A license authorizes the holder to do something that he or she would not be entitled to do without the license. Licensing may be directed toward revenue raising purposes, or toward regulation of the licensed activity, or both. Statutes frequently require that a person obtain a license before practicing certain professions such as law or medicine, or before carrying on a particular business such as that of a real estate broker or stock broker. If the license is required to protect the public from unqualified persons, an assignment of that license to secure a loan would probably not be enforceable.

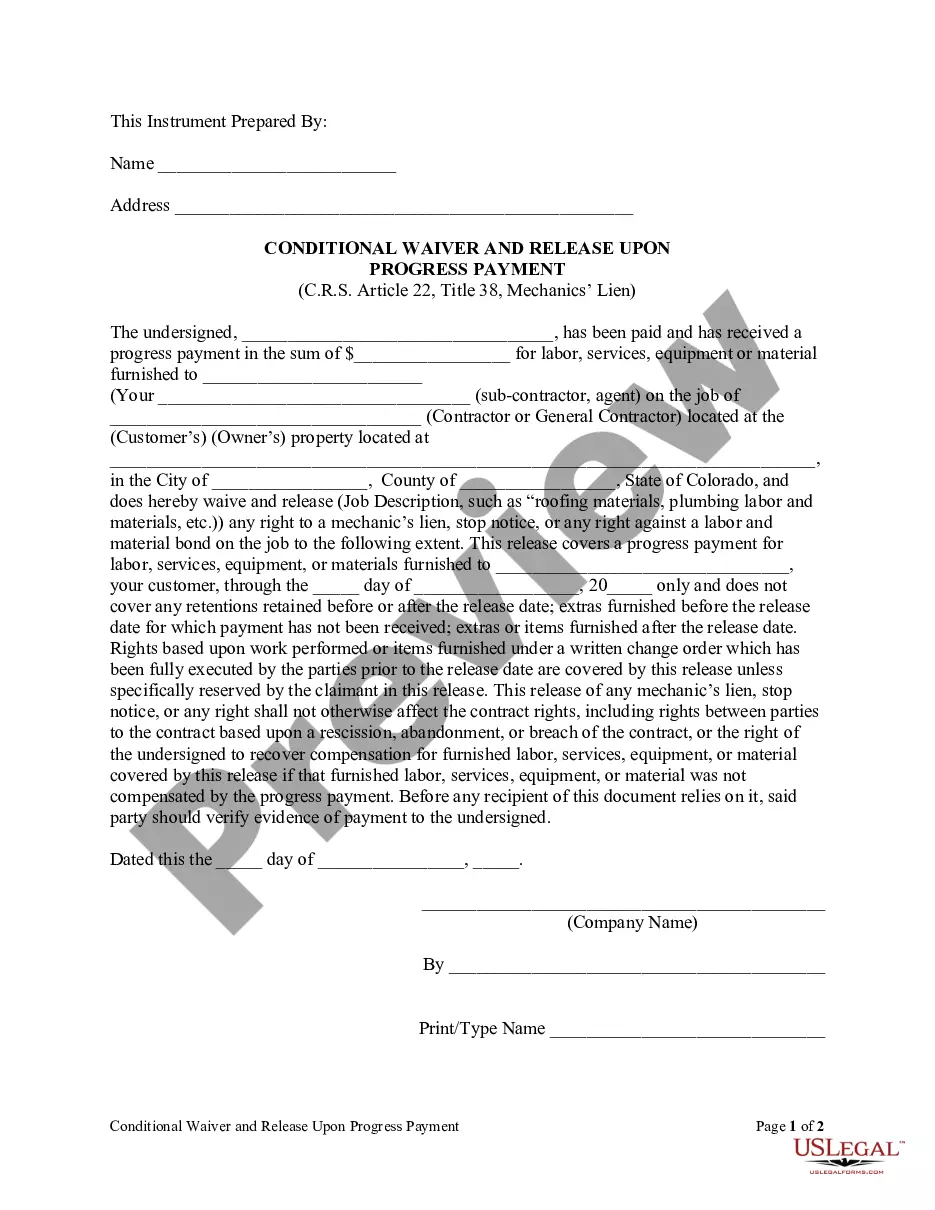

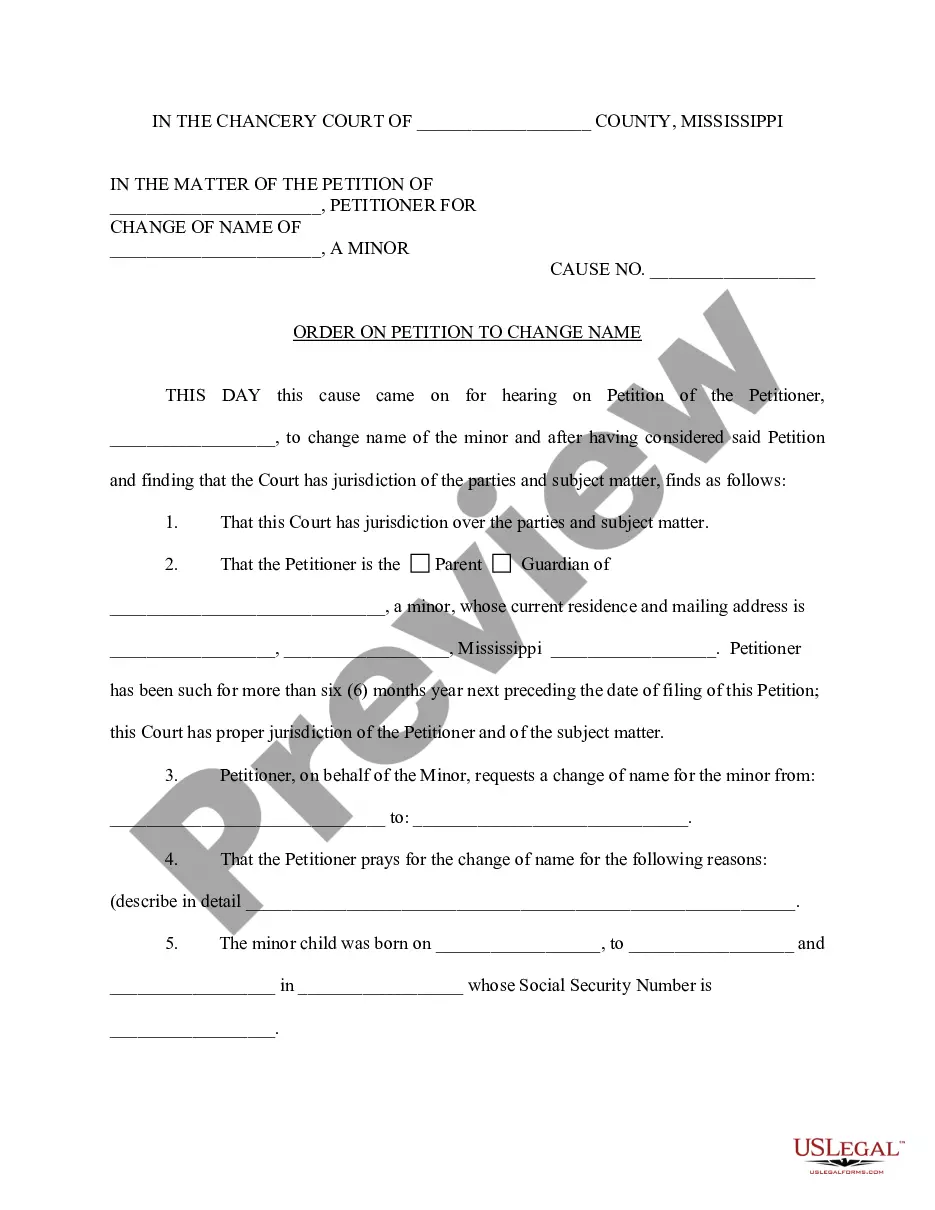

New Mexico Assignment of Business License as Security for a Loan

Description

How to fill out Assignment Of Business License As Security For A Loan?

Are you presently in the placement in which you need files for sometimes business or person reasons just about every day? There are a lot of legitimate record layouts available online, but locating versions you can depend on is not easy. US Legal Forms offers a huge number of form layouts, just like the New Mexico Assignment of Business License as Security for a Loan, that happen to be written to satisfy federal and state needs.

When you are presently knowledgeable about US Legal Forms internet site and get an account, just log in. Afterward, you can obtain the New Mexico Assignment of Business License as Security for a Loan template.

If you do not offer an profile and would like to start using US Legal Forms, adopt these measures:

- Obtain the form you want and make sure it is to the correct metropolis/area.

- Take advantage of the Review button to check the shape.

- Browse the outline to actually have chosen the appropriate form.

- If the form is not what you`re looking for, utilize the Research area to get the form that meets your needs and needs.

- When you get the correct form, simply click Acquire now.

- Pick the pricing plan you need, submit the necessary information to produce your money, and pay for your order using your PayPal or charge card.

- Pick a convenient file format and obtain your version.

Find all the record layouts you may have purchased in the My Forms food selection. You can get a additional version of New Mexico Assignment of Business License as Security for a Loan anytime, if required. Just click on the required form to obtain or printing the record template.

Use US Legal Forms, the most comprehensive collection of legitimate types, to save lots of some time and stay away from errors. The service offers professionally made legitimate record layouts that can be used for a variety of reasons. Make an account on US Legal Forms and start creating your way of life a little easier.

Form popularity

FAQ

Section 32 of Regulation Z implements the Home Ownership and Equity Protection Act of 1994 (HOEPA). HOEPA protects consumers from deceptive and unfair practices in home equity lending by establishing specific disclosure requirements for certain mortgages that have high rates of interest or assess high fees and points.

2021 New Mexico Statutes. Chapter 58 - Financial Institutions and Regulations. Article 21A - Home Loan Protection. Section 58-21A-5 - Limitations and prohibited practices for high-cost home loans.

Licensing: Every lender offering title loans in New Mexico must be licensed under the New Mexico Regulation and Licensing Department (4). 4. Repossession Laws: In the case of a loan default, New Mexico law allows the lender to repossess and sell the vehicle (5).

The goal of HOEPA is to stop abusive practices in refinances and closed-end home equity loans that have higher interest rates or high fees. If you decide to take out a "high-cost mortgage," meaning the interest rate or fees exceed specific amounts, HOEPA provides you with protection against abusive lending practices.

The purpose of the New Mexico Mortgage Loan Originator Licensing Act [58-21B-1 NMSA 1978] is to protect consumers seeking mortgage loans.

STATE LICENSE AND PERMITS. New Mexico requires that several types of businesses obtain licenses. It also requires that practitioners of several professions obtain licenses (Boards and Commissions governs this area). If a business serves alcohol, it must obtain an additional license.

On January 1, 2023, House Bill 132 went into effect enacting a 36% annual percentage rate (APR) cap on loans up to $10,000 made under the New Mexico Bank Installment Loan Act of 1959 and the New Mexico Small Loan Act (SLA).

Your mortgage will be considered a higher-priced mortgage loan (HPML) if the APR is a certain percentage higher than the APOR, depending on what type of loan you have: First-lien mortgages: If your mortgage is a first-lien mortgage, the lender of this mortgage will be the first to be paid if you go into foreclosure.