Nevada Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions

Description

How to fill out Borrow Money On Promissory Note - Resolution Form - Corporate Resolutions?

If you desire to accumulate, acquire, or print legal document models, utilize US Legal Forms, the leading source of legal forms, available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you need.

Numerous templates for business and personal purposes are organized by categories and suggestions, or keywords.

Each legal document template you purchase is yours permanently.

You have access to every form you acquired within your account. Click on the My documents section and choose a form to print or download again.

- Utilize US Legal Forms to obtain the Nevada Borrow Funds on Promissory Note - Resolution Form - Corporate Resolutions in just a few clicks.

- If you are an existing US Legal Forms client, Log In to your account and select the Acquire option to get the Nevada Borrow Funds on Promissory Note - Resolution Form - Corporate Resolutions.

- You can also access forms you have previously acquired from the My documents tab in your account.

- If you are a first-time user of US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

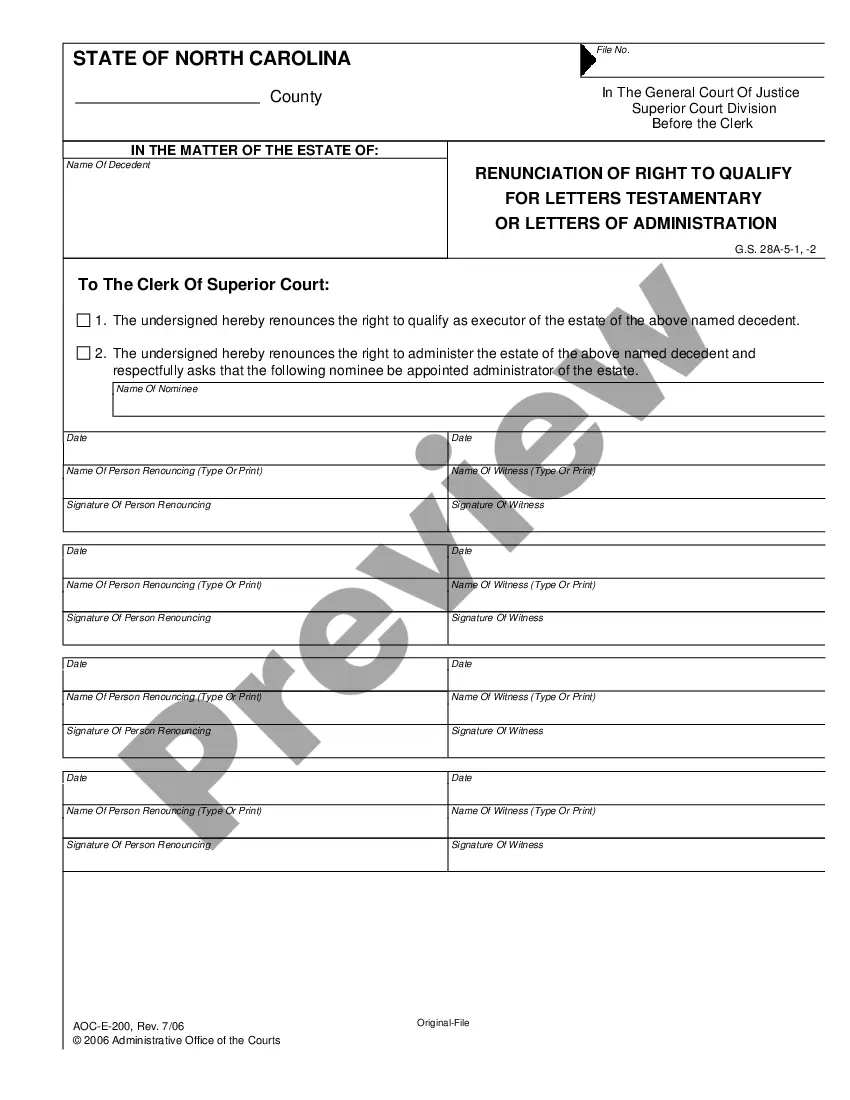

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now option. Choose your preferred payment method and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it on your device.

- Step 7. Fill out, edit, and print or sign the Nevada Borrow Funds on Promissory Note - Resolution Form - Corporate Resolutions.

Form popularity

FAQ

SBA Form 160, Resolution of Board of Directors is a form issued by the Small Business Administration (SBA) and filed with SBA Business Expansion loans - including Direct, Guaranteed, or Participation loans.

Use this form to designate additional authorized individuals to act on behalf of the Licensee.

A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances. Corporate resolutions provide a paper trail of the decisions made by the board and the executive management team.

A corporate resolution that authorizes borrowing on a line of credit is often referred to a borrowing resolution. This resolution indicates that the members (LLC) or Board of Directors (Corporation) have held a meeting and conducted a vote allowing the company to borrow a specific loan amount.

What to Include in a Corporate Resolution FormThe date of the resolution.The state in which the corporation is formed and under whose laws it is acting.Signatures of officers designated to sign corporate resolutionsusually the board chairperson or the corporate secretary.Title the document with its purpose.More items...?

Name of the lender from whom they will borrow sums of money. Signature of authorized member/director that will execute and endorse all such documents required by said bank as well as agreement to perform all acts and sign all agreements and obligations required by said bank. The state where the business is formed.

A corporate resolution is a written document created by the board of directors of a company detailing a binding corporate action. A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances.

Corporate resolution (also known as a board resolution) is a written legal document, issued by the board of directors of a corporation, documenting a binding decision made on behalf of the corporation.

A granted authority that will put a firm into debt that is passed by a resolution of stock holders.

A corporate resolution that authorizes borrowing on a line of credit is often referred to a borrowing resolution. This resolution indicates that the members (LLC) or Board of Directors (Corporation) have held a meeting and conducted a vote allowing the company to borrow a specific loan amount.