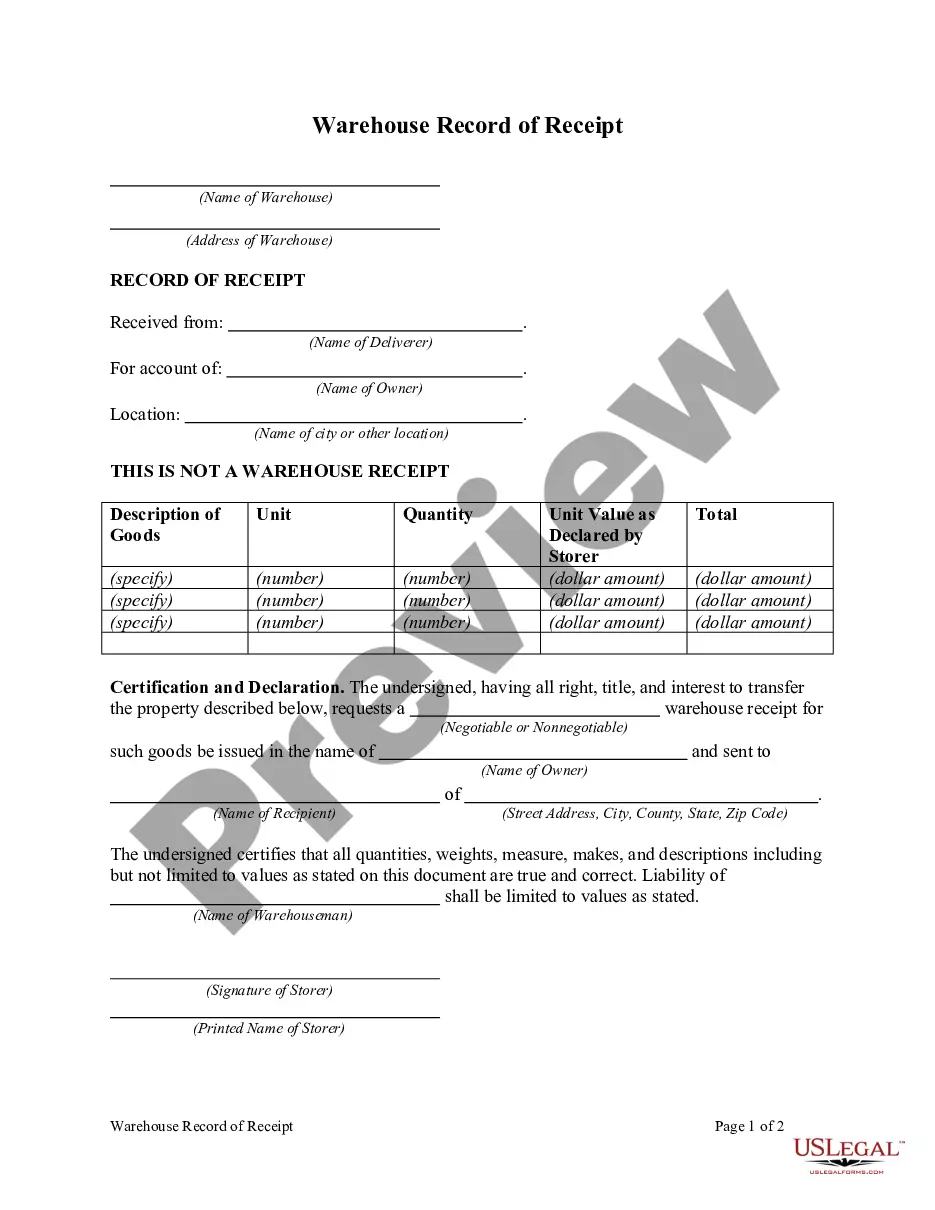

New Mexico Warehouse Record of Receipt

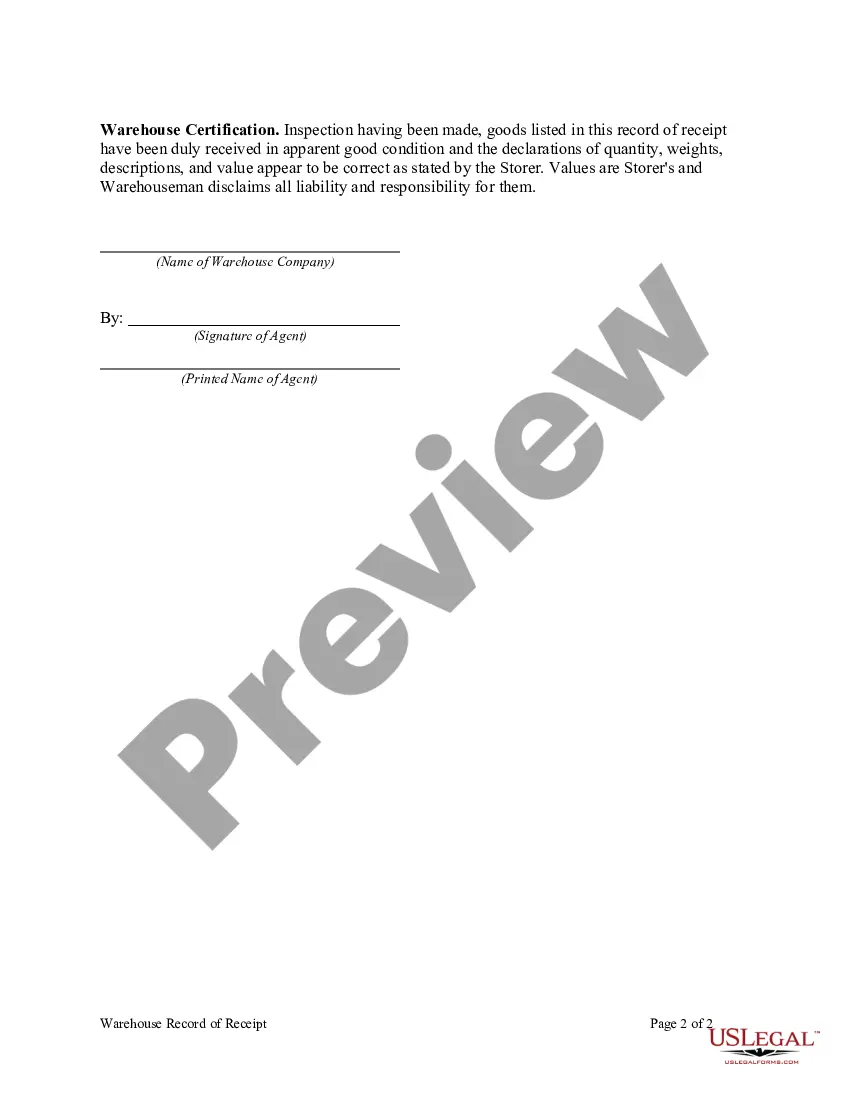

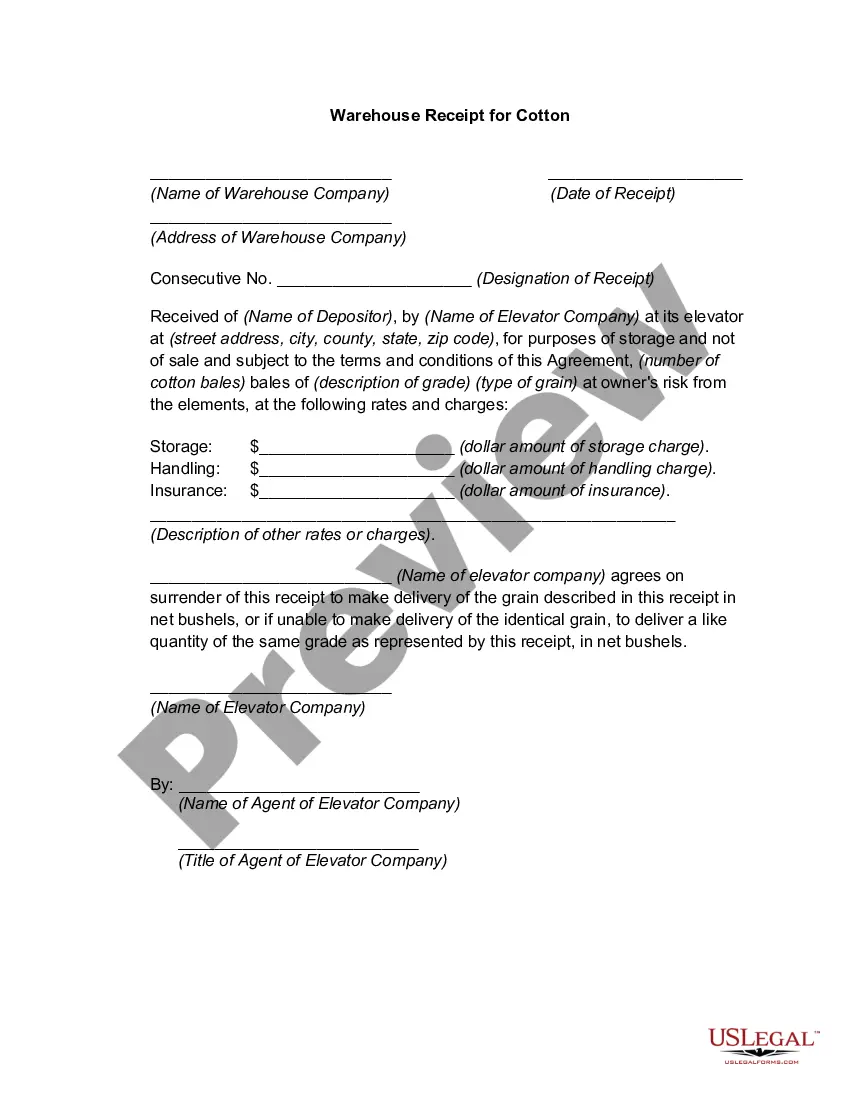

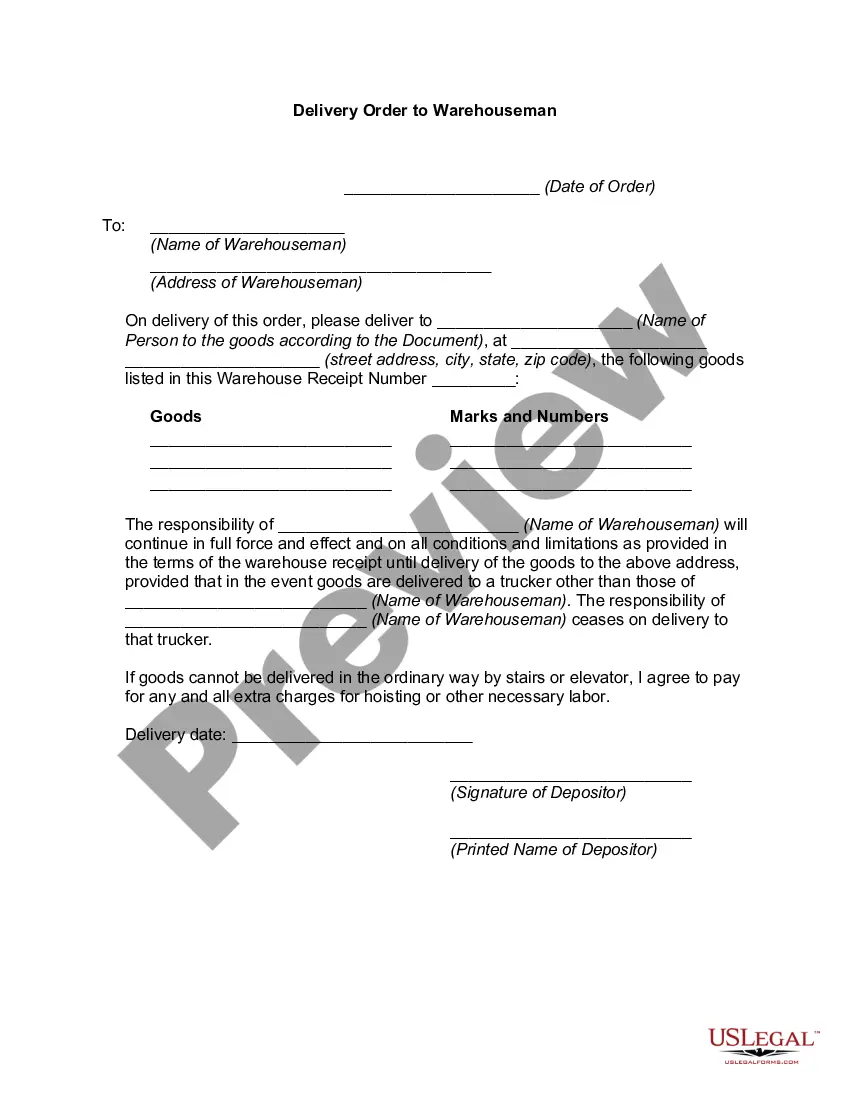

Description

How to fill out Warehouse Record Of Receipt?

If you wish to finish, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest selection of official forms, which can be accessed online.

Make use of the website's simple and user-friendly search to locate the documents you require.

An assortment of templates for business and personal uses are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your details to sign up for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to find the New Mexico Warehouse Record of Receipt in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to acquire the New Mexico Warehouse Record of Receipt.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Make sure you have selected the form for the correct region/country.

- Step 2. Use the Review option to check the form's details. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Gross receipts include all revenue in whatever form received or accrued (in accordance with the entity's accounting method) from whatever source, including from the sales of products or services, interest, dividends, rents, royalties, fees, or commissions, reduced by returns and allowances.

The state imposes a governmental gross receipts tax of 5.00% on the receipts of New Mexico state and local governments.

Introduction. Gross receipts taxes are applied to receipts from a firm's total sales. Unlike a corporate income tax, these taxes apply to the firm's sales without deductions for a firm's costs. They are not adjusted for a business' profit levels or expenses and apply to all transactions a business makes.

(Available July 1, 2018 until July 1,2022). Gross receipts are taxable, exempt, or deductible. If your receipts do not fall under any exemption or deduction, those receipts are taxable.

Because gross receipts taxes are imposed at intermediate stages of production and do not allow deductions for costs, they are not based on profits or net income (like a corporate income tax) or final consumption (like a well-constructed sales tax).

To find your gross receipts for personal income, add up your sales. Then, subtract your cost of goods sold and sales returns and allowances to get total income. The better your financial records are, the easier the process will be.

New Mexico does not have a sales tax. It has a gross receipts tax instead. This tax is imposed on persons engaged in business in New Mexico. In almost every case, the person engaged in business passes the tax to the consumer either separately stated or as part of the selling price.

Every person required to file a New Mexico gross receipts tax return must complete and file a TRD-41413 New Mexico Gross Receipts Tax Return. Use the Schedule A, New Mexico Gross Receipts Tax Schedule A if additional space is needed to report gross receipts from multiple locations.

How GRT Differs From Income Taxes or Franchise Taxes. Some states tax the incomes of businesses, but in most cases that taxable income is net incomesales minus expenses. The gross receipts tax doesn't deduct expenses. Other states have franchise taxes, which are similar to income taxes.

Add up your total sales to get gross receipts. If you've kept good records, it should be simple. Then subtract the cost of goods sold, as well as sales returns and allowances, to get your total income.