New Mexico Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase

Description

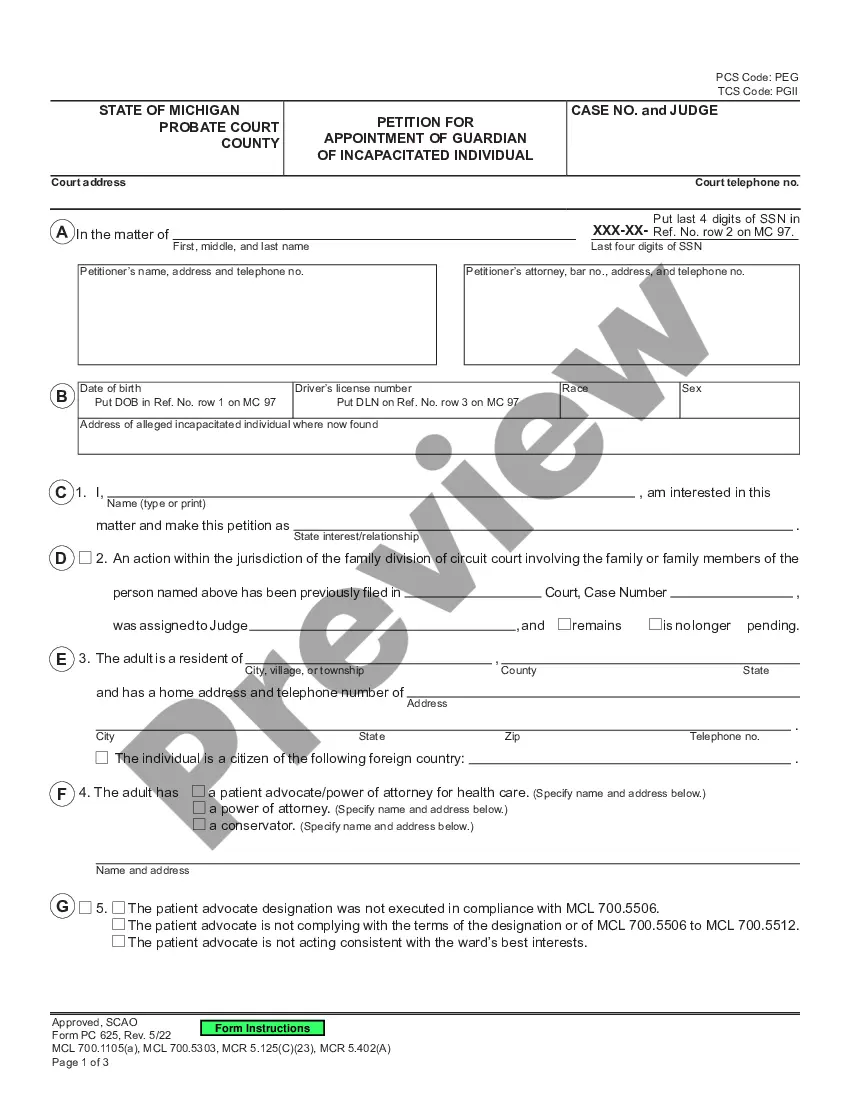

How to fill out Net Lease Of Equipment (personal Propety Net Lease) With No Warranties By Lessor And Option To Purchase?

Selecting the optimum legal document template can be a challenge.

Unquestionably, there are numerous designs accessible online, but how will you find the legal form you require.

Utilize the US Legal Forms site.

First, ensure you have chosen the correct form for your city/state. You can preview the form using the Preview button and review the form details to confirm this is the right one for you.

- The service provides thousands of templates, such as the New Mexico Net Lease of Equipment (personal Property Net Lease) without Warranties by Lessor and Option to Purchase, which can be used for business and personal needs.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to acquire the New Mexico Net Lease of Equipment (personal Property Net Lease) without Warranties by Lessor and Option to Purchase.

- Use your account to search through the legal forms you have previously purchased.

- Visit the My documents tab in your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

Net leases generally include property taxes, property insurance premiums, or maintenance costs, and are often used in commercial real estate. In addition to triple net leases, the other types of net leases are single net leases and double net leases.

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

Most equipment leases will provide that if a default exists and the lessee has not yet filed for bankruptcy, the lessor is permitted to terminate the lease and recover its equipment.

Most financial leases are "net" leases, meaning that the lessee is responsible for maintaining and insuring the asset and paying all property taxes, if applicable. Financial leases are often used by businesses for expensive capital equipment.

A $1 Buyout Lease, also called a capital lease, is similar to purchasing equipment with a loan. With this type of lease, there is a higher monthly payment compared with an FMV lease, but at the end of the lease term, the lessee purchases the equipment for $1.

Gross leases are commonly used for commercial properties, such as office buildings and retail spaces. Modified leases and fully service leases are the two types of gross leases. Gross leases are different from net leases, which require the tenant to pay one or more of the costs associated with the property.

When you lease equipment, the lessor is effectively putting up a lump sum of money on your behalf, which you will pay off with interest over time. The effective interest rate on a lease can be anywhere from the low single digits to more than 30%, with the average is around 6% to16%.

The term net lease refers to a contractual agreement where a lessee pays a portion or all of the taxes, insurance fees, and maintenance costs for a property in addition to rent. Net leases are commonly used in commercial real estate.

The term "net lease" is distinguished from the term "gross lease". In a net lease, the property owner receives the rent "net" after the expenses that are to be passed through to tenants are paid.

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...