New Mexico Auditor Agreement - Self-Employed Independent Contractor

Description

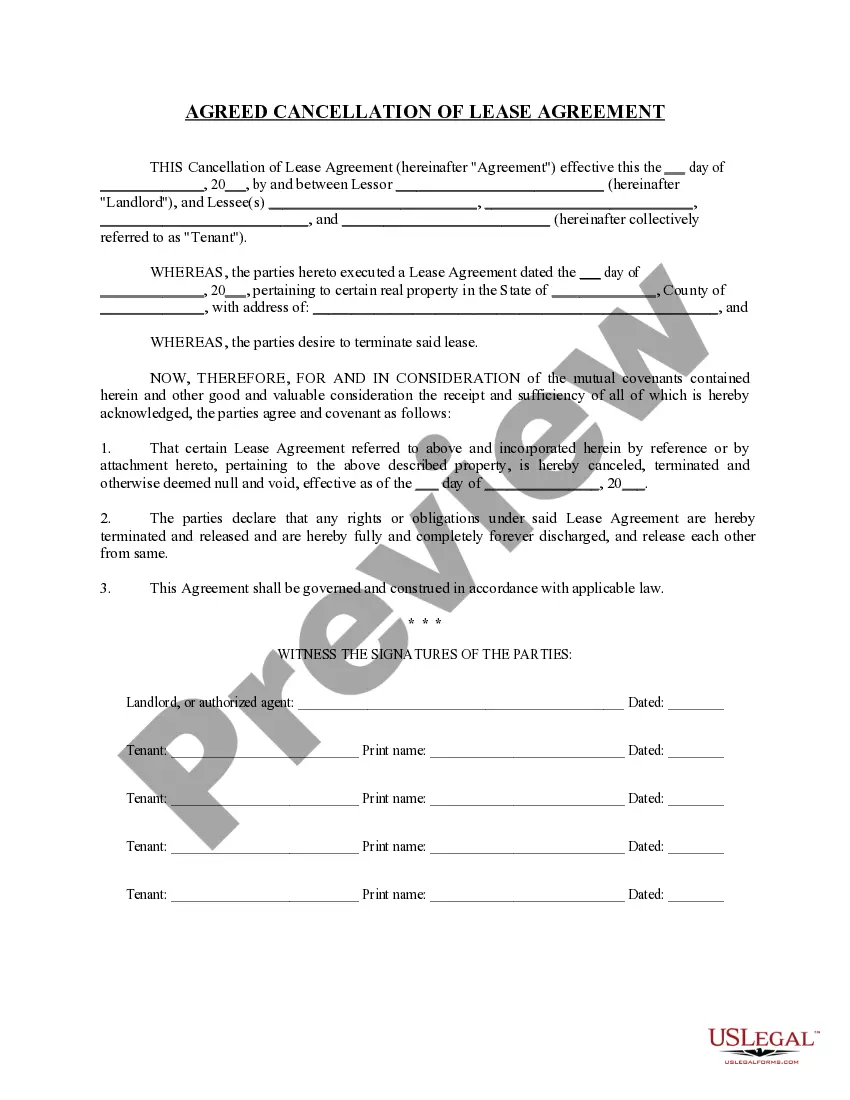

How to fill out Auditor Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a diverse selection of legal document templates that you can download or create. While using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of documents such as the New Mexico Auditor Agreement - Self-Employed Independent Contractor within moments.

If you already have an account, Log In and download the New Mexico Auditor Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously obtained documents in the My documents section of your account.

If you wish to use US Legal Forms for the first time, here are simple steps to get you started: Ensure you have selected the correct form for your city/state. Click the Review button to examine the document's content. Read the document description to confirm that you have selected the right form. If the document does not meet your needs, utilize the Search field at the top of the screen to find one that does. If you are happy with the form, confirm your choice by clicking the Download now button. Then, select the payment plan you prefer and provide your details to register for the account. Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction. Select the format and download the document to your device. Make modifications. Fill out, edit, print, and sign the downloaded New Mexico Auditor Agreement - Self-Employed Independent Contractor.

Using US Legal Forms ensures you have access to a vast array of legal documents tailored to your specific needs, making the process efficient and straightforward.

Start managing your legal documentation with ease by exploring our extensive library today.

- Every template you add to your account has no expiration date and is yours indefinitely.

- If you wish to download or create another version, simply go to the My documents section and click on the document you want.

- Access the New Mexico Auditor Agreement - Self-Employed Independent Contractor with US Legal Forms, the most comprehensive library of legal document templates.

- Utilize a multitude of professional and state-specific templates that fulfill your business or personal requirements and needs.

- Your documents are stored securely and can be retrieved whenever you need them.

- Stay organized by keeping track of all your legal forms in one place.

Form popularity

FAQ

To fill out an independent contractor form, provide your contact information and a description of the services you intend to offer. Accurately document payment details and attach any needed documentation. Tools like the New Mexico Auditor Agreement - Self-Employed Independent Contractor on US Legal Forms can guide you through the requirements, ensuring compliance with state regulations.

Filling out an independent contractor agreement requires you to enter essential information such as the names of both parties and the details of the proposed work. Be sure to specify payment terms, whether it’s hourly or project-based, and include deadlines where applicable. Utilizing resources like the New Mexico Auditor Agreement - Self-Employed Independent Contractor can simplify the process by providing a structured format.

To write an effective independent contractor agreement, start by clearly defining the scope of work and responsibilities. Outline payment terms and conditions, including rates and deadlines. Additionally, include clauses on confidentiality and termination to protect both parties. Using the New Mexico Auditor Agreement - Self-Employed Independent Contractor can help ensure you cover all necessary elements specific to New Mexico laws.

Writing a contract for an independent contractor requires clarity and detail. Begin with the scope of work, payment terms, and deadlines. Both parties should agree on ownership of work, confidentiality, and termination conditions. A well-structured New Mexico Auditor Agreement - Self-Employed Independent Contractor template can significantly simplify this process and ensure all important aspects are covered.

In New Mexico, whether an independent contractor needs a license depends on the type of work they perform. Certain professions and trades require specific licenses to operate legally. It is essential for contractors to check state regulations to ensure compliance. Using a New Mexico Auditor Agreement - Self-Employed Independent Contractor can guide you through the licensing requirements relevant to your situation.

The primary requirement for being an independent contractor is the ability to control one’s work and how it gets done. Unlike employees, independent contractors must offer their services to multiple clients. They must also obtain any necessary licenses and permits based on their profession. A New Mexico Auditor Agreement - Self-Employed Independent Contractor can help streamline these requirements.

A managed audit in New Mexico involves a systematic review of a business's compliance with state tax obligations. This process ensures accuracy in tax reporting and addresses issues of underreporting or misclassification. Engaging professionals who specialize in a New Mexico Auditor Agreement - Self-Employed Independent Contractor can help contractors and businesses navigate this audit process effectively.

Recent changes in federal regulations have clarified the classification of independent contractors. These rules aim to ensure proper classification and compliance, affecting how businesses engage self-employed individuals. Understanding this new rule is vital for both contractors and businesses to maintain legal compliance. You can find relevant resources and guidance through a New Mexico Auditor Agreement - Self-Employed Independent Contractor.

A basic independent contractor agreement establishes the working relationship between a contractor and a client. This agreement typically includes the scope of work, payment terms, and deadlines. It helps both parties understand their rights and responsibilities while protecting their interests. A New Mexico Auditor Agreement - Self-Employed Independent Contractor serves as a comprehensive tool to navigate these terms.

A basic 1099 agreement outlines the relationship between a business and a self-employed independent contractor. This document specifies the terms of payment, services rendered, and expectations from both parties. It is essential for tax purposes, as businesses report payments to contractors on Form 1099. Using a New Mexico Auditor Agreement - Self-Employed Independent Contractor can help clarify these terms.