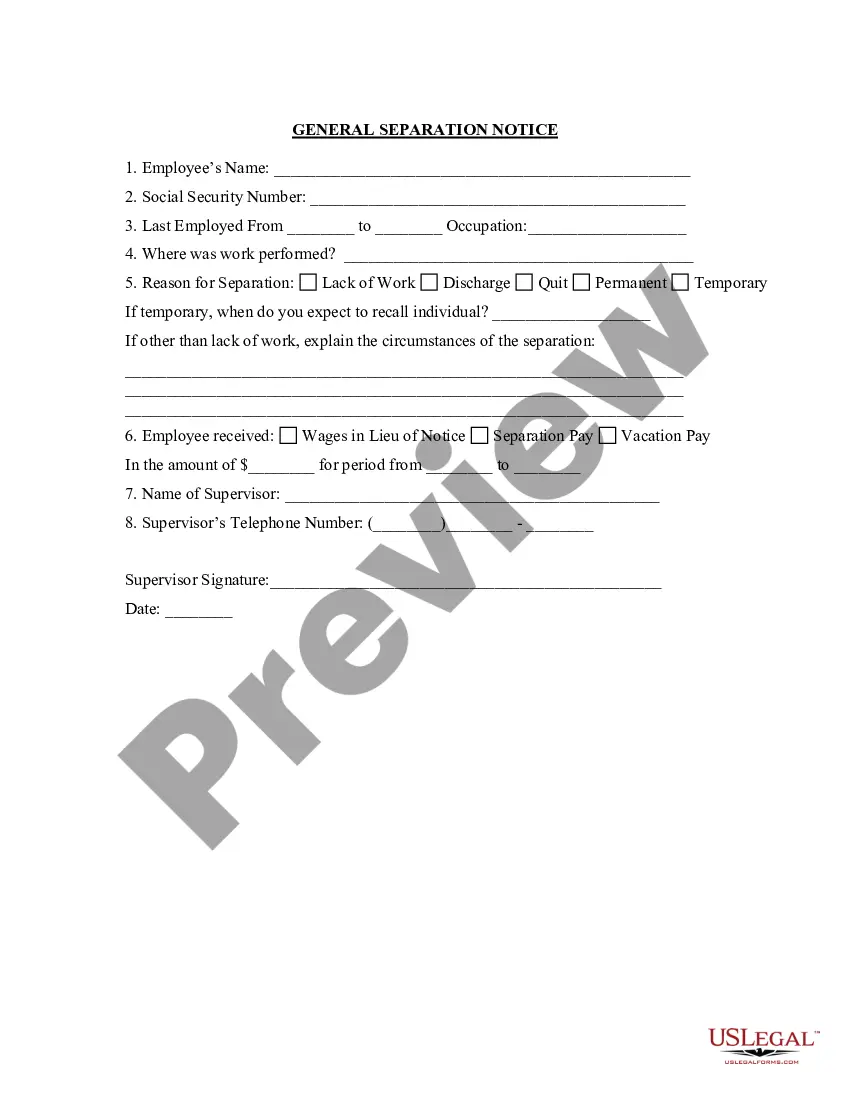

New Mexico Separation Notice for 1099 Employee

Description

How to fill out Separation Notice For 1099 Employee?

Are you presently in a location where you require documents for either business or personal purposes nearly every day? There are numerous legal document templates available online, but locating trustworthy ones isn’t easy.

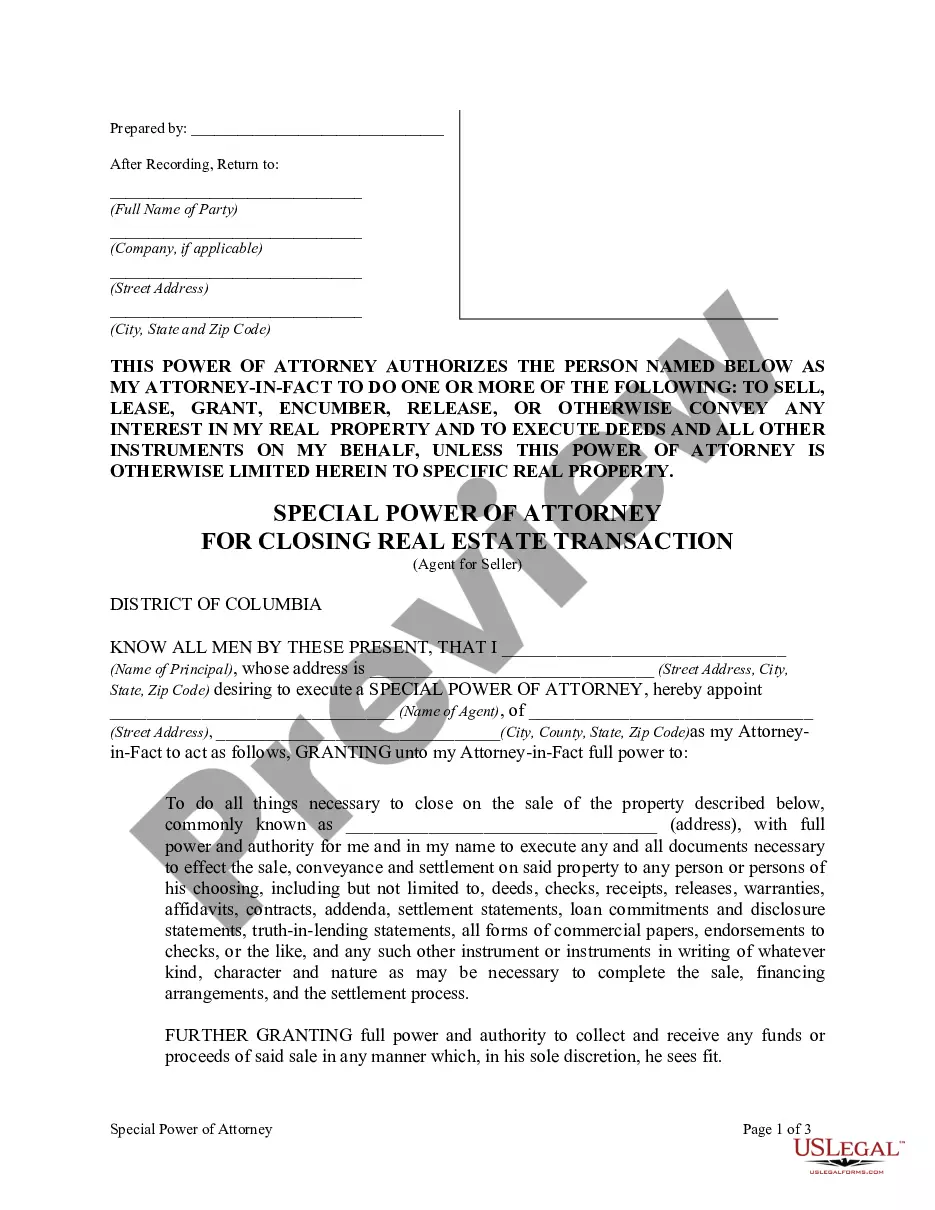

US Legal Forms offers a plethora of form templates, including the New Mexico Separation Notice for 1099 Employee, which are crafted to comply with state and federal regulations.

If you are already acquainted with the US Legal Forms website and possess an account, simply Log In. After that, you can download the New Mexico Separation Notice for 1099 Employee template.

- Acquire the necessary form and ensure it is for the correct region/state.

- Utilize the Review button to examine the form.

- Consult the overview to confirm that you have selected the correct form.

- If the form isn’t what you’re seeking, employ the Search field to find the document that fits your needs and requirements.

- Once you find the suitable form, click on Acquire now.

- Choose the pricing plan you prefer, fill in the required details to set up your account, and pay for the order using your PayPal or credit card.

- Select a preferred file format and download your copy.

Form popularity

FAQ

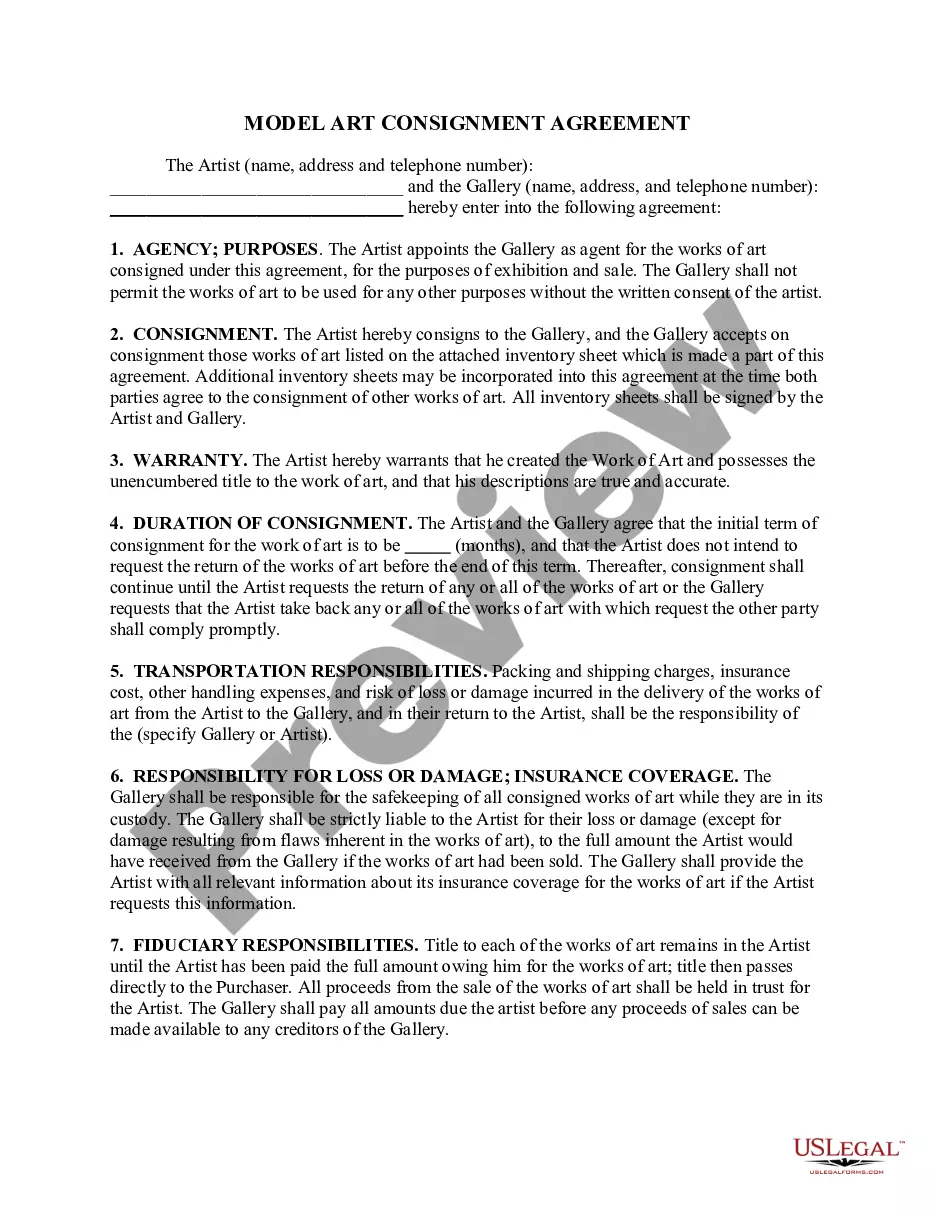

The contract states further that "as an Independent contractor, you are not entitled to paid annual leave, or paid sick leave, paid responsibility leave, and you are not entitled to be paid for overtime worked and you're not entitled to be paid for public holidays or Sundays worked."

There are a few changes to Form 1099-NEC for the 2021 tax year that filers should be aware of. The IRS classified Form 1099-NEC as a continuous-use form. This means, the Form will be updated by the IRS as needed rather than annually.

The general rule is that business owners must issue a Form 1099-NEC to each person to whom they have paid at least $600 in rents, services (including parts and materials), prizes and awards, or other income payments.

In most circumstances, your clients are required to issue Form 1099-NEC when they pay you $600 or more in any year. If you receive payments through online payment services such as PayPal, you might receive form 1099-K in addition to Form 1099-NEC.

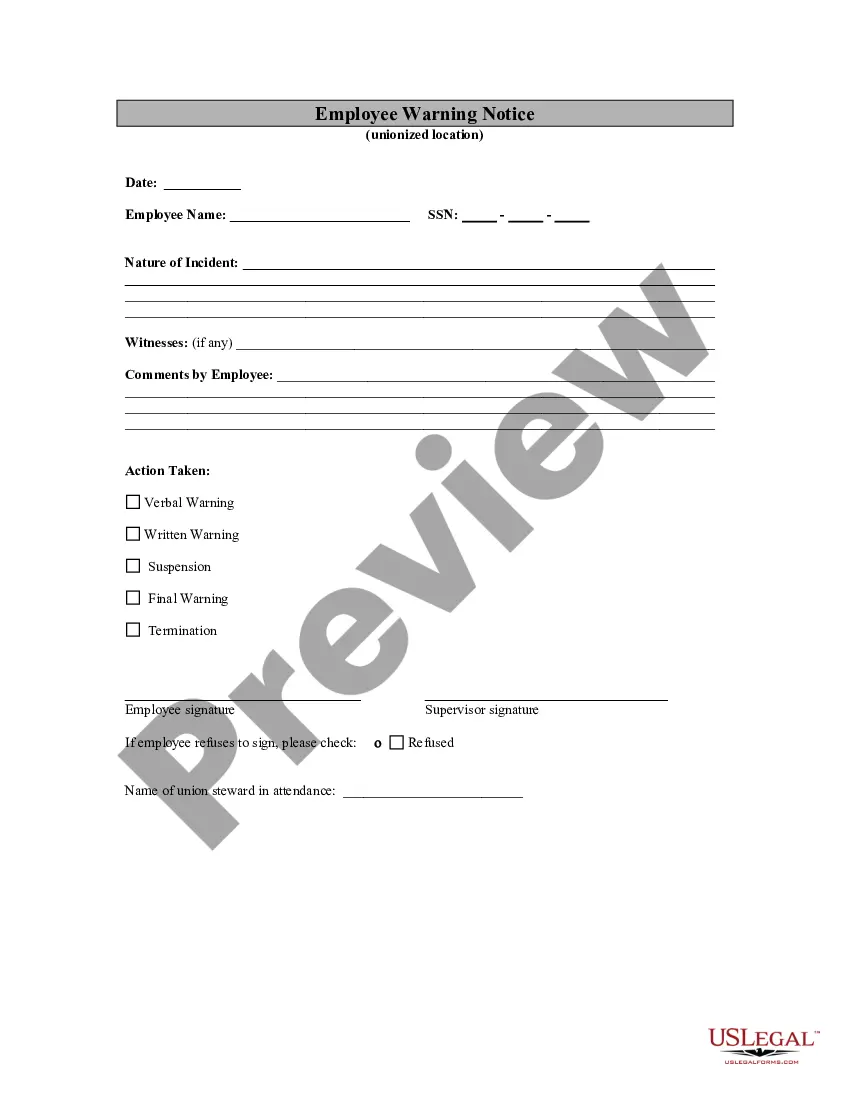

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.

The contract usually stipulates that notification must be made in writing, with some contracts requiring 30 days' notice and other considerations, such as payment on termination of the contract or return of materials at the time of separation.

It sends a message to your new employer. Whether leaving on good or not-so-great terms, contractors offering their employer two weeks' notice will ultimately be beneficial to their careers.

The new-for-2022 law change that sharply reduced the reporting threshold at which third-party payment settlement entities must issue a Form 1099-K, Payment Card and Third Party Network Transactions, drew a cautionary tax tip from the Taxpayer Advocate Service (TAS) and urging from the National Taxpayers Union

Write a resignation letter that you can hand to your supervisor. Include your reasons for leaving and the date upon which you intend to end your employment. Thank the organization for the opportunities you've had while with the company. Remain professional and positive in your tone and content.

Who Needs to Get a 1099 Form? Usually, anyone who was paid $600 or more in non-employment income should receive a 1099. However, there are many types of 1099s for different situations.