New Mexico Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock

Description

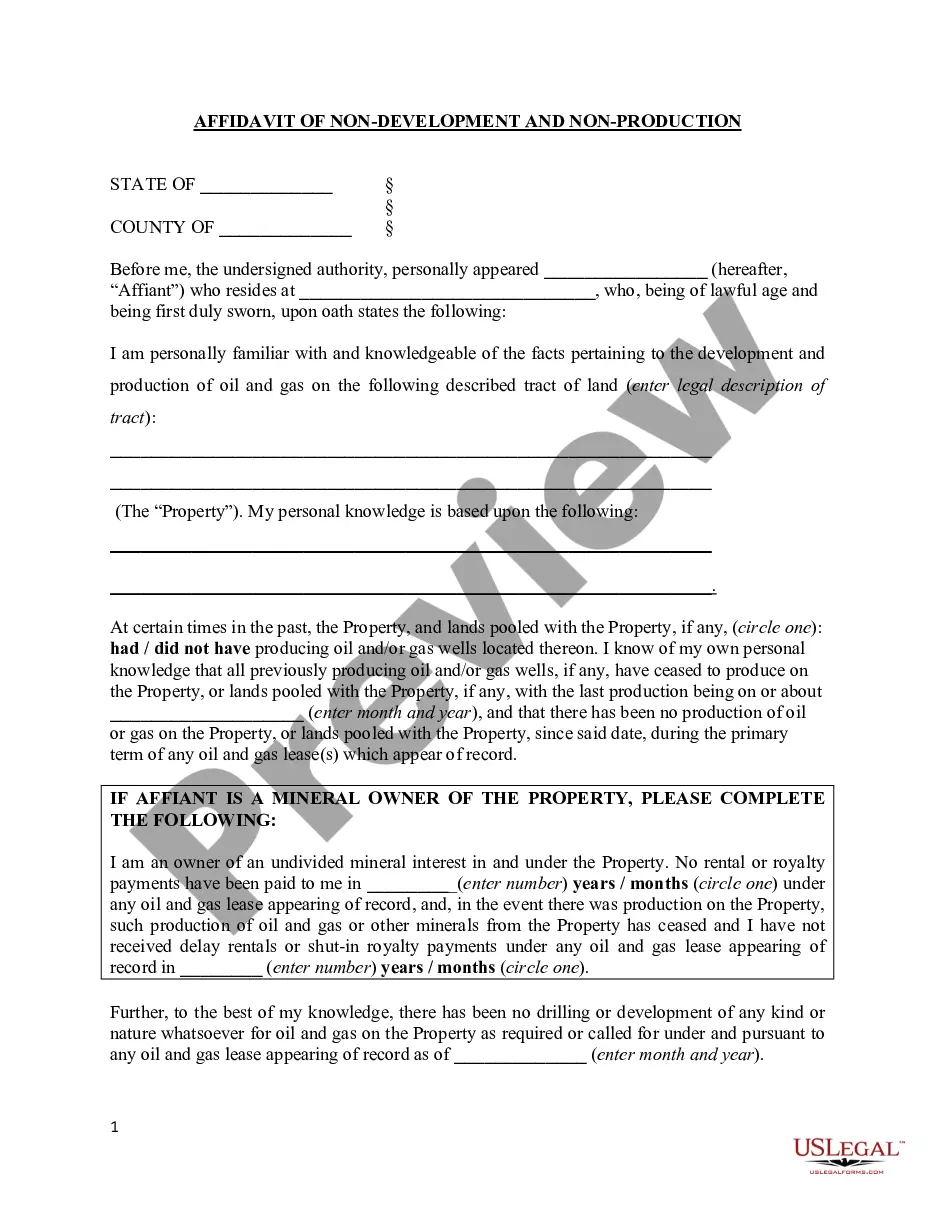

How to fill out Articles Supplementary - Classifying Preferred Stock As Cumulative Convertible Preferred Stock?

Are you currently in the position in which you need papers for both organization or individual functions just about every day? There are tons of lawful papers layouts available online, but locating ones you can rely isn`t easy. US Legal Forms gives a huge number of kind layouts, just like the New Mexico Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock, which are written in order to meet federal and state specifications.

In case you are presently informed about US Legal Forms site and have a merchant account, simply log in. After that, you are able to down load the New Mexico Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock template.

Unless you offer an profile and want to start using US Legal Forms, abide by these steps:

- Obtain the kind you need and make sure it is for that right town/area.

- Make use of the Review option to analyze the shape.

- Look at the explanation to ensure that you have selected the proper kind.

- When the kind isn`t what you`re searching for, make use of the Look for area to obtain the kind that suits you and specifications.

- Whenever you discover the right kind, simply click Get now.

- Select the costs prepare you need, complete the desired details to generate your money, and pay money for the transaction with your PayPal or credit card.

- Select a convenient data file structure and down load your copy.

Find every one of the papers layouts you possess purchased in the My Forms food list. You can obtain a additional copy of New Mexico Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock anytime, if needed. Just go through the essential kind to down load or print the papers template.

Use US Legal Forms, probably the most considerable selection of lawful varieties, to save lots of time as well as stay away from blunders. The service gives appropriately produced lawful papers layouts which you can use for a selection of functions. Generate a merchant account on US Legal Forms and begin generating your life a little easier.

Form popularity

FAQ

Noncumulative describes a type of preferred stock that does not entitle investors to reap any missed dividends. By contrast, "cumulative" indicates a class of preferred stock that indeed entitles an investor to dividends that were missed.

Conversion price can be calculated by dividing the convertible preferred stock's par value by the stipulated conversion ratio.

The journal entry for issuing preferred stock is very similar to the one for common stock. This time Preferred Stock and Paid-in Capital in Excess of Par - Preferred Stock are credited instead of the accounts for common stock.

Redeemable convertible preference share It is liable to be redeemed by that body corporate. On redemption, the shareholder receives: an agreed cash amount; or. an agreed number of ordinary shares in the issuing body corporate.

Convertible preferred shares can be converted into common stock at a fixed conversion ratio. Once the market price of the company's common stock rises above the conversion price, it may be worthwhile for the preferred shareholders to convert and realize an immediate profit.

The preferred stock converts into a variable number of shares and the monetary value of the obligation is based solely on a fixed monetary amount (stated value) known at inception. ingly, it should be classified as a liability under the guidance in ASC 480-10-25-14a.

The preferred stock converts into a variable number of shares and the monetary value of the obligation is based solely on a fixed monetary amount (stated value) known at inception. ingly, it should be classified as a liability under the guidance in ASC 480-10-25-14a.

Convertible preferred shares can be converted into common stock at a fixed conversion ratio.