New Mexico Sample Letter of Credit

Description

How to fill out Sample Letter Of Credit?

Discovering the right lawful document web template can be quite a struggle. Naturally, there are tons of web templates available on the Internet, but how would you obtain the lawful type you need? Take advantage of the US Legal Forms site. The service gives a huge number of web templates, including the New Mexico Sample Letter of Credit, which you can use for company and private requirements. All of the types are examined by experts and meet state and federal specifications.

Should you be currently registered, log in to the account and click the Down load option to have the New Mexico Sample Letter of Credit. Make use of account to check throughout the lawful types you might have acquired in the past. Go to the My Forms tab of the account and acquire yet another version from the document you need.

Should you be a fresh user of US Legal Forms, allow me to share basic directions for you to follow:

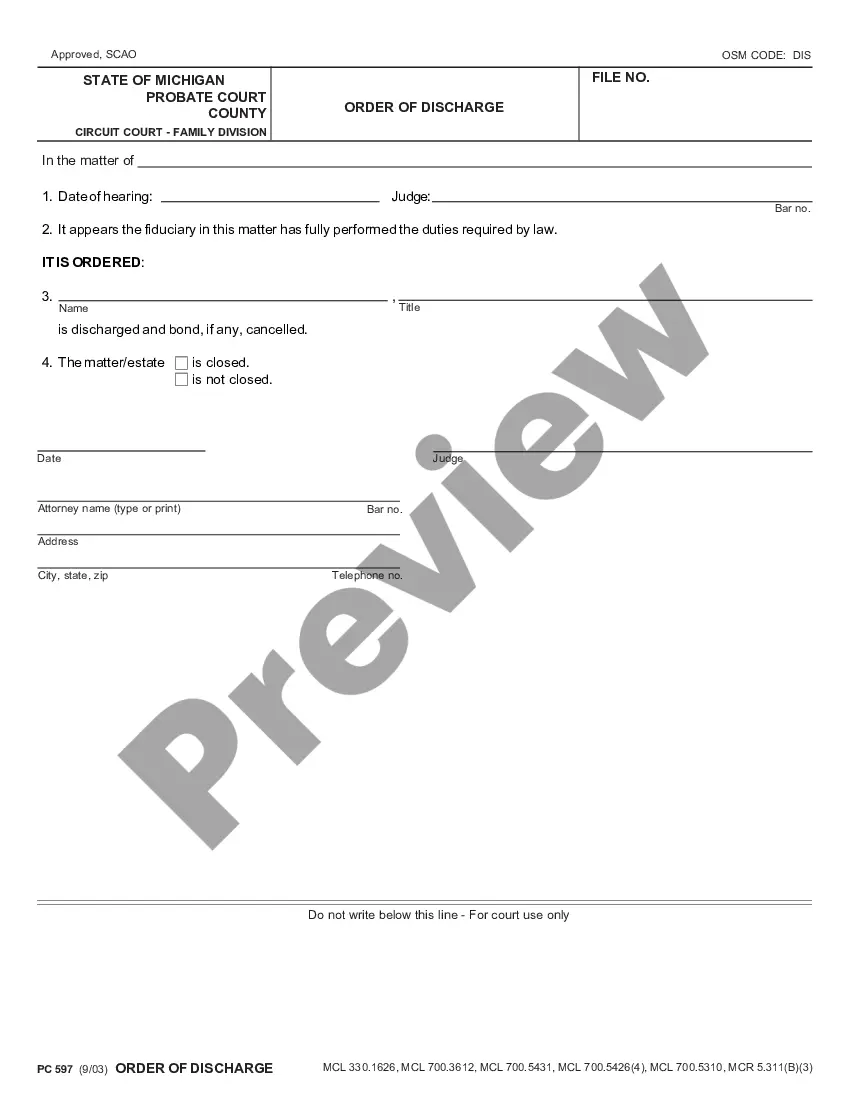

- First, be sure you have selected the proper type to your area/county. You are able to examine the form making use of the Review option and browse the form description to ensure it will be the best for you.

- In the event the type does not meet your expectations, take advantage of the Seach area to obtain the proper type.

- Once you are positive that the form is suitable, go through the Buy now option to have the type.

- Pick the rates plan you desire and type in the necessary information and facts. Design your account and pay money for your order utilizing your PayPal account or bank card.

- Select the file format and obtain the lawful document web template to the system.

- Full, change and produce and indication the received New Mexico Sample Letter of Credit.

US Legal Forms will be the largest local library of lawful types for which you can discover different document web templates. Take advantage of the company to obtain skillfully-made files that follow express specifications.

Form popularity

FAQ

The most common types of letters of credit today are commercial letters of credit, standby letters of credit, revocable letters of credit, irrevocable letters of credit, revolving letters of credit, and red clause letters of credit, although there are several other types of letters of credit.

Some utility companies allow new customers to submit a letter of credit from their previous utility company instead of a security deposit. If you never missed any payments, then your old utility company will tell your new provider that you're a reliable customer. These are also known as "credit reference letters."

Some utility companies allow new customers to submit a letter of credit from their previous utility company instead of a security deposit. If you never missed any payments, then your old utility company will tell your new provider that you're a reliable customer. These are also known as "credit reference letters."

How to Apply for a Letter of Credit. The exporter and their bank must be satisfied with the creditworthiness of the importer's bank. Once the Sales Agreement is completed, the importer applies to their bank to open a Letter of Credit in favor of the exporter.

A Letter of Credit is a contractual commitment by the foreign buyer's bank to pay once the exporter ships the goods and presents the required documentation to the exporter's bank as proof. As a trade finance tool, Letters of Credit are designed to protect both exporters and importers.

The letter of credit outlines the conditions under which payment will be made to an exporter. The issuing bank will generally act on behalf of its client (the buyer) to ensure that all conditions have been met before the funds of the letter of credit are released.

A letter of credit can be requested by a former customer of a utility. It's typically printed on letterhead stationery and includes account number, payment history, dates and balances. Assuming you have a record of on-time payments, submitting such a letter could result in a lower deposit required by the new utility.

Common uses for these letters are to help reduce or waive a deposit with another utility company when you're moving or to help with a loan. If you would like a letter stating your internal credit standing with New Mexico Gas Company, log on to Manage My Account. Then select ?Request letter of credit.?