New Mexico Retainer Agreement

Description

How to fill out Retainer Agreement?

US Legal Forms - one of the largest libraries of authorized varieties in the United States - provides a wide array of authorized record layouts you may obtain or produce. Using the internet site, you will get a huge number of varieties for organization and individual uses, categorized by categories, states, or keywords.You can get the newest models of varieties like the New Mexico Retainer Agreement in seconds.

If you currently have a registration, log in and obtain New Mexico Retainer Agreement in the US Legal Forms library. The Download switch will show up on each develop you perspective. You have access to all earlier acquired varieties inside the My Forms tab of the bank account.

If you want to use US Legal Forms the first time, allow me to share basic directions to help you started:

- Make sure you have selected the proper develop for the town/state. Click on the Review switch to analyze the form`s content material. Read the develop information to ensure that you have chosen the correct develop.

- In the event the develop doesn`t satisfy your requirements, use the Research industry near the top of the display to discover the the one that does.

- If you are satisfied with the shape, validate your selection by visiting the Purchase now switch. Then, pick the pricing strategy you want and provide your credentials to register for an bank account.

- Process the transaction. Utilize your credit card or PayPal bank account to complete the transaction.

- Choose the format and obtain the shape on the product.

- Make modifications. Fill out, change and produce and indication the acquired New Mexico Retainer Agreement.

Each template you included with your account does not have an expiration day and is yours forever. So, if you would like obtain or produce an additional version, just go to the My Forms area and click on on the develop you want.

Get access to the New Mexico Retainer Agreement with US Legal Forms, one of the most comprehensive library of authorized record layouts. Use a huge number of specialist and condition-distinct layouts that meet up with your business or individual demands and requirements.

Form popularity

FAQ

A retainer is a fee paid to a lawyer or law firm in advance of services being rendered, and the law firm should hold it in a trust account until the services are provided. It gets booked to the balance sheet as a prepaid expense (which is an asset).

A retainer fee is an advance payment a client makes to a professional, and it is considered a down payment on the future services rendered by that professional. Regardless of occupation, the retainer fee funds the initial expenses of the working relationship.

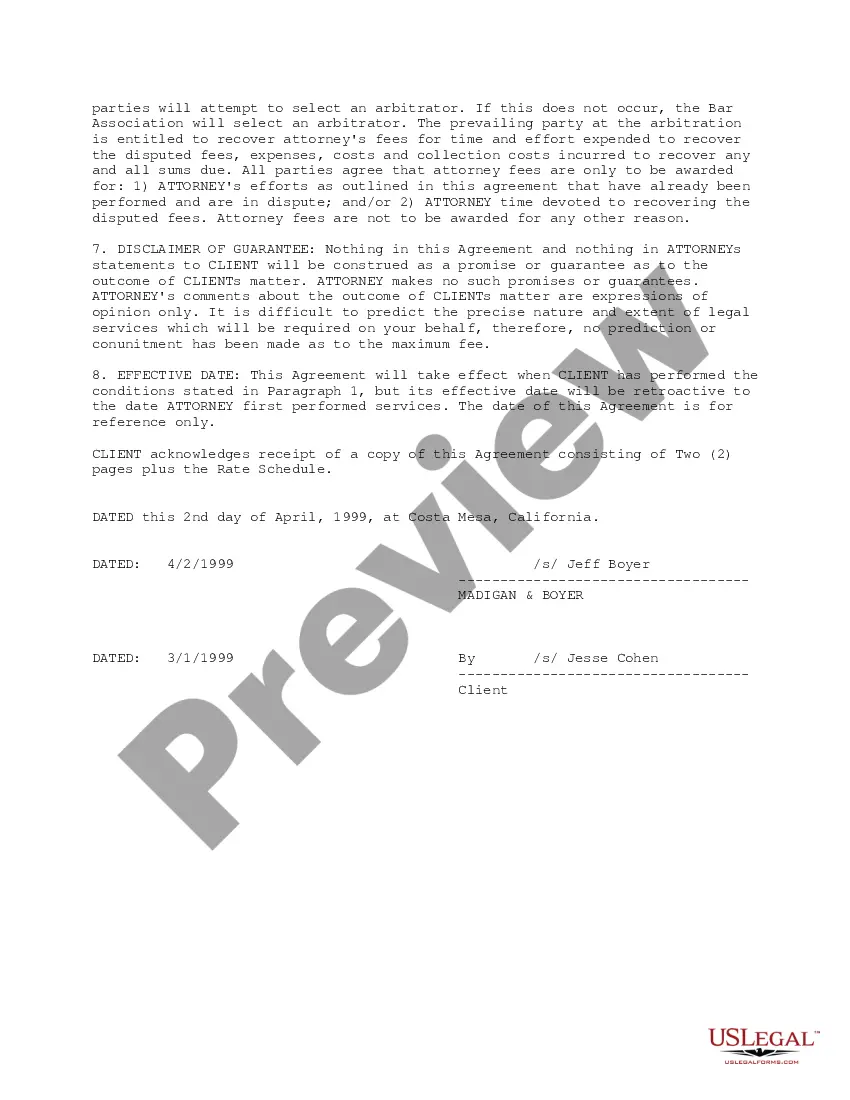

The essential parts of the agreement include: Scope and nature of the work. What is the attorney expected to do for the client? ... Retainer fee. The retainer fee is the amount charged to the client. ... Client expenses. The client typically pays for some expenses, especially filing-related expenses, and travel costs.

The retainer or deposit is treated as a liability to show that, although your business is holding the money from a deposit or retainer, it doesn't belong to you until it's used to pay for services. When you invoice the customer and receive payment against it, you'll turn that liability into income.

Accounting for a Retainer Fee If the firm is using the accrual basis of accounting, retainers are recognized as a liability upon receipt of the cash, and are recognized as revenue only after the associated work has been performed.

The retainer or deposit is treated as a liability to show that, although your business is holding the money from a deposit or retainer, it doesn't belong to you until it's used to pay for services. When you invoice the customer and receive payment against it, you'll turn that liability into income.

Make sure all the following details make it into your retainer contract: The amount you're to receive each month. The date you're to be paid by. Any invoicing procedures you're expected to follow. Exactly how much work and what type of work you expect to do. When your client needs to let you know about the month's work by.