One principal advantage of insurance trusts is that they permit a greater flexibility in investment and distribution than may be effected under settlement options generally included in the policies themselves. Another advantage is that such trusts, like other gifts of insurance policies, may afford substantial estate tax savings.

New Mexico Irrevocable Trust Funded by Life Insurance

Description

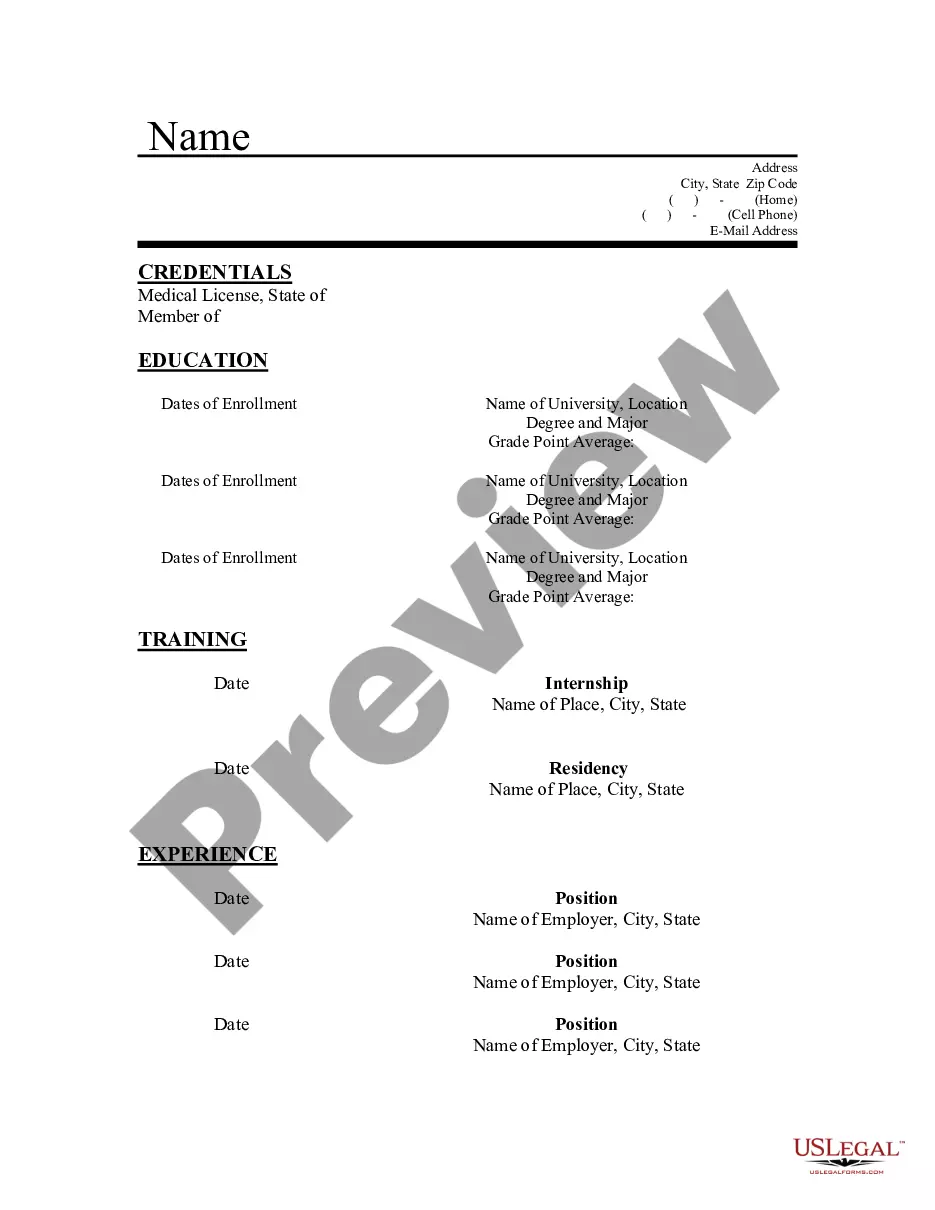

How to fill out Irrevocable Trust Funded By Life Insurance?

Obtaining the appropriate legal document template can be challenging.

Clearly, there are countless templates accessible online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the New Mexico Irrevocable Trust Funded by Life Insurance, suitable for both business and personal requirements.

If the form does not meet your requirements, utilize the Search section to find the correct document. Once you are confident that the form is suitable, click the Get now button to obtain the form. Choose your pricing plan and enter the necessary information. Create your account and pay for an order using your PayPal account or Visa or Mastercard. Select the document format and download the legal document template for your use. Complete, modify, print, and sign the acquired New Mexico Irrevocable Trust Funded by Life Insurance. US Legal Forms is the largest repository of legal forms where you can find a range of document templates. Use the service to acquire professionally designed documents that comply with state regulations.

- All forms are verified by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and select the Download option to access the New Mexico Irrevocable Trust Funded by Life Insurance.

- Use your account to browse the legal forms you have previously obtained.

- Proceed to the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have chosen the correct form for your locality/state. You can preview the form using the Preview option and review the form outline to confirm it is right for you.

Form popularity

FAQ

In general, life insurance proceeds are not taxable to a New Mexico irrevocable trust funded by life insurance, as long as the trust is set up correctly. The IRS excludes death benefits from taxable income when a policy is owned by an irrevocable trust. Therefore, beneficiaries can receive the full amount without worrying about taxes. It is advisable to consult a tax professional for personalized advice on your specific situation.

Funding a trust with life insurance involves designating an irrevocable trust as the beneficiary of your life insurance policy. This approach allows the trust to receive the policy's death benefit, which can then be used to fund your estate or provide for specific beneficiaries. By doing this through a New Mexico Irrevocable Trust Funded by Life Insurance, you can achieve effective asset protection and estate planning.

To leave life insurance to a trust, first, you need to create a New Mexico Irrevocable Trust Funded by Life Insurance. Next, contact your insurance provider to change the beneficiary of your policy to the trust. This process ensures that the life insurance benefits go directly to the trust upon your passing, avoiding probate and helping manage the distribution of your assets as per your wishes.

When a person dies, the New Mexico Irrevocable Trust Funded by Life Insurance remains in effect, and its terms dictate the management and distribution of assets. The trust's appointed trustee will take over the management of the trust assets, including disbursing the life insurance benefits to the designated beneficiaries. This arrangement ensures that the deceased's wishes are honored, and their assets are managed efficiently according to the trust's specifications.

The 3-year rule for a New Mexico Irrevocable Trust Funded by Life Insurance refers to the IRS regulation that states if a policyholder dies within three years of transferring a life insurance policy to an irrevocable trust, the policy's death benefit may still be included in their estate. This rule emphasizes the importance of timing when setting up the trust. To avoid adverse tax implications, it’s advisable to establish the trust well before any significant health issues arise.

Yes, you can place life insurance in a New Mexico Irrevocable Trust Funded by Life Insurance, which is a common strategy for estate planning. This ensures that the policy's death benefit goes directly to the beneficiaries without being included in the taxable estate. By doing so, you effectively remove the life insurance from your estate, allowing for greater tax advantages.

There are some disadvantages to consider with a New Mexico Irrevocable Trust Funded by Life Insurance. One major drawback is the loss of control over the assets placed in the trust, as they cannot be easily altered or accessed by the grantor once established. Additionally, establishing and maintaining this type of trust may involve legal fees and administrative costs, which can add to your overall expenses.

A New Mexico Irrevocable Trust Funded by Life Insurance does not automatically dissolve after death. Instead, the trust typically continues to exist until its terms are fulfilled. The assets within the trust, including life insurance proceeds, are managed according to the trust agreement, ensuring the beneficiaries receive the intended benefits.

Yes, you can place life insurance in an irrevocable trust, and it can offer significant advantages. A New Mexico Irrevocable Trust Funded by Life Insurance can help keep the death benefit outside your taxable estate, providing financial security for your beneficiaries. This arrangement also protects the policy proceeds from creditors, ensuring that your loved ones receive the intended support. It’s essential to work with professionals to set up the trust correctly.

Generally, an irrevocable life insurance trust does not require a separate tax return if it has no income-generating assets. However, if the trust accumulated income, you may need to file a return. Understanding the tax implications of your New Mexico Irrevocable Trust Funded by Life Insurance is fundamental. Consulting with a tax advisor can clarify your obligations and ensure compliance.