Nevada Corporate Resolution Authorizing a Charitable Contribution

Description

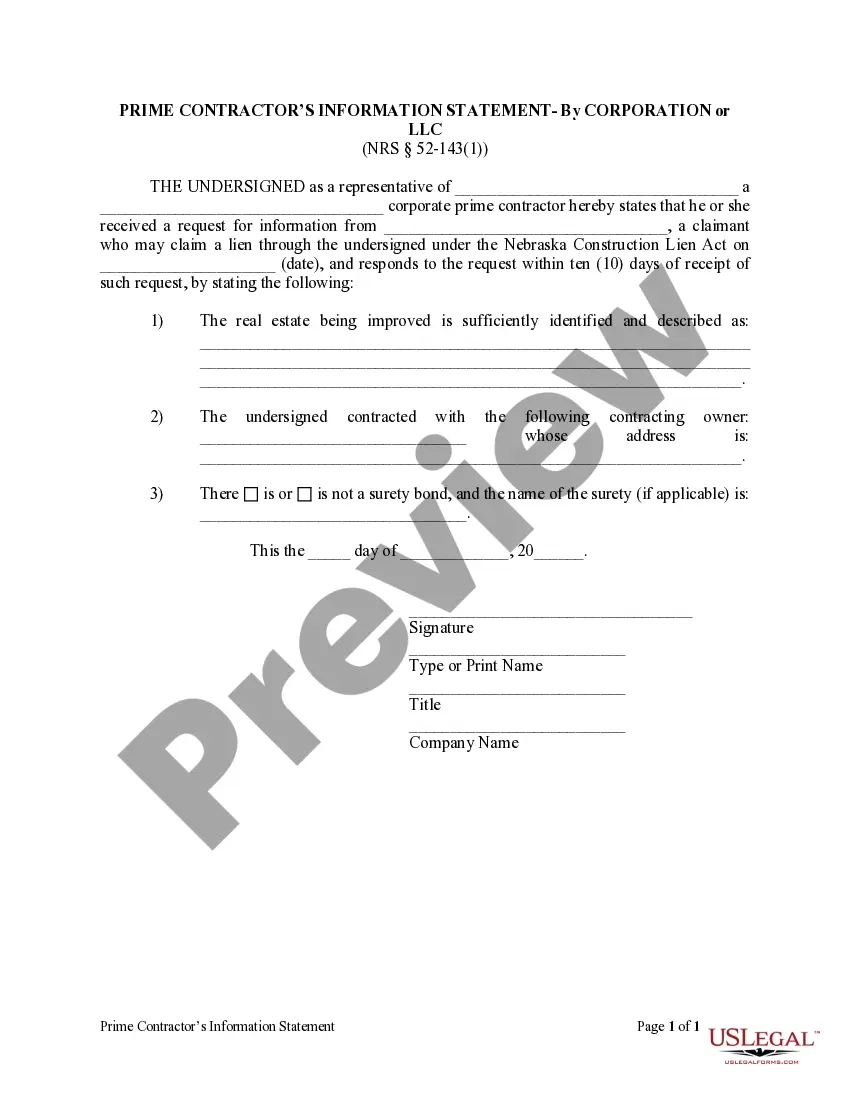

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution.

How to fill out Corporate Resolution Authorizing A Charitable Contribution?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a variety of legal document formats that you can download or print.

By using the website, you can find thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can acquire the latest versions of forms such as the Nevada Corporate Resolution Authorizing a Charitable Contribution within seconds.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose the payment plan you prefer and enter your details to register for an account.

- If you already have a membership, Log In to download the Nevada Corporate Resolution Authorizing a Charitable Contribution from your US Legal Forms library.

- The Download button will appear on every document you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the appropriate form for your city/state.

- Click the Review option to view the form's details.

Form popularity

FAQ

To establish a non-profit organization in Nevada, you need to follow a series of steps, including selecting a unique name, filing Articles of Incorporation, and applying for tax-exempt status with the IRS. Creating a Nevada Corporate Resolution Authorizing a Charitable Contribution is an important part of the governing process once your organization is set up. USLegalForms offers templates and guidance to help streamline the incorporation process, ensuring you meet all state and federal requirements.

Yes, non-profits in Nevada are required to obtain a business license, similar to for-profit entities. This requirement ensures that all organizations, including those planning a Nevada Corporate Resolution Authorizing a Charitable Contribution, operate legally within the state. Failing to obtain the necessary licenses can lead to fines and penalties. You can explore USLegalForms for information on acquiring the right licenses and ensuring compliance.

The term '990' refers to the IRS form that tax-exempt organizations in the U.S. must complete each year to provide transparency about their financial operations. It is crucial for maintaining tax-exempt status and for informing the public about how funds are allocated. When drafting a Nevada Corporate Resolution Authorizing a Charitable Contribution, knowing how to report those contributions on Form 990 is vital for compliance. You can find resources on USLegalForms to guide you through this process.

Form 990 is an essential document that non-profit organizations in the United States file annually with the IRS. This form provides detailed financial information, including revenue, expenses, and governance practices. If you plan to make charitable contributions, understanding Form 990 will help ensure that your Nevada Corporate Resolution Authorizing a Charitable Contribution aligns with the IRS requirements. Using platforms like USLegalForms can simplify the process of preparing and filing Form 990.

To start a 501c3 in Nevada, you first need to develop a clear mission statement and gather a board of directors. Prepare your Articles of Incorporation, making sure they include specific language required for 501c3 status. After filing with the state, you must create bylaws and hold an organizational meeting. Don’t forget to establish a Nevada Corporate Resolution Authorizing a Charitable Contribution to ensure your organization’s commitment to charitable work is clear and formal.

Amending the Articles of Incorporation in Nevada involves several clear steps. Begin by drafting the proposed amendment, which may include changes like the organization's name or purpose. You'll then need to obtain approval from your board and potentially the members of the organization, followed by filing the amended Articles of Incorporation with the Secretary of State. If your amendment includes a Nevada Corporate Resolution Authorizing a Charitable Contribution, ensure it is documented properly.

To form a 501c3 in Nevada, start by choosing a unique name for your organization that complies with state regulations. Next, prepare and file your Articles of Incorporation with the Nevada Secretary of State, ensuring they contain provisions for a charitable purpose. A Nevada Corporate Resolution Authorizing a Charitable Contribution may also be necessary to outline your organization's commitment to charitable activities. Finally, file for tax-exempt status with the IRS to complete your formation.

In Nevada, a corporation is required to appoint at least one officer, although it is common to have more. These typically include the roles of president, secretary, and treasurer. Having clearly defined officers is essential for drafting a Nevada Corporate Resolution Authorizing a Charitable Contribution, as these individuals will be responsible for implementing and overseeing the approved charitable activities.

Section 78.315 of the Nevada General Corporation Law outlines the powers and responsibilities assigned to corporate officers. This section is significant because it clarifies the authority that officers have when making decisions, including those related to charitable contributions. A Nevada Corporate Resolution Authorizing a Charitable Contribution must align with these guidelines to ensure valid execution.

Every corporation must have at least three key officers: a president, a secretary, and a treasurer. These officers are essential for the overall management and compliance of the corporation. When authorizing any charitable contribution, including through a Nevada Corporate Resolution Authorizing a Charitable Contribution, these officers ensure that the actions align with both corporate goals and legal requirements.