New Mexico Loan Agreement for Business

Description

How to fill out Loan Agreement For Business?

Choosing the right lawful record web template can be a have a problem. Needless to say, there are a lot of layouts available on the Internet, but how would you obtain the lawful kind you need? Make use of the US Legal Forms web site. The service delivers 1000s of layouts, for example the New Mexico Loan Agreement for Business, that can be used for company and private demands. All of the varieties are examined by specialists and fulfill state and federal needs.

When you are already registered, log in to the bank account and click the Download option to find the New Mexico Loan Agreement for Business. Use your bank account to look throughout the lawful varieties you have purchased in the past. Go to the My Forms tab of your respective bank account and obtain yet another duplicate of your record you need.

When you are a new end user of US Legal Forms, allow me to share simple directions that you should follow:

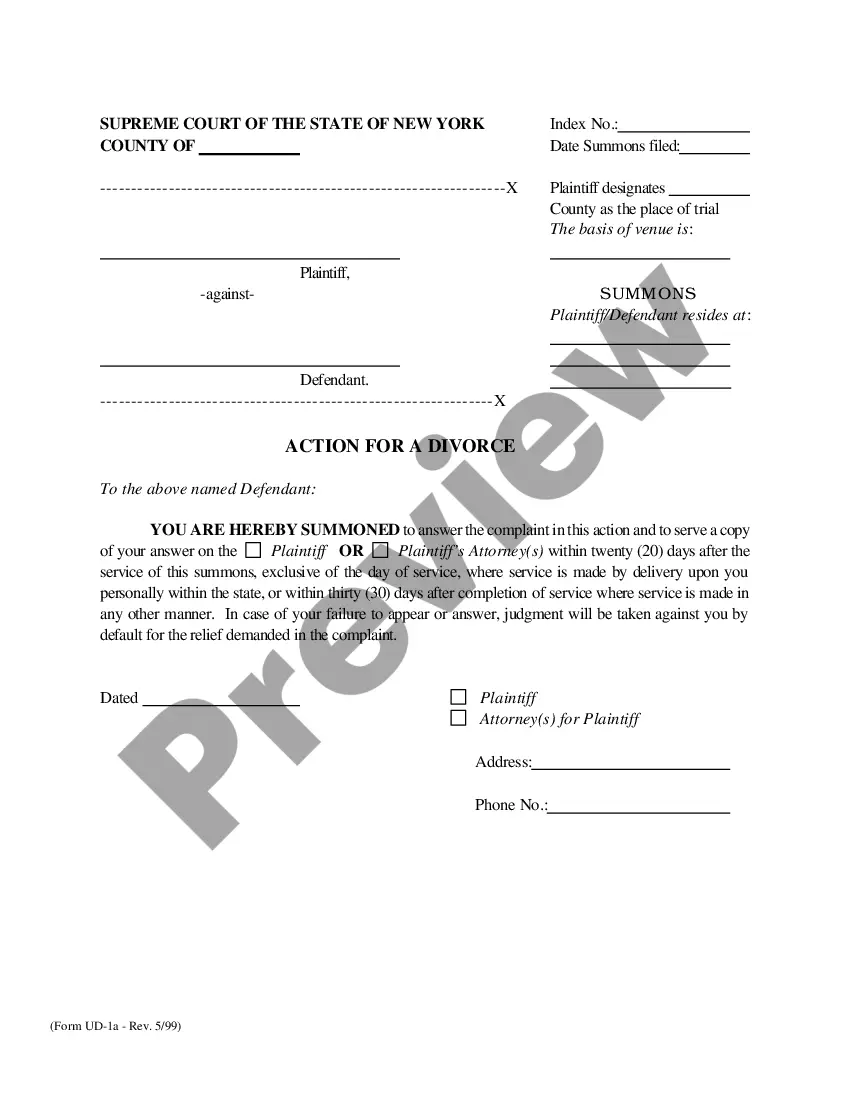

- Initially, ensure you have chosen the correct kind for the area/area. You are able to look through the shape while using Review option and read the shape information to make sure it will be the best for you.

- If the kind fails to fulfill your requirements, make use of the Seach field to obtain the proper kind.

- Once you are certain the shape is suitable, select the Buy now option to find the kind.

- Choose the rates program you desire and enter the needed information. Make your bank account and pay for your order with your PayPal bank account or credit card.

- Choose the document structure and download the lawful record web template to the device.

- Total, change and printing and sign the attained New Mexico Loan Agreement for Business.

US Legal Forms may be the most significant catalogue of lawful varieties for which you will find different record layouts. Make use of the service to download appropriately-made files that follow state needs.

Form popularity

FAQ

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

How to Write a Business Loan Agreement Step 1 ? Set an Effective Date. ... Step 2 ? Identify the Parties. ... Step 3 ? Include the Loan Amount. ... Step 4 ? Create a Repayment Schedule. ... Step 5 ? Define Security Interests or Collateral. ... Step 6 ? Set an Interest Rate. ... Step 7 ? Late Payment Fees. ... Step 8 ? Determine Prepayment Options.

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid.

In most cases, a contract does not have to be notarized since the signed contract itself is enforceable and legally binding in state or federal courts. Many types of written contracts don't require a notary public to be valid.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

You can write up a personal loan agreement by hand, with pen and paper, or draft it on your computer. Once the document looks good, it can be printed out and signed by both parties.