Nevada Sample Letter for Return of Overpayment to Client

Description

How to fill out Sample Letter For Return Of Overpayment To Client?

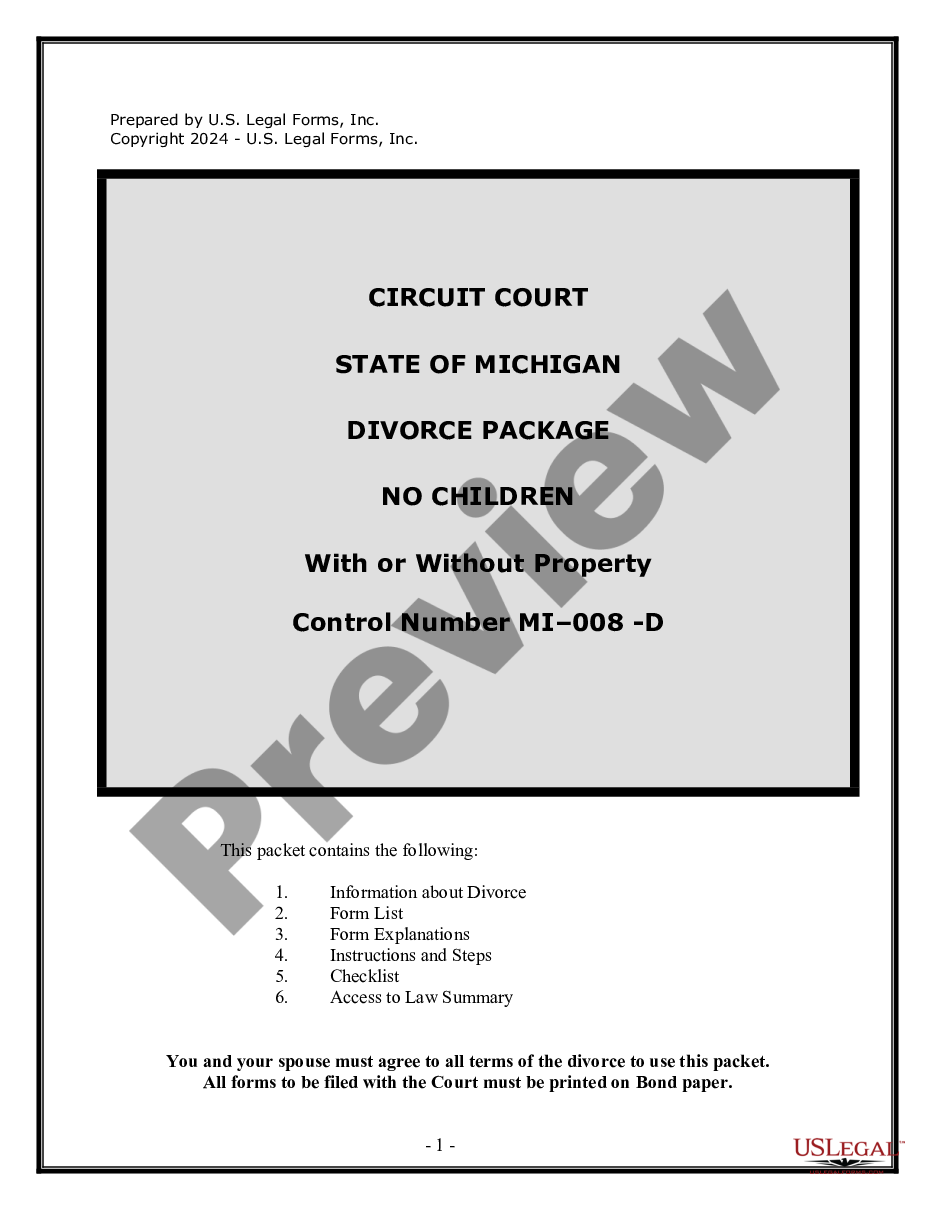

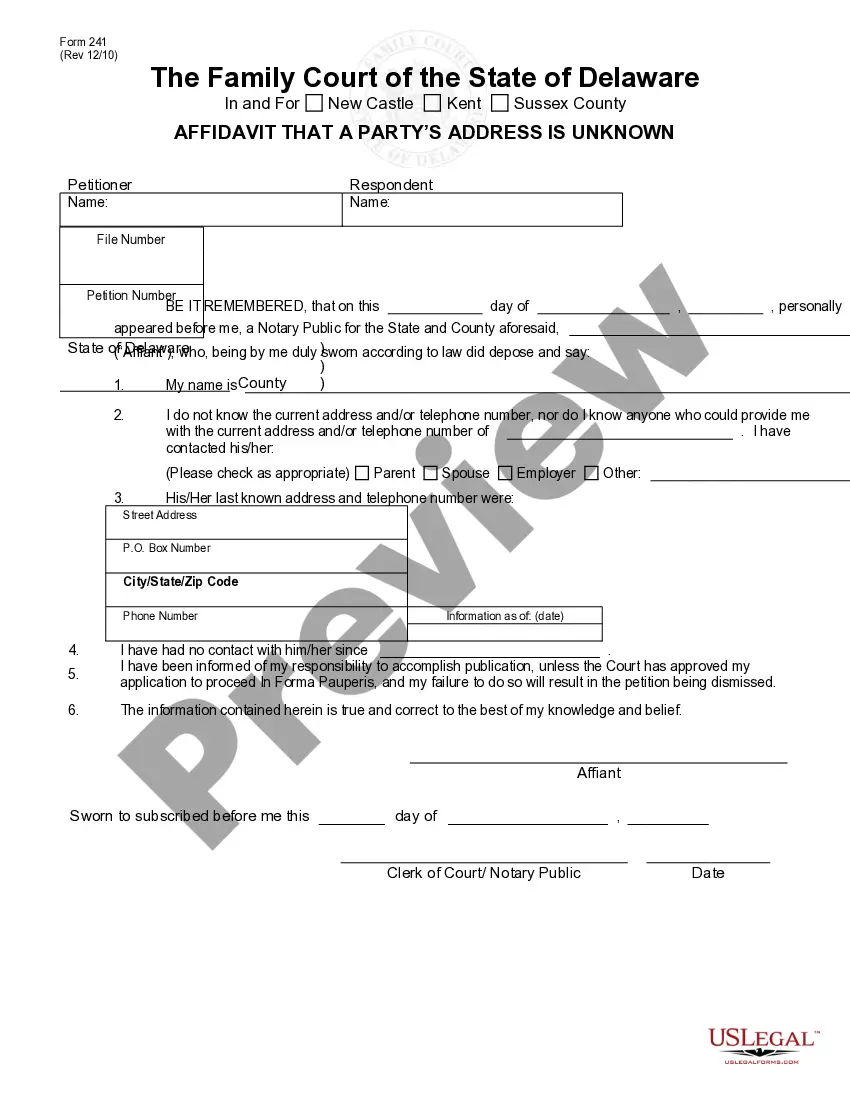

US Legal Forms - among the most significant libraries of legitimate forms in the United States - provides a wide range of legitimate record layouts you may download or produce. Using the internet site, you will get a huge number of forms for organization and personal purposes, sorted by types, claims, or keywords and phrases.You will find the latest types of forms like the Nevada Sample Letter for Return of Overpayment to Client in seconds.

If you already have a monthly subscription, log in and download Nevada Sample Letter for Return of Overpayment to Client in the US Legal Forms library. The Obtain switch can look on each and every form you see. You get access to all earlier acquired forms from the My Forms tab of the profile.

If you wish to use US Legal Forms for the first time, listed below are easy guidelines to help you began:

- Be sure to have picked the correct form for your personal town/area. Click on the Preview switch to check the form`s content. Browse the form information to actually have selected the appropriate form.

- In case the form doesn`t fit your specifications, utilize the Look for area towards the top of the display to get the one which does.

- If you are happy with the shape, validate your selection by clicking on the Acquire now switch. Then, select the prices prepare you like and give your accreditations to register for an profile.

- Procedure the transaction. Use your bank card or PayPal profile to accomplish the transaction.

- Select the file format and download the shape on the gadget.

- Make modifications. Fill up, modify and produce and sign the acquired Nevada Sample Letter for Return of Overpayment to Client.

Every single design you included in your bank account lacks an expiration particular date and it is your own for a long time. So, in order to download or produce another copy, just visit the My Forms segment and click in the form you will need.

Get access to the Nevada Sample Letter for Return of Overpayment to Client with US Legal Forms, one of the most comprehensive library of legitimate record layouts. Use a huge number of specialist and state-distinct layouts that satisfy your organization or personal needs and specifications.

Form popularity

FAQ

How to Send an Incorrect Payment Letter to Customers (Template Included) Choose a Clear Subject Line. Bring Attention to the Incorrect Payment. Apologize for the Error. Explain How to Correct the Error. Offer Additional Service. Incorrect Payment Templates You Can Use. Conclusion.

Options for handling overpayments are to either refund the amount or establish a credit for it. The receiver cannot keep an overpayment, as it is neither revenue nor income. Account credits caused by customer overpayment are recorded as liabilities or contra-assets on the balance sheet until applied against an invoice.

Refund Letter Format: Guidelines and Tips Ask for a refund in a polite and respectful manner. Include the details about the product such as was purchased, when and at what price. Mention why you returned the item. Mention the relevant information of the transactions such as the date and place of delivery.

How to write this credit letter: Carefully explain how much the customer has overpaid. Inform the client how you plan to correct the error. Offer additional service.

Apply the credit to an invoice you already created Select + New. Select Receive payment. Select the customer, then the credit and the invoice. Select another pending invoice and enter the overpayment amount in its Payment column. Select Save and new or Save and close.

I acknowledge on [date] I received an over payment in the amount of $____________. I understand that [Company Name] will need to be reimbursed. I have selected the checked option below to repay the company. ? ____ Deduct the overpayment from my salary from next pay period.

Issue a Credit Regular customers will often choose to leave the money on account because it's easiest for both parties. If this is the case, the business must issue a credit to the customer's account. The amount overpaid on the invoice is recorded as a credit on the balance sheet, not in a revenue account.

If the employer has overpaid an employee by mistake then the employer has the right to reclaim that money back. However, employees and workers are protected, under section 13 of the Employment Rights Act 1996, from any unlawful deductions from their wages.

I am writing to you because I have been informed that I have been overpaid. I (am/was employed/engaged) by you from (enter date) to (enter date) as a (enter job title) on a (enter job type - full time, part time or agency/casual) basis. You have stated that I have been overpaid by a total sum of (enter amount).

1 ? Confirm that the customer has paid too much. If a customer contacts you with a problem like this, have a look at the invoice in question and check your bank records. ... 2 ? Match the invoice to the overpayment. ... 3 ? Account for the overpayment. ... 4 ? Create a credit note. ... 5 ? Match the credit note with the refund.