Nevada Loan Agreement - Long Form

Description

How to fill out Loan Agreement - Long Form?

Have you found yourself in a scenario that requires documentation for either business or personal purposes almost every day.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Nevada Loan Agreement - Long Form, designed to meet federal and state regulations.

Once you find the correct document, click Buy now.

Select the payment plan you prefer, fill in the required information to set up your account, and complete your purchase using PayPal or a credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can download another copy of the Nevada Loan Agreement - Long Form at any time, if necessary. Simply go through the required document to download or print the template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers properly crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Nevada Loan Agreement - Long Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct region/state.

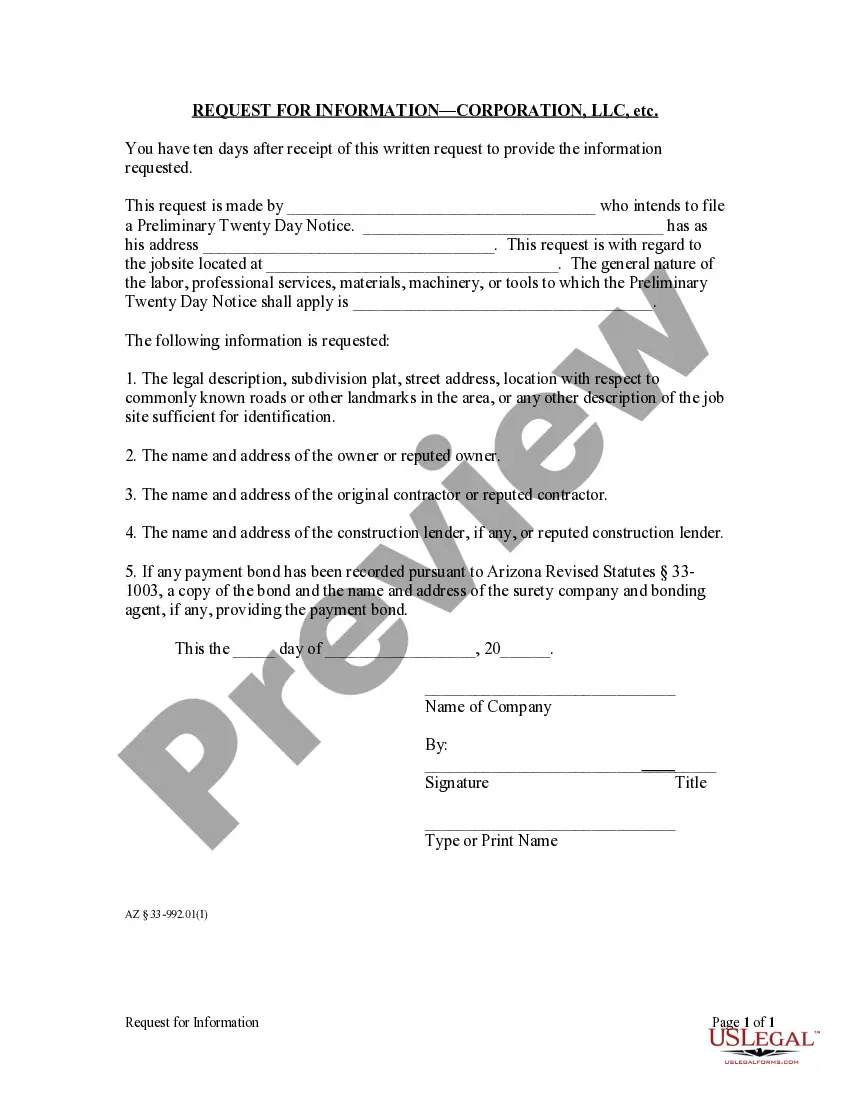

- Utilize the Preview button to review the form.

- Check the summary to ensure you have selected the right document.

- If the form is not what you seek, use the Search box to find the form that suits your needs.

Form popularity

FAQ

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

Components of a Loan Principal: This is the original amount of money that is being borrowed. Loan Term: The amount of time that the borrower has to repay the loan. Interest Rate: The rate at which the amount of money owed increases, usually expressed in terms of an annual percentage rate (APR).

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved. However, its terms - which can include a specific date of repayment, interest rate and repayment schedule - are more certain than those of an IOU.

Categorizing loan agreements by type of facility usually results in two primary categories: term loans, which are repaid in set installments over the term, or. revolving loans (or overdrafts) where up to a maximum amount can be withdrawn at any time, and interest is paid from month to month on the drawn amount.

Loan structure refers to the loan term, interest rate, risk, collateral, and repayment. Loan structure is designed to meet the borrowers' financing requirements while protecting the lender from losses due to the borrowers' failure to repay the debt, interest, and fees.