New Jersey Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

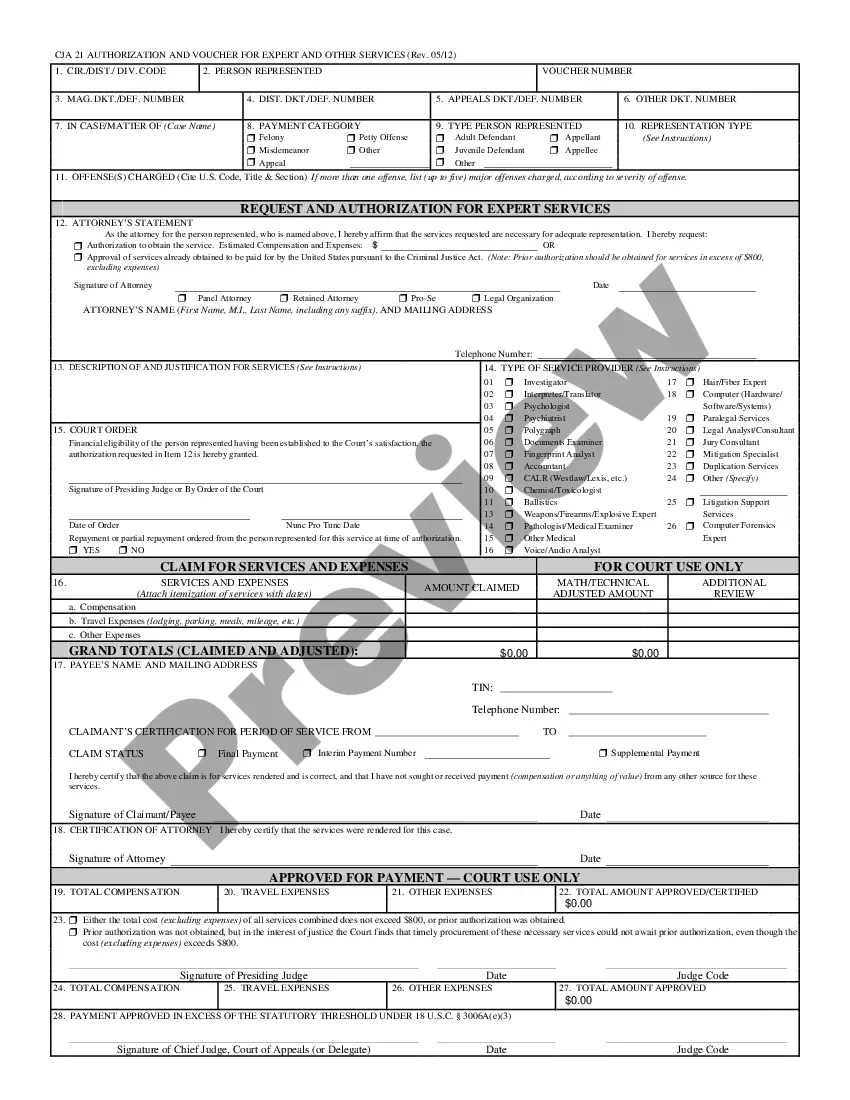

How to fill out Stipulation Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

It is possible to devote time on the web attempting to find the lawful file template that fits the state and federal requirements you need. US Legal Forms gives 1000s of lawful kinds which can be reviewed by specialists. You can easily acquire or print out the New Jersey Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease from the assistance.

If you already have a US Legal Forms profile, you are able to log in and click on the Download option. Afterward, you are able to full, modify, print out, or indication the New Jersey Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease. Every lawful file template you get is yours for a long time. To have an additional version for any acquired form, visit the My Forms tab and click on the related option.

Should you use the US Legal Forms web site initially, keep to the straightforward recommendations below:

- Initially, ensure that you have chosen the correct file template for the area/town that you pick. Look at the form explanation to ensure you have picked the correct form. If offered, utilize the Review option to look throughout the file template as well.

- If you would like find an additional version in the form, utilize the Look for field to discover the template that meets your requirements and requirements.

- Upon having found the template you want, click Acquire now to continue.

- Pick the rates strategy you want, enter your qualifications, and sign up for a free account on US Legal Forms.

- Complete the purchase. You can use your bank card or PayPal profile to fund the lawful form.

- Pick the structure in the file and acquire it to the device.

- Make changes to the file if necessary. It is possible to full, modify and indication and print out New Jersey Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease.

Download and print out 1000s of file templates making use of the US Legal Forms Internet site, that offers the biggest variety of lawful kinds. Use specialist and condition-certain templates to deal with your company or specific requires.

Form popularity

FAQ

8/8ths / 8/8ths Basis: a term used to describe either the full Working Interest or full Net Revenue Interest with respect to a given Tract. Pursuant to an Oil and Gas Lease, the Lessor retains the Lessor Royalty.

?To pay Lessor for gas (including casinghead gas) and all other substance covered hereby, a royalty of 3/16 of the proceeds realized by Lessee from the sale thereof.? This simply means the operator will pay a royalty of 3/16 of revenue generated from production on the property.

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.

It is calculated as follows: Volume X Price ? Deductions ? Taxes X Owner Interest = Your Royalty Payment. Whether you are a mineral owner receiving royalty checks or just wanting to know what your minerals are worth, LandGate knows what they are worth and can market your minerals to get you the most money.

A clause in an oil & gas lease that allows a lessee to keep the lease in effect past the primary term by substituting payment of shut-in royalty for actual production.

1. n. [Oil and Gas Business] Ownership in a share of production, paid to an owner who does not share in the right to explore or develop a lease, or receive bonus or rental payments. It is free of the cost of production, and is deducted from the royalty interest.

8/8ths / 8/8ths Basis: a term used to describe either the full Working Interest or full Net Revenue Interest with respect to a given Tract. Pursuant to an Oil and Gas Lease, the Lessor retains the Lessor Royalty.

Overriding Royalty Interest (ORRI) A royalty in excess of the royalty provided in the Oil & Gas Lease. Usually, an override is added during an intervening assignment. ORRIs are created out of the working interest in a property and do not affect mineral owners.