New Mexico Outside Project Manager Agreement - Self-Employed Independent Contractor

Description

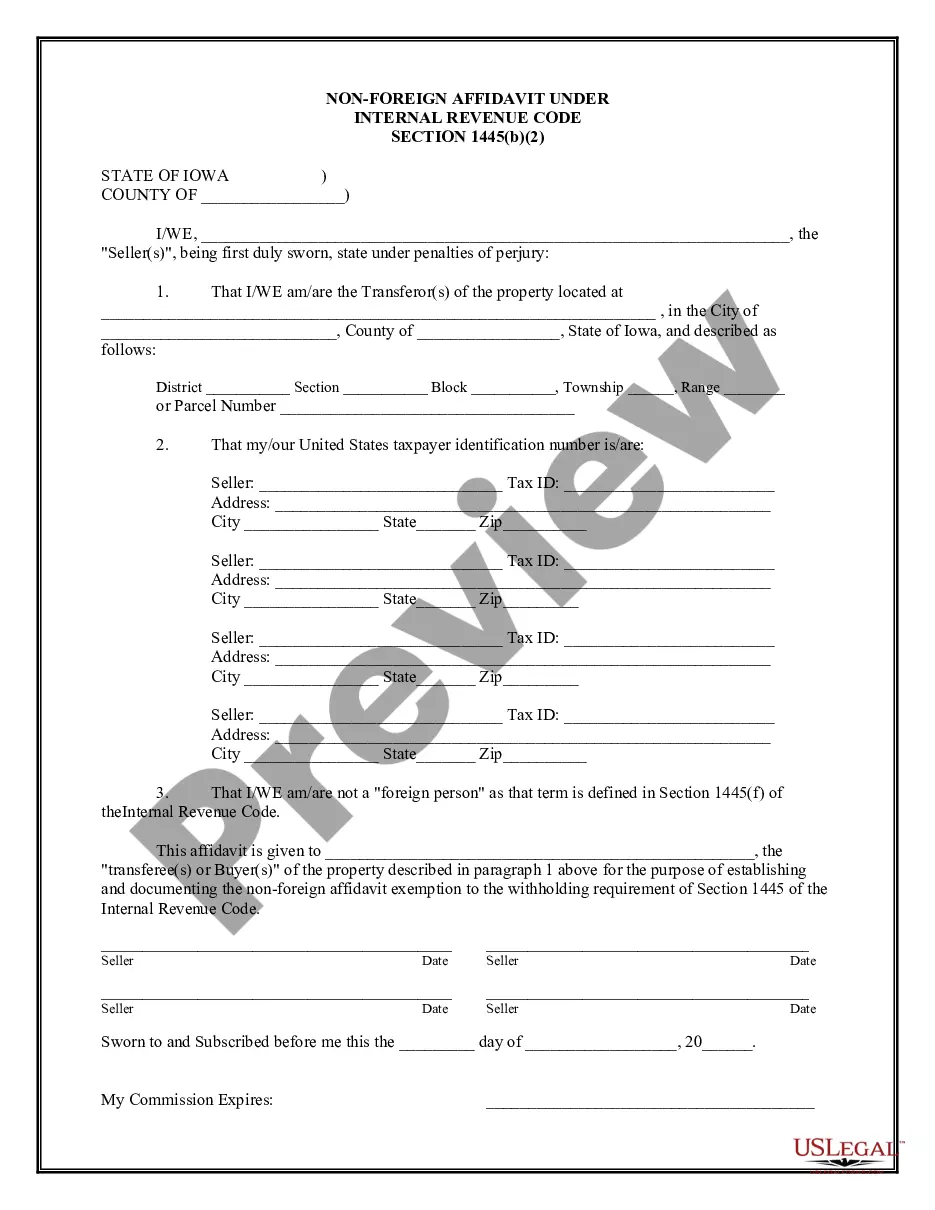

How to fill out Outside Project Manager Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal document templates that you can download or print.

While using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the New Mexico Outside Project Manager Agreement - Self-Employed Independent Contractor in a matter of minutes.

If you already possess a monthly subscription, Log In to download the New Mexico Outside Project Manager Agreement - Self-Employed Independent Contractor from the US Legal Forms collection. The Download button will appear on every form you view. You can find all previously saved forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make changes. Complete, edit, print, and sign the saved New Mexico Outside Project Manager Agreement - Self-Employed Independent Contractor. Each template you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the New Mexico Outside Project Manager Agreement - Self-Employed Independent Contractor with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are some simple instructions to get started.

- Ensure you have selected the correct form for your region/area.

- Click the Preview button to view the form's content.

- Read the form details to confirm that you have chosen the correct form.

- If the form does not meet your requirements, utilize the Search bar at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the payment plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

When employing an independent contractor, such as one governed by the New Mexico Outside Project Manager Agreement - Self-Employed Independent Contractor, specific paperwork is essential. You will need a detailed written contract that specifies the work, payment terms, and deadlines. It's also necessary to obtain a W-9 form from the contractor for tax reporting purposes, ensuring everything is compliant with state regulations.

Independent contractors should complete several key forms to ensure proper documentation and compliance. Primarily, they need to fill out a W-9 form to provide their taxpayer information to clients. Additionally, when working under the New Mexico Outside Project Manager Agreement - Self-Employed Independent Contractor, they should maintain detailed records of their invoices and payment receipts for accurate tax reporting.

Independent contractors in New Mexico must meet specific legal requirements to ensure compliance. According to the New Mexico Outside Project Manager Agreement - Self-Employed Independent Contractor, contractors must have a valid business license and maintain their own liability insurance. Moreover, they should not be classified as employees, which means they must control how they perform their work.

To hire an independent contractor under the New Mexico Outside Project Manager Agreement - Self-Employed Independent Contractor, you will need several key documents. First, gather a signed contract that outlines the scope of work and payment terms. Additionally, keep a W-9 form on file for reporting income to the IRS. This ensures that you fulfill tax obligations and maintain a professional relationship.

Filling out an independent contractor agreement is a straightforward process. Start by inputting the contractor's information, including name and contact details, followed by the hiring party's information. Then, specify the services provided, payment details, and deadlines, ensuring everything aligns with the New Mexico Outside Project Manager Agreement - Self-Employed Independent Contractor. Once complete, both parties should sign to make the agreement legally binding.

An independent contractor typically fills out several important documents. These may include a W-9 form for tax purposes, and a detailed independent contractor agreement, like the New Mexico Outside Project Manager Agreement - Self-Employed Independent Contractor. Additionally, they may need to provide invoices for their services and any relevant insurance documentation, depending on the nature of their work.

Writing an independent contractor agreement involves a few key steps. First, clearly define the scope of work, including specific tasks and deadlines. Next, outline the payment terms and any tax responsibilities, ensuring compliance with the laws surrounding the New Mexico Outside Project Manager Agreement - Self-Employed Independent Contractor. Finally, include sections on confidentiality and dispute resolution for added protection.

Creating an independent contractor agreement involves several steps. First, you need to define the scope of work clearly, including deliverables, deadlines, and compensation. For a New Mexico Outside Project Manager Agreement - Self-Employed Independent Contractor, you can use a customizable template to ensure all legal requirements are met. Platforms like uslegalforms provide reliable resources to help you draft an enforceable agreement.

Typically, the party hiring the independent contractor drafts the agreement. This could be a business, a project manager, or an individual looking for specific services. In the case of a New Mexico Outside Project Manager Agreement - Self-Employed Independent Contractor, it's important to outline responsibilities, payment terms, and project scope. You might also consider using platforms like uslegalforms to find professionally crafted templates.

The new federal rule for independent contractors focuses on simplifying the classification process to determine if a worker is an employee or an independent contractor. This rule emphasizes the importance of control and the nature of the work relation. Being aware of these changes is critical, as they can affect your compliance within agreements such as the New Mexico Outside Project Manager Agreement - Self-Employed Independent Contractor. Staying updated on regulations helps you maintain your status effectively.