New Mexico Ratification of Operating Agreement

Description

How to fill out Ratification Of Operating Agreement?

Are you presently within a placement where you require files for both business or individual uses just about every working day? There are a variety of authorized document themes accessible on the Internet, but discovering versions you can trust is not straightforward. US Legal Forms gives 1000s of kind themes, just like the New Mexico Ratification of Operating Agreement, that are published in order to meet state and federal requirements.

When you are previously acquainted with US Legal Forms website and also have an account, basically log in. Afterward, you can download the New Mexico Ratification of Operating Agreement web template.

If you do not come with an accounts and need to begin to use US Legal Forms, abide by these steps:

- Get the kind you need and make sure it is for the appropriate area/state.

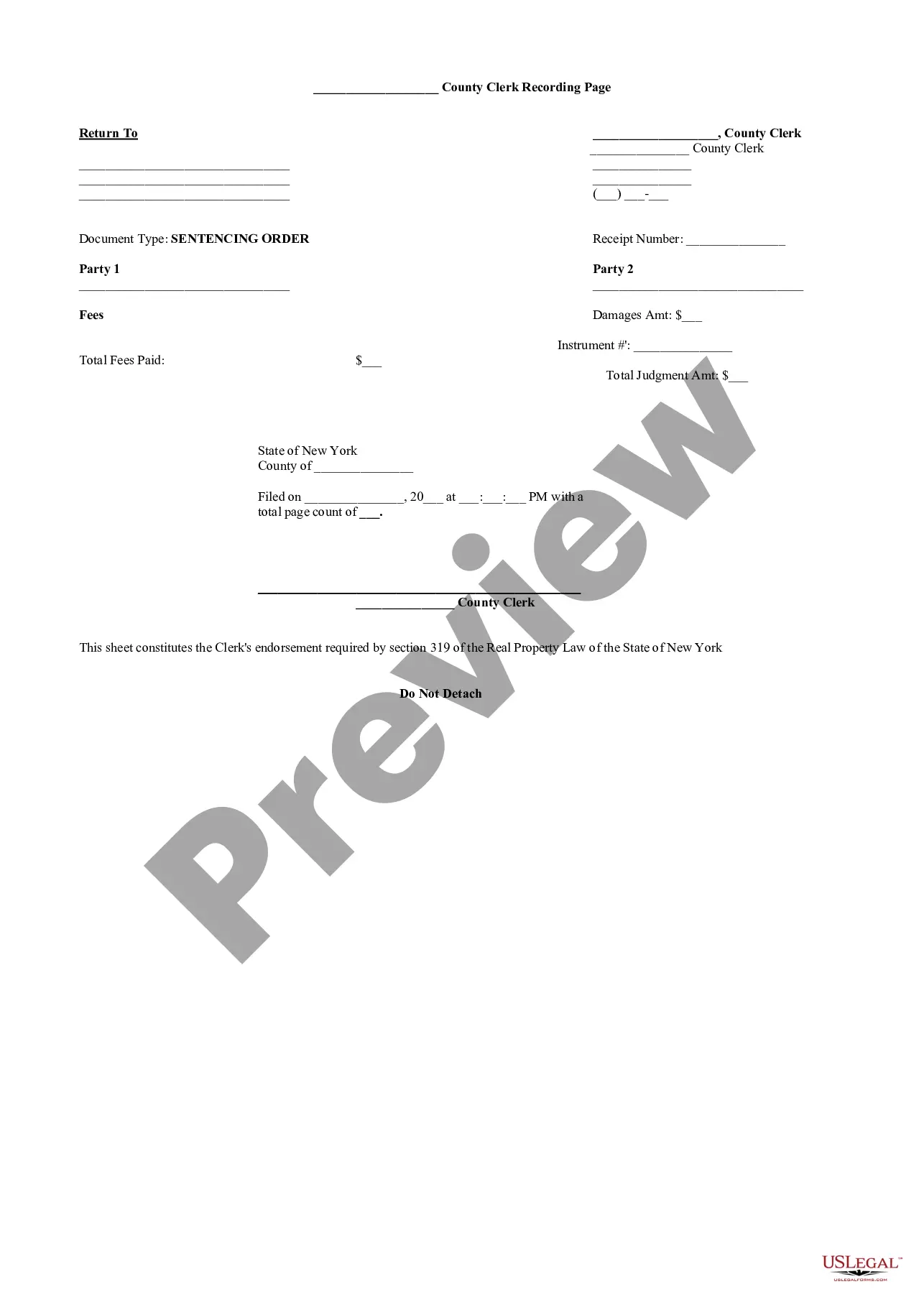

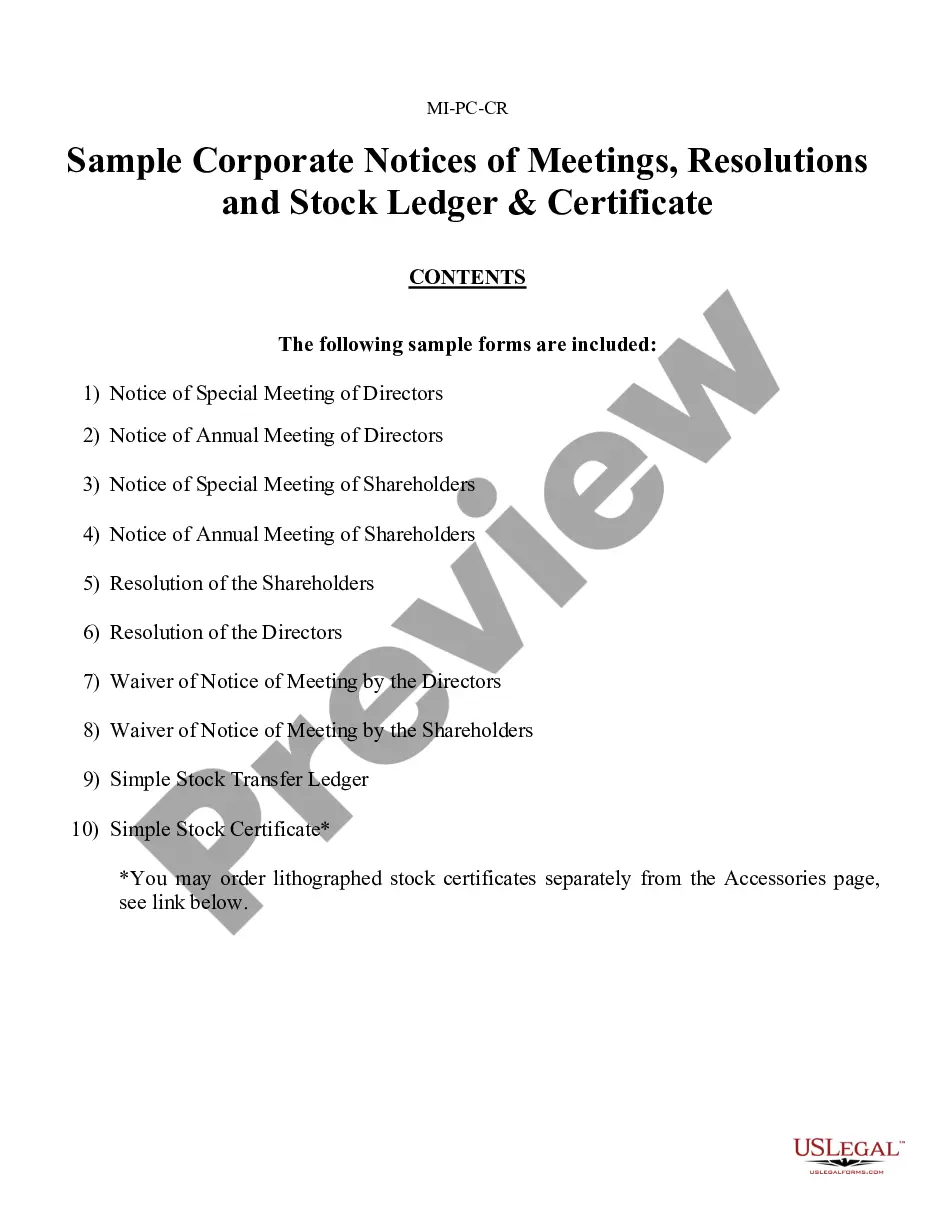

- Take advantage of the Preview key to check the form.

- Browse the description to ensure that you have chosen the appropriate kind.

- In case the kind is not what you`re trying to find, use the Look for field to get the kind that meets your needs and requirements.

- If you get the appropriate kind, click Purchase now.

- Choose the prices program you would like, fill out the desired info to make your account, and buy the order with your PayPal or bank card.

- Choose a hassle-free file structure and download your copy.

Locate all the document themes you might have purchased in the My Forms menus. You can aquire a further copy of New Mexico Ratification of Operating Agreement whenever, if necessary. Just click on the necessary kind to download or print the document web template.

Use US Legal Forms, by far the most substantial assortment of authorized kinds, in order to save time as well as steer clear of faults. The service gives appropriately made authorized document themes which you can use for a variety of uses. Create an account on US Legal Forms and initiate creating your way of life easier.

Form popularity

FAQ

New Mexico does not require LLCs to file an annual report. New Mexico imposes a franchise tax on LLCs if they paid federal income tax. The franchise tax is filed along with the state income tax, and is due by the 15th day of the third month following the close of the tax year. The fee is $50.

As the owner of an LLC, you must pay self-employment tax and federal income tax, both of which are levied as ?pass-through taxation." Federal taxes can be complicated, so speak to your accountant or professional tax preparer to ensure that your New Mexico LLC is paying the correct amount.

See details. New Mexico LLCs don't have to file an Annual Report or pay an annual fee. The New Mexico Secretary of State doesn't require it. Although most states have annual reports and fees, New Mexico is one of the few states that doesn't require LLCs to file (or pay) an Annual Report.

As per the New Mexico LLC Act, an Operating Agreement isn't required for an LLC in New Mexico. But while it's not required in New Mexico to conduct business, we strongly recommend having an Operating Agreement for your LLC.

An operating agreement should include the following: Percentage of members' ownership. Meeting provisions and voting rights. Powers and duties of members and management. Distribution of profits and losses. Tax treatment preference. A liability statement. Management structure. Operating procedures.

Classifications. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC as either a corporation, partnership, or as part of the LLC's owner's tax return (a ?disregarded entity?).

You can get an LLC in New Mexico in 1-3 business days if you file online (and 2-3 weeks if you file by mail).

In New Mexico, there is no annual fee. Another cost that goes along with the formation of an LLC is the registered agent. You can choose a member of the LLC or a manager as the registered agent, but you can also choose to hire a third party.