New Mexico Investment - Grade Bond Optional Redemption (without a Par Call)

Description

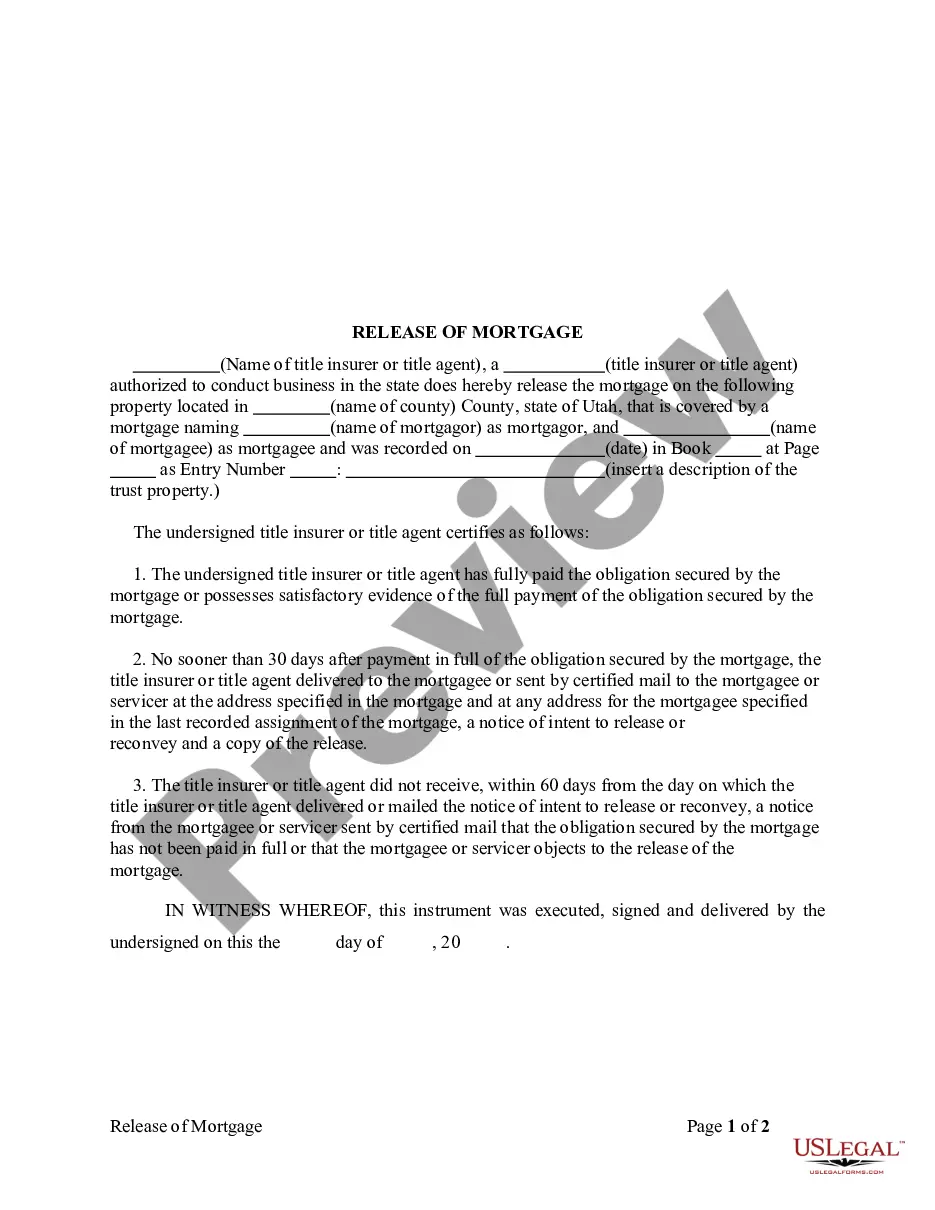

How to fill out Investment - Grade Bond Optional Redemption (without A Par Call)?

If you have to full, download, or print out authorized record templates, use US Legal Forms, the greatest collection of authorized varieties, that can be found on the web. Make use of the site`s basic and hassle-free lookup to get the paperwork you want. Different templates for enterprise and person reasons are categorized by groups and says, or key phrases. Use US Legal Forms to get the New Mexico Investment - Grade Bond Optional Redemption (without a Par Call) in a few mouse clicks.

In case you are previously a US Legal Forms buyer, log in to your profile and click on the Download option to have the New Mexico Investment - Grade Bond Optional Redemption (without a Par Call). Also you can gain access to varieties you earlier delivered electronically inside the My Forms tab of your respective profile.

If you are using US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape for that proper area/region.

- Step 2. Make use of the Review choice to examine the form`s information. Don`t neglect to learn the description.

- Step 3. In case you are not happy using the kind, make use of the Search industry towards the top of the display screen to locate other versions from the authorized kind template.

- Step 4. Once you have found the shape you want, go through the Get now option. Opt for the costs strategy you like and put your qualifications to register for an profile.

- Step 5. Procedure the deal. You should use your bank card or PayPal profile to perform the deal.

- Step 6. Select the formatting from the authorized kind and download it in your gadget.

- Step 7. Complete, change and print out or sign the New Mexico Investment - Grade Bond Optional Redemption (without a Par Call).

Every authorized record template you acquire is yours eternally. You have acces to each kind you delivered electronically within your acccount. Go through the My Forms segment and decide on a kind to print out or download once again.

Be competitive and download, and print out the New Mexico Investment - Grade Bond Optional Redemption (without a Par Call) with US Legal Forms. There are thousands of specialist and status-distinct varieties you may use for the enterprise or person requirements.

Form popularity

FAQ

investmentgrade bond is a bond that pays higher yields but also carries more risk and a lower credit rating than an investmentgrade bond. Noninvestmentgrade bonds are also called highyield bonds or junk bonds. HighYield Bond: Definition, Types, and How to Invest Investopedia ? Bonds ? Fixed Income Investopedia ? Bonds ? Fixed Income

High-yield bond issuance usually entails three steps: Investment bankers draft an offering proposal, or prospectus, and negotiate conditions with potential investors. The securities are allocated/syndicated to bondholders once terms of the offering are finalized.

Investment grade categories indicate relatively low to moderate credit risk, while ratings in the speculative categories signal either a higher level of credit risk or that a default has already occurred. Fitch may also disclose issues relating to a rated issuer that are not and have not been rated. Rating Definitions - Fitch Ratings fitchratings.com ? products ? rating-definiti... fitchratings.com ? products ? rating-definiti...

Bonds with a low credit rating are known as non-investment grade or junk bonds. Junk Bonds - What You Need to Know about Junk Bond Ratings Corporate Finance Institute ? Resources Corporate Finance Institute ? Resources

Bond Redemption Date means, with respect to any Bond, the date on which such Bond is redeemed pursuant to the applicable Bond Documents. Bond Redemption Date means any date, other than an Interest Payment Date, upon which Bonds shall be redeemed pursuant to the Indenture. Bond Redemption Date Definition | Law Insider lawinsider.com ? dictionary ? bond-redempt... lawinsider.com ? dictionary ? bond-redempt...

investmentgrade bond is a bond that pays higher yields but also carries more risk and a lower credit rating than an investmentgrade bond. Noninvestmentgrade bonds are also called highyield bonds or junk bonds.

A bond redemption is the full repayment of the principal amount (the amount you invested) and any interest owed to date. What is bond redemption? - Help Centre - Crowdcube crowdcube.com ? en-us ? articles ? 3600006... crowdcube.com ? en-us ? articles ? 3600006...

The simple reason to buy a junk bond is for higher returns. Junk bonds are risky assets but due to their high risk, they come with returns that are higher than safer, investment-grade bonds. Investors willing to take on higher risk for higher returns would buy junk bonds. Everything You Need to Know About Junk Bonds - Investopedia investopedia.com ? articles investopedia.com ? articles

Bond redemption is the process by which a bond issuer repays the principal amount of a bond to the bondholder on the bond's maturity date. When a bond is issued, it has a specified term or maturity date, which is the date when the bond issuer is obligated to pay back the principal amount of the bond to the bondholder. Bond Redemption and Types of Bond Redemption | IndiaBonds indiabonds.com ? news-and-insight ? bond-... indiabonds.com ? news-and-insight ? bond-...

Optional Redemption On or after the Par Call Date, the Company may redeem the notes, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal amount of the notes being redeemed plus accrued and unpaid interest thereon to the redemption date.