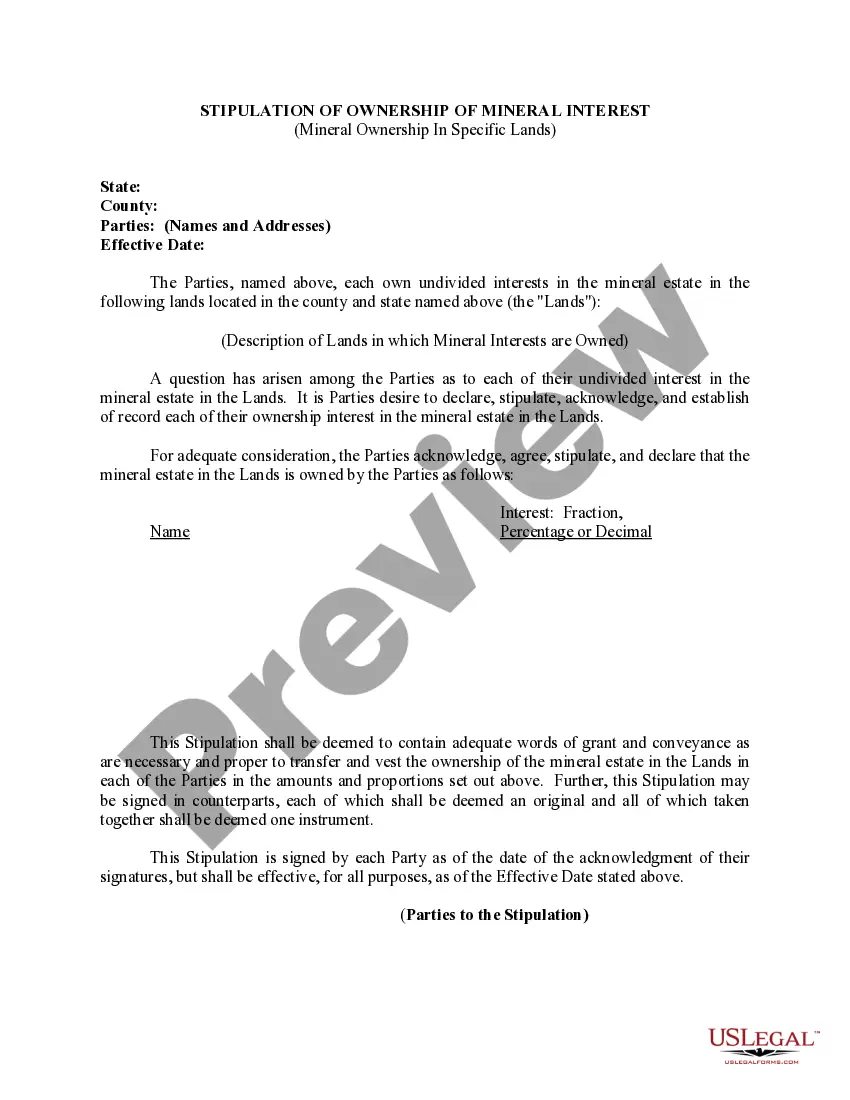

This form is a sample of an agreement to extend the time of a loan commitment in order to consummate a purchase of real property which will be security for the loan. In effect the loan applicant is asking for an extension of the date of closing set forth in the loan commitment or application.

New Mexico Extension of Loan Closing Date

Description

How to fill out Extension Of Loan Closing Date?

If you wish to total, download, or print out legitimate record themes, use US Legal Forms, the most important assortment of legitimate types, that can be found online. Use the site`s basic and hassle-free research to get the files you will need. Numerous themes for business and individual purposes are sorted by categories and states, or keywords. Use US Legal Forms to get the New Mexico Extension of Loan Closing Date in a few clicks.

If you are already a US Legal Forms consumer, log in in your bank account and click on the Download option to find the New Mexico Extension of Loan Closing Date. You can also access types you formerly delivered electronically inside the My Forms tab of your own bank account.

If you use US Legal Forms initially, follow the instructions under:

- Step 1. Ensure you have selected the form for the right town/region.

- Step 2. Use the Review option to look through the form`s articles. Do not forget to read the description.

- Step 3. If you are not satisfied with all the develop, take advantage of the Lookup area on top of the display to locate other types of the legitimate develop web template.

- Step 4. When you have identified the form you will need, click on the Get now option. Pick the prices prepare you favor and add your credentials to sign up to have an bank account.

- Step 5. Approach the transaction. You should use your credit card or PayPal bank account to accomplish the transaction.

- Step 6. Pick the formatting of the legitimate develop and download it on your system.

- Step 7. Comprehensive, revise and print out or indication the New Mexico Extension of Loan Closing Date.

Every single legitimate record web template you get is your own property for a long time. You might have acces to every develop you delivered electronically inside your acccount. Select the My Forms area and pick a develop to print out or download again.

Contend and download, and print out the New Mexico Extension of Loan Closing Date with US Legal Forms. There are many professional and status-specific types you can utilize for your business or individual demands.

Form popularity

FAQ

When available, the redemption period generally ranges from 30 days to a year. In most states that provide a post-sale redemption period, specific factors often change the redemption period's length. For example: The redemption period might vary depending on whether the foreclosure is judicial or nonjudicial.

? To redeem property, the redemption statute requires a debtor to pay only the amount paid at the foreclosure sale, with interest from the date of purchase at the rate of ten percent a year; all taxes, interest and penalties that were paid by the purchaser; and all payments made by the purchaser to satisfy in whole or ...

Does New Mexico Law Allow for a Redemption Period After a Foreclosure? Yes, New Mexico law allows a borrower to redeem a property within nine months of the foreclosure sale date. The borrower must pay the foreclosure sale price, costs, fees and interest in order to redeem the property.

Redemption is a period after your home has already been sold at a foreclosure sale when you can still reclaim your home. You will need to pay the outstanding mortgage balance and all costs incurred during the foreclosure process. Many states have some type of redemption period.

If you have a valid 6-month Federal extension (IRS Form 4868), you will automatically receive a New Mexico extension for the same amount of time.

Form RPD-41096, Application for Extension of Time to File By obtaining an extension of time to file your return, penalty for failure to file and pay is waived through the extension period, provided you file the return and pay the tax shown on the return by the extended due date.

Does New Mexico support tax extension for business tax returns? Yes. The state of New Mexico requires businesses to file a Federal Form 7004 rather than requesting a separate state tax extension. State Tax extension Form can be filed only if the federal tax extension Form 7004 was rejected.

If your New Mexico property taxes are delinquent for more than two years, your home will be added to a "tax delinquency list." (N.M. Stat. § 7-38-61.) Three years after the first delinquent date shown on the list, the Taxation and Revenue Department will schedule a sale to sell your home to pay off the tax debt.