New Mexico Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service

Description

How to fill out Retirement Plan Transfer Agreement Regarding Contribution Plan Meeting Requirements Of The Internal Revenue Service?

Finding the right legitimate papers template can be quite a battle. Obviously, there are tons of web templates available on the Internet, but how do you discover the legitimate kind you require? Use the US Legal Forms web site. The support gives a large number of web templates, like the New Mexico Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service, that can be used for organization and private requires. All of the varieties are checked by professionals and satisfy federal and state specifications.

Should you be presently signed up, log in to the bank account and then click the Obtain switch to find the New Mexico Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service. Make use of bank account to check through the legitimate varieties you have bought previously. Check out the My Forms tab of the bank account and have yet another backup in the papers you require.

Should you be a whole new customer of US Legal Forms, listed here are easy recommendations so that you can stick to:

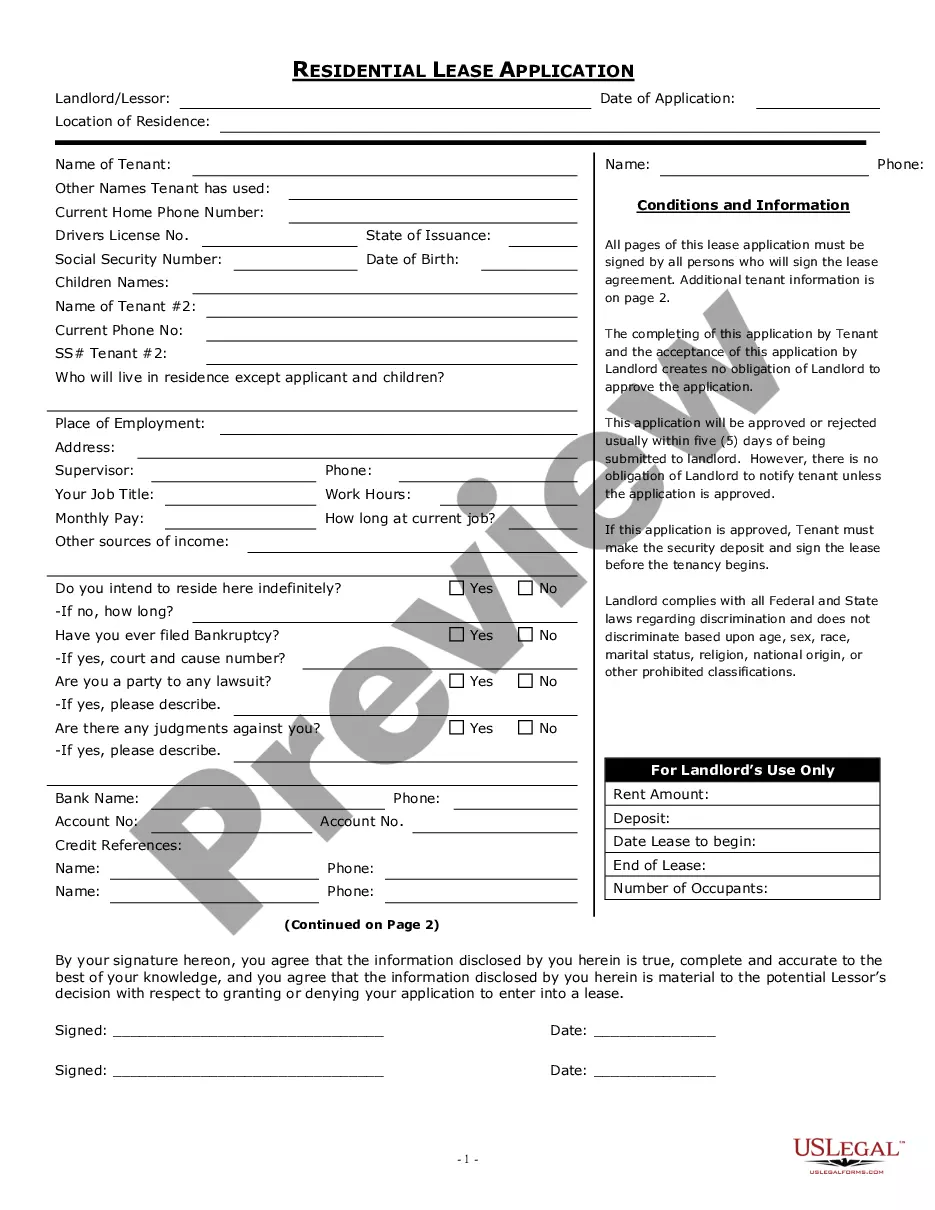

- Initial, be sure you have selected the right kind for your city/county. It is possible to look over the shape utilizing the Review switch and study the shape information to make certain it is the best for you.

- In the event the kind will not satisfy your needs, utilize the Seach area to obtain the appropriate kind.

- When you are certain the shape would work, click on the Acquire now switch to find the kind.

- Opt for the rates prepare you need and enter in the essential information and facts. Build your bank account and pay for an order using your PayPal bank account or charge card.

- Select the document file format and download the legitimate papers template to the device.

- Total, revise and produce and indicator the acquired New Mexico Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service.

US Legal Forms will be the largest library of legitimate varieties where you can discover numerous papers web templates. Use the service to download expertly-produced papers that stick to express specifications.

Form popularity

FAQ

More In Help. Employers who paid wages to agricultural employees (farmworkers) that are subject to federal income tax withholding or social security and Medicare taxes must file a Form 943, Employer's Annual Federal Tax Return for Agricultural Employees. Topic No. 760, Form 943 ? Reporting and Deposit Requirements for ... - IRS irs.gov ? taxtopics irs.gov ? taxtopics

Employer contributions made to safe harbor 401(k) and SIMPLE 401(k) plans must be fully vested immediately. A 401(k) participant becomes 100% vested at normal retirement age, when meeting a company's early retirement age provision, or if their retirement plan is fully or partially terminated.

If you file Form 943 electronically, you can e-file and use EFW to pay the balance due in a single step using tax preparation software or through a tax professional. However, don't use EFW to make federal tax deposits. For more information on paying your taxes using EFW, go to IRS.gov/EFW. Instructions for Form 943 (2022) | Internal Revenue Service IRS (.gov) ? instructions ? i943 IRS (.gov) ? instructions ? i943

How Should You Complete Form 943? Enter your EIN, name, and address in the spaces provided. Don't use your social security number (SSN) or individual taxpayer identification number (ITIN). Generally, enter the business (legal) name you used when you applied for your EIN. 2023 Instructions for Form 943 - IRS IRS (.gov) ? pub ? irs-pdf ? i943 IRS (.gov) ? pub ? irs-pdf ? i943 PDF

How To Complete Form 943 Your name, address and EIN (employer identification number) Total wages paid to each employee, including how much of that pay was sick or family leave. Total amount of federal income tax withheld from the employees for the year. Total deposits made for the year.

In general, an employee must be allowed to participate in a qualified retirement plan if he or she meets both of the following requirements: Has reached age 21. Has at least 1 year of service.

The IRS Business Mileage Reimbursement Rate is 65.5 cents per mile as of July 1, 2023. The 2024 rates will be released in December. With the commuting valuation rule, the value is calculated by multiplying the number of trips by either $1.50 (one way) or $3 (round trip).

It's designed to be used in place ? or in addition to Form 941 ? for businesses that routinely pay farm workers. Form 943 is only used by companies that employ and pay farmworkers wages by cash, checks, or money orders. Non-cash wages are food and lodging, or payment for services other than farm work. IRS Form 943 for 2023: Simple instructions and PDF download OnPay ? Payroll ? The Payroll Process OnPay ? Payroll ? The Payroll Process