New Mexico Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement

Description

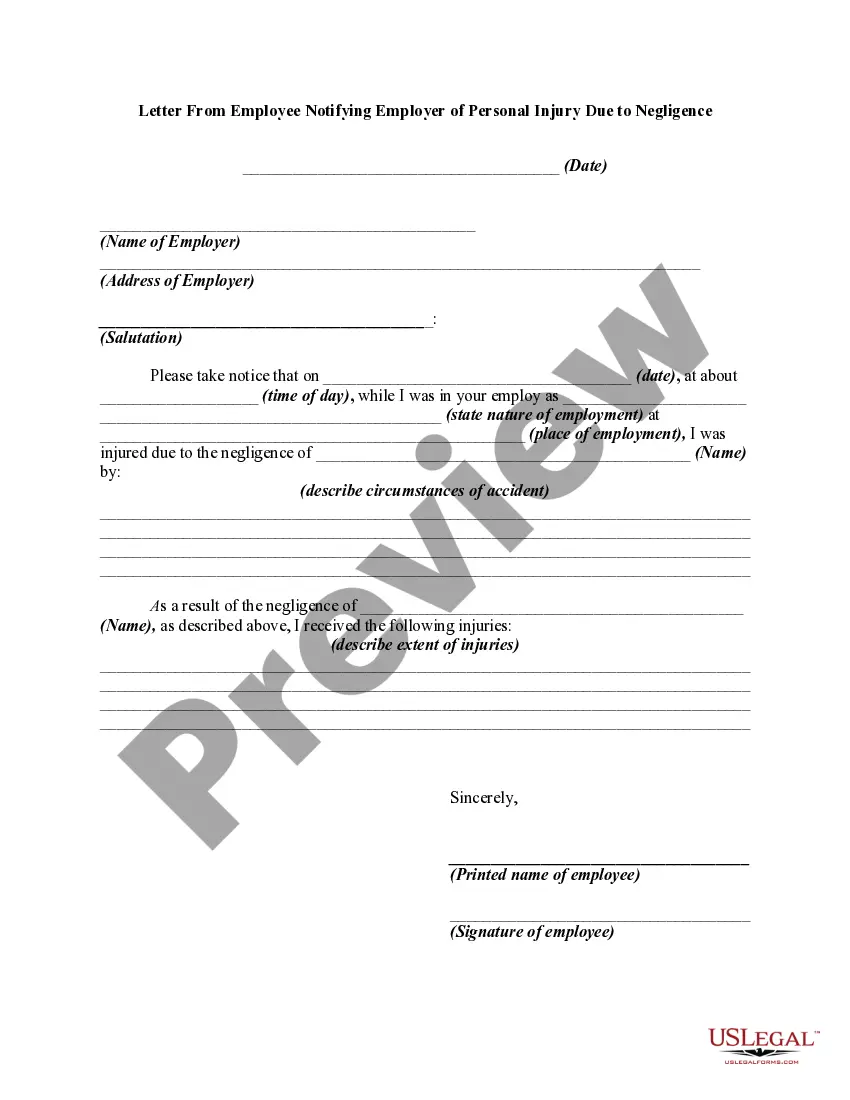

How to fill out Disclosure Of Distribution Agreement, Services Agreement And Tax Sharing Agreement?

Have you been in a situation where you need papers for sometimes enterprise or person functions nearly every day time? There are a variety of lawful document templates available on the net, but discovering types you can depend on isn`t easy. US Legal Forms gives a huge number of kind templates, like the New Mexico Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement, that are written in order to meet state and federal specifications.

When you are already acquainted with US Legal Forms internet site and have a merchant account, just log in. Afterward, you may down load the New Mexico Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement web template.

Should you not offer an accounts and would like to begin using US Legal Forms, adopt these measures:

- Discover the kind you will need and ensure it is to the proper city/county.

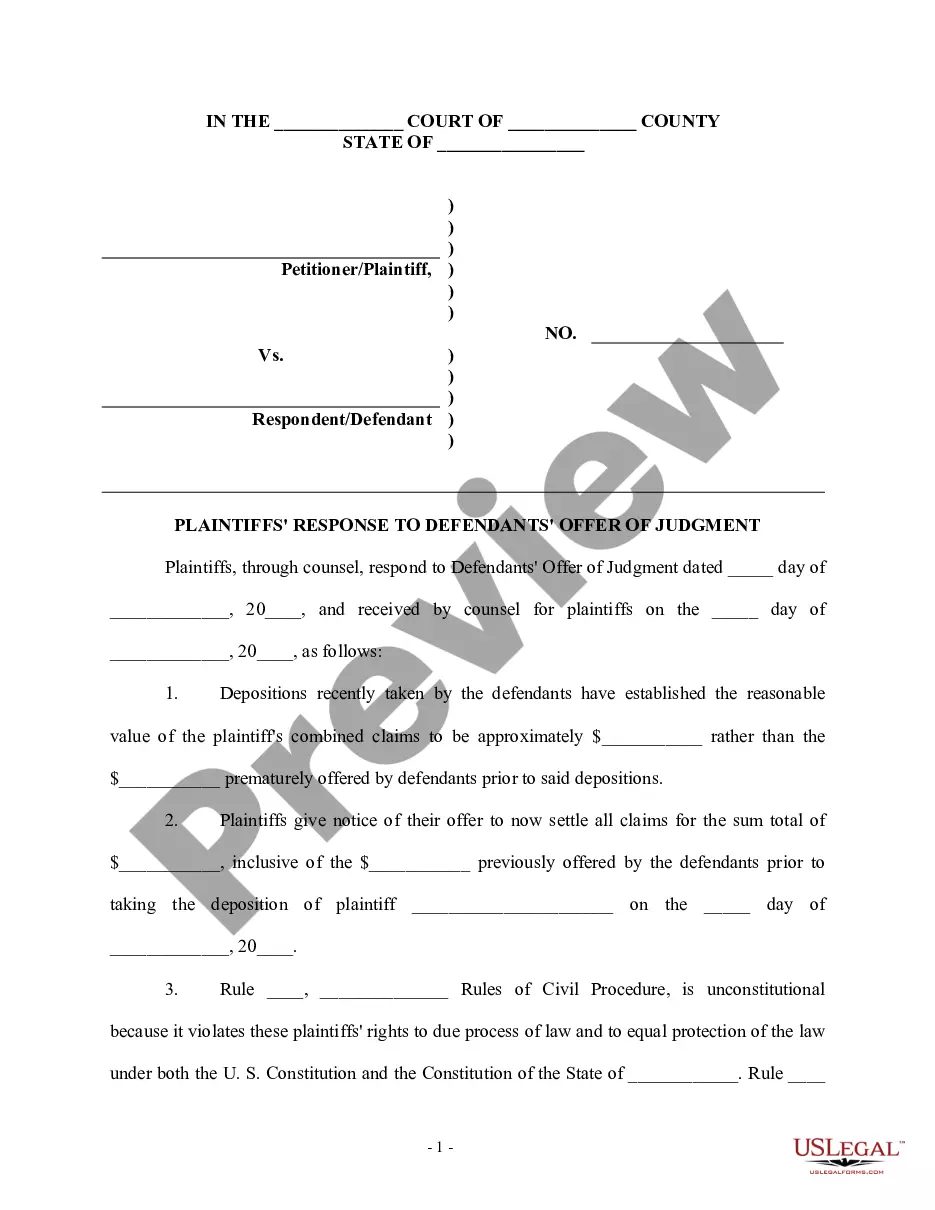

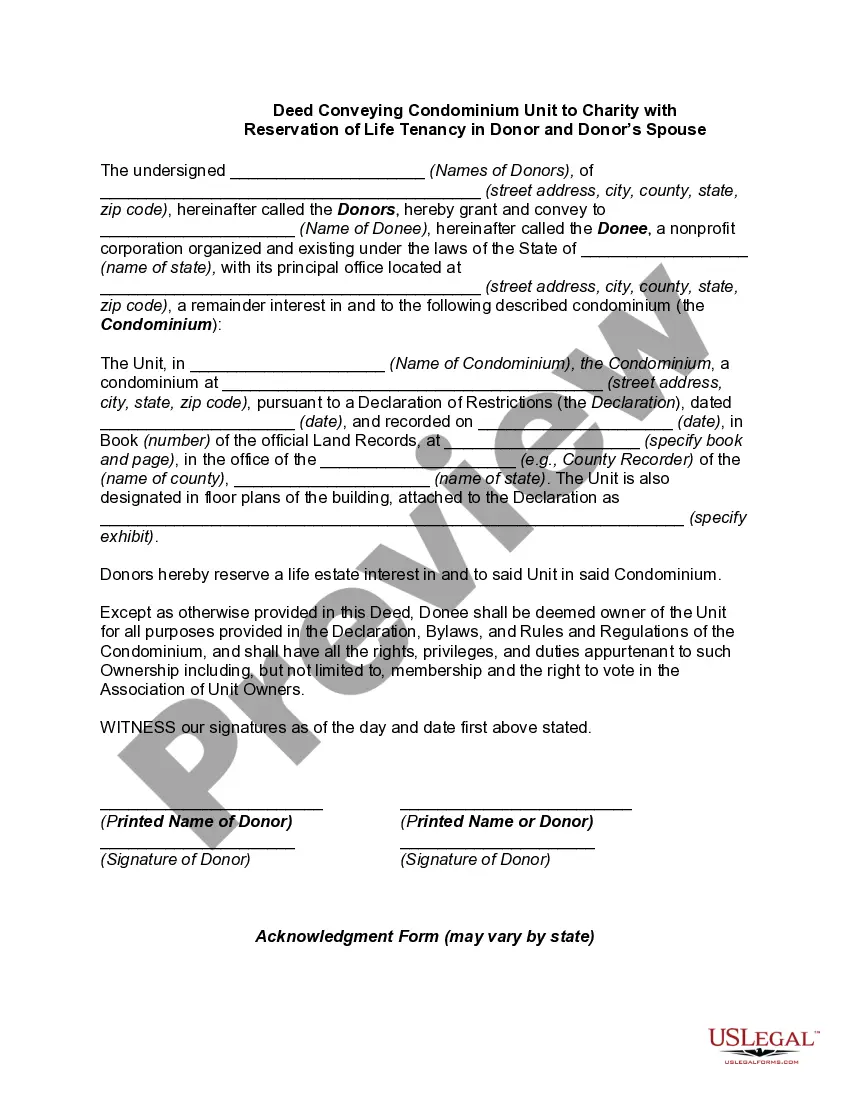

- Use the Review option to check the form.

- Look at the explanation to ensure that you have selected the right kind.

- If the kind isn`t what you`re searching for, make use of the Research field to find the kind that suits you and specifications.

- If you get the proper kind, click on Acquire now.

- Choose the costs strategy you would like, fill in the necessary info to produce your bank account, and purchase an order using your PayPal or bank card.

- Select a hassle-free document file format and down load your duplicate.

Get every one of the document templates you have bought in the My Forms food selection. You can get a further duplicate of New Mexico Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement whenever, if possible. Just click on the required kind to down load or print the document web template.

Use US Legal Forms, the most considerable variety of lawful varieties, to conserve time as well as stay away from faults. The services gives professionally made lawful document templates that can be used for a selection of functions. Make a merchant account on US Legal Forms and begin creating your lifestyle easier.

Form popularity

FAQ

New Mexico Tax Power of Attorney (Form ACD-31102), otherwise known as the ?Taxation and Revenue Department Tax Information Authorization,? is a form used to appoint someone, usually a tax attorney or accountant, to represent your tax-related affairs.

All owners of New Mexico businesses registered as a Partnership, Limited Liability Company or Corporation must obtain a New Mexico CRS Tax ID number.

These tax-exempt goods include gasoline, groceries, durable medical equipment, prescription medications, and certain medical services. Additionally, there are certain customers that are exempt from the gross receipts tax, such as nonprofits, government agencies, and merchants buying goods for resale.

New Mexico does not require LLCs to file an annual report. New Mexico imposes a franchise tax on LLCs if they paid federal income tax. The franchise tax is filed along with the state income tax, and is due by the 15th day of the third month following the close of the tax year. The fee is $50.

A NMBTIN is a unique taxpayer ID issued by the New Mexico Department of Taxation and Revenue. It is used to report withholdings, gross receipt taxes, and any compensation you may receive. This is different from your Federal Employer Identification Number, which is also required for most business types.

The state GRT was lowered July 1, 2022, for the first time in 40 years. On July 1, 2023, the GRT rate will drop again, to 4.875%. For the most part, New Mexico GRT rates are based on the location where the products were delivered or the services supplied.

A New Mexico tax power of attorney (Form ACD-31102) is a form that gives a taxpayer authority to select up to two (2) representatives the power to handle tax matters on their behalf before the New Mexico Taxation and Revenue Department (TRD).

The 2019 amendment, effective June 14, 2019, reduced the capital gains deduction from fifty percent to forty percent of the taxpayer's net capital gain income for the taxable year for which the deduction is being claimed; in Subsection A, Paragraph A(2), deleted "the following percentage" and added "forty percent", and ...