The New Mexico Restricted Stock Bonus Plan is a specific compensation program offered by McDonald and Company Investments, Inc., to their eligible employees in the state of New Mexico. This initiative is designed to reward and incentivize deserving employees by granting them restricted stock units (RSS) as a bonus. Under this plan, eligible employees receive a predetermined number of RSS, which represent an ownership stake in McDonald and Company Investments, Inc. However, this RSS is subject to certain restrictions and conditions that need to be met in order to be fully vested and exercised. One type of New Mexico Restricted Stock Bonus Plan is the Performance-based RSU Plan. In this plan, the grants of RSS are linked to the achievement of specific performance targets set by the company. These targets are usually based on individual, team, or company-wide performance metrics, such as revenue growth, profitability, client retention, or other relevant factors. Another type of New Mexico Restricted Stock Bonus Plan is the Time-based RSU Plan. Under this plan, employees receive a set number of RSS based on their tenure with the company. This RSS typically vest over a specific period, encouraging employee loyalty and retention. To fully benefit from the New Mexico Restricted Stock Bonus Plan, employees must fulfill all requirements and restrictions specified in the plan's terms and conditions. These may include remaining employed with McDonald and Company Investments, Inc. for a certain period, achieving performance goals, or meeting other milestones as defined in the plan. Once the RSS are fully vested, employees have the option to convert them into company shares or receive the equivalent monetary value. The New Mexico Restricted Stock Bonus Plan serves several purposes. It aligns the interests of the employees with those of the company, as they directly benefit from its growth and success. It also aids in attracting and retaining top talent, as the opportunity to own a stake in the company represents a valuable incentive. Moreover, the plan promotes employee engagement and motivation by rewarding outstanding performance and dedication to the organization. In summary, the New Mexico Restricted Stock Bonus Plan of McDonald and Company Investments, Inc. is a compensation program offering eligible employees the opportunity to receive RSS as a bonus. This RSS represents ownership in the company and are subject to various restrictions and conditions. The program aims to reward and incentivize employees, align their interests with the company's, and foster engagement and retention.

New Mexico Restricted Stock Bonus Plan of McDonald and Company Investments, Inc.

Description

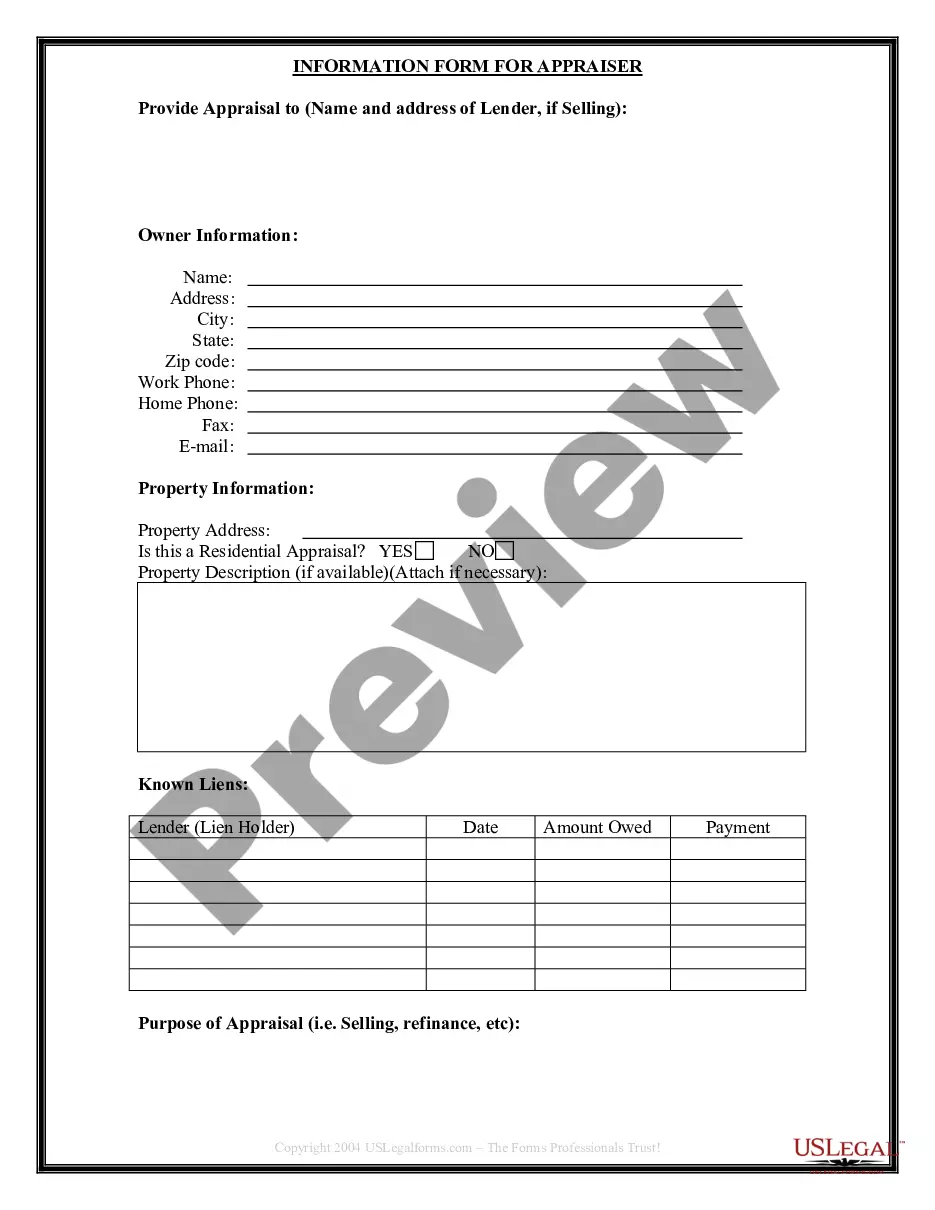

How to fill out New Mexico Restricted Stock Bonus Plan Of McDonald And Company Investments, Inc.?

You can commit hrs on the web attempting to find the legitimate file web template that fits the state and federal requirements you want. US Legal Forms offers thousands of legitimate types which can be examined by experts. It is possible to download or printing the New Mexico Restricted Stock Bonus Plan of McDonald and Company Investments, Inc. from the services.

If you have a US Legal Forms accounts, it is possible to log in and click the Obtain key. Afterward, it is possible to complete, change, printing, or sign the New Mexico Restricted Stock Bonus Plan of McDonald and Company Investments, Inc.. Each and every legitimate file web template you buy is your own eternally. To get yet another version of the acquired develop, visit the My Forms tab and click the related key.

Should you use the US Legal Forms web site for the first time, adhere to the easy instructions under:

- Very first, be sure that you have selected the correct file web template for that region/area that you pick. Browse the develop description to make sure you have selected the right develop. If accessible, take advantage of the Preview key to search from the file web template too.

- If you want to find yet another edition of your develop, take advantage of the Research field to find the web template that meets your requirements and requirements.

- Once you have located the web template you want, click Get now to proceed.

- Choose the pricing strategy you want, key in your credentials, and sign up for your account on US Legal Forms.

- Total the transaction. You can use your Visa or Mastercard or PayPal accounts to fund the legitimate develop.

- Choose the file format of your file and download it for your device.

- Make alterations for your file if possible. You can complete, change and sign and printing New Mexico Restricted Stock Bonus Plan of McDonald and Company Investments, Inc..

Obtain and printing thousands of file templates using the US Legal Forms web site, which provides the most important variety of legitimate types. Use expert and status-particular templates to take on your organization or individual requirements.

Form popularity

FAQ

A stock bonus plan is a qualified, defined contribution plan. Employers have the discretion to make yearly contributions on behalf of their employees. Contribu- tions need not be made or invested in company stock but usually are, and employees have the right to take plan distributions in the form of company stock.

McDirect Shares is a McDonald's stock purchase plan through which you are eligible to build your share ownership and reinvest dividends. You can purchase stock through convenient payroll deductions and a minimal start up fee. It's more important than ever to save for retirement.

Whereas a stock bonus plan is not required to invest in employer securities, an ESOP must invest primarily in employer securities, to the extent that employer stock is available. The employer can contribute company stock directly to the plan.

A stock bonus plan is a defined-contribution profit sharing plan, to which employers contribute company stock. These are considered to be qualified retirement plans, and as such, they're governed by the Employee Retirement Income Security Act (ERISA).

Profit-sharing Vs. So, let's look at some of the differences below. Profit-sharing can be a part of the employee's retirement plan. Bonuses are a part of the employee's annual compensation. Employees receive the amount at the time of retirement if it is merged with their 401(k) plan.