New Mexico Leaseback Provision in Sales Agreement

Description

How to fill out Leaseback Provision In Sales Agreement?

Are you in a situation where you must have documentation for both organizational or personal purposes almost all the time.

There are numerous legal document templates accessible online, but locating ones you can trust is not simple.

US Legal Forms provides an extensive array of form templates, such as the New Mexico Leaseback Provision in Sales Agreement, which are crafted to comply with state and federal requirements.

Once you find the appropriate form, click Get now.

Choose the pricing plan you desire, submit the required information to create your account, and pay for your order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the New Mexico Leaseback Provision in Sales Agreement template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

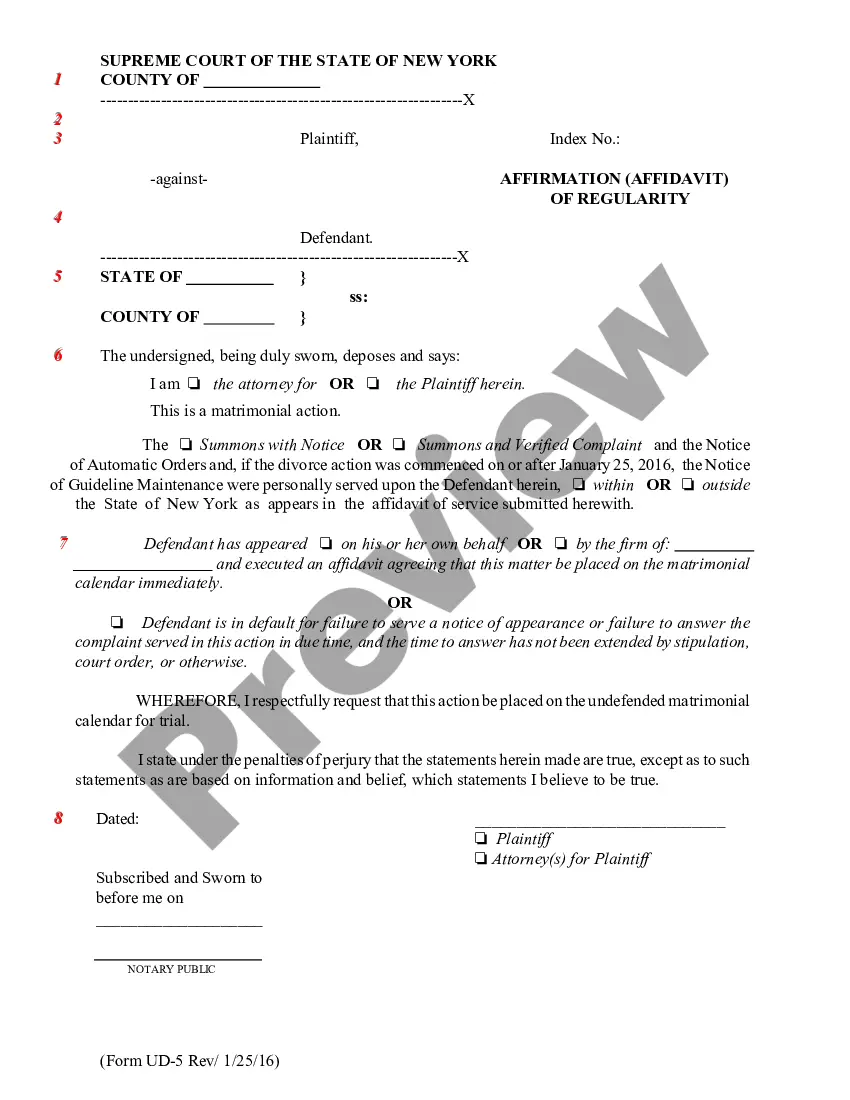

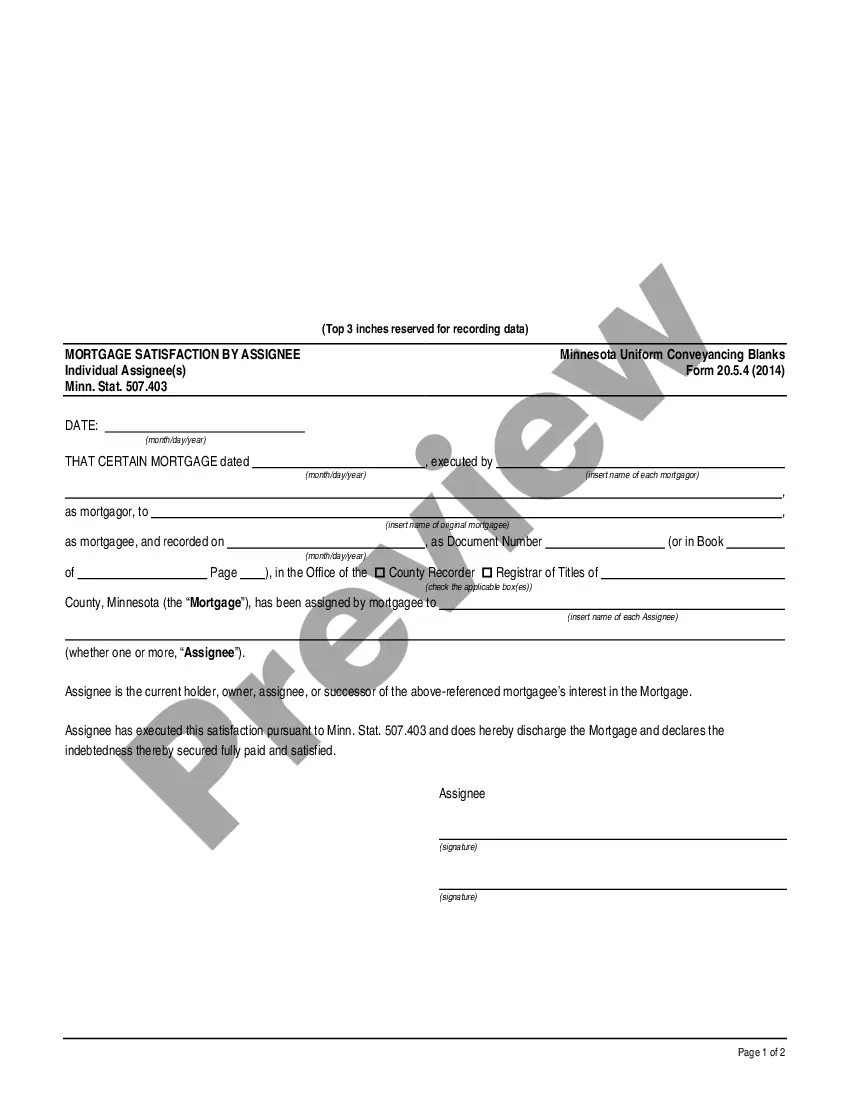

- Use the Review button to assess the form.

- Check the description to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search field to locate a form that meets your needs and requirements.

Form popularity

FAQ

While leasebacks can provide immediate capital, they also come with certain disadvantages. Sellers may lose ownership of the asset, leading to potential long-term financial obligations. Additionally, the terms of the New Mexico Leaseback Provision in Sales Agreement can be complex, which may create operational challenges. To navigate these concerns effectively, consider consulting the resources available on US Legal Forms.

There are several types of sale and leaseback arrangements, including single-tenant and multi-tenant leases. Each type offers unique benefits and structures, catering to different business needs. Knowing the types can help you take full advantage of the New Mexico Leaseback Provision in Sales Agreement. US Legal Forms provides resources that help you understand the options available for your specific situation.

The right of use in a sale and leaseback arrangement refers to the tenant's legal permission to occupy and use the property. This right continues for the duration of the lease, allowing flexibility for both parties. When considering the New Mexico Leaseback Provision in Sales Agreement, it is vital to clearly outline this right to avoid future disputes. US Legal Forms offers templates that can help you draft effective agreements.

A capital lease and a sale-leaseback are not the same. In a capital lease, the lessee obtains ownership benefits through long-term use, while in a sale-leaseback, the seller leases back the asset after selling it. Understanding the distinction can help you better navigate the complexities of the New Mexico Leaseback Provision in Sales Agreement. For tailored guidance, consider using US Legal Forms to access the necessary documentation.

For tax purposes, sale-leaseback transactions are generally treated as separate occurrences. The New Mexico Leaseback Provision in Sales Agreement outlines tax implications on both the sale and the lease. The seller may enjoy tax benefits through depreciation and interest deductions on the lease. Understanding these tax treatments can assist you in making informed financial decisions and maximizing benefits.

To execute a leaseback, begin by identifying the asset you want to sell and the right buyer for the transaction. The New Mexico Leaseback Provision in Sales Agreement will guide you in constructing the terms of the leaseback arrangement following the sale. Once the sale is completed, finalize the lease terms, which will dictate how you maintain usage of the asset. This strategic move can help enhance your financial flexibility.

A leaseback provision is a contractual agreement that grants one party the right to lease back property that they have sold to another party. In the context of the New Mexico Leaseback Provision in Sales Agreement, it details the terms under which the original owner can continue to utilize the property post-sale. This provision is beneficial for maintaining operational efficiency while freeing up capital. Understanding leaseback terms is essential for maximizing benefits.

The 842 and 840 lease accounting standards refer to different approaches in accounting for sale-leaseback transactions. The New Mexico Leaseback Provision in Sales Agreement often requires specific disclosures and treatments under these standards. In 840, the leaseback may be recorded as an operating lease, while 842 introduces a more comprehensive framework that often leads to capital lease classifications. Understanding these differences is crucial for proper compliance.

The two major types of leases are operating leases and finance leases. Operating leases are often used for short-term leases, allowing easier asset management. In contrast, finance leases are typically long-term agreements, making them ideal for businesses investing in significant assets with steady use, especially relevant under the New Mexico Leaseback Provision in Sales Agreement.

The two types of sale and leaseback leases are operating leases and capital leases. An operating lease typically offers more flexibility and lower short-term costs, while a capital lease can provide long-term benefits depending on the contract terms. Understanding these options is essential when considering the New Mexico Leaseback Provision in Sales Agreement.