Nevada Officers Salary - Resolution Form - Corporate Resolutions

Description

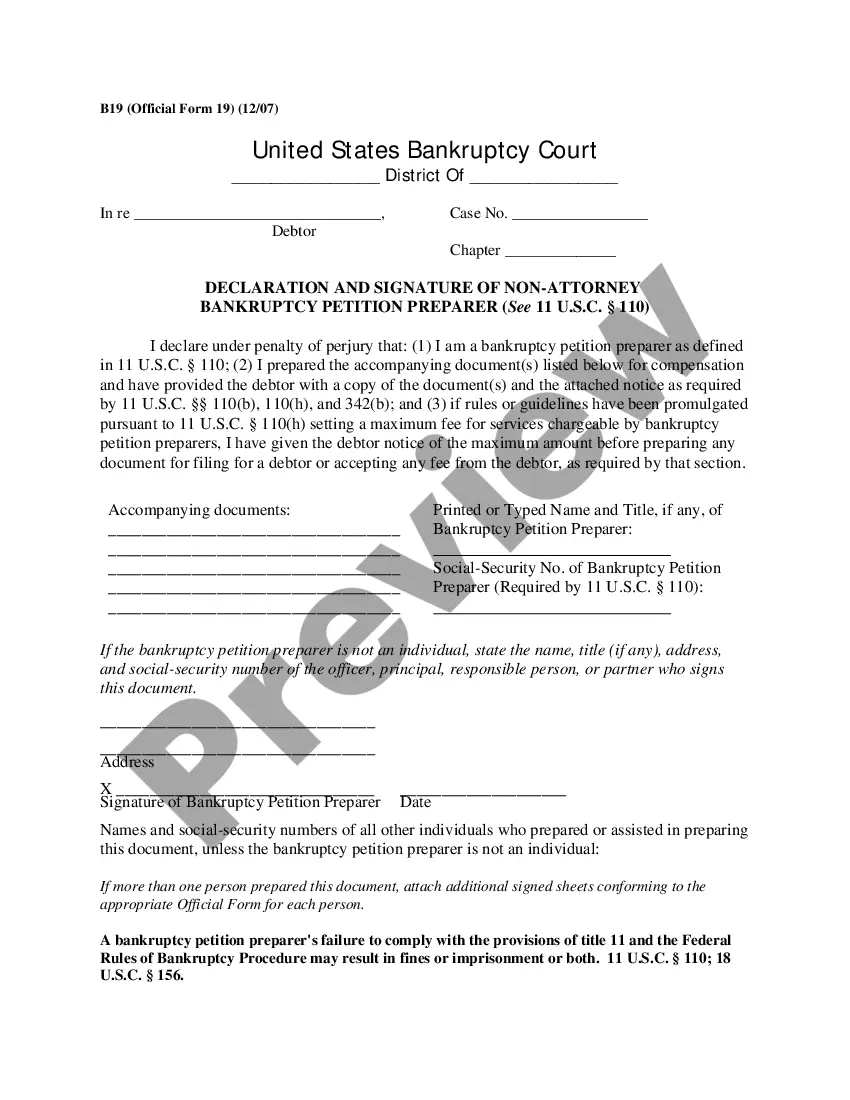

How to fill out Officers Salary - Resolution Form - Corporate Resolutions?

You can dedicate hours online looking for the legal document template that complies with the state and federal regulations you need.

US Legal Forms offers a vast array of legal forms that have been evaluated by experts.

You can easily download or print the Nevada Officers Salary - Resolution Form - Corporate Resolutions from my services.

If you wish to find another version of the form, use the Search field to locate the template that meets your needs and requirements.

- If you have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can fill out, modify, print, or sign the Nevada Officers Salary - Resolution Form - Corporate Resolutions.

- Each legal document template you obtain is yours for an indefinite time.

- To retrieve another copy of a purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your area/location of preference. Check the form description to confirm you have selected the right form.

- If available, use the Preview button to view the document template as well.

Form popularity

FAQ

A director's resolution for signing authority is a formal decision made by a company's board to grant certain powers to directors or executives. This resolution usually outlines who can sign contracts, manage financial transactions, and represent the company legally. It serves to enhance accountability and ensures clear communication within the organization. Use the Nevada Officers Salary - Resolution Form - Corporate Resolutions available on our platform to draft this essential document efficiently.

A corporate resolution for signing authority is a document that explicitly designates individuals who have the right to sign documents on behalf of a corporation. These resolutions define roles, responsibilities, and limits of authority, minimizing the risks of misunderstandings. With a corporate resolution in place, your business operations can run smoothly and without interruption. Our platform offers the Nevada Officers Salary - Resolution Form - Corporate Resolutions to help you establish this important document.

Signing authority refers to the legal power given to individuals to sign documents and make decisions for a business or organization. This authority ensures that contracts, agreements, and other official paperwork can be executed correctly and validly. Establishing clear signing authority helps prevent unauthorized actions that could harm the corporate entity. You can create a solid framework for this through the Nevada Officers Salary - Resolution Form - Corporate Resolutions.

A board resolution for a corporate account is a record of a decision made by the board of directors concerning the management of corporate accounts. This resolution specifies the individuals authorized to conduct transactions and manage finances on behalf of the corporation. Having a clear board resolution can prevent disputes and streamline business operations. Our services provide a Nevada Officers Salary - Resolution Form - Corporate Resolutions to assist you in this area.

Proof of signing authority is evidence that supports an individual's capacity to act on behalf of a corporation in legal and financial matters. This proof is often shown through corporate resolutions or official documents that indicate who has been granted authority. This is essential for maintaining transparency and trust with third parties. Utilize our Nevada Officers Salary - Resolution Form - Corporate Resolutions to establish this proof effortlessly.

A corporate resolution showing signing authority is a formal document that indicates who has the power to sign on behalf of a corporation. This resolution outlines the specific individuals authorized to execute contracts and other legal documents. By documenting these powers, businesses ensure clarity in operations and compliance. You can easily obtain a Nevada Officers Salary - Resolution Form - Corporate Resolutions through our platform.

A corporate resolution for authorized signers is a formal document that outlines the individuals allowed to act on behalf of the corporation in specific matters. It is typically used for banking activities, contract signings, and other significant decisions within the company. This resolution helps establish clear authority and accountability among corporate officers. Having a structured approach will help you manage the Nevada Officers Salary - Resolution Form - Corporate Resolutions effectively.

To change an LLC to an S corporation in Nevada, first, ensure your LLC meets the S corporation eligibility criteria. This involves filing the appropriate paperwork with the state and completing IRS Form 2553 to elect S corporation status. You may also need to amend your operating agreement to reflect the new corporate structure. Utilizing platforms like US Legal Forms can simplify this process, particularly when handling the Nevada Officers Salary - Resolution Form - Corporate Resolutions.

To file for an S corporation in Nevada, you begin by forming a regular C corporation and then elect S corporation status using IRS Form 2553. It is essential to meet the qualifications outlined by the IRS, including having no more than 100 shareholders. Ensure that you also comply with state requirements, as they may differ. Resources like US Legal Forms can assist you with the Nevada Officers Salary - Resolution Form - Corporate Resolutions, making the process more manageable.

An S corporation in Nevada provides several advantages, such as pass-through taxation, which helps avoid double taxation on corporate income. Additionally, it offers personal liability protection for owners, safeguarding their personal assets from business debts. This structure can also enhance credibility with customers and lenders. Overall, understanding the Nevada Officers Salary - Resolution Form - Corporate Resolutions can streamline your compliance and operational strategies.