Nevada Corporate Guaranty - General

Description

How to fill out Corporate Guaranty - General?

It is feasible to spend hours online attempting to locate the legal document template that meets the federal and state requirements you seek.

US Legal Forms offers thousands of legal forms that are reviewed by experts.

You can easily download or print the Nevada Corporate Guaranty - General from the service.

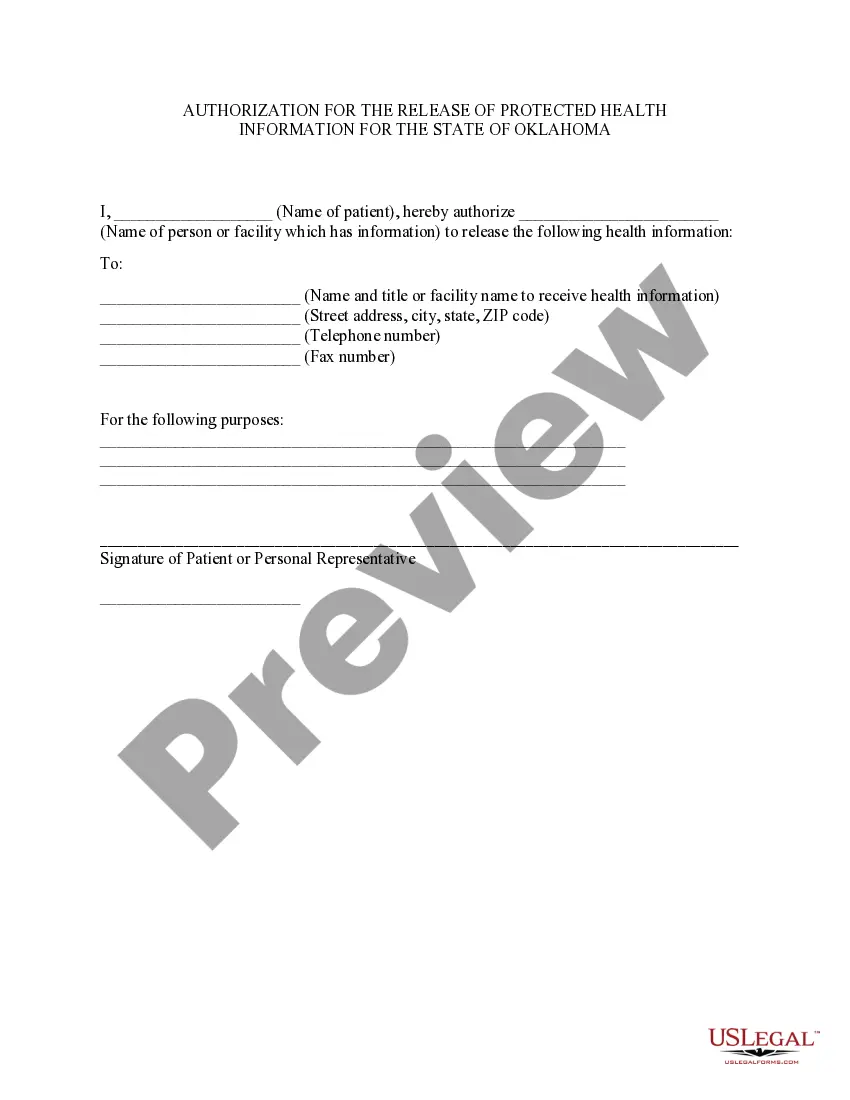

If available, utilize the Review button to browse through the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Nevada Corporate Guaranty - General.

- Each legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for your area/city of choice.

- Review the form description to ensure you have chosen the correct form.

Form popularity

FAQ

The maximum coverage amount for health insurance plans in Nevada typically varies, but it is important to know that the Nevada Corporate Guaranty - General ensures a level of protection. When a health insurer fails, the guarantee association may cover up to $500,000 in benefits. This includes major medical coverage, long-term care benefits, and more. By understanding these limits, you can make informed decisions about your health insurance needs.

Filing a complaint against a business in Nevada is a straightforward process. You can start by gathering all relevant details, such as your contact information, the business’s name, and a description of your complaint. Then, visit the Nevada Attorney General’s website to submit your complaint online or download a form to send via mail. For additional resources and legal assistance, US Legal Forms provides helpful guides and documents that can support you in addressing your Nevada Corporate Guaranty - General.

To close your MBT account in Nevada, you should first ensure that all ongoing transactions are completed. Next, you will need to submit a written request to your financial institution or the appropriate state department, indicating your desire to close the account. Make sure to confirm that there are no outstanding balances or unresolved issues. If you require assistance, consider utilizing US Legal Forms, where you can find documents and guidance on managing your Nevada Corporate Guaranty - General.

The Nevada Insurance Guaranty Association aims to safeguard policyholders and beneficiaries if an insurance company goes bankrupt. It covers claims for various types of insurance, ensuring that critical financial support remains available during uncertain times. This association enhances the overall stability of the insurance market and promotes consumer confidence in Nevada corporate guaranties. Knowledge of this function is essential for any business or individual seeking security.

The purpose of the California Insurance Guarantee Association (CIGA) is to protect policyholders when an insurer becomes financially unstable. CIGA provides a safety net for consumers by covering claims up to a specified limit. This security helps maintain trust in the insurance system and safeguards your investments in Nevada corporate guaranties. Knowing this can empower you to make informed decisions about your policies.

To fill out a personal guarantee, start by providing your personal information, such as your full name, address, and social security number. Next, review the terms and conditions of the guarantee, ensuring you understand your obligations. Finally, sign the document and date it, committing to cover the financial responsibilities if the primary party defaults. Using platforms like Uslegalforms can simplify this process and ensure you're completing your Nevada Corporate Guaranty - General correctly.

The code has the effect of law only when it is adopted by the particular state. California has largely adopted the UCC, with some changes. Indeed, the UCC has been adopted by all 50 states of the U.S, although with variations. It is the longest and most elaborate of the uniform acts.

Nevada Revised Statutes is an annotated codification of all statute laws in Nevada of a general, public, and permanent nature. Officially cited as NRS, the code consists of 63 loose-leaf volumes including indices, comparative tables, and certain special and local acts.

UPDATE ON UCC ARTICLE 5 (1995): UCC Article 5 (1995) has been adopted in 52 jurisdictions. It has not been adopted in: Puerto Rico.

A corporation is a legal entity that is separate and distinct from its owners. Under the law, corporations possess many of the same rights and responsibilities as individuals. They can enter contracts, loan and borrow money, sue and be sued, hire employees, own assets, and pay taxes.