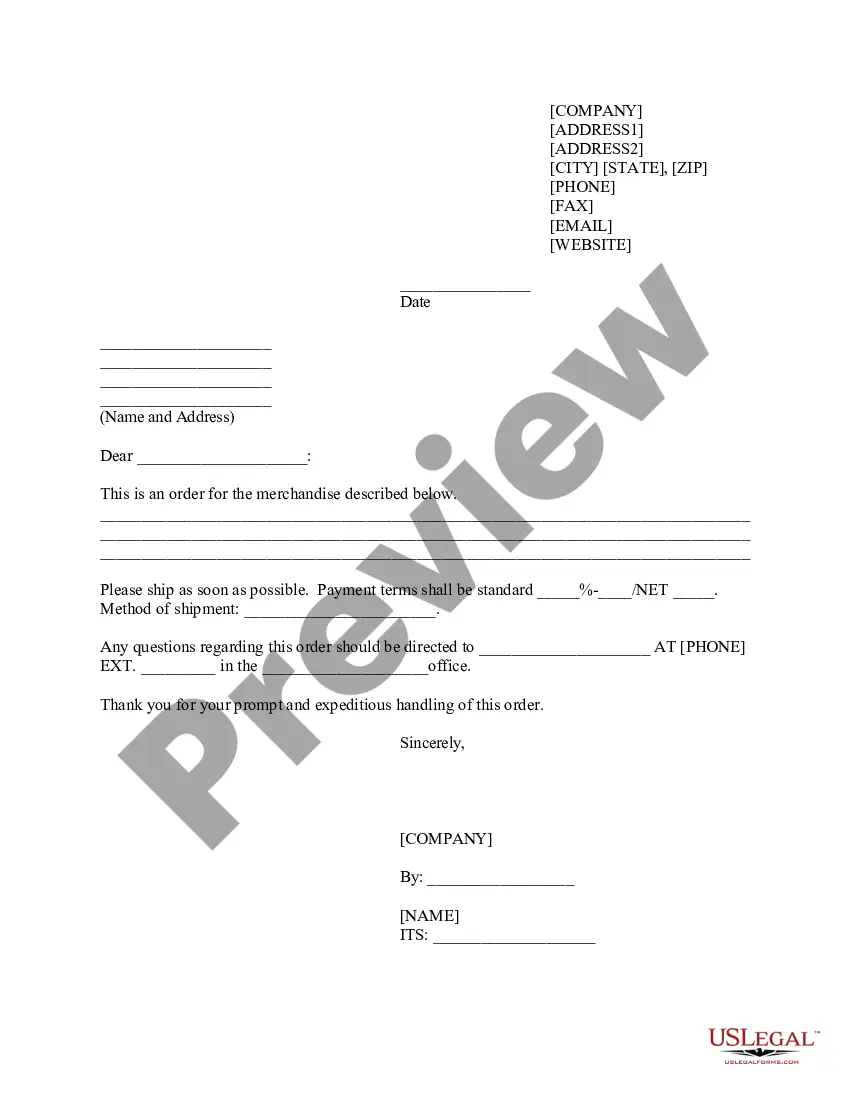

This form is a Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Nevada Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage

Description

How to fill out Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage?

Are you presently in a scenario where you will require documentation for both organizational or personal reasons almost every day? There are numerous legitimate document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers thousands of form templates, including the Nevada Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, designed to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Nevada Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage template.

Select a convenient file format and download your copy.

You can find all the document templates you have purchased in the My documents section. You can download or print the Nevada Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage template whenever necessary. Just click on the desired form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and make sure it is for the correct state/county.

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the right form.

- If the form is not what you need, use the Search field to find the form that suits your requirements.

- Once you find the correct form, click Purchase now.

- Select the pricing plan you prefer, provide the necessary information to create your account, and complete the purchase using your PayPal or credit card.

Form popularity

FAQ

In Nevada, insurance companies are required to investigate claims within a reasonable timeframe, typically around 30 days for initial review. However, the investigation may extend longer if the insurer needs additional information. If disputes arise regarding coverage, you might consider a Nevada Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage to seek clarity. Resources available on USLegalForms can assist you in preparing the necessary documentation.

Life insurance policies can typically be contested for up to two years after the policy is issued. During this period, the insurer can investigate claims for misrepresentation or fraud. After this timeframe, a Nevada Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage may be necessary if disputes arise regarding the validity of a claim. It's essential to understand these timelines to protect your interests.

To complain about insurance in Nevada, you should first contact your insurance provider to resolve the issue directly. If that does not work, you can file a complaint with the Nevada Division of Insurance. This process may involve submitting a formal Nevada Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, which could clarify your rights and obligations under the policy. Utilizing platforms like USLegalForms can help you navigate this process more efficiently.

A declaratory judgment in insurance is a court's determination of the rights and obligations of parties under an insurance policy. This legal mechanism clarifies coverage issues and disputes, allowing parties to understand their positions more clearly. When pursuing a Nevada Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, this type of judgment can resolve uncertainties regarding policy terms and coverage, leading to fair outcomes.

Rule 35 in Nevada allows a party to request a physical or mental examination of another party when their condition is in controversy. This examination is often used in personal injury and insurance cases to assess claims more accurately. When dealing with a Nevada Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, understanding this rule can help ensure that all relevant medical information is considered in your case.

Rule 59 in Nevada governs the grounds for a new trial or the amendment of a judgment. This rule provides options for parties to seek relief from a judgment based on errors or irregularities that may have affected the outcome. Understanding this rule is crucial when filing a Nevada Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, as it may provide a pathway to challenge unfavorable decisions.

The rule 68 offer of judgment in Nevada allows a defendant to make a formal offer to resolve a dispute before trial. If the plaintiff does not accept this offer and fails to obtain a more favorable judgment, they may be liable for the defendant's costs incurred after the offer was made. This rule can significantly impact cases like a Nevada Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, encouraging parties to settle disputes efficiently.