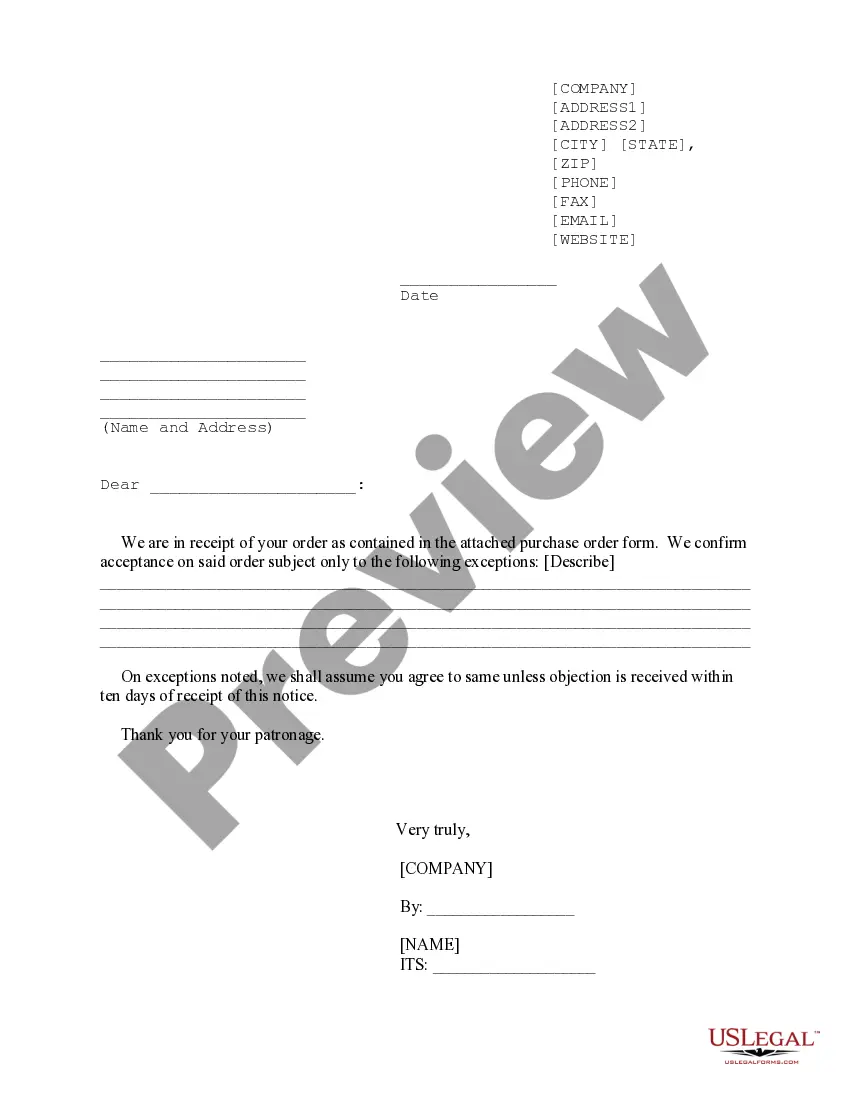

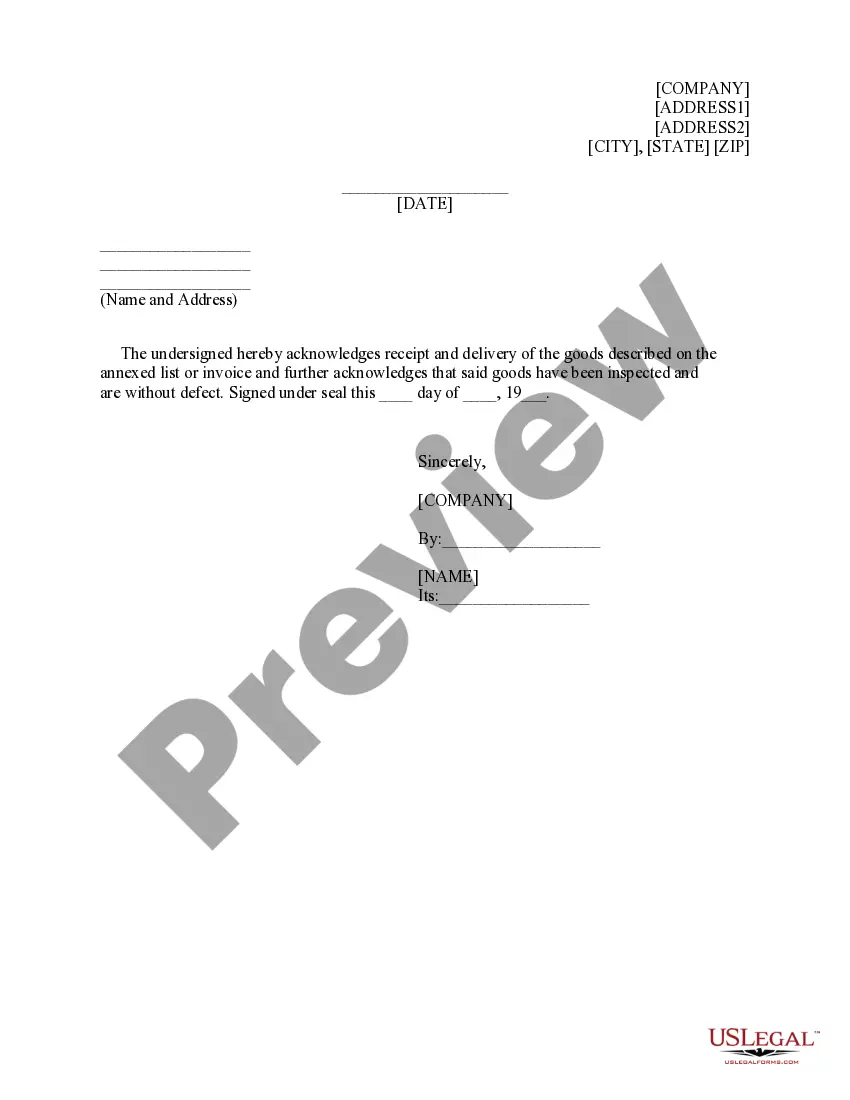

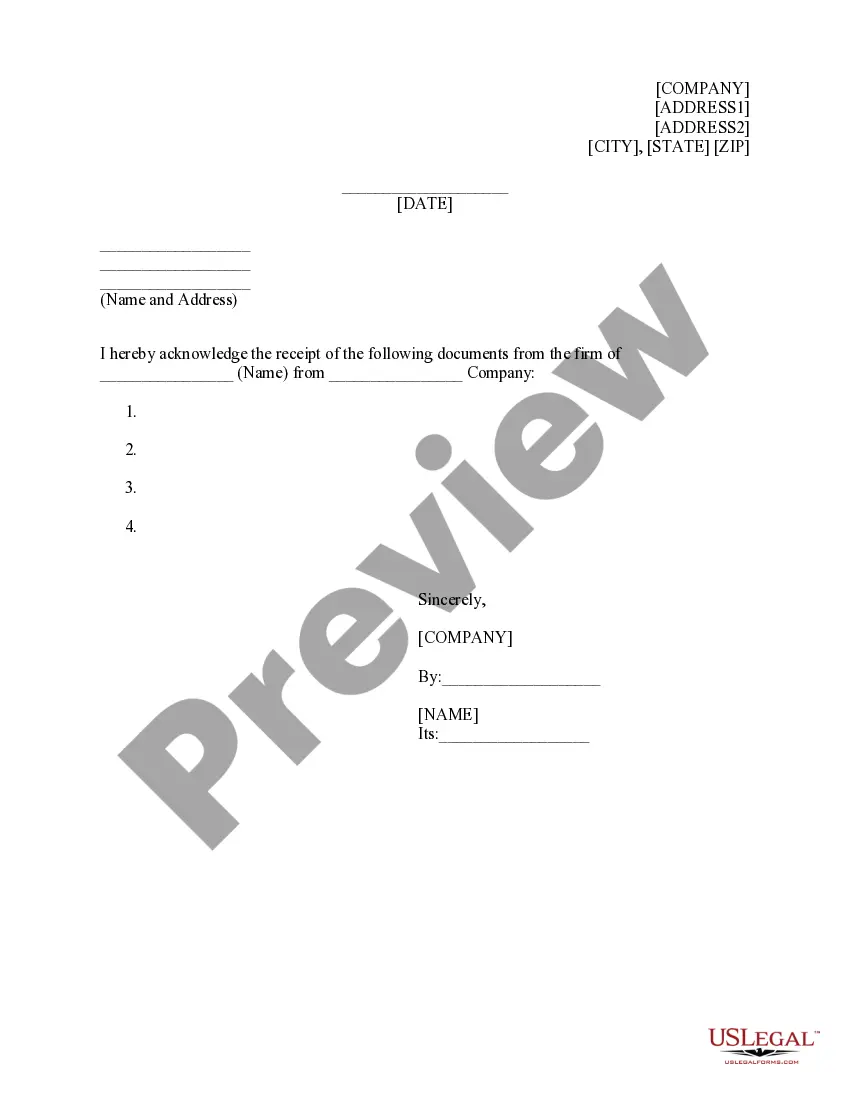

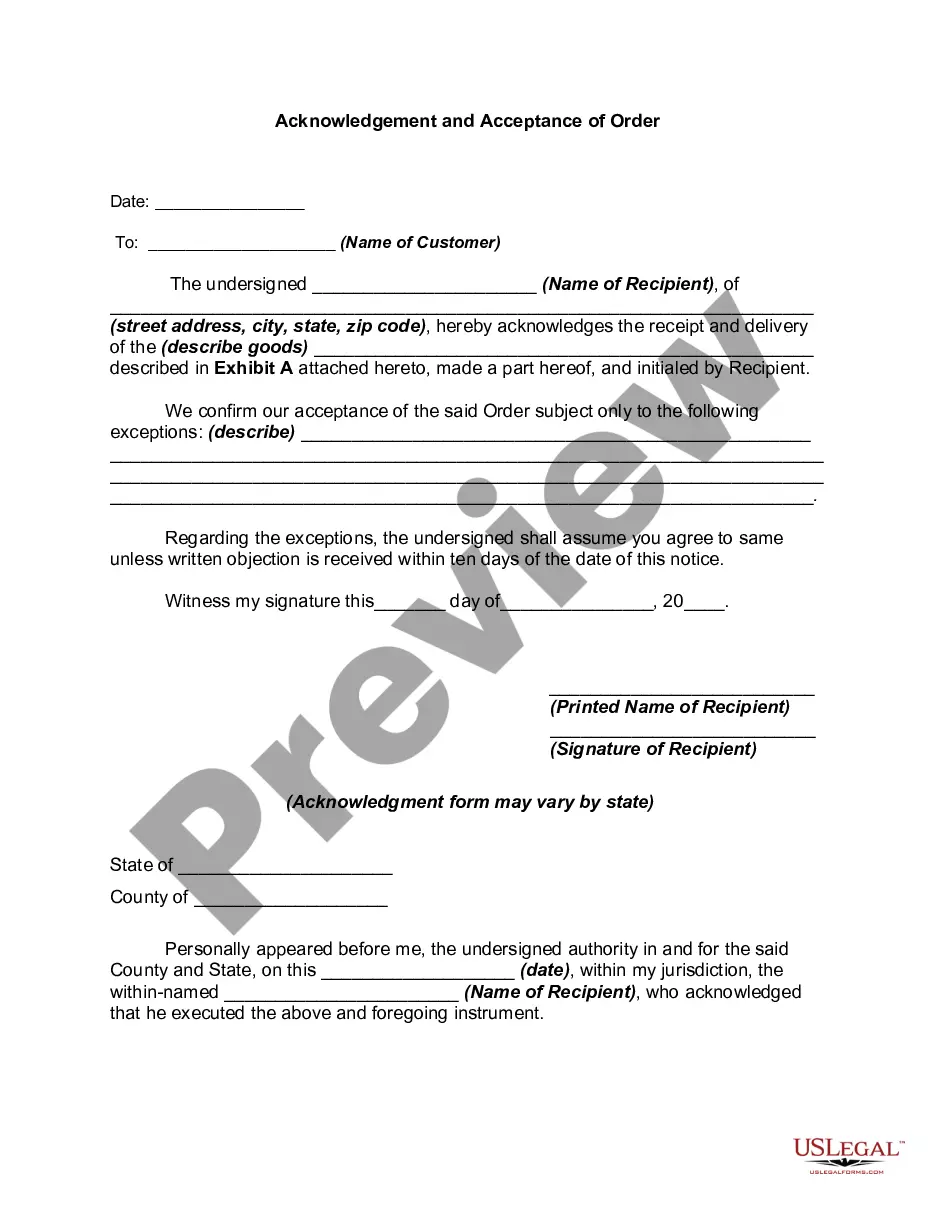

New Mexico Seller's Confirmation of Receipt and Acceptance of Order

Description

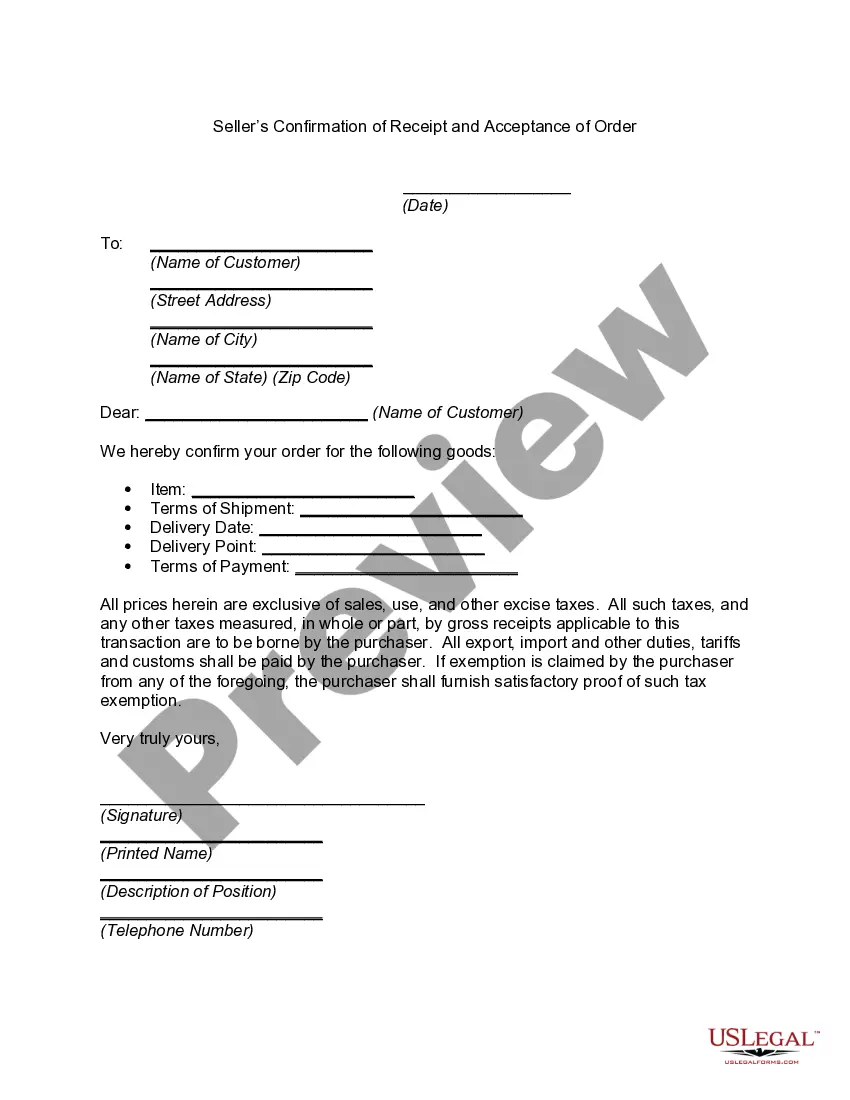

How to fill out Seller's Confirmation Of Receipt And Acceptance Of Order?

You can invest time online searching for the legal document template that meets the federal and state requirements you have.

US Legal Forms offers a vast variety of legal forms that are reviewed by experts.

You can obtain or create the New Mexico Seller’s Confirmation of Receipt and Acceptance of Order through my services.

If available, use the Preview option to view the document template as well.

- If you already have a US Legal Forms account, you may Log In and click on the Download button.

- Then, you may complete, modify, print, or sign the New Mexico Seller’s Confirmation of Receipt and Acceptance of Order.

- Every legal document template you acquire is yours indefinitely.

- To get another copy of any purchased form, go to the My documents section and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Review the form description to confirm you have selected the right document.

Form popularity

FAQ

A Nontaxable Transaction Certificate (NTTC) obtained from the Taxation and Revenue Department (TRD) allows you as a seller or lessor to deduct the receipts from qualified transactions from your gross receipts. You need only one NTTC from a customer to cover all transactions of the same type with that customer.

Every person required to file a New Mexico gross receipts tax return must complete and file a TRD-41413 New Mexico Gross Receipts Tax Return. Use the Schedule A, New Mexico Gross Receipts Tax Schedule A if additional space is needed to report gross receipts from multiple locations.

CRS number means the New Mexico tax identification number issued by the New Mexico taxation and revenue department that is used for reporting gross receipts, compensating, and withholding tax.

If you have no business location or resident salesperson but are liable for gross receipts tax (for instance, because you lease property used in New Mexico or perform a non-construction service in New Mexico), you are liable for tax at the rate for out-of-state businesses, the state gross receipts tax rate of 5.125%.

Nursery Teacher Training Course (NTTC)

New Mexico considers you a tax-exempt organization if the federal government has first granted the status to you under Section 501(c) of the Internal Revenue Code with a classification as an educational or social entity. Your gross receipts may be exempt from gross receipts tax under Section 7-9-29 NMSA 1978.

To obtain NTTCs, the applicant must have a New Mexico business tax identification number (CRS Identification Number) issued by this Department. A buyer or lessee may register solely to obtain NTTCs by marking the NTTC only checkbox on the application for a New Mexico business tax identification number.

TYPE 9 certificates may be executed for the purchase of tangible personal. property only and may not be used for the purchase of services, the pur- chase of a license or other intangible property, for the lease of property or to. purchase construction materials for use in construction projects (except as.

Nonprofits with gross receipts normally $50,000 or less, can submit a Form 990-N, Electronic Notice (e-Postcard) for Tax Exempt Organizations Not Required to File Form 990 or 990-EZ.

A New Mexico resale certificate (also commonly known as a resale license, reseller permit, reseller license and tax exemption certificate) is a tax-exempt form that permits a business to purchase goods from a supplier, that are intended to be resold without the reseller having to pay sales tax on them.