New Mexico Daily Accounts Receivable

Description

How to fill out Daily Accounts Receivable?

Are you presently in a situation where you require documents for either business or personal use almost every day.

There are numerous legal document templates accessible online, but finding ones you can rely on isn't easy.

US Legal Forms provides thousands of template options, such as the New Mexico Daily Accounts Receivable, that are designed to meet federal and state regulations.

If you find the correct form, click Get now.

Select the pricing plan you desire, complete the necessary details to create your account, and pay for an order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New Mexico Daily Accounts Receivable template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

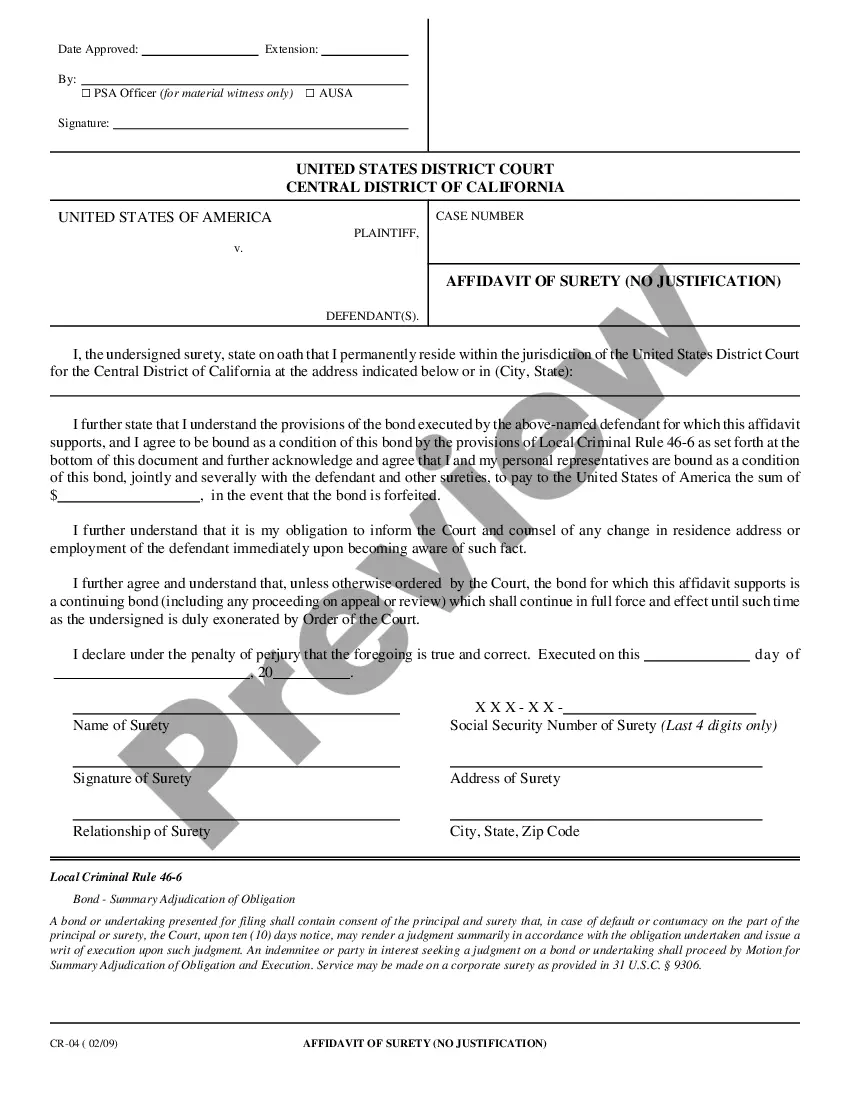

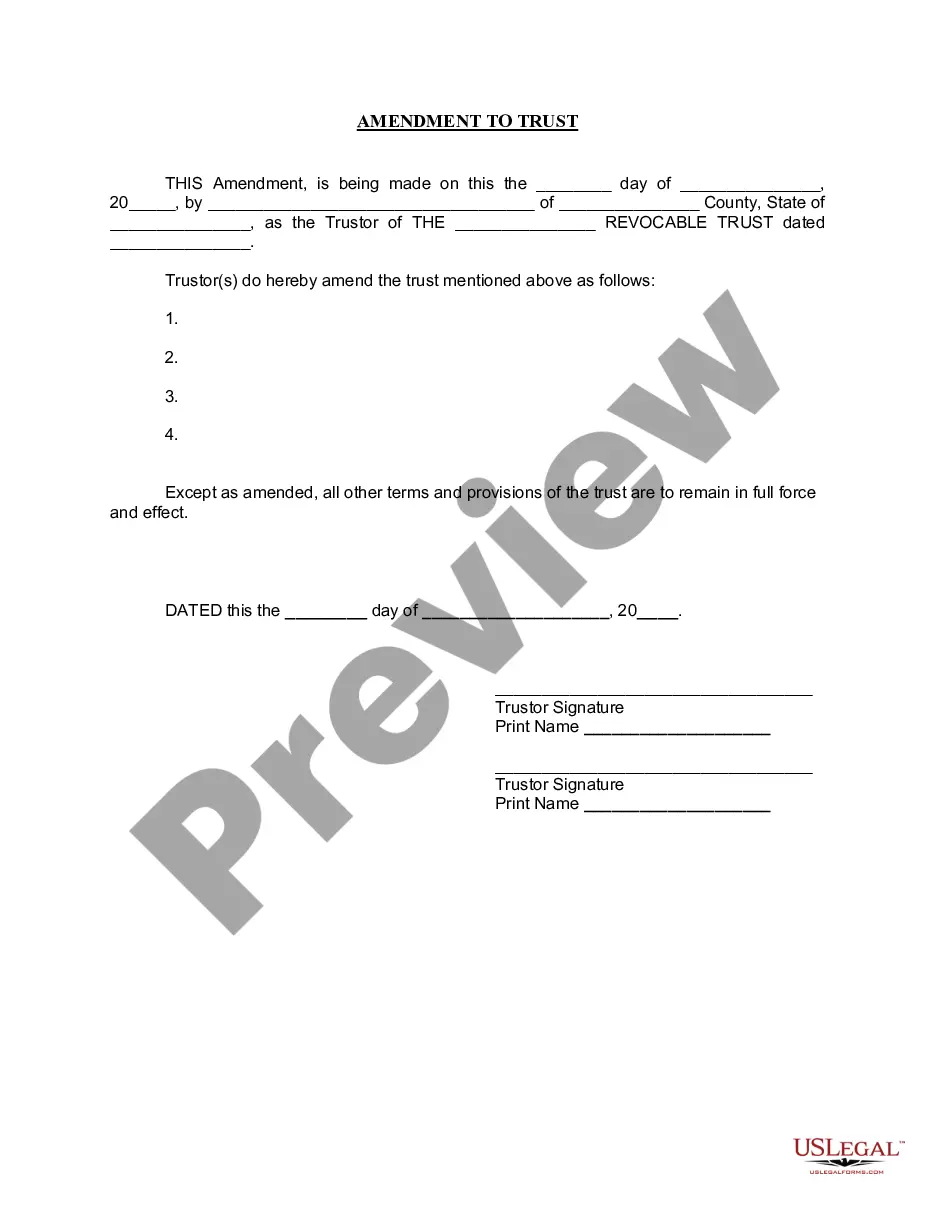

- Utilize the Review button to evaluate the form.

- Check the information to confirm that you have selected the right form.

- If the form isn't what you are searching for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

When the invoice is paid, the amount is recorded as a debit to the accounts payable account; thus, lowering the credit balance. The higher the accounts payable, the higher its credit balance is, and the lower the accounts payable, the lower its credit balance.

Account receivables are classified as current assets assuming that they are due within one year. To record a journal entry for a sale on account, one must debit a receivable and credit a revenue account. When the customer pays off their accounts, one debits cash and credits the receivable in the journal entry.

Accounts receivable (AR) is money that your customers owe you for buying goods and services on credit. Your accounts receivable consist of all the unpaid invoices or money owed by your customers. Your customers should pay this amount before the invoice due date.

Follow these tips to ensure efficient and effective accounts receivable management.Use Electronic Billing & Payment.Outline Clear Billing Procedures.Set Credit & Collection Policies and Stick to Them.Be Proactive.Set up Automations.Make It Easy for Customers.Use the Right KPIs.Involve All Teams in the Process.

Companies record accounts receivable as assets on their balance sheets since there is a legal obligation for the customer to pay the debt. Furthermore, accounts receivable are current assets, meaning the account balance is due from the debtor in one year or less.

You use the invoice to add a journal entry as a debit in the accounts receivable account and a credit in the sales account. Once the customer has paid the invoice, you can list a debit in the sales account and a credit in the accounts receivable account.

Accounts Receivable (AR) refers to the outstanding invoices a company has, or the money it is owed from its clients.

This credit of $10,000 is recorded as your account receivable (AR). Accounts receivable is therefore the sum of money your customer owes you for goods or services you delivered to them or that they used, which they have not yet paid for.

A medical account receivable refers to the outstanding reimbursement owed to providers for issued treatments and services, whether the financial responsibility falls to the patient or their insurance company.

Account Receivable is an account created by a company to record the journal entry of credit sales of goods and services, for which the amount has not yet been received by the company. The journal entry is passed by making a debit entry in Account Receivable and corresponding credit entry in Sales Account.