Although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor are recognized, and the insertion of provisions embodying these indicia in the contract will help to insure that the relationship reflects the intention of the parties. These indicia generally relate to the basic issue of control. The general test of what constitutes an independent contractor relationship involves which party has the right to direct what is to be done, and how and when. Another important test involves the method of payment of the contractor.

New Mexico Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor

Description

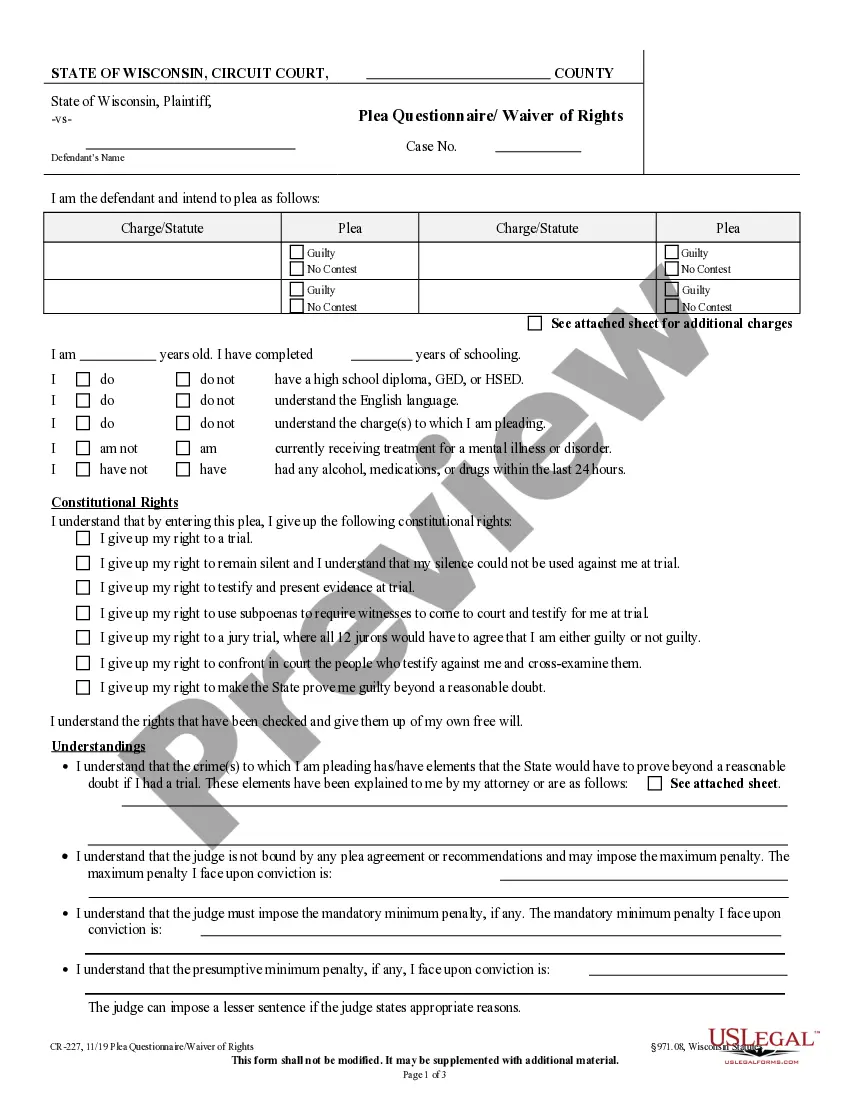

How to fill out Agreement By Accounting Firm To Employ Auditor As Self-Employed Independent Contractor?

Locating the appropriate format for legal documents can be challenging.

Of course, there are numerous templates accessible online, but how can you acquire the legal form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the New Mexico Agreement by Accounting Firm to Hire Auditor as Self-Employed Independent Contractor, which you can use for business and personal purposes.

You can preview the form using the Review option and read the form description to ensure it is suitable for your needs.

- All forms are verified by experts and comply with state and federal regulations.

- If you are already logged in, access your account and click on the Download button to acquire the New Mexico Agreement by Accounting Firm to Hire Auditor as Self-Employed Independent Contractor.

- You can use your account to review the legal forms you have previously ordered.

- Visit the My documents section of your account to obtain another copy of the documents you need.

- If you are a new user of US Legal Forms, here are some simple guidelines for you to follow.

- First, confirm you have selected the correct form for your city/region.

Form popularity

FAQ

An individual contract agreement refers to a specific legal document that outlines the terms between an accounting firm and an auditor working under a New Mexico Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor. This contract defines the scope of work, payment terms, obligations, and rights of both parties. Having a clear agreement minimizes misunderstandings and protects the interests of both the accounting firm and the independent contractor. Using a reliable platform like uslegalforms can help you create this document efficiently.

Yes, New Mexico does require 1099 filing for certain payments made to independent contractors, including those under a New Mexico Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor. If your accounting firm pays an auditor $600 or more in a year, you must provide a 1099 form to report these payments. This ensures compliance with both federal and state tax regulations. Regular filing also helps maintain accurate records for your firm.

Yes, in New Mexico, certain types of contractors must have a license depending on the trade or service they provide. This includes construction, plumbing, and electrical work, among others. If you hire independent contractors under a New Mexico Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, verify their licensing to ensure compliance with state regulations.

Hiring an independent contractor in Mexico is possible, but it involves understanding local labor laws and regulations. If your business operates in both countries, a clear contractual agreement is vital to outline the responsibilities and expectations. A New Mexico Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor may not be applicable in Mexico, so it's wise to adapt your contracts to fit the legal standards there.

In New Mexico, a business license is typically required for businesses operating within city and county limits. Specific industries may have additional licensing requirements; thus, it is essential to check local regulations. If you are hiring an independent contractor in New Mexico, such as through a New Mexico Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, ensure you comply with all licensing needs to avoid potential issues.

Yes, New Mexico offers a voluntary disclosure program that allows businesses to report and settle past tax obligations without facing penalties. This program is beneficial for those who may be uncertain about their tax status. Utilizing a New Mexico Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor can aid in navigating these tax matters effectively.

In New Mexico, an independent contractor is an individual who provides services to a business without being an employee. They have the freedom to choose how they complete their work, which can include working on a project-by-project basis. A New Mexico Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor outlines the terms and conditions of this relationship, ensuring both parties understand their rights and responsibilities.

Yes, a US company can hire an independent contractor in Mexico. Engaging the contractor may require a clear agreement, like the New Mexico Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor. This contract clarifies the terms of employment and the contractor's obligations. Utilizing a platform like US Legal Forms can simplify this process by providing tailored legal documents to ensure compliance with both US and Mexican laws.

The self-employment tax in New Mexico consists of a rate of 15.3%, applied to net earnings. This includes both Social Security and Medicare taxes, making financial planning vital for independent contractors. When establishing a New Mexico Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, understanding your tax obligations helps ensure effective budgeting.

Self-employment tax in New Mexico is a combination of Social Security and Medicare taxes. Currently, it is about 15.3% on net earnings, with self-employed individuals responsible for the full amount. This tax structure is essential to consider when entering into a New Mexico Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, as it impacts total earnings.