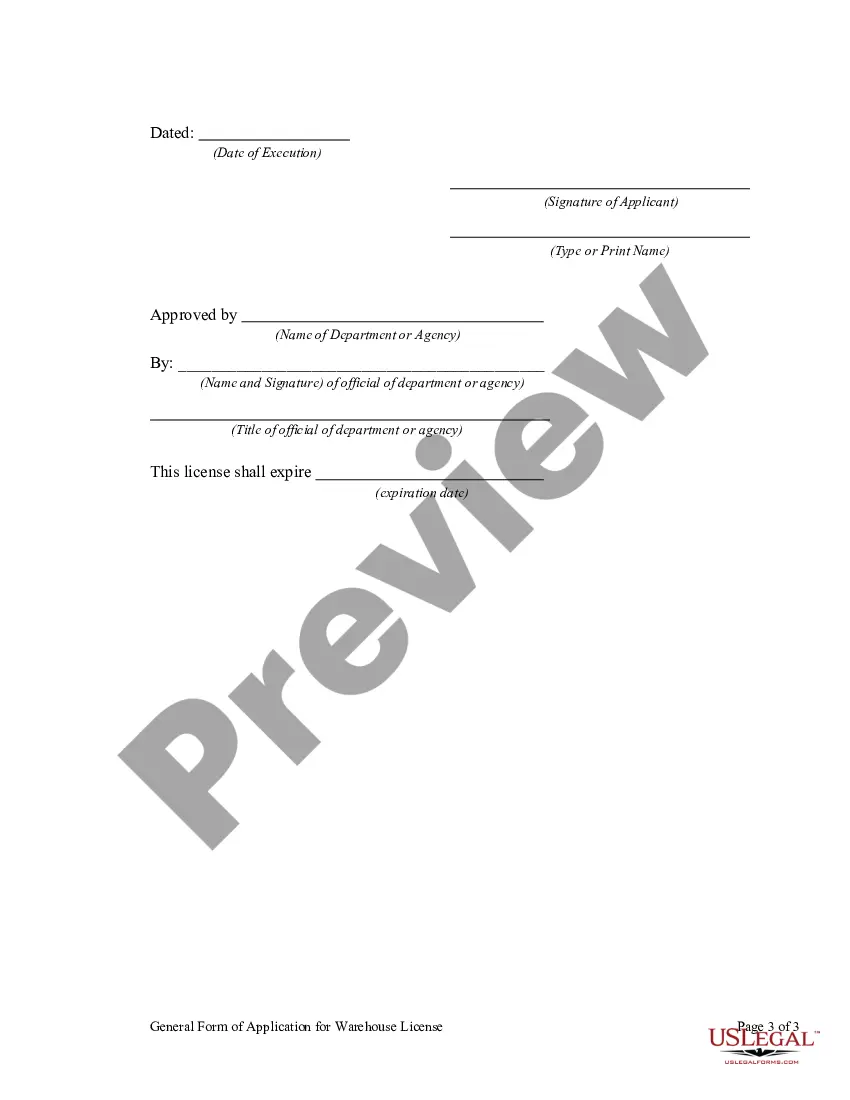

How to fill out General Form Of Application For Warehouse License?

If you wish to compile, acquire, or create authentic legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site's user-friendly and accessible search function to locate the documents you require.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Select your preferred payment plan and provide your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to obtain the Nevada General Form of Application for Warehouse License in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Nevada General Form of Application for Warehouse License.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review function to check the form's contents. Be sure to read the details.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

The time it takes to receive your contractor's license in Nevada can vary based on multiple factors. After submitting the Nevada General Form of Application for Warehouse License, the processing time may range from several weeks to a few months. This duration depends on the completeness of your application and the current workload of the licensing board. It's wise to follow up periodically to ensure your application is on track.

To acquire your contractor's license in Nevada, you must complete the Nevada General Form of Application for Warehouse License as part of the process. This application requires information on your business experience, financial status, and any relevant insurance coverage. Once you submit the application, you may need to pass a licensing exam. Remember to review all requirements and ensure you maintain compliance with state regulations.

To obtain a Nevada state business license, you need to complete the Nevada General Form of Application for Warehouse License, among other necessary documents. Start by determining the type of business entity you plan to establish. After gathering required information, you can submit your application through the Nevada Secretary of State’s office, either online or by mail. Additional fees may apply depending on your business type and location.

Steps for Obtaining a Business License in NevadaOPTION 1: Apply Online With Nevada SilverFlume.OPTION 2: Apply by Mail, by Fax, or in Person.Fee: $200 (does not include formation fees)Filing Addresses: Secretary of State. Commercial Recordings Division. 202 North Carson Street. Carson City, NV 89701.Fax: (775) 684-5725.

A seller's permit can be obtained by registering through SilverFlume (State of Nevada Business Portal) or by mailing in Nevada Business Registration Form. Information needed to register includes: Type of business entity: Sole Proprietorship, Partnership, Corporation, Limited Liability Company (LLC)

For sole proprietors and partnerships, a State Business License application can be filed online at , or submitted by mail, fax, or in-person at one of our two office locations in Carson City or Las Vegas and filed while you wait.

The cost to start a Nevada limited liability company (LLC) online is $425. This fee is paid to the Nevada Secretary of State when filing the LLC's Articles of Organization.

Is a DBA the same as a business license? In short, no. A DBA is required only if you wish to conduct business under a name other than your own name, where as a business license will be required by all businesses who wish to operate within a particular county.

Doing business as (DBA) refers to businesses that operate under a fictitious name, while limited liability company (LLC) refers to legal entities that are entirely separate from business owners. LLCs offer far more legal protections to business owners than DBAs do.

What does DBA mean? DBA stands for doing business as. It's also referred to as your business's assumed, trade or fictitious name. Filing for a DBA allows you to conduct business under a name other than your own; your DBA is different from your name as the business owner, or your business's legal, registered name.