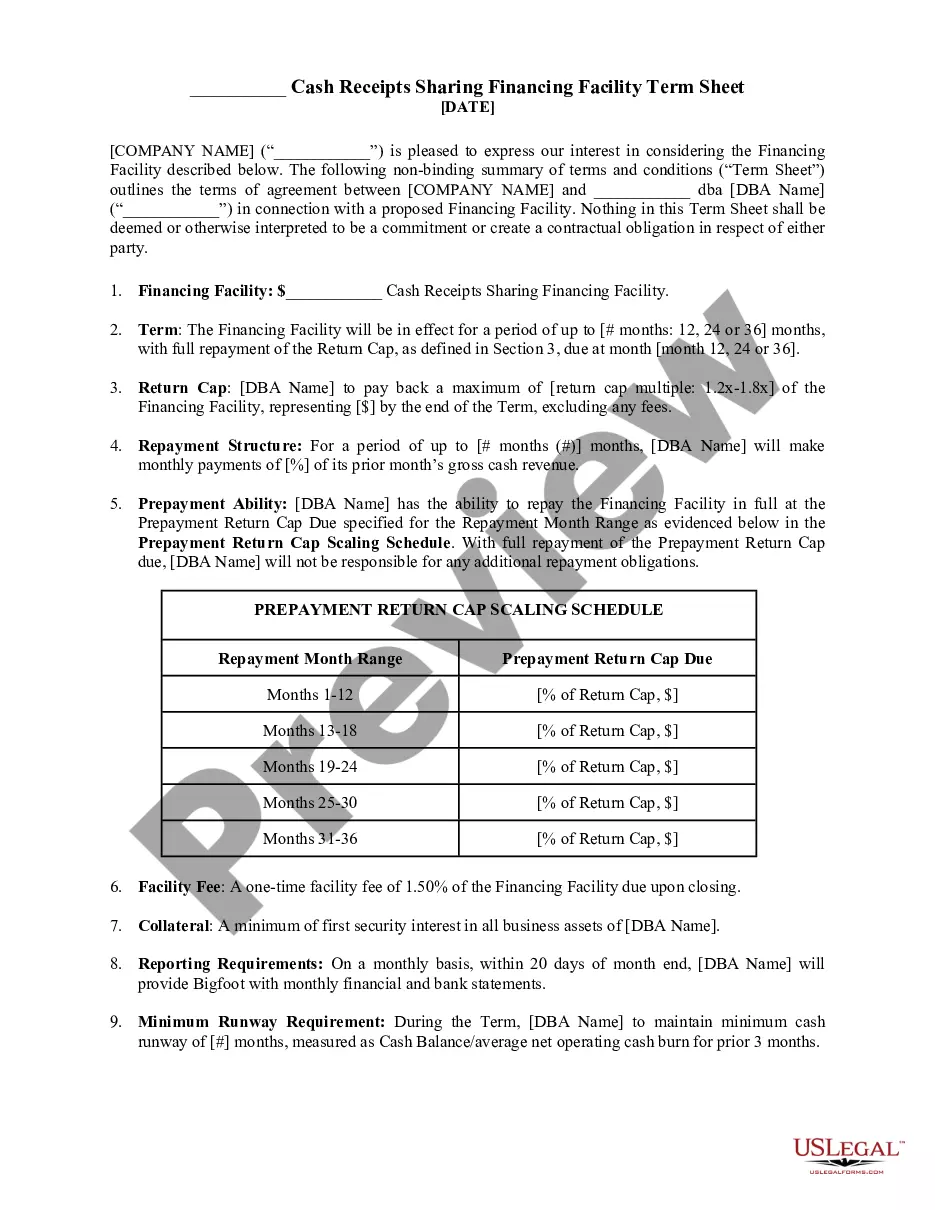

New Mexico Cash Receipts Sharing Financing Facility Term Sheet

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth."

How to fill out Cash Receipts Sharing Financing Facility Term Sheet?

It is possible to invest time online trying to find the legal document format that fits the federal and state demands you need. US Legal Forms provides a huge number of legal kinds that happen to be analyzed by pros. It is possible to download or print out the New Mexico Cash Receipts Sharing Financing Facility Term Sheet from your services.

If you already have a US Legal Forms bank account, you are able to log in and then click the Acquire button. Afterward, you are able to complete, edit, print out, or signal the New Mexico Cash Receipts Sharing Financing Facility Term Sheet. Each legal document format you acquire is the one you have for a long time. To get an additional version associated with a obtained type, proceed to the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms web site the very first time, stick to the basic directions under:

- Very first, make certain you have chosen the right document format for the state/metropolis of your choice. See the type outline to make sure you have chosen the right type. If accessible, make use of the Preview button to appear through the document format at the same time.

- If you want to get an additional edition from the type, make use of the Look for area to discover the format that fits your needs and demands.

- Upon having discovered the format you desire, simply click Acquire now to carry on.

- Select the prices prepare you desire, type your accreditations, and sign up for a merchant account on US Legal Forms.

- Comprehensive the purchase. You should use your charge card or PayPal bank account to pay for the legal type.

- Select the format from the document and download it for your device.

- Make alterations for your document if possible. It is possible to complete, edit and signal and print out New Mexico Cash Receipts Sharing Financing Facility Term Sheet.

Acquire and print out a huge number of document templates making use of the US Legal Forms site, that offers the most important collection of legal kinds. Use professional and state-particular templates to deal with your company or person demands.

Form popularity

FAQ

The state's income tax rates range from 0% to 5.9%, and New Mexico doesn't charge a sales tax.

EFFECTIVE July 1, 2023 The state portion of the gross receipts tax rate has been lowered from 5.000% to 4.875%, due to HB-163 from the 2022 legislative session. This change impacts all location codes across the state. Make sure to review the Gross Receipts and Compensating Tax Rate Schedule included in this packet.

Section 7-9-4 - Imposition and rate of tax; denomination as "gross receipts tax". A. For the privilege of engaging in business, an excise tax equal to five and one-eighth percent of gross receipts is imposed on any person engaging in business in New Mexico.

What charges are taxable? In New Mexico, the state gross receipts tax (GRT) is levied on a business's receipts from sales and services, including transient accommodations, so any revenue received from providing short-term rentals is subject to GRT.

Compensating tax is imposed when a business or an individual uses tangible property, a service, a license or a franchise that was acquired as a result of a transaction with a person located outside the state that would have been subject to gross receipts tax if the seller had nexus in New Mexico.

Gross receipts tax in New Mexico applies to receipts from sales of property, services (including research and development services), and tangible personal property. New Mexico GRT also applies to the right to use a franchise in the state.

EFFECTIVE July 1, 2023 The state portion of the gross receipts tax rate has been lowered from 5.000% to 4.875%, due to HB-163 from the 2022 legislative session. This change impacts all location codes across the state. Make sure to review the Gross Receipts and Compensating Tax Rate Schedule included in this packet.

If you need assistance, call 1-866-809-2335. Once you're online filing your return, you can also pay online.