New Mexico Multistate Promissory Note - Secured

Description

How to fill out Multistate Promissory Note - Secured?

Are you presently in a role where you require documents for both business or personal purposes nearly every day.

There are numerous authentic document templates available online, but finding reliable ones isn’t straightforward.

US Legal Forms provides a wide array of form templates, such as the New Mexico Multistate Promissory Note - Secured, which can be tailored to meet federal and state criteria.

Utilize US Legal Forms, the most extensive collection of legitimate documents, to save time and avoid mistakes.

The service offers professionally crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms site and have your account, just Log In.

- After that, you can download the New Mexico Multistate Promissory Note - Secured template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it corresponds to the appropriate city/state.

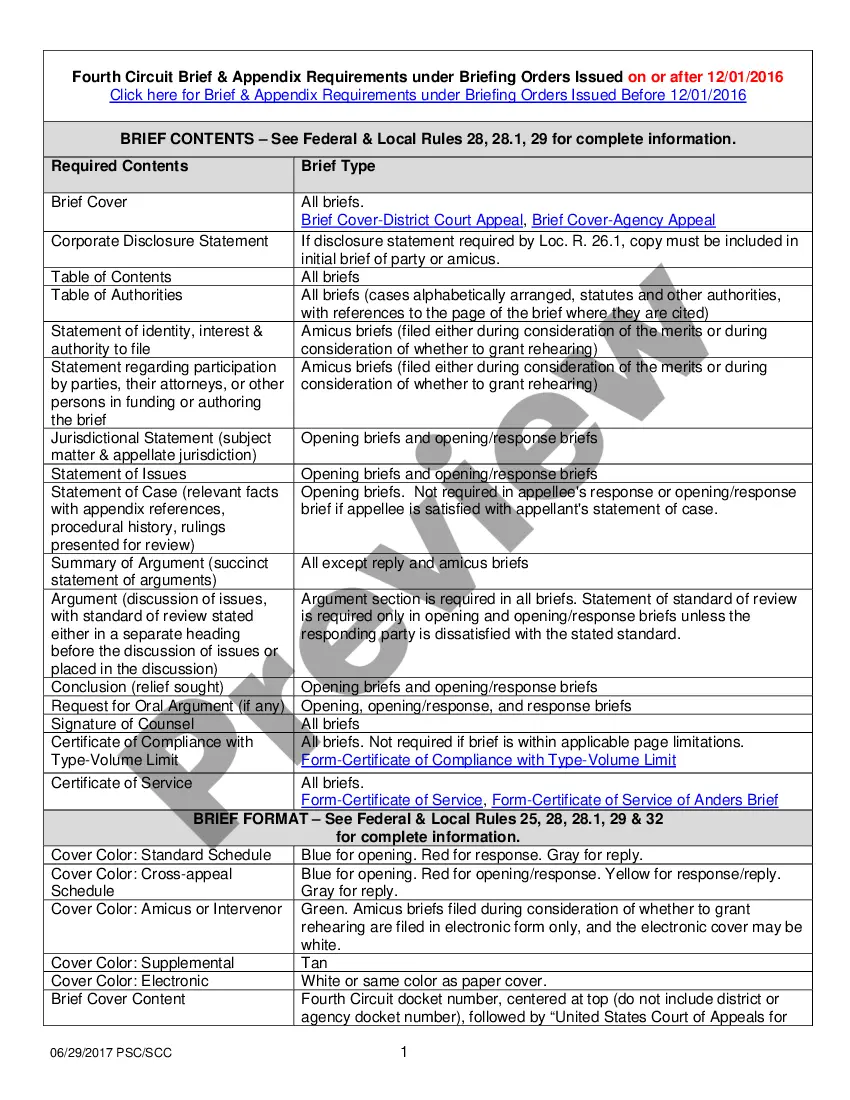

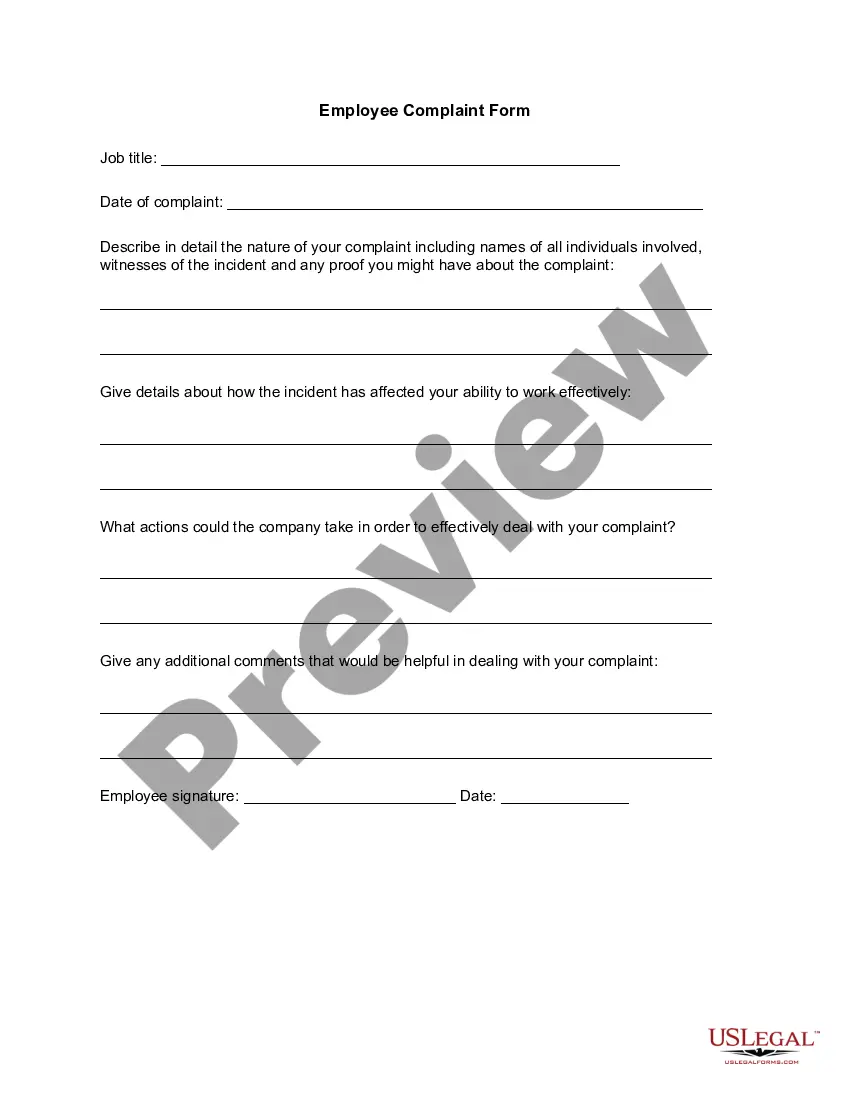

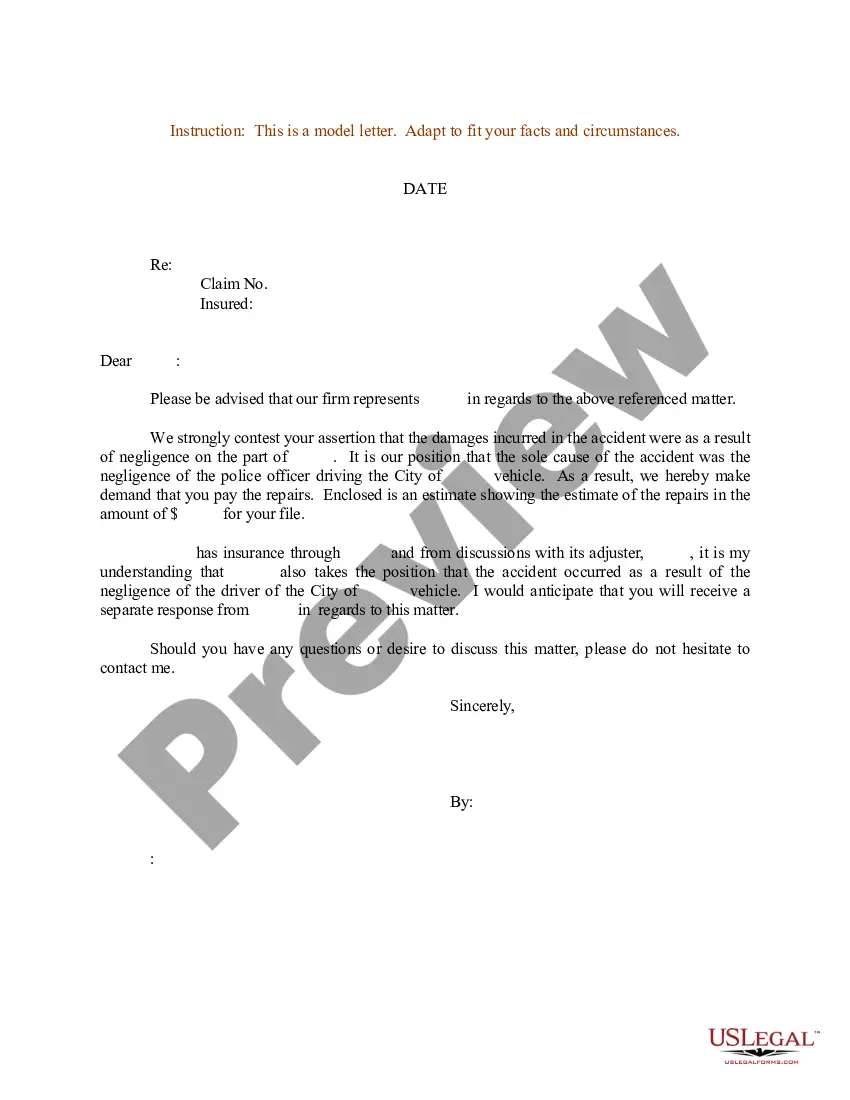

- Use the Review feature to evaluate the document.

- Check the description to confirm that you have chosen the correct form.

- If the form isn’t what you are looking for, utilize the Search field to find the form that meets your needs and requirements.

- Once you locate the right form, click Purchase now.

- Select the payment plan you desire, enter the required information to create your account, and pay for your order using your PayPal or credit card.

- Choose a suitable file format and download your copy.

- Review all the document templates you have acquired in the My documents section.

- You can obtain an additional copy of the New Mexico Multistate Promissory Note - Secured at any time, if needed. Just click the required form to download or print the document template.

Form popularity

FAQ

A secured convertible promissory note is a form of debt that gives the lender the right to convert the note into equity under specific conditions. This type of note combines elements of security with potential ownership benefits, appealing to both parties involved. The New Mexico Multistate Promissory Note - Secured can be tailored to include such features, providing flexibility and security in financial agreements.

An unsecured promissory note is typically not classified as a security under U.S. law. Unsecured notes do not involve collateral, making them personal rather than investment agreements. Opting for a New Mexico Multistate Promissory Note - Secured provides added security, specifying collateral and making the document stronger and more reliable.

Generally speaking, most promissory notes are not classified as securities. They are structured as personal agreements rather than investment instruments. The New Mexico Multistate Promissory Note - Secured emphasizes this distinction, providing a legal framework for personal loans without the compliance demands tied to securities.

Yes, a promissory note is a legally binding document once correctly executed. For it to be enforceable, both parties must agree to the terms, which are clearly outlined in the note. A New Mexico Multistate Promissory Note - Secured ensures compliance with legal standards, making it a reliable instrument in lending.

Absolutely, a promissory note can be secured by collateral. This type of note, often called a secured promissory note, offers protection to the lender. In a New Mexico Multistate Promissory Note - Secured, the presence of collateral gives the lender more confidence in the lending arrangement.

While promissory notes provide clear terms, they also have some drawbacks. For example, if the borrower defaults, collection can be challenging, especially if no collateral backs the note. Furthermore, a New Mexico Multistate Promissory Note - Secured might require more paperwork and legal compliance, potentially complicating the process.

Promissory notes can indeed be backed by collateral, known as secured notes. In a New Mexico Multistate Promissory Note - Secured, collateral provides an added layer of security for the lender. This means that if the borrower defaults, the lender has rights to the collateral, thus reducing risk.

Yes, there is a common format for a promissory note. Typically, it includes the names of the parties involved, the principal amount, interest rate, payment schedule, and terms of repayment. For a New Mexico Multistate Promissory Note - Secured, it’s crucial to follow state-specific regulations. This ensures the note is compliant and enforceable.

The primary difference between a promissory note and a demand promissory note lies in repayment terms. A promissory note specifies a set repayment schedule, while a demand promissory note allows lenders to request repayment at any moment. For those seeking stability, considering a New Mexico Multistate Promissory Note - Secured might be advantageous.

To convert a promissory note into a security, you must complete a few important steps. First, ensure the note meets the necessary legal requirements for securities under state and federal law. Then, you may need to register it or prepare an offering statement, depending on how you intend to sell it. Using a New Mexico Multistate Promissory Note - Secured can simplify this process.