Nevada Direct Deposit Form for Stimulus Check

Description

How to fill out Direct Deposit Form For Stimulus Check?

You might spend hours online trying to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast collection of legal forms that are vetted by professionals.

You can easily obtain or print the Nevada Direct Deposit Form for Stimulus Check from our platform.

- If you have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can fill out, edit, print, or sign the Nevada Direct Deposit Form for Stimulus Check.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of the downloaded form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your region/area of choice.

- Read the form details to confirm you have chosen the right form.

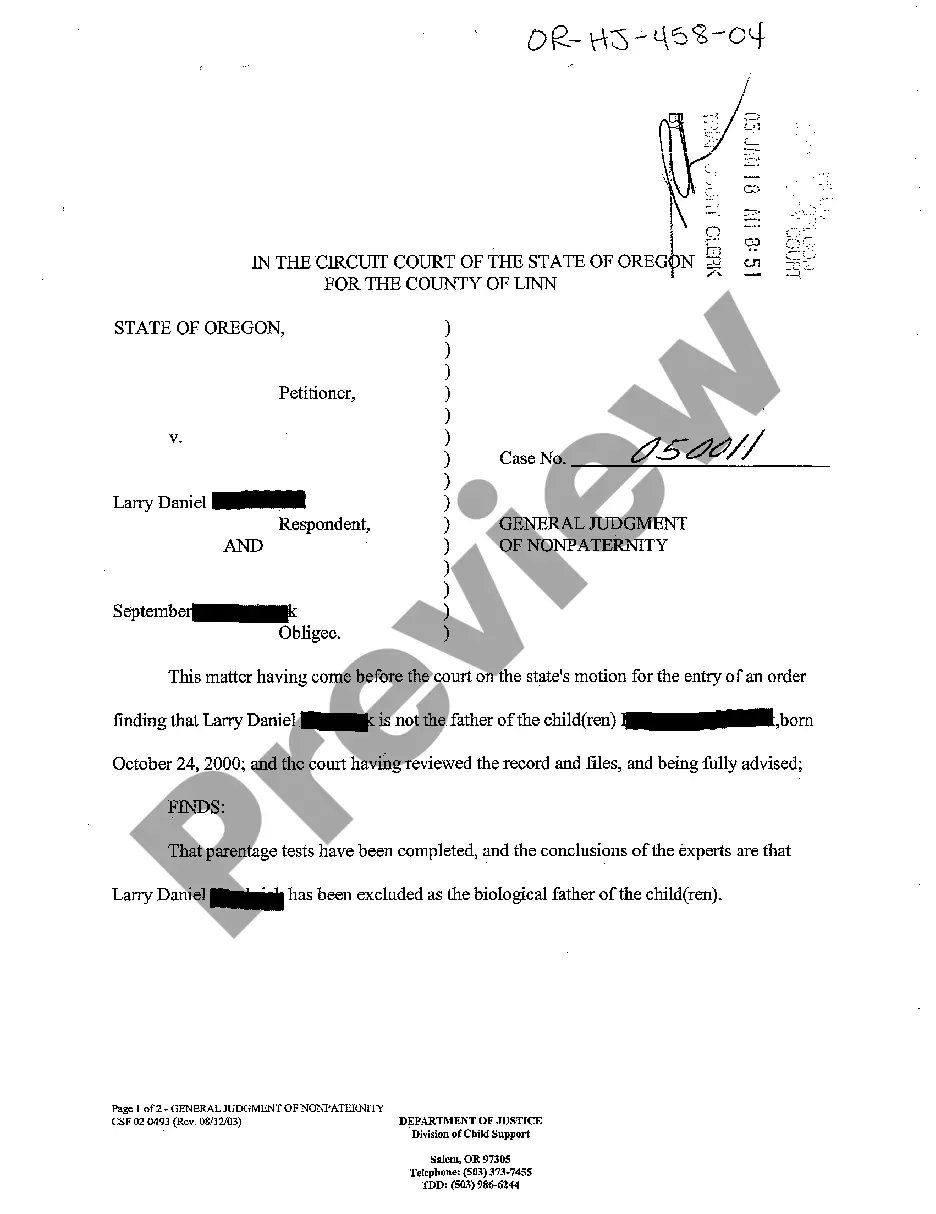

- If available, utilize the Preview button to review the document template as well.

- If you wish to find another version of the form, use the Search field to locate the template that fulfills your needs and requirements.

- Once you have found the template you need, click Get now to proceed.

- Select the pricing plan you want, enter your credentials, and register for a free account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal form.

- Choose the format of your document and download it to your device.

- Make edits to your document if necessary. You can fill out, modify, and sign and print the Nevada Direct Deposit Form for Stimulus Check.

- Download and print a vast number of document templates using the US Legal Forms site, which offers the largest assortment of legal forms.

- Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

You do not need to apply for the $1,400 stimulus check if you filed your taxes for the previous year. The IRS automatically determines who qualifies based on your tax return. However, if you need to ensure you receive your payment via direct deposit, completing the Nevada Direct Deposit Form for Stimulus Check is a proactive step.

To change your bank account for your stimulus check, you can update your information through the IRS 'Get My Payment' tool if you have not yet received your payment. If your payment has already been issued, you will need to wait for the check and then follow the appropriate steps to claim it. Submitting the Nevada Direct Deposit Form for Stimulus Check can help ensure future payments go to your new account.

To qualify for the third stimulus check, you must meet specific income requirements and have a valid Social Security number. The IRS uses your latest tax return to determine eligibility. Ensuring your information is updated on the Nevada Direct Deposit Form for Stimulus Check can help streamline the payment process.

If you did not receive your stimulus check, you might need to fill out the IRS Form 1040 or 1040-SR to claim the Recovery Rebate Credit. This process requires providing details about your income and prior payments. Additionally, submitting the Nevada Direct Deposit Form for Stimulus Check can facilitate future payments directly to your bank account.

Eligibility for the $1,400 stimulus check generally includes individuals who meet certain income thresholds set by the IRS. Single filers earning up to $75,000, and married couples earning up to $150,000 are typically eligible. It's essential to complete the Nevada Direct Deposit Form for Stimulus Check to ensure you receive your payment directly into your bank account.

You can obtain proof of your stimulus check by accessing your IRS account online. The IRS provides a record of payments made, which you can download for your records. Utilizing the Nevada Direct Deposit Form for Stimulus Check can also help ensure your payment information is accurate and readily available.

To check if you are eligible for the $1,400 stimulus check, visit the IRS website and use the 'Get My Payment' tool. You will need to provide your personal information, including your Social Security number and date of birth. This tool will inform you about your payment status and whether you will receive the check via direct deposit using the Nevada Direct Deposit Form for Stimulus Check.

Yes, the IRS is sending $1,400 COVID stimulus checks to taxpayers who missed out on the credit in the previous rounds. If you have not received your payment, you can take action by submitting the Nevada Direct Deposit Form for Stimulus Check. This form allows you to securely provide your bank details, ensuring you receive your funds directly and quickly.

The IRS has announced plans to issue $3,000 tax refunds to eligible taxpayers in June 2025. This refund is part of ongoing efforts to support American families. To receive your refund efficiently, consider using the Nevada Direct Deposit Form for Stimulus Check. This option ensures your refund lands in your account without unnecessary delays.

Yes, the IRS is working to distribute $2.4 billion in unclaimed $1,400 stimulus payments. Many taxpayers may not have claimed these payments due to various reasons. If you believe you qualify, you can use the Nevada Direct Deposit Form for Stimulus Check to ensure that you receive your payment directly to your bank account. This process simplifies claiming your funds and speeds up the delivery.