New Mexico Personal Property Inventory

Description

How to fill out Personal Property Inventory?

If you wish to acquire, download, or print official form templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Utilize the site’s user-friendly and efficient search tool to locate the documents you require.

Various templates for business and personal applications are categorized by type and state, or keywords.

Step 4. Once you have identified the form you need, select the Purchase now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to find the New Mexico Personal Property Inventory with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to access the New Mexico Personal Property Inventory.

- You can also retrieve forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

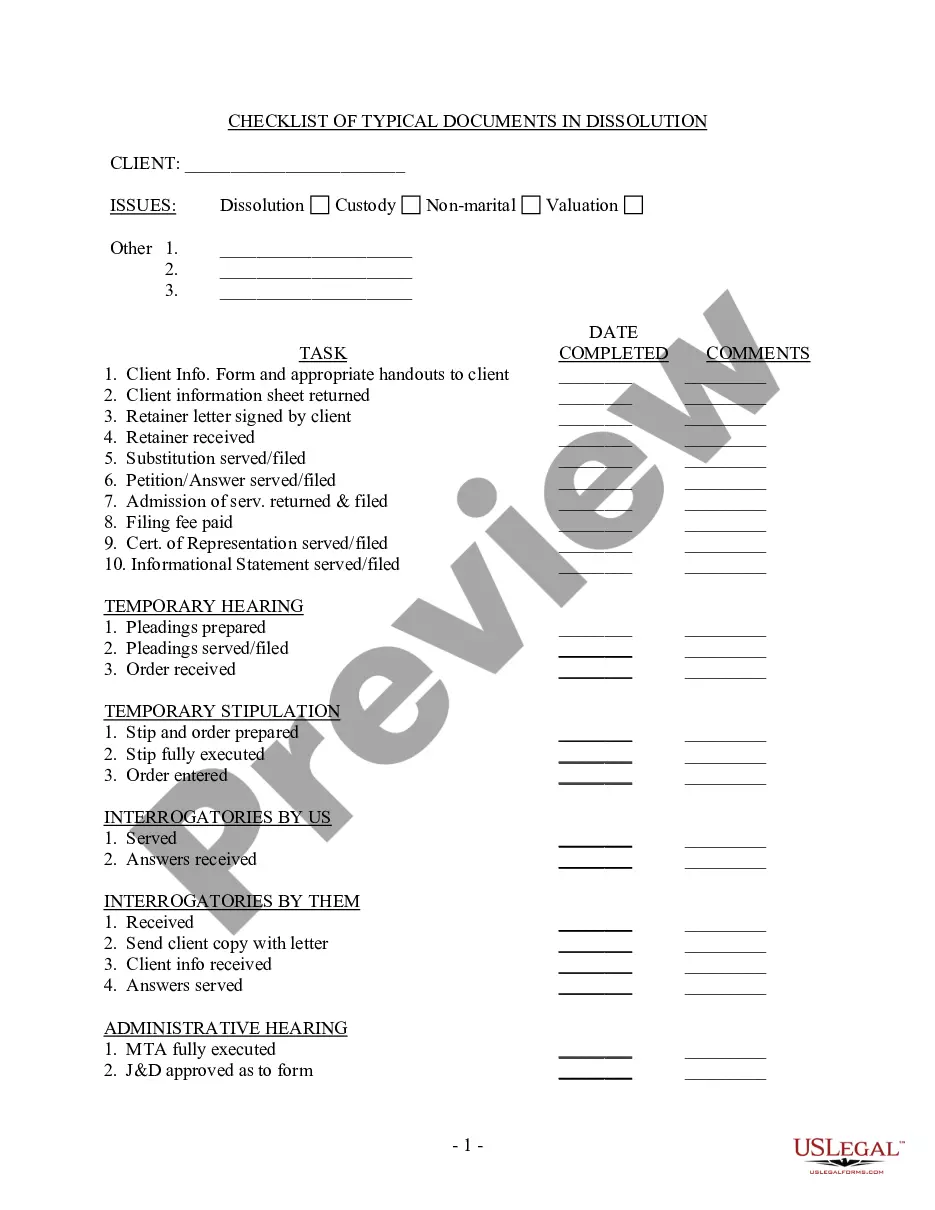

- Step 2. Use the Preview option to review the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Certain groups are exempt from paying property taxes in New Mexico, including seniors over 65, veterans with disabilities, and some categories of low-income homeowners. By maintaining an accurate New Mexico Personal Property Inventory, you can ensure you apply for any available exemptions. Check with the local tax authority to see if you qualify. US Legal Forms can assist you in navigating the paperwork required for these exemptions.

You can enter your personal property tax in the local assessor’s office in New Mexico. This office evaluates your New Mexico Personal Property Inventory and determines its taxable value. Additionally, you may have online options to submit this information more efficiently. Using resources from US Legal Forms can guide you through the process, making it easier.

In New Mexico, property tax exemption for seniors typically begins when individuals turn 65. However, seniors must meet certain income requirements to qualify for property tax benefits related to their New Mexico Personal Property Inventory. It's essential to stay informed about these regulations, as they may change. Always consult with a tax professional to understand your specific situation.

In New Mexico, tangible personal property encompasses items that have physical form and can be owned or used by individuals and businesses. This includes everything from furniture and electronics to machinery and equipment. Keeping a detailed record of your tangible personal property is crucial for tax purposes, insurance claims, and estate planning. A well-organized New Mexico Personal Property Inventory offers a beneficial tool for tracking your possessions effectively.

A tangible personal property example would be a computer, which you can physically touch and use. Other examples include jewelry, vehicles, and household appliances—all items that contribute to your overall wealth and may require documentation for insurance or tax purposes. When curating your New Mexico Personal Property Inventory, be sure to include all physical items you own. This practice will provide valuable insights into your assets.

Several states do impose personal property tax on inventory, including New Mexico, which requires businesses to report their tangible assets. This tax varies by state and often applies to items such as goods held for sale and machinery. It's crucial for business owners to stay informed about state-specific regulations to ensure compliance. A comprehensive New Mexico Personal Property Inventory will help you fulfill these reporting requirements accurately.

Examples of tangible personal property include furniture, vehicles, and equipment. These items can be physically touched and moved, making them distinct from intangible assets like patents or trademarks. As you compile your New Mexico Personal Property Inventory, include all your tangible assets to ensure accurate assessment for insurance or tax purposes. By keeping a complete list, you gain a clearer picture of your wealth and obligations.

In New Mexico, seniors aged 65 and older can qualify for a property tax exemption that allows them to reduce their property taxes. This exemption can significantly benefit seniors on fixed incomes. However, it's essential to verify whether you meet the specific eligibility criteria to ensure you take advantage of this financial relief. Keep your New Mexico Personal Property Inventory handy, as it may be necessary when filing for the exemption.

Tangible personal property refers to physical items that can be touched or moved. However, intangible assets, such as stocks, bonds, and intellectual property, do not fall under this category. Understanding what constitutes tangible personal property is vital when managing your New Mexico Personal Property Inventory. This distinction helps you accurately assess what needs to be documented and insured.

Yes, inventory does count as property under both state and federal laws. This means it is subject to property tax in many jurisdictions, including New Mexico. By maintaining a New Mexico Personal Property Inventory, you can clearly establish what constitutes your property and ensure accurate tax reporting. This clarity can greatly simplify your financial management and tax compliance processes.