A Nevada Claim of Exemption from Execution is a legal document used to protect certain property from being taken by creditors. The State of Nevada offers this protection to its residents based on the Nevada Constitution and the Revised Statutes of Nevada. This document is used to exempt certain types of property from a levy of execution, including wages, money, goods, chattels, and other personal property. Additionally, the claim exempts certain amounts of equity in real and personal property, as well as retirement accounts, from being seized. There are four different types of Nevada Claim of Exemption from Execution: 1. Homestead Exemption: This allows up to $550,000 of equity in a primary residence to be exempt from seizure. 2. Wild Card Exemption: This allows up to $12,000 of any personal property to be exempt from seizure. 3. Retirement Exemption: This allows up to $350,000 in retirement accounts to be exempt from seizure. 4. Motor Vehicle Exemption: This allows up to $15,000 in equity in a motor vehicle to be exempt from seizure.

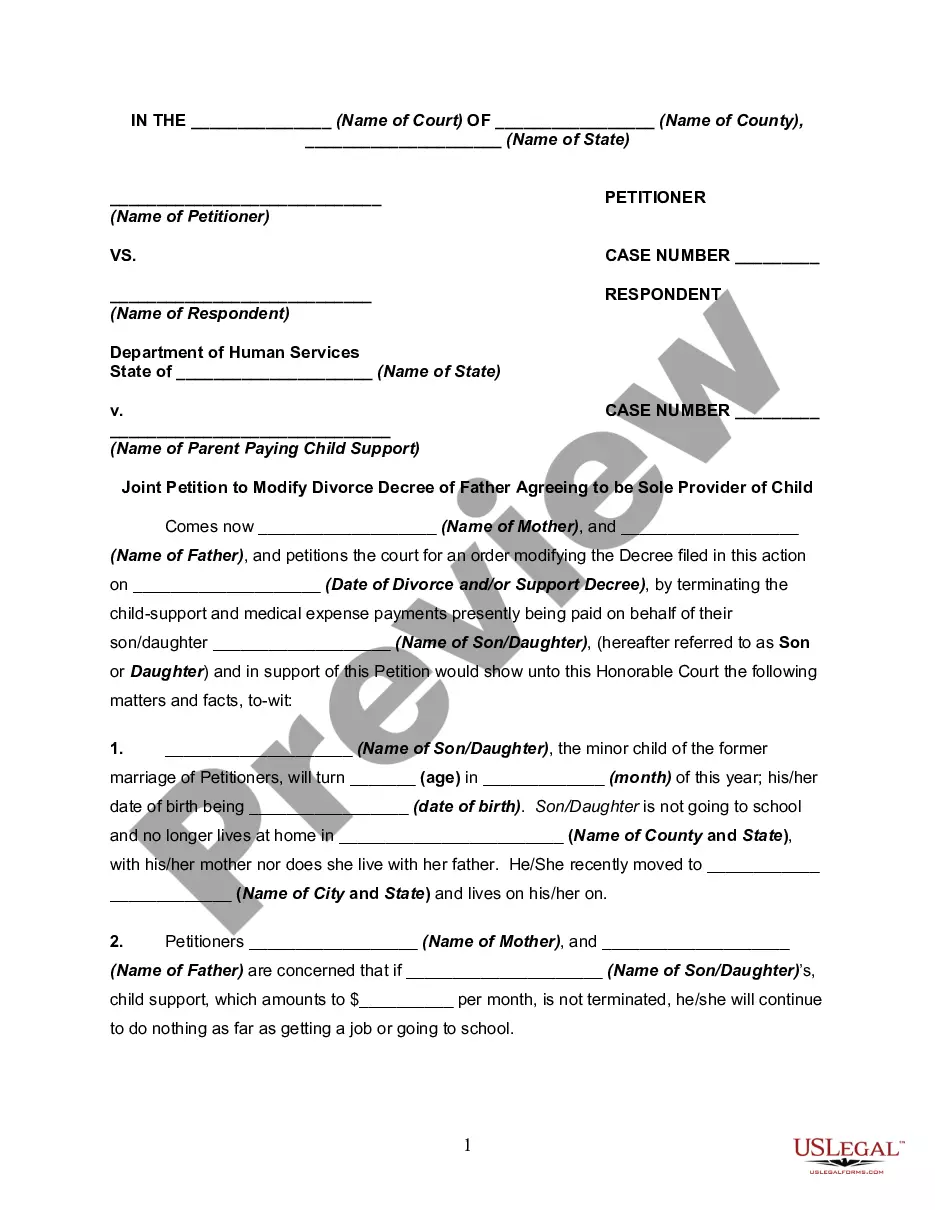

Nevada CLAIM of EXEMPTION FROM EXECUTION

Description

Key Concepts & Definitions

Claim of Exemption from Execution refers to a legal declaration by a debtor that certain personal property or income is exempt from a judicial execution to satisfy a creditor's judgment. This is primarily used to protect basic living necessities from being seized following a lawsuit result. It typically involves the debtor filling out a claim form that lists the property they consider exempt under state law. The court then decides whether the claim is valid based on the rules of exemption in that jurisdiction.

Step-by-Step Guide: How to File a Claim of Exemption from Execution

- Gather Pertinent Information: Collect all relevant financial documents and information regarding the debt and judgment.

- Identify Applicable Exemptions: Review your states exemption statutes to identify which types of property or income are legally protected from creditors.

- Complete the Claim Form: Fill out the necessary form provided typically by your states judicial department, detailing your assets and claiming your exemptions.

- File the Claim: Submit the claim form to the court that issued the execution against your property.

- Notify the Creditor: Provide the creditor with a copy of the claim of exemption you filed.

- Attend the Court Hearing: In most cases, a court hearing will be scheduled where you must present evidence that your claimed exemptions are valid under state law.

- Wait for the Decision: The court will issue a decision on whether your properties are exempt from execution, which may require compliance from both you and the creditor.

Risk Analysis

Filing a claim of exemption from execution can pose certain risks, including:

- Rejection of Claims: Incorrectly filed or unsubstantiated claims can be rejected, leaving properties vulnerable to execution.

- Legal Complications: The process may involve complex legal proceedings that require precise documentation and compliance with all procedural requirements.

- Financial Disclosure: The process requires disclosure of personal financial information, which could be scrutinized and challenged by creditors.

Best Practices in Filing for Exemptions

When claiming exemptions from execution, adhere to these best practices for a smoother process and better protection of assets:

- Thorough Documentation: Ensure all your documentation is accurate, detailed, and ready for court review.

- Legal Guidance: Consider consulting with a legal expert specializing in debtor-creditor laws in your jurisdiction for tailored advice.

- Timely Filing: File your claim as soon as possible after the judgment to avoid the risk of property seizure.

- Clear Understanding of Laws: Have an in-depth understanding of the states exemption laws and procedures to bolster your claims credibility.

FAQ

- What properties can be declared as exempt? Common exemptions include homestead, personal property, and certain types of income like social security benefits.

- How long does the process take? The duration can vary widely based on jurisdiction, claim complexity, and court schedules.

- Can the exemption decision be appealed? Yes, both the debtor and creditor have rights to appeal the courts decision on exemptions.

How to fill out Nevada CLAIM Of EXEMPTION FROM EXECUTION?

If you’re looking for a way to appropriately prepare the Nevada CLAIM of EXEMPTION FROM EXECUTION without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every personal and business situation. Every piece of paperwork you find on our web service is drafted in accordance with federal and state regulations, so you can be sure that your documents are in order.

Adhere to these straightforward instructions on how to acquire the ready-to-use Nevada CLAIM of EXEMPTION FROM EXECUTION:

- Make sure the document you see on the page corresponds with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Enter the form name in the Search tab on the top of the page and select your state from the dropdown to locate another template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to save your Nevada CLAIM of EXEMPTION FROM EXECUTION and download it by clicking the appropriate button.

- Import your template to an online editor to complete and sign it quickly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

You do this by filing a Claim of Exemption with the court clerk and mailing a copy to the judgment creditor, the sheriff or constable who served the collection paperwork, and any third party involved (like your employer or bank, for example).

?Should I declare myself exempt from withholding?? No, it's not a good idea to claim you're exempt simply in order to get a bigger paycheck. By certifying you are exempt, your employer wouldn't withhold any federal income tax amounts during the year, and that would result in a large tax bill due in April.

If you are not tax-exempt, you are going to have to pay your taxes eventually, and filing a withholding exemption is not going to change that. If you claim exempt on your Form W-4 without actually being eligible, anticipate a large tax bill and possible penalties after you file your tax return.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

If wage garnishment means that you can't pay for your family's basic needs, you can ask the court to order the debt collector to stop garnishing your wages or reduce the amount. This is called a Claim of Exemption.

A court order that directs law enforcement personnel to take action in an attempt to satisfy a judgment won by the plaintiff. Specifically, a writ of execution usually addresses a sheriff. The sheriff, in turn, attempts to levy property owned by the defendant.

What are exemptions? An exemption is a dollar amount that can be deducted from an individual's total income, thereby reducing. the taxable income.

(NRS 21.090(1)(m).) If the judgment being collected arises from a medical bill, the judgment debtor's primary dwelling and the land upon which it is situated (if owned by the judgment debtor), including a mobile or manufactured home, are exempt from execution regardless of the amount of equity.