New Mexico Affidavit of Domicile for Deceased

Description

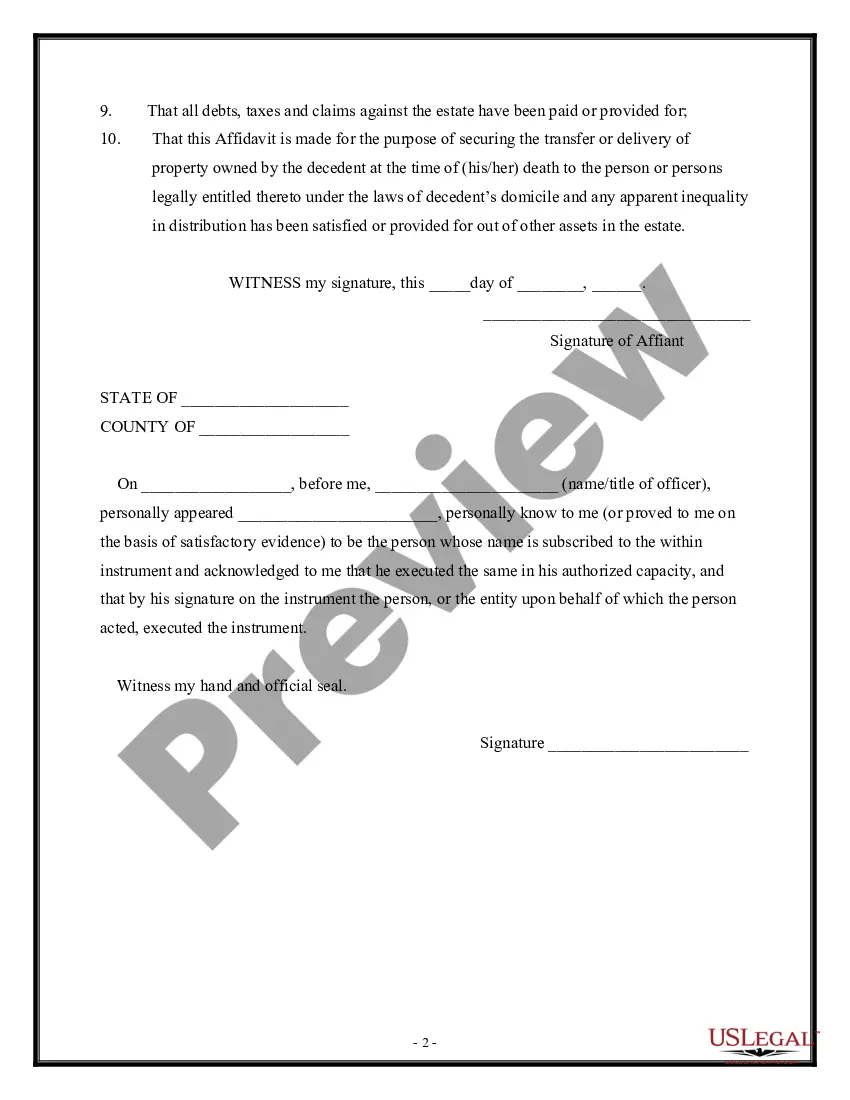

How to fill out Affidavit Of Domicile For Deceased?

Are you currently in the situation where you will need paperwork for possibly company or person reasons virtually every day? There are tons of legal file templates available online, but discovering ones you can trust isn`t simple. US Legal Forms gives a large number of develop templates, like the New Mexico Affidavit of Domicile for Deceased, which can be composed to fulfill federal and state needs.

In case you are presently familiar with US Legal Forms web site and also have a free account, merely log in. Afterward, you may down load the New Mexico Affidavit of Domicile for Deceased template.

If you do not offer an accounts and need to begin to use US Legal Forms, follow these steps:

- Find the develop you will need and ensure it is for that proper metropolis/region.

- Utilize the Preview switch to analyze the form.

- Browse the outline to ensure that you have chosen the right develop.

- In case the develop isn`t what you`re searching for, take advantage of the Research industry to find the develop that suits you and needs.

- If you find the proper develop, just click Purchase now.

- Opt for the prices plan you would like, fill out the required details to generate your bank account, and buy the order with your PayPal or Visa or Mastercard.

- Select a handy document structure and down load your copy.

Get each of the file templates you might have bought in the My Forms food list. You can aquire a additional copy of New Mexico Affidavit of Domicile for Deceased whenever, if necessary. Just click the needed develop to down load or print the file template.

Use US Legal Forms, by far the most substantial variety of legal varieties, in order to save time as well as steer clear of faults. The assistance gives appropriately manufactured legal file templates which can be used for a selection of reasons. Generate a free account on US Legal Forms and begin making your daily life a little easier.

Form popularity

FAQ

The Affidavit for Collection of Personal Property of the Decedent (as it's referred to in New Mexico) can only be used for small estates with a total value not exceeding $50,000 ( not including liens and encumbrances).

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

A ballpark fee for preparation of the affidavit is between $750 for a very simple estate with few heirs to several thousand dollars for a more complicated estate with many heirs. The filing fees to record the affidavit in each county where the real property is located usually run about $50 to $75 in Texas.

An affidavit of heirship is easier than going through the court process, but it only applies to land/real estate property. It does not cure or determine beneficiaries to bank accounts or other assets.

Your separate or personal property will be divided between your spouse and children if you have children or your spouse and parents or siblings if you don't have children. Your spouse will inherit ing to these rules even if you were separated or estranged, but not if you were divorced.

If there is no Will, and the decedent is survived by heirs, and the estate is under $20,000.00 and held in the decedent's name alone and not held jointly with a living person, a "next of kin" affidavit can be issued by the Surrogate to one of the surviving next-of-kin upon receipt of consent forms from all other ...

An Affidavit of Heirship is a sworn statement that identifies the heirs of a deceased property owner. Good to know: By Texas law, all property owned by the deceased passes to the Heirs at Law of the deceased unless there is a valid Will or other estate plan in place stating otherwise.

The Affidavit of Next of Kin must be done in the County where the decedent resided at time of death. Bring an original or certified copy to the Surrogate at time of application. List all the assets in the decedent's name alone in order to determine the number of true copies of the affidavits that will be required.