New Mexico Quitclaim Deed for Mineral / Royalty Interest

Description

How to fill out Quitclaim Deed For Mineral / Royalty Interest?

US Legal Forms - one of several greatest libraries of legal kinds in the USA - provides a wide range of legal papers layouts you can obtain or print. Utilizing the internet site, you can find a huge number of kinds for business and specific purposes, categorized by types, suggests, or keywords.You can find the newest versions of kinds like the New Mexico Quitclaim Deed for Mineral / Royalty Interest within minutes.

If you already possess a registration, log in and obtain New Mexico Quitclaim Deed for Mineral / Royalty Interest from your US Legal Forms local library. The Down load option will show up on every single kind you perspective. You get access to all in the past acquired kinds inside the My Forms tab of your own accounts.

If you want to use US Legal Forms initially, allow me to share basic instructions to help you began:

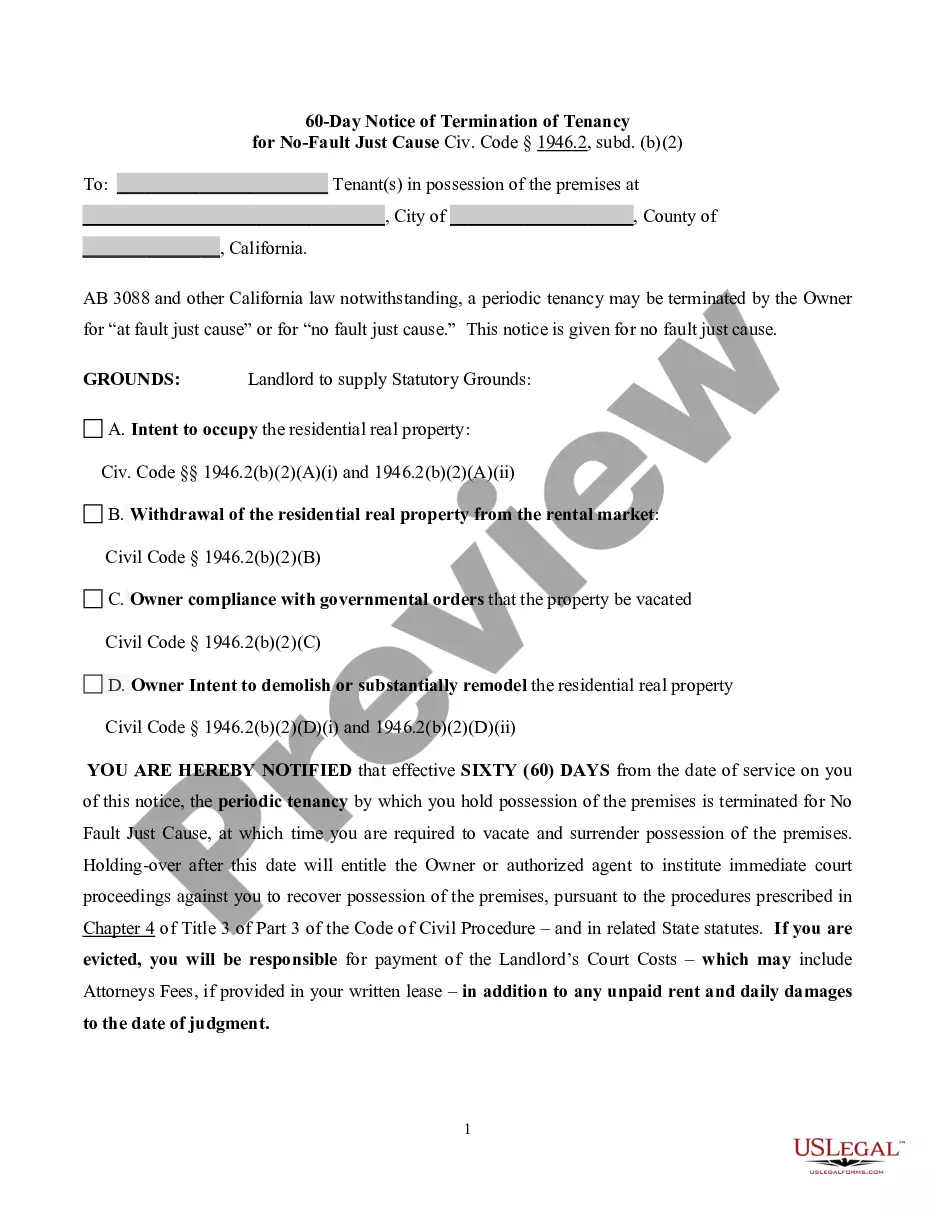

- Ensure you have picked out the right kind for your area/area. Click the Review option to review the form`s information. Browse the kind description to actually have chosen the proper kind.

- If the kind doesn`t match your requirements, use the Lookup industry near the top of the display screen to obtain the one that does.

- If you are pleased with the form, validate your option by visiting the Acquire now option. Then, opt for the costs prepare you like and offer your accreditations to sign up for the accounts.

- Procedure the purchase. Utilize your Visa or Mastercard or PayPal accounts to accomplish the purchase.

- Select the structure and obtain the form in your product.

- Make alterations. Load, edit and print and indicator the acquired New Mexico Quitclaim Deed for Mineral / Royalty Interest.

Each and every web template you added to your money lacks an expiration date and is your own property permanently. So, if you would like obtain or print one more duplicate, just go to the My Forms section and click on in the kind you want.

Gain access to the New Mexico Quitclaim Deed for Mineral / Royalty Interest with US Legal Forms, probably the most comprehensive local library of legal papers layouts. Use a huge number of skilled and state-certain layouts that satisfy your small business or specific demands and requirements.

Form popularity

FAQ

1978, § 14-9-1) ? A quit claim deed is required to be filed at the County Clerk's Office where the property is located along with the required recording fee(s). Signing (N. M. S. A. 1978, § 47-1-44) ? In New Mexico, it must be signed with a Notary Public viewing the Grantor(s) signature(s).

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

Mineral rights can expire if the owner does not renew them or if they go unclaimed for a certain period of time. Mineral rights can also be sold, fractionalized, or transferred through gifting or inheritance.

Minerals include gold, silver, coal, oil, and gas. If you want to transfer the rights to these minerals to another party, you can do so in a variety of ways: by deed, will, or lease. Before you transfer mineral rights, you should confirm that you own the rights that you seek to transfer.

Transfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir.

Whether mineral rights transfer with the property depends on the estate type. If it's a severed estate, surface rights and mineral rights are separate and do not transfer together. However, if it's a unified estate, the land and the mineral rights can be conveyed with the property.

To transfer any rights to minerals successfully, follow these steps: The new owner has to acquire a copy of the deed for the site at a local courthouse in New Mexico. Review the deed to ensure it matches the description and to ensure that the so-called rights to any minerals are included in the property deed.