New Mexico Terminate S Corporation Status - Resolution Form - Corporate Resolutions

Description

How to fill out Terminate S Corporation Status - Resolution Form - Corporate Resolutions?

Selecting the appropriate legal document template can be a challenge.

Certainly, there are numerous templates accessible online, but how do you obtain the correct document you need.

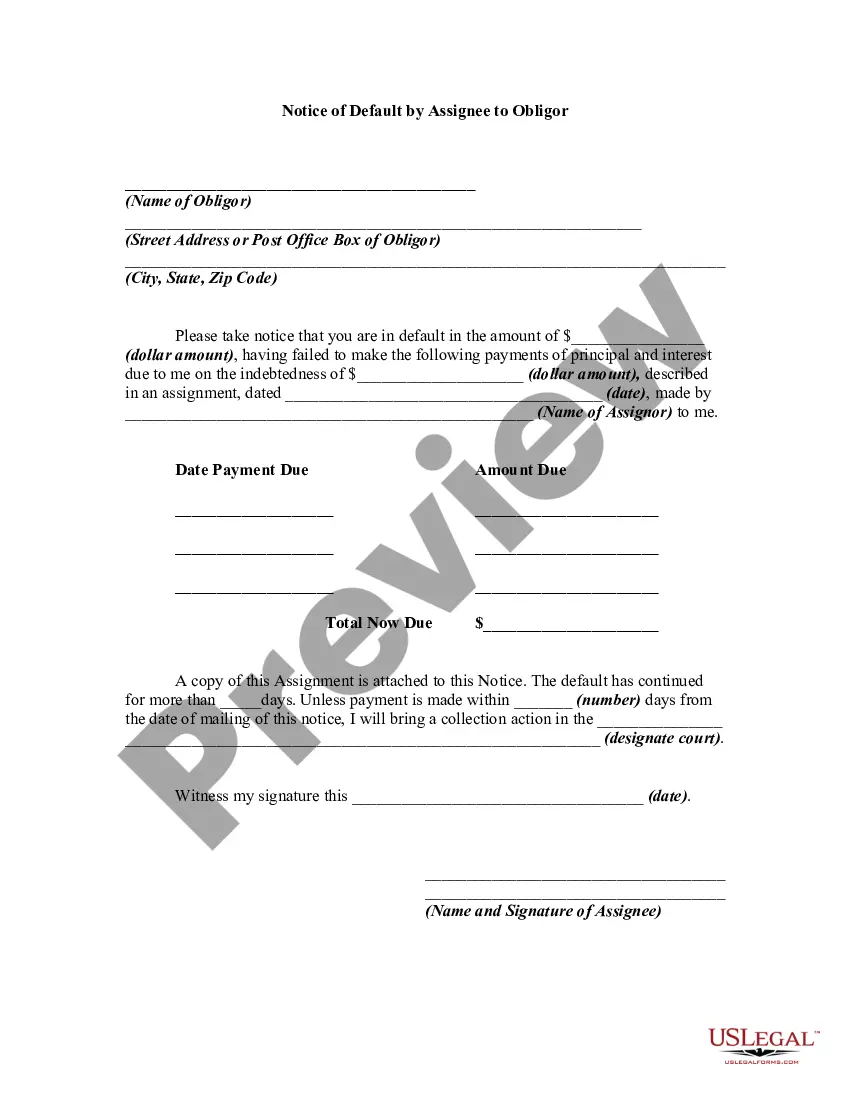

Utilize the US Legal Forms website. The platform offers a wide array of templates, including the New Mexico Terminate S Corporation Status - Resolution Form - Corporate Resolutions, suitable for business and personal purposes.

You can review the form using the Preview option and read the form description to verify it is the right choice for you.

- All documents are vetted by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Acquire option to locate the New Mexico Terminate S Corporation Status - Resolution Form - Corporate Resolutions.

- Use your account to review the legal templates you have purchased previously.

- Go to the My documents section of your account for another copy of the document you need.

- If you’re a new user of US Legal Forms, here are some straightforward steps to follow.

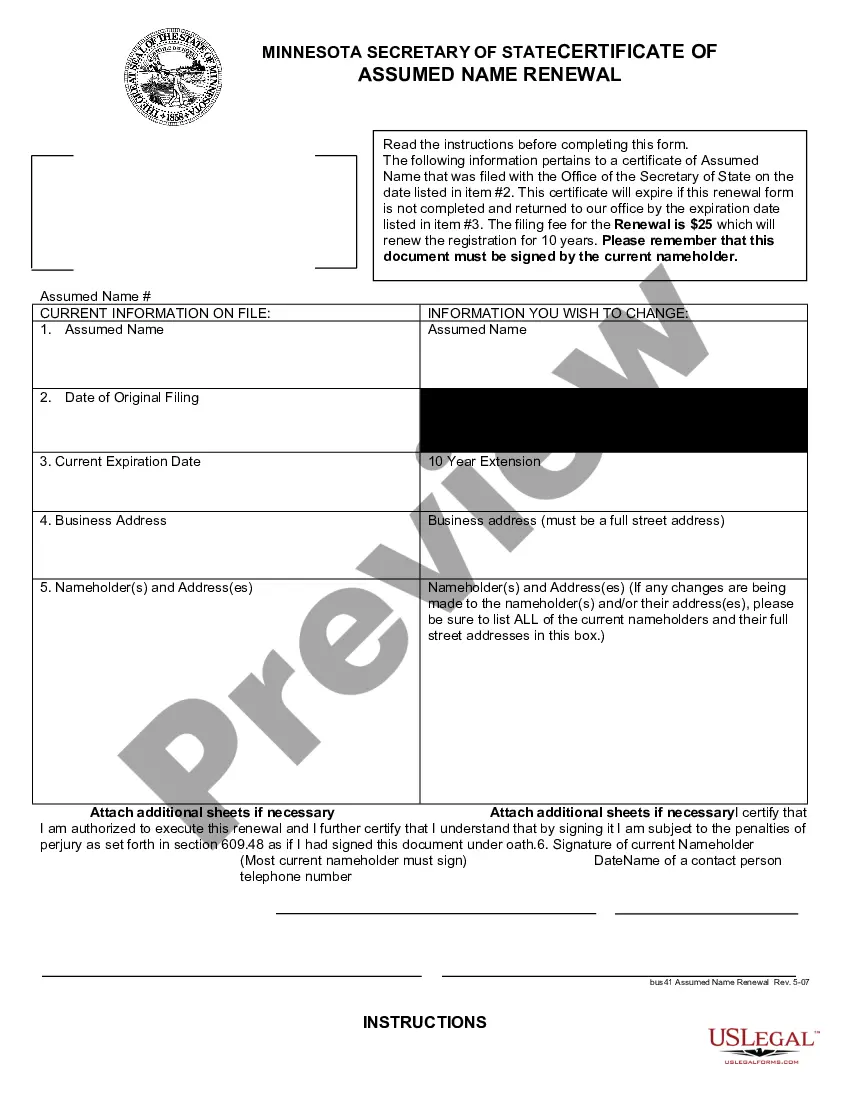

- First, ensure you have selected the correct form for your locality.

Form popularity

FAQ

To revoke a Subchapter S election/small business election that was made on Form 2553, submit a statement of revocation to the service center where you file your annual return. The statement should state: The corporation revokes the election made under Section 1362(a)

To revoke a Subchapter S election/small business election that was made on Form 2553, submit a statement of revocation to the service center where you file your annual return. The statement should state: The corporation revokes the election made under Section 1362(a)

They are only required when the board of directors makes a significant business decision. A corporate resolution creates a paper trail of an important decision in case it ever needs to be reviewed by shareholders, officers, or the IRS.

If business owners want to revoke the S Corp election retroactively to the first day of their tax year, they must submit their statement by the 16th day of the third month of the tax year.

In fact, all states require C-corporations and S-corporations to issue corporate resolutions to document important board of director decisions. Resolutions are required even if you're the sole shareholder of your corporation and the only member of the board.

An S corporation election may be terminated involuntarily if the entity ceases to qualify as a small business corporation or its passive income exceeds the passive income limitation. An S corporation ceases to qualify as an S corporation if it does not meet the criteria in Sec.

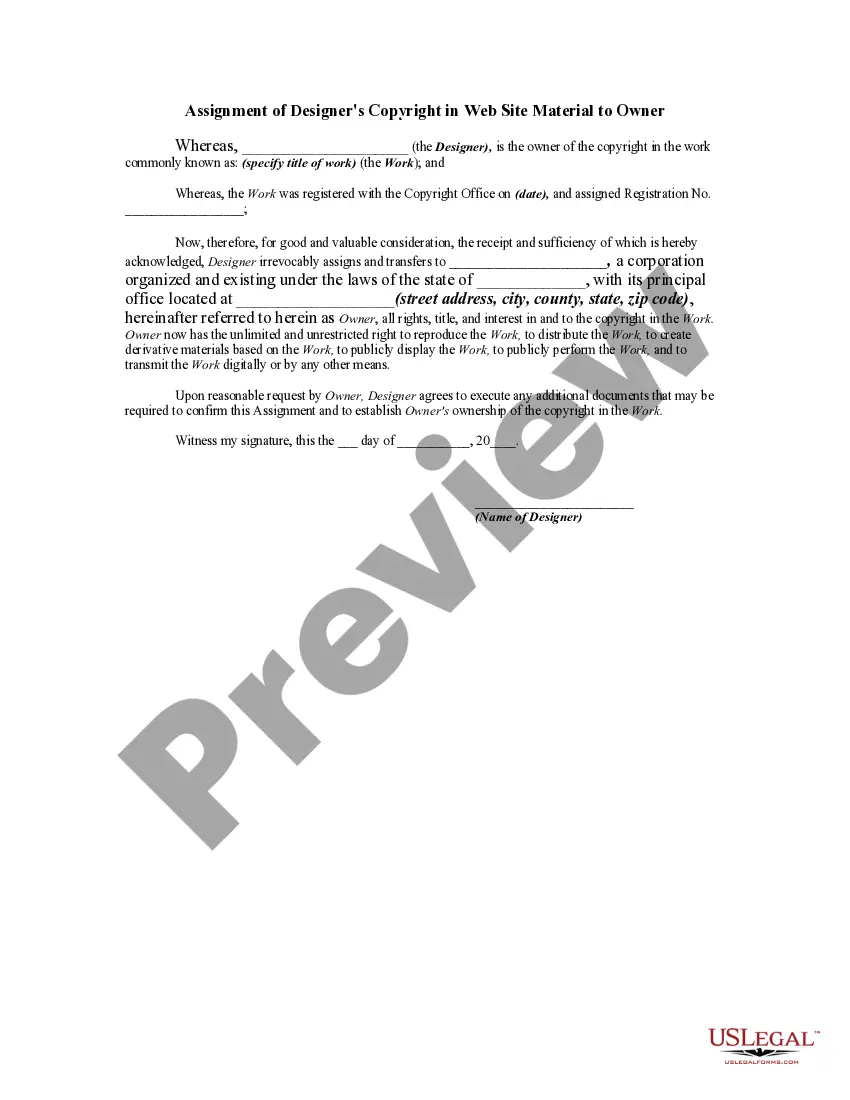

A corporate resolution is a document that formally records the important binding decisions into which a company enters. These decisions are made by such stakeholders as the corporation's managers, directors, officers or owners.

Other common actions that are likely to need a corporate resolution include the following: Purchase of real estate. Applying for loans or credit. The issuance of debt to raise capital or money, such as corporate bonds.

Inadvertent Termination of the S Election An entity will cease being a small business corporation if at any time it issues a second class of stock, acquires more than 100 shareholders, or has an ineligible shareholder.

Resolutions are important for companies in that they aid the process of making decisions. However, it should be noted that board resolutions are not required by law and are less powerful than bylaws, which take precedence if any conflict occurs between the two.