New Mexico Deed Conveying Property to Charity with Reservation of Life Estate

Description

How to fill out Deed Conveying Property To Charity With Reservation Of Life Estate?

Are you currently in the place the place you will need paperwork for either business or person uses nearly every time? There are a variety of lawful file templates available on the Internet, but discovering ones you can depend on is not easy. US Legal Forms offers 1000s of kind templates, much like the New Mexico Deed Conveying Property to Charity with Reservation of Life Estate, that are written to meet federal and state specifications.

Should you be already familiar with US Legal Forms internet site and have an account, just log in. Following that, you can down load the New Mexico Deed Conveying Property to Charity with Reservation of Life Estate web template.

Should you not come with an profile and would like to start using US Legal Forms, follow these steps:

- Discover the kind you want and ensure it is for the appropriate city/state.

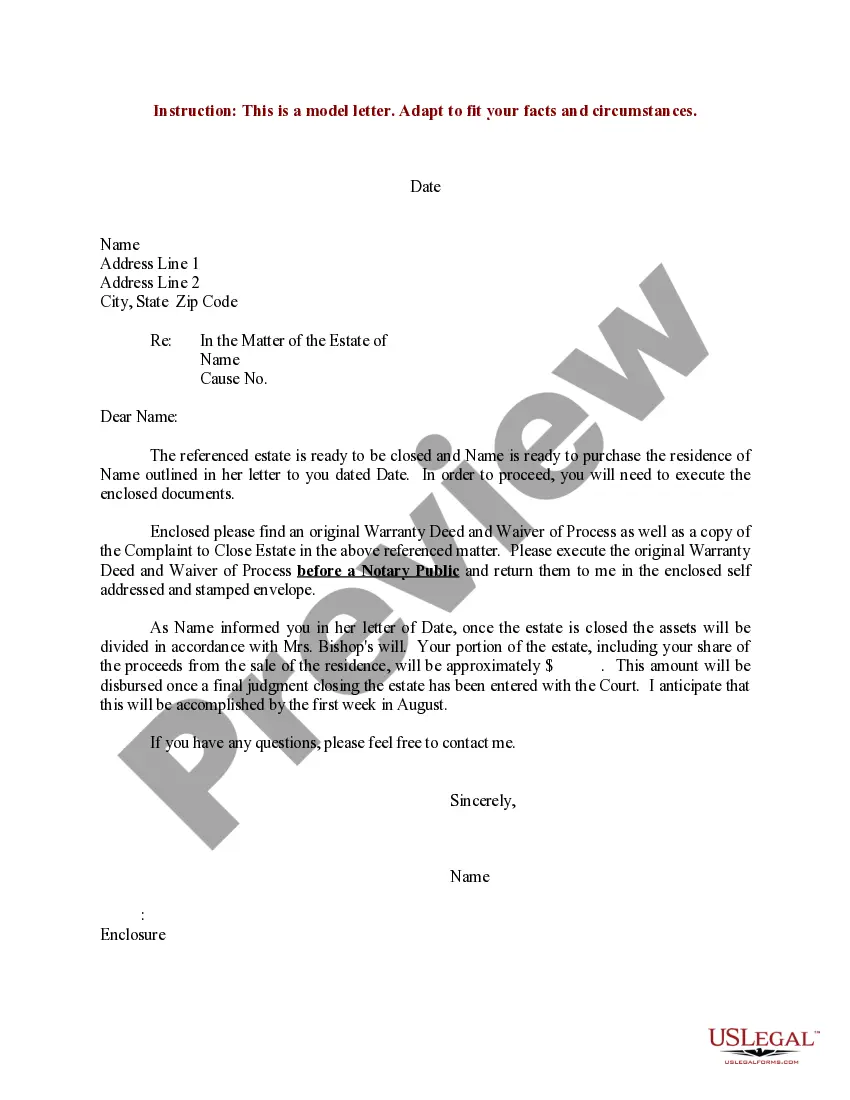

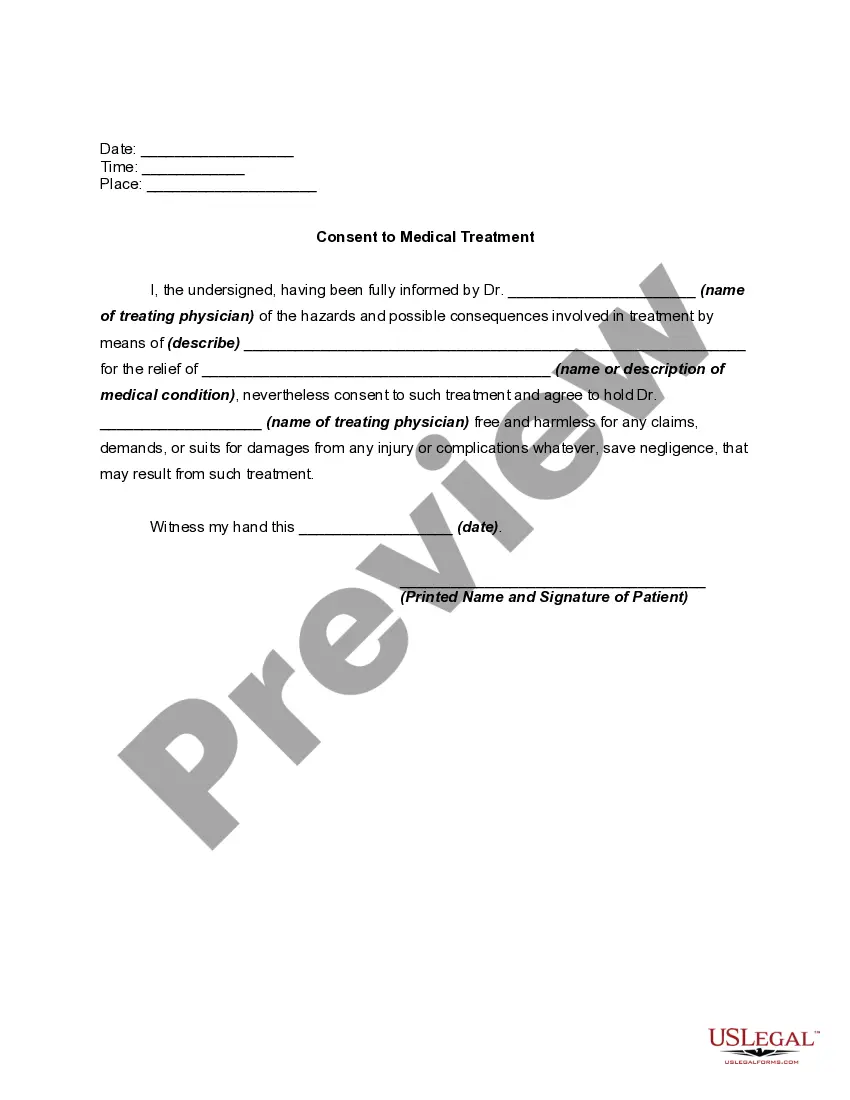

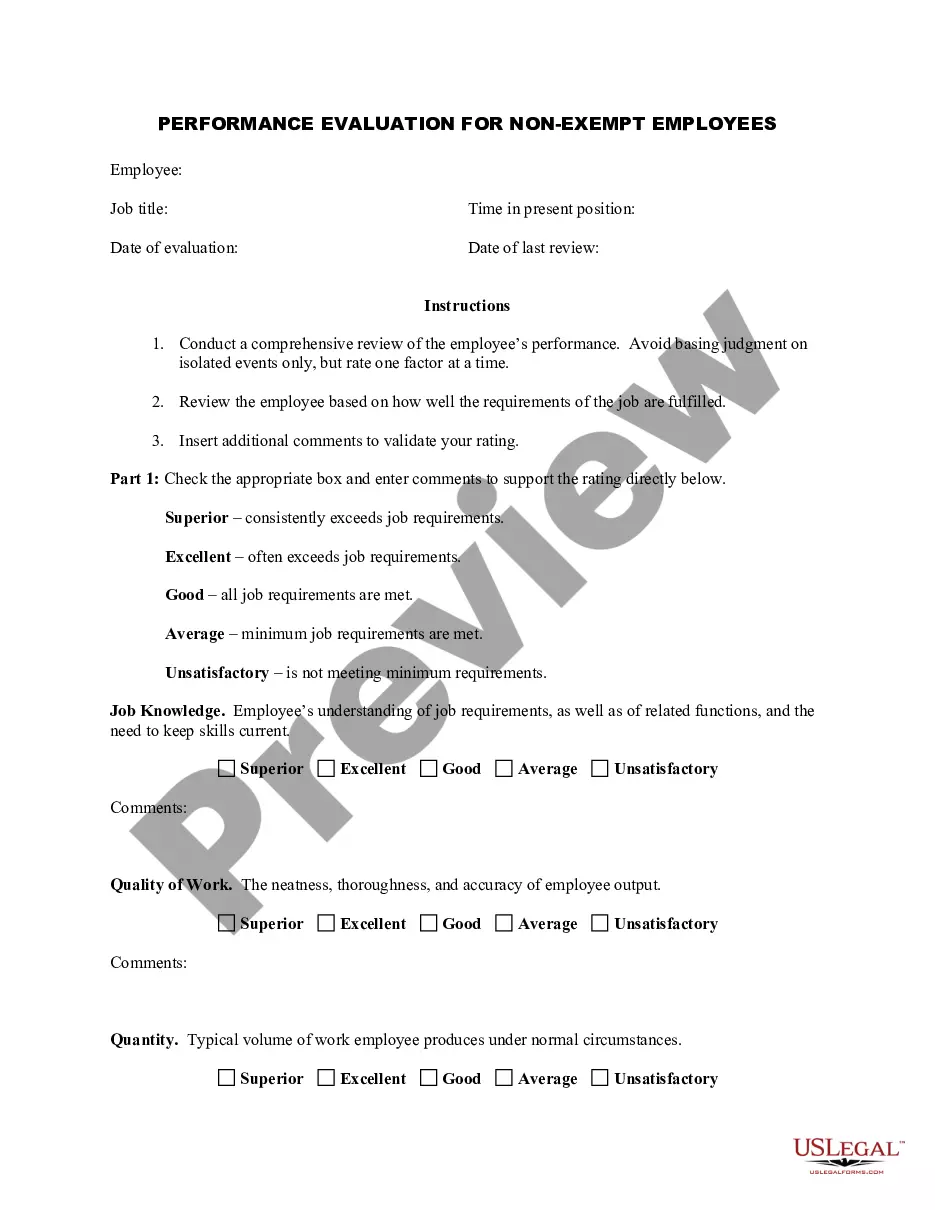

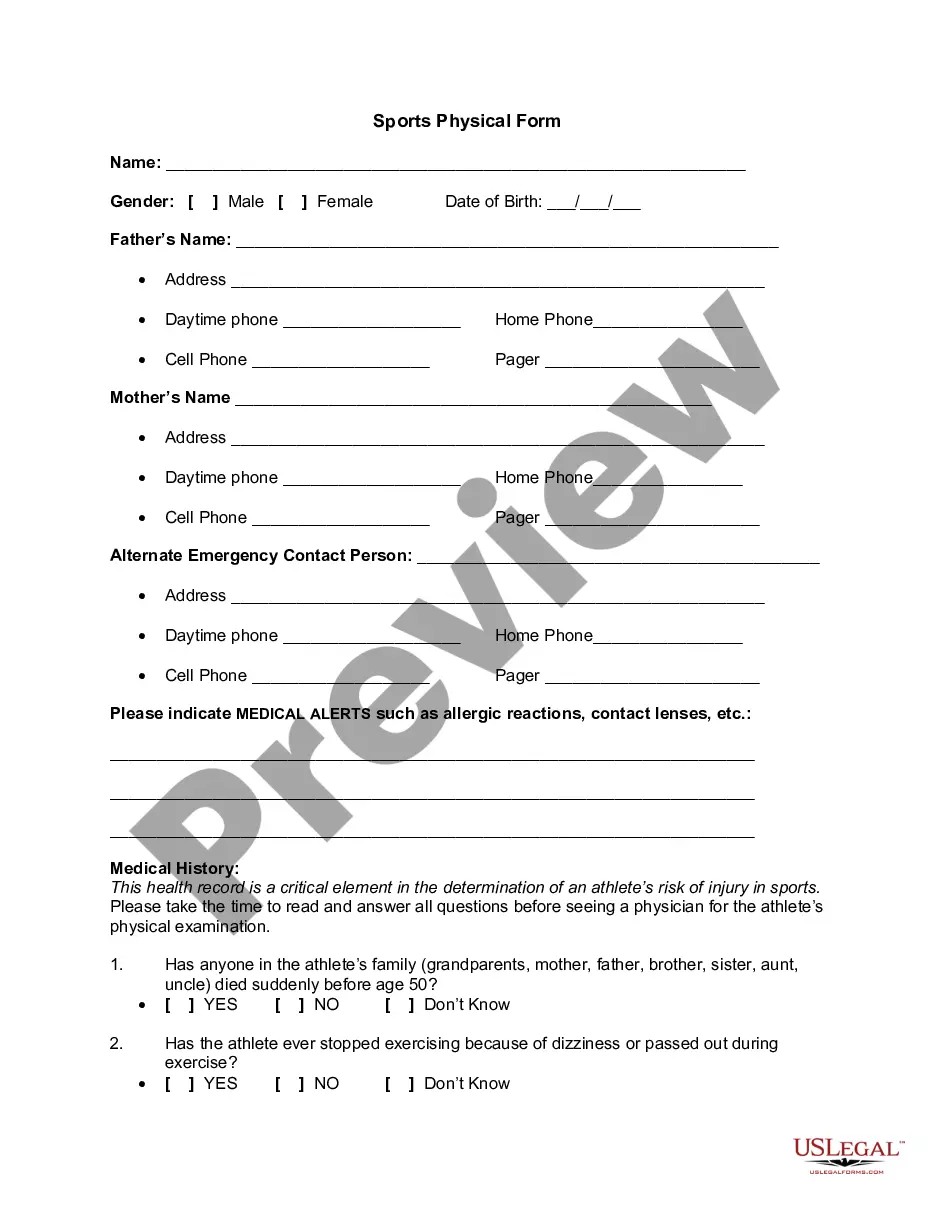

- Take advantage of the Review button to analyze the shape.

- Read the description to actually have chosen the proper kind.

- If the kind is not what you are searching for, make use of the Research industry to obtain the kind that meets your needs and specifications.

- Once you get the appropriate kind, click on Purchase now.

- Opt for the rates strategy you would like, fill in the necessary details to make your money, and buy the order making use of your PayPal or bank card.

- Pick a practical file structure and down load your backup.

Get every one of the file templates you have bought in the My Forms food selection. You can get a more backup of New Mexico Deed Conveying Property to Charity with Reservation of Life Estate any time, if required. Just click the necessary kind to down load or print out the file web template.

Use US Legal Forms, probably the most comprehensive selection of lawful forms, to save lots of time as well as steer clear of faults. The support offers professionally manufactured lawful file templates that you can use for an array of uses. Generate an account on US Legal Forms and start producing your way of life easier.

Form popularity

FAQ

A life tenant does not have complete control over the property because they do not own the whole bundle of rights. The life tenant cannot sell, mortgage or in any way transfer or encumber the property. If either party wants to sell the property, both the life tenant and remainderman must agree.

When the life tenant dies, the remainderman typically receives a step-up tax basis in the property. This means the remainderman takes ownership of the home at its fair market value at the time of the life tenant's death. This can save the remainderman capital gains tax when the property is sold.

The remainderman may receive a substantial capital gains tax break when and if the house is sold (since its tax valuation will be based on its value at the time of the life tenant's death, not at the time it was purchased by the life tenant).

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.

Upon the life tenant's death, the remaindermen receive what is known as a "stepped-up" basis in the property. This means the property's tax basis is its fair market value at the time of the life tenant's death, not the value at which the life tenant originally purchased the property.

How to Minimize Capital Gains Tax on Inherited Property Sell the inherited property quickly. ... Make the inherited property your primary residence. ... Rent the inherited property. ... Qualify for a partial exclusion. ... Disclaim the inherited property. ... Deduct Selling Expenses from Capital Gains.

Generally, the capital gains pass through to the heirs. The estate reports the gain on the estate income tax return, but then takes a deduction for the amount of the gain distributed to the heirs since this usually happens during the same tax year.

When you inherit property, the IRS applies what is known as a stepped-up cost basis. You do not automatically pay taxes on any property that you inherit. If you sell, you owe capital gains taxes only on any gains that the asset made since you inherited it.