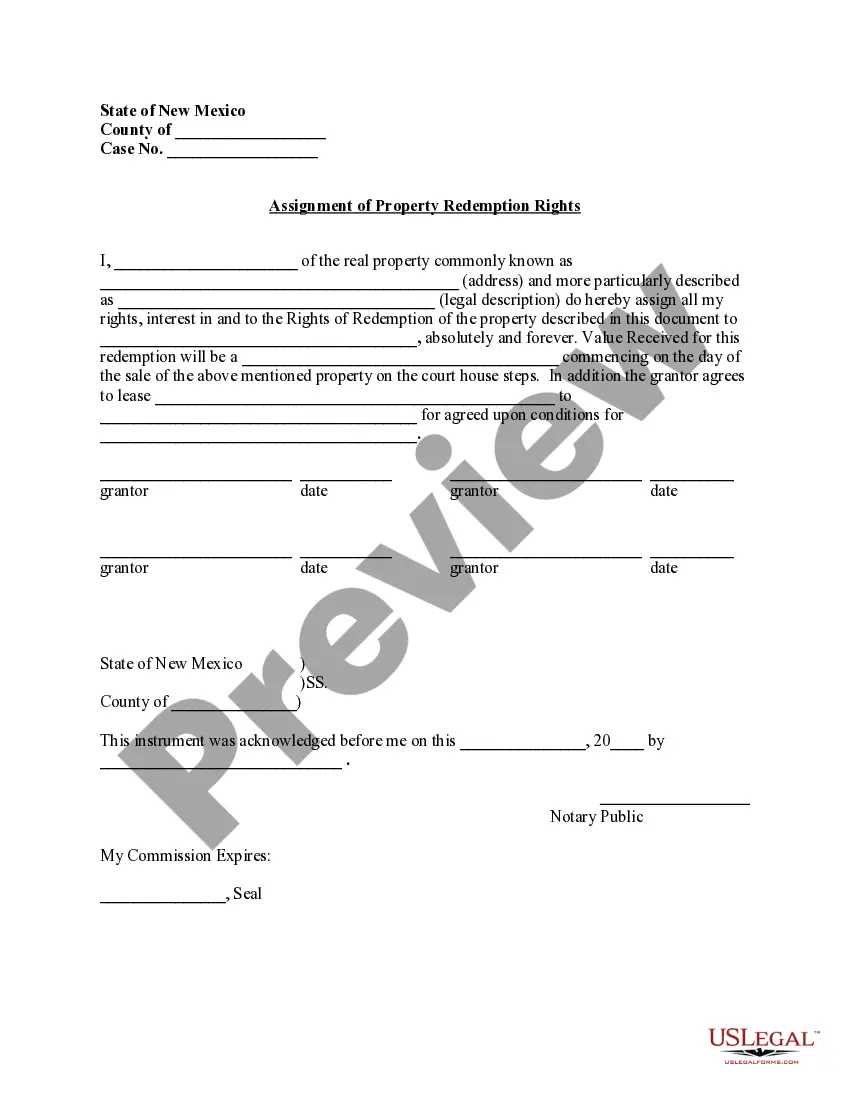

New Mexico Assignment of Property Redemption Rights

Description

How to fill out New Mexico Assignment Of Property Redemption Rights?

US Legal Forms is really a unique platform to find any legal or tax document for filling out, including New Mexico Assignment of Property Redemption Rights. If you’re tired of wasting time searching for perfect examples and paying money on document preparation/lawyer fees, then US Legal Forms is precisely what you’re trying to find.

To enjoy all of the service’s benefits, you don't need to download any application but just choose a subscription plan and create an account. If you already have one, just log in and find the right template, download it, and fill it out. Saved documents are saved in the My Forms folder.

If you don't have a subscription but need to have New Mexico Assignment of Property Redemption Rights, check out the guidelines below:

- check out the form you’re looking at applies in the state you want it in.

- Preview the example and read its description.

- Click Buy Now to get to the register page.

- Pick a pricing plan and carry on registering by entering some info.

- Select a payment method to finish the sign up.

- Download the document by choosing the preferred format (.docx or .pdf)

Now, fill out the document online or print it. If you feel unsure about your New Mexico Assignment of Property Redemption Rights form, contact a lawyer to analyze it before you send out or file it. Start without hassles!

Form popularity

FAQ

State Statutory Redemption Laws The redemption period in states that allow it ranges from just 30 days to as high as two years. Many states reduce the redemption period if the property has been abandoned, while borrowers may waive their redemption rights in many states.

Even if the property is sold before the redemption period expires, the homeowner still has an opportunity to reclaim the property. However, if they can't raise enough funds to reclaim ownership of the property, they can sell the redemption rights to the buyer at a price that they can both agree on.

Learn about the right of redemption. A "redemption period" is a specific amount of time given to borrowers in foreclosure during which they can pay to redeem their property.pay off the total debt, including the principal balance, plus costs and interest, before the sale to stop the foreclosure, or.

The "right of redemption" is the right of a homeowner to either: stop a foreclosure sale from taking place by paying off the mortgage debt or. repurchase the property after a foreclosure sale by paying a specific sum of money within a limited period of time.

Statutory right of redemption allows the borrower to pay the debt and reclaim the property for a statutory period which may go beyond the completion of the sale (up to a year, in some states).

Statutory redemption laws work if the winning bidder at the foreclosure sale bids a fair price for the home; otherwise, the former owner may not be able to redeem the property.The former homeowner also can opt to waive the right of redemption after the foreclosure sale.

Right of redemption is a legal process that allows a delinquent mortgage borrower to reclaim their home or other property subject to foreclosure if they are able to repay their obligations in time.

Yes you can waive your right to redemption. Mortgage companies often will pay you for a waiver of your redemption rights in certain circumstances.