New Mexico New Employee Survey

Description

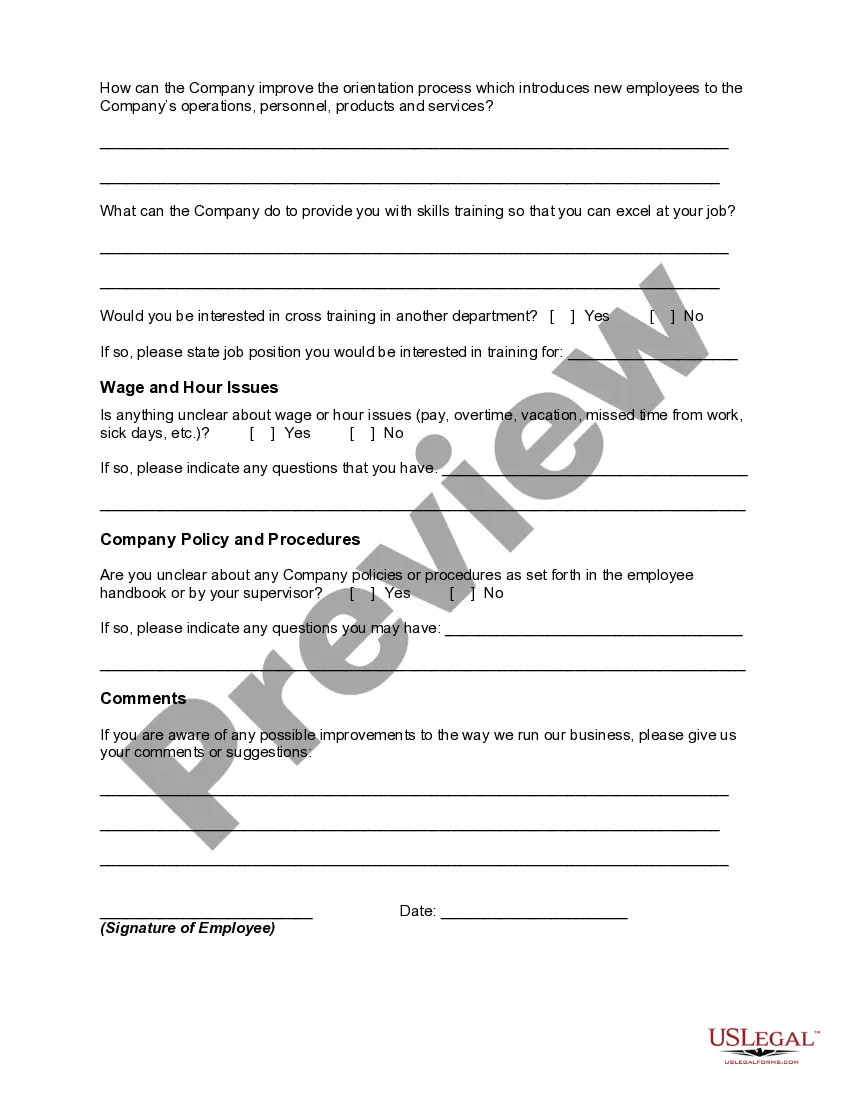

New employee surveys can be done for many purposes. One of them is the new employee orientation survey. This survey is generally done after a few days of orientation to determine any potential issues relating to productivity, turnover, attitudes and other aspects. It would also help the management to understand the productivity of the orientation or training program that the new employee went through in the initial days. The employee's experiences in the early days of employment are also important determinants, since they represent the company's image through the eyes of a new person.

Another kind of new employee survey can be undertaken to know whether the employee has completely understood all the aspects of the new job or not. This can include the job analysis and description, the basics of the job, the most enjoyable and least enjoyable parts of the job, and so on. New employee survey can include information relating to corporate culture, training, supervisor relations, work environment, pay and benefits, communications, feedback, leadership, corporate vision, and overall satisfaction.

How to fill out New Employee Survey?

It is feasible to invest time online attempting to locate the legitimate format that satisfies the state and federal criteria you require.

US Legal Forms offers a vast array of legal documents that have been reviewed by experts.

You can obtain or print the New Mexico New Employee Survey from our service.

If available, use the Review option to examine the format as well. If you wish to get another version of the form, utilize the Lookup field to find the format that meets your needs and specifications.

- If you already possess a US Legal Forms account, you can Log In and select the Download option.

- Afterwards, you can complete, modify, print, or sign the New Mexico New Employee Survey.

- Every legal format you acquire is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click on the respective option.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct format for the state/city you choose.

- Review the form details to confirm you have chosen the appropriate form.

Form popularity

FAQ

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Employees must submit basic information including name, Social Security number and citizenship status. Employees also must supply documentation along with this form to prove they are eligible to work in the United States. Documentation examples include a current passport, state issued I.D. and Social Security card.

Before you can add an employee to your team, you are legally responsible for confirming the employee is eligible to work in the United States.Form I-9.Form W-4.State W-4.Emergency contact form.Employee handbook acknowledgment form.Bank account information form.Benefits forms.

What kind of details should an employee information form contain?Full name.Address and phone number.Social Security Number (SSN).Spouse information.Position and department.Start date.Salary.Emergency contact information.

They could determine the size and delivery of your paycheck, for example.5 forms to complete when starting a new job. You might be wondering why you need to be prepared for your new-hire paperwork.I-9 documents.W-4 form.Direct deposit form.Benefits enrollment.Company-specific paperwork.

Initial hiring documentsJob application form.Offer letter and/or employment contract.Drug testing records.Direct deposit form.Benefits forms.Mission statement and strategic plan.Employee handbook.Job description and performance plan.More items...?

Initial hiring documentsJob application form.Offer letter and/or employment contract.Drug testing records.Direct deposit form.Benefits forms.Mission statement and strategic plan.Employee handbook.Job description and performance plan.More items...?

To know how much income tax to withhold from employees' wages, you should have a Form W-4, Employee's Withholding Certificate, on file for each employee. Ask all new employees to give you a signed Form W-4 when they start work. Make the form effective with the first wage payment.

New hire forms checklistForm I-9.W-4.State new hire tax forms.New hire reporting.Offer letter.Employment agreement.Employee handbook acknowledgment.Direct deposit authorization.More items...?

For each compensated employee, federal regulations require that a Form W-2, Wage and Tax Statement, be completed annually and sent to the Social Security Administration. Business owners must also provide each employee with a copy of the W-2 for individual tax purposes.