New Mexico Invoice Template for Accountant

Description

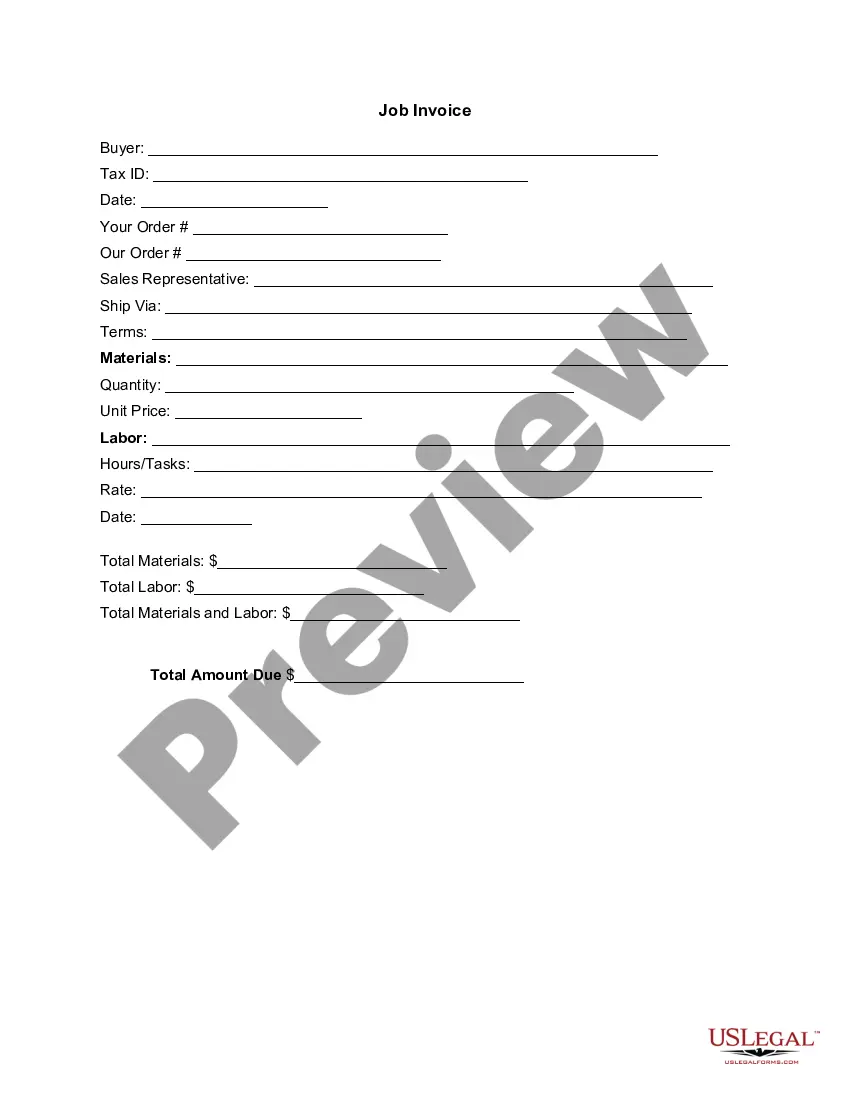

How to fill out Invoice Template For Accountant?

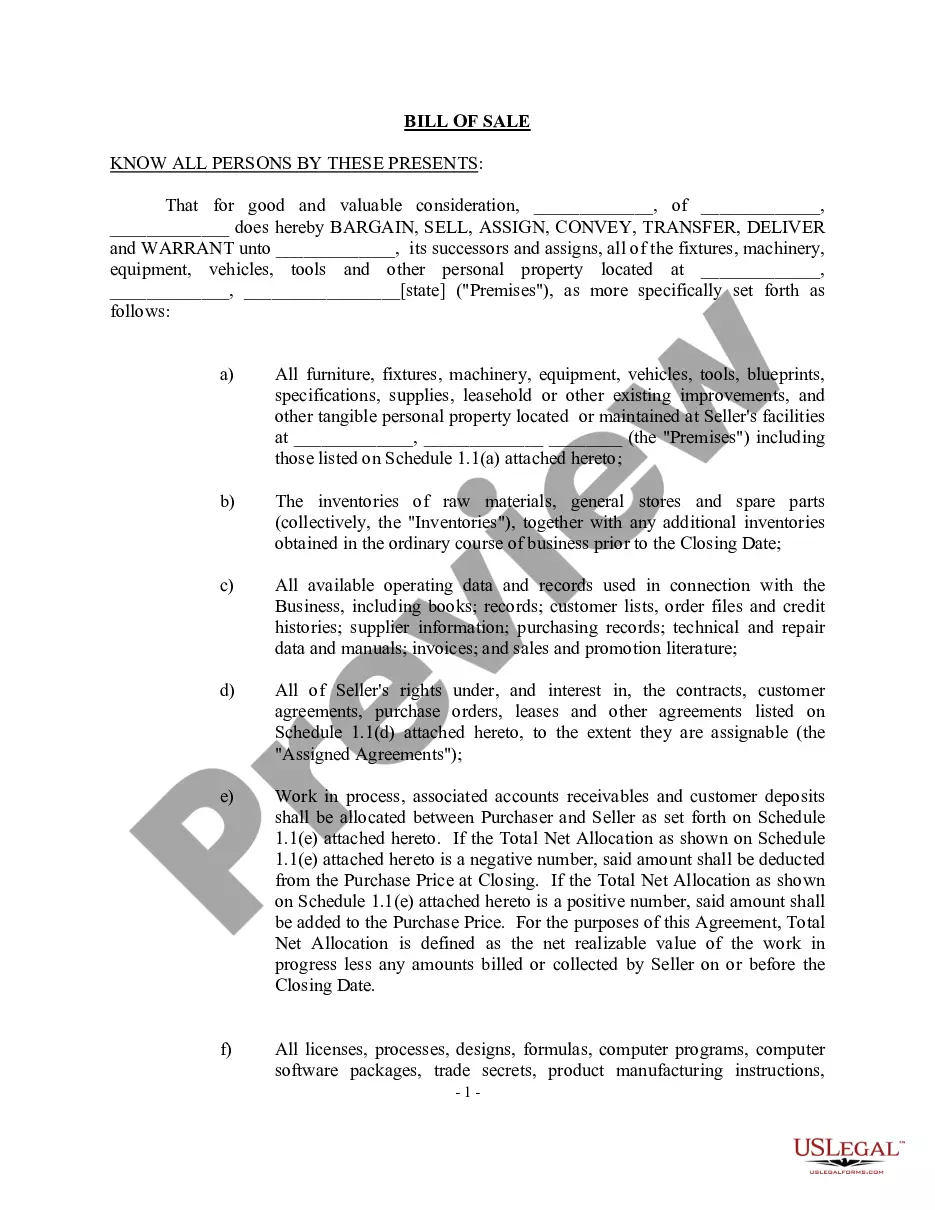

Locating the appropriate legal document format can be a challenge.

Of course, there are numerous templates available online, but how do you identify the legal form you require? Utilize the US Legal Forms website.

The service offers a vast array of templates, such as the New Mexico Invoice Template for Accountant, suitable for both business and personal purposes.

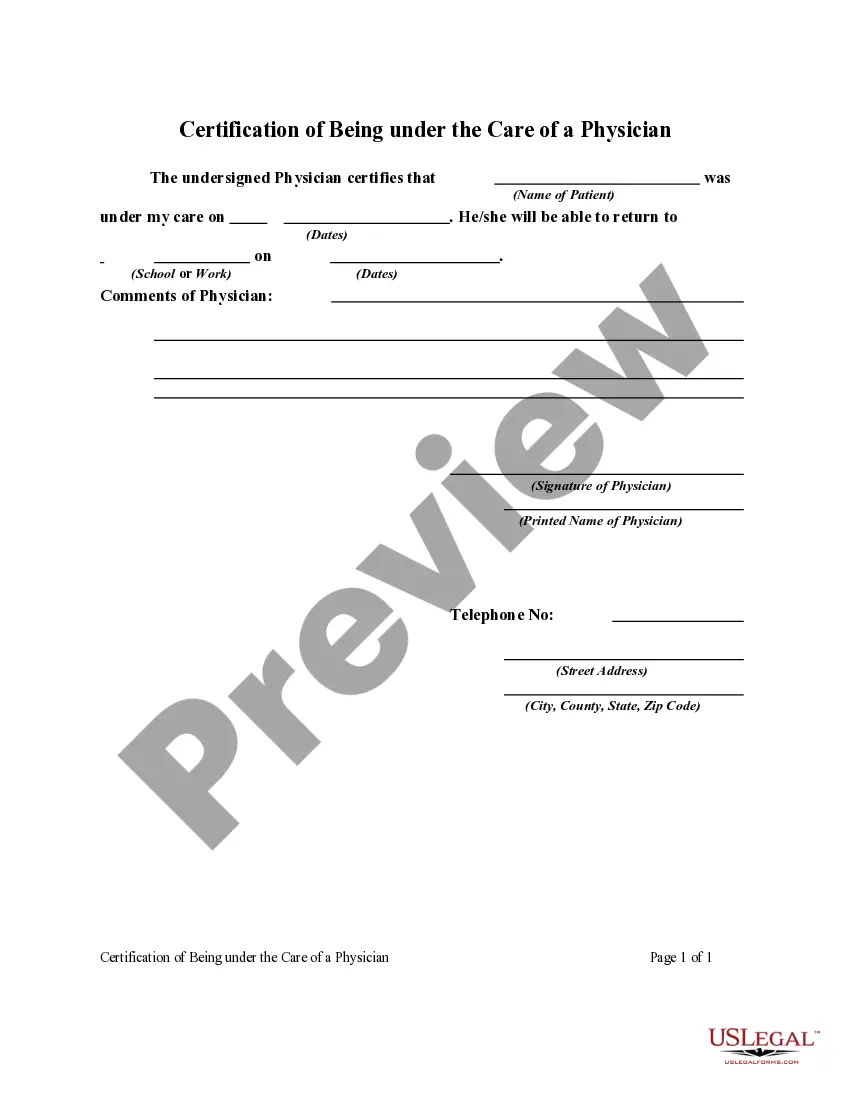

You can review the form using the Preview option and read the form description to ensure it is the right one for you.

- All of the forms are verified by professionals and meet federal and state standards.

- If you are already registered, Log In to your account and click the Download button to retrieve the New Mexico Invoice Template for Accountant.

- You can use your account to browse through the legal forms you may have previously acquired.

- Visit the My documents tab in your account to download another copy of the document you need.

- As a new user of US Legal Forms, here are straightforward instructions for you to follow.

- First, ensure you have selected the correct document for your area.

Form popularity

FAQ

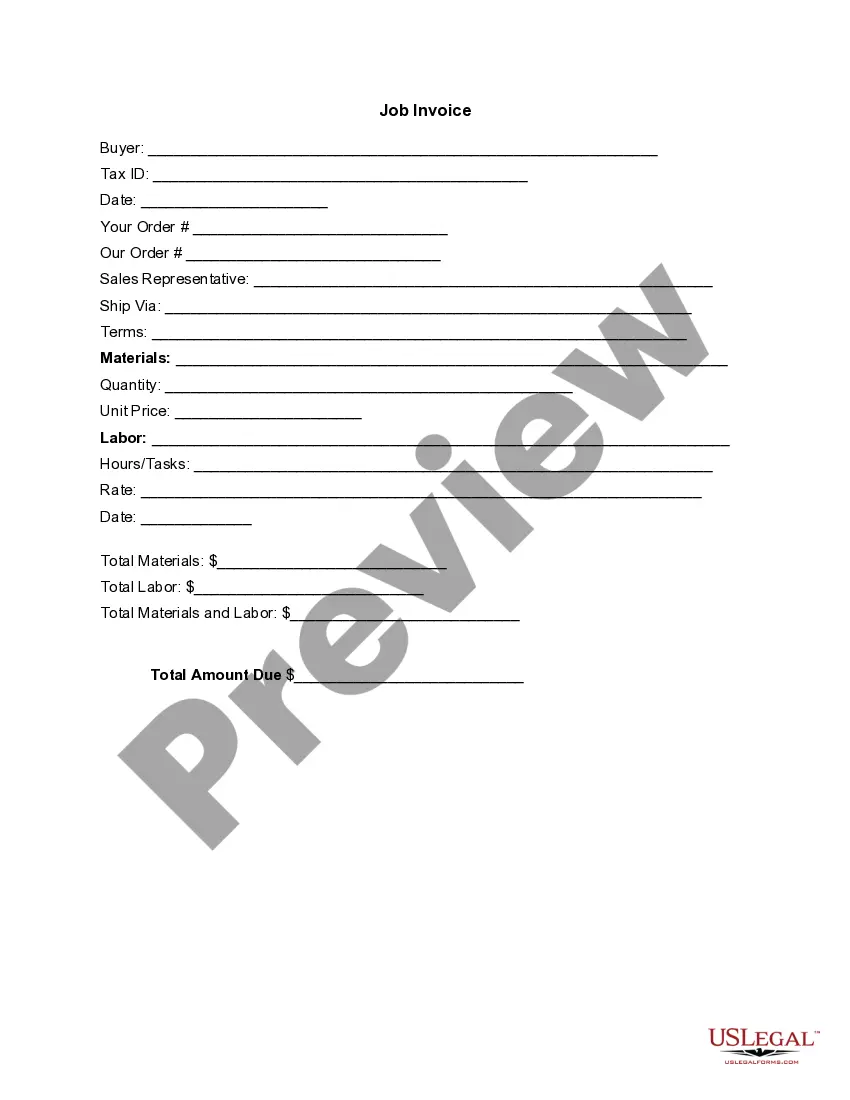

You can easily create an invoice template in Microsoft Word by utilizing its built-in features and design options. Consider including sections for essential invoice details, like your business information and payment terms. For added convenience, a New Mexico Invoice Template for Accountant can serve as a starting point, ensuring you cover all necessary aspects for compliance.

Certainly, creating your own invoice template is possible and can be tailored to fit your unique requirements. If you use software like Google Docs or Excel, you can establish a format that includes all necessary fields. However, consider using a New Mexico Invoice Template for Accountant to save time and ensure your template meets state requirements.

Yes, QuickBooks provides a variety of invoice templates that users can customize to suit their business needs. These templates help you manage your accounting efficiently while ensuring professional presentation. Additionally, incorporating a New Mexico Invoice Template for Accountant may enhance your QuickBooks experience with localized compliance.

Creating an invoice template involves outlining the standard fields you repeatedly use in your invoices. You can design your own template using software like Microsoft Word or Excel, or you may prefer a New Mexico Invoice Template for Accountant for ease of use. This way, you save time and maintain consistency in your billing process.

Yes, you can create an invoice yourself by using simple software tools or templates available online. Utilizing a New Mexico Invoice Template for Accountant can significantly simplify the process, guiding you through the necessary fields. This approach ensures that your invoices are professional, clear, and meet your accounting needs.

To create an effective invoice format, start by determining the essential components, such as your business name, contact information, and invoice number. Next, include fields for the client's details, item descriptions, quantities, rates, and total amounts. Consider using a New Mexico Invoice Template for Accountant to streamline your process and ensure compliance with local regulations.

In New Mexico, certain organizations, such as charities and government entities, may qualify for tax-exempt status. Additionally, specific individuals, like veterans in certain situations, might also be eligible. A New Mexico Invoice Template for Accountant can help these entities manage their finances while ensuring compliance with state tax regulations.

Residents or part-year residents who meet certain income criteria are required to file a New Mexico tax return. This applies to various forms of income, including wages, investments, and business profits. By using a New Mexico Invoice Template for Accountant, you can organize your income and ensure you fulfill your filing obligations correctly.

Any resident who earns above the state’s filing threshold must file a New Mexico tax return. This requirement generally applies to individuals with wages, self-employment income, or other types of taxable income. To simplify this process, incorporating a New Mexico Invoice Template for Accountant can help maintain accurate records necessary for filing.

Individuals who earn below a certain income threshold typically do not need to file a state tax return in New Mexico. This includes some retirees and those relying on specific types of income. Utilizing a New Mexico Invoice Template for Accountant can help keep track of your income and determine if you need to file.