This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Mexico Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse

Description

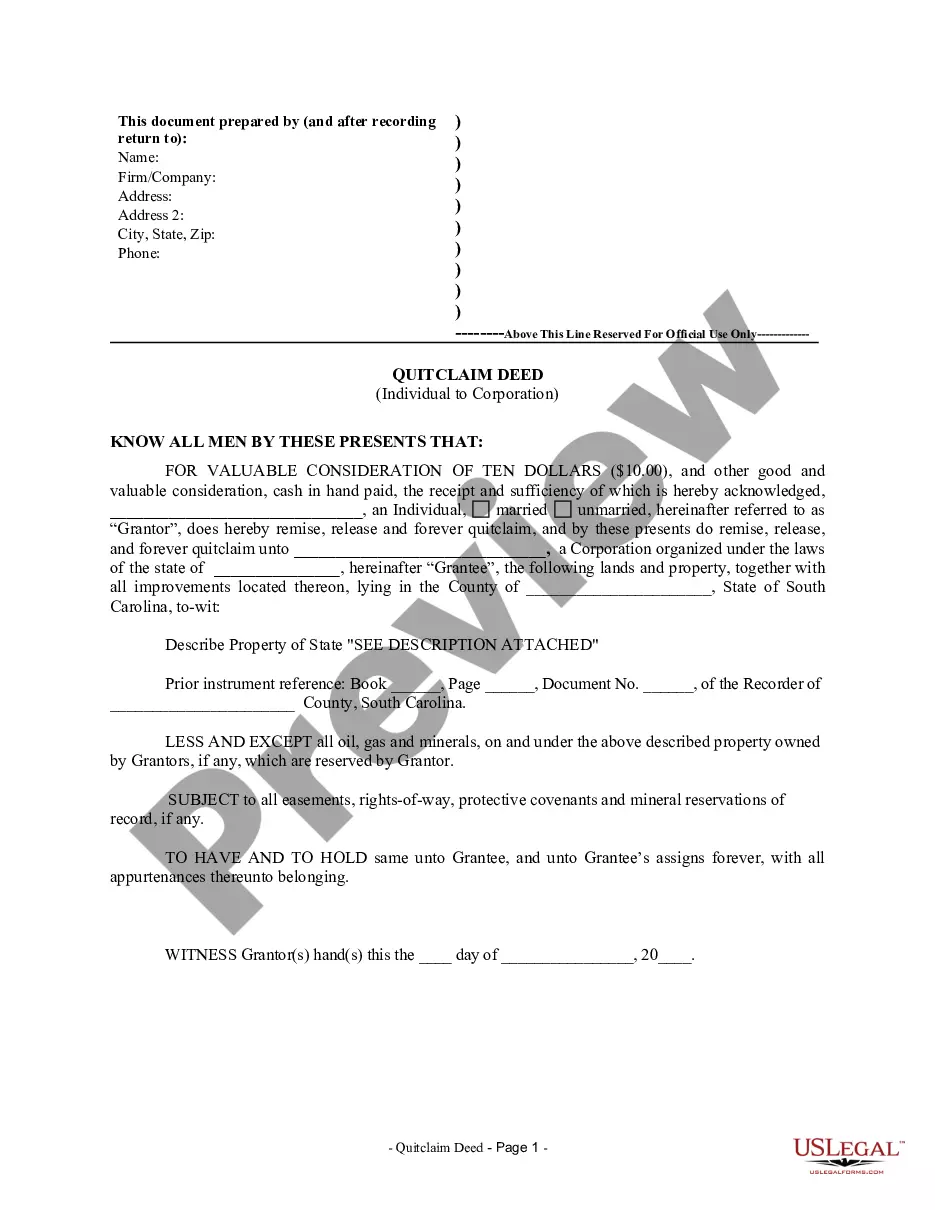

How to fill out Notice Of Non-Responsibility For Debts Or Liabilities Contracted By Spouse?

Are you in a position where you need documents for either corporate or personal activities almost every day.

There are many legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the New Mexico Notice of Non-Responsibility for Debts or Liabilities Incurred by Spouse, which are created to comply with federal and state requirements.

Once you find the right document, click Buy now.

Choose the pricing plan you want, fill out the necessary information to create your account, and complete the payment using PayPal or Visa or MasterCard.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the New Mexico Notice of Non-Responsibility for Debts or Liabilities Incurred by Spouse template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct city/state.

- Use the Preview button to review the document.

- Read the description to ensure you have selected the correct document.

- If the document is not what you are looking for, use the Search field to find the document that meets your needs and requirements.

Form popularity

FAQ

Generally, creditors cannot pursue you for your spouse's debt unless you are co-signed or jointly liable. If you take action by filing a New Mexico Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse, it can help clarify and reinforce that separation. Consulting legal services can offer you further insights and assist you in protecting your finances.

Debt collectors may target spouses if the debt is shared or if the state law allows it. However, the New Mexico Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can help limit their ability to pursue your spouse for your individual debts. Make sure to keep all documentation and consult resources to protect your interests.

In many cases, you cannot be held responsible for your spouse's debt if the debt is in their name only. Filing a New Mexico Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can further clarify this separation of responsibility. Understanding the specifics of your financial obligations is crucial, so speaking with a legal expert is advisable.

Creditors generally can pursue your spouse only if they are jointly responsible for the debt. However, if you have filed a New Mexico Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse, it may help protect your spouse from being liable for your individual debts. Always consider consulting a legal professional to understand your specific situation.

liable spouse is one who is not responsible for paying the tax debt incurred by their partner. This designation typically applies to individuals who can prove they did not know about the tax issues or that the debts were unfairly assessed against them. If you are seeking protection related to the New Mexico Notice of NonResponsibility for Debts or Liabilities Contracted by Spouse, understanding your status as a nonliable spouse can effectively shape your approach. Expert advice can clarify your situation.

A request for relief by separation of liability can be made when you and your spouse have filed a joint tax return, and you wish to separate responsibilities for tax owed due to your spouse's actions. This request must be made within two years of the IRS beginning collection actions against you. If you are facing issues related to the New Mexico Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse, timely filing is essential. Consult professionals to ensure your request is submitted correctly.

To seek innocent spouse relief, you must file IRS Form 8857, the Request for Innocent Spouse Relief. This form allows the IRS to assess whether you meet the criteria for relief based on your specific circumstances. If the debts concern the New Mexico Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse, it’s vital to provide detailed information. Utilizing resources like USLegalForms can ensure you complete the form correctly.

IRS Form 12508 is used to request a refund of tax payments made by an innocent spouse. This form is specifically designed for those who qualify for innocent spouse relief and have made payments that can be refunded. If you're navigating issues related to the New Mexico Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse, this form may be essential in reclaiming your funds. Complete this form carefully to ensure successful processing.

IRS Form 8857 is specifically used for requesting innocent spouse relief, while Form 8379 is for injured spouse claims. Form 8857 applies when a spouse seeks exemption from responsibility for a tax liability due to the other spouse’s actions. In contrast, Form 8379 allows a non-liable spouse to claim their share of a tax refund when offset against the other spouse's debts. When dealing with the New Mexico Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse, understanding this difference is vital.

There are four primary types of innocent spouse relief: deferral of liability, separation of liability, equitable relief, and traditional innocent spouse relief. Each type offers different levels of protection based on your specific situation and the nature of the debts. If your case relates to the New Mexico Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse, identifying the right type is essential for proper resolution. Consulting with experts can help you choose the best path.