New Jersey Irrevocable Power of Attorney for Transfer of Stock by Executor

Description

How to fill out Irrevocable Power Of Attorney For Transfer Of Stock By Executor?

If you wish to accumulate, acquire, or print legal document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Employ the site’s straightforward and efficient search tool to obtain the documents you require.

Various templates for business and personal reasons are categorized by types and keywords, or search terms.

Step 4. Once you have found the form you need, click on the Acquire now button. Choose your preferred pricing plan and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to procure the New Jersey Irrevocable Power of Attorney for Transfer of Stock by Executor in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and then click the Acquire option to locate the New Jersey Irrevocable Power of Attorney for Transfer of Stock by Executor.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

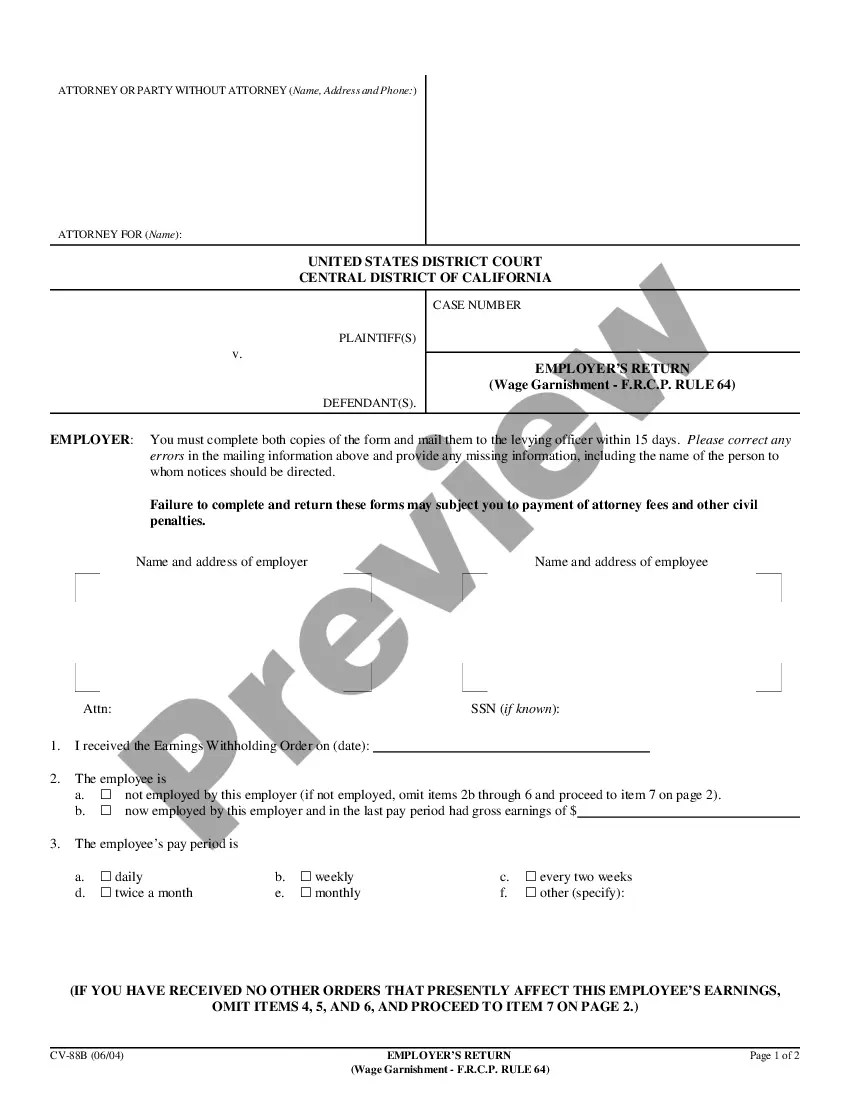

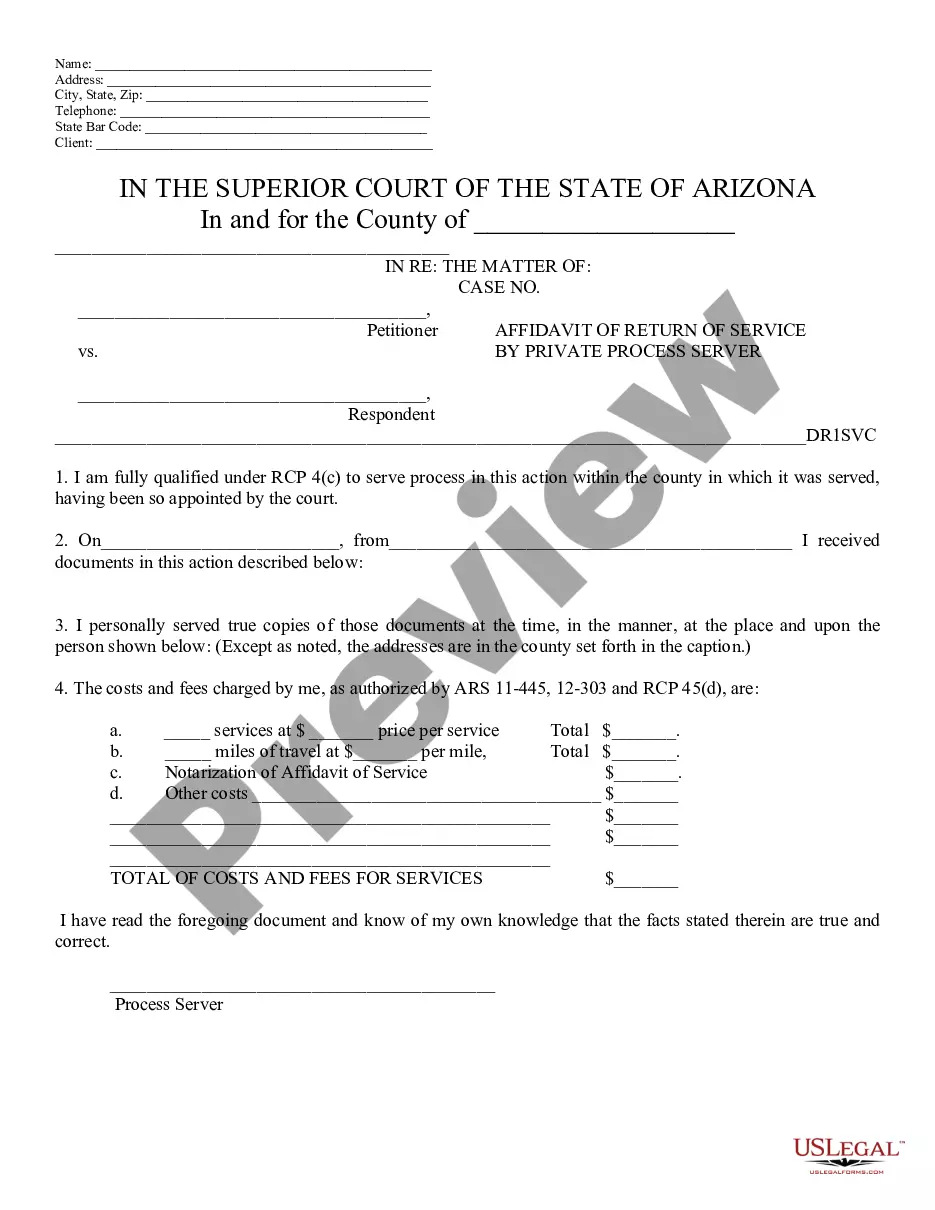

- Step 2. Use the Review option to examine the form’s content.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other types of legal document templates.

Form popularity

FAQ

Transferring stock ownership after death involves several steps, starting with locating the deceased's will or trust. The executor can then use the New Jersey Irrevocable Power of Attorney for Transfer of Stock by Executor to initiate the transfer process. This document allows the executor to act on behalf of the deceased, ensuring a smooth transition of ownership. If you need assistance, US Legal Forms offers the necessary templates to guide you through this transfer.

When the owner of stocks passes away, the ownership does not simply disappear. Instead, stocks are transferred to the deceased's estate and handled according to their will or state laws. The New Jersey Irrevocable Power of Attorney for Transfer of Stock by Executor can facilitate this transfer, allowing the executor to manage and sell the stocks as needed. Understanding this process is crucial, and resources like US Legal Forms can help you navigate it effectively.

To sell shares owned by a deceased individual, you must first obtain the New Jersey Irrevocable Power of Attorney for Transfer of Stock by Executor. This document allows the executor to manage the deceased's financial affairs, including selling shares. You will need to provide proof of death, such as a death certificate, and present the power of attorney to the brokerage firm holding the stocks. Using a reliable platform like US Legal Forms can simplify the process by providing the necessary legal documents.

Transferring a power of attorney in New Jersey requires you to revoke the existing power of attorney and create a new document. You should provide notice to the current agent and any relevant parties about the revocation. For situations involving the New Jersey Irrevocable Power of Attorney for Transfer of Stock by Executor, it's vital to consult with legal professionals or use reliable resources like US Legal Forms to ensure the transfer process is completed correctly and legally.

To obtain a power of attorney in New Jersey, you must complete a power of attorney form that meets state requirements. You can either create a custom document or use a template, such as those provided by US Legal Forms. It's essential to ensure the document clearly states the powers being granted, especially if you are focusing on the New Jersey Irrevocable Power of Attorney for Transfer of Stock by Executor. After completing the form, sign it in the presence of a notary public to make it legally binding.

A Power of Attorney (POA) in New Jersey cannot perform certain actions outside its defined authority, such as making or changing a will or acting in a manner that violates the principal's wishes. Additionally, a POA cannot make decisions about healthcare if such powers are not explicitly granted. When dealing with stock transfers, utilizing a New Jersey Irrevocable Power of Attorney for Transfer of Stock by Executor ensures clarity in authority and limitations. To help navigate these complexities, US Legal Forms offers valuable templates and information.

The irrevocable trust law in New Jersey allows individuals to create trusts that cannot be altered or revoked once established. This law ensures that the assets placed in the trust are protected from creditors and are managed according to the terms set by the trust creator. When considering setting up an irrevocable trust, one should explore the benefits of a New Jersey Irrevocable Power of Attorney for Transfer of Stock by Executor, as it can facilitate the smooth transfer of stocks within the trust framework. For more information and guidance, consider using the resources available at US Legal Forms.