This form is used to when it has been discovered that through a drafting error the (Fraction or Percentage ) interest in the mineral estate conveyed in a Deed was stated incorrectly. It is the purpose of this instrument and the intention of Grantor and Grantee to correct this error, and to accurately state the actual mineral interest intended to be conveyed by the Deed.

New Jersey Correction to Mineral Deed As to Interest Conveyed

Description

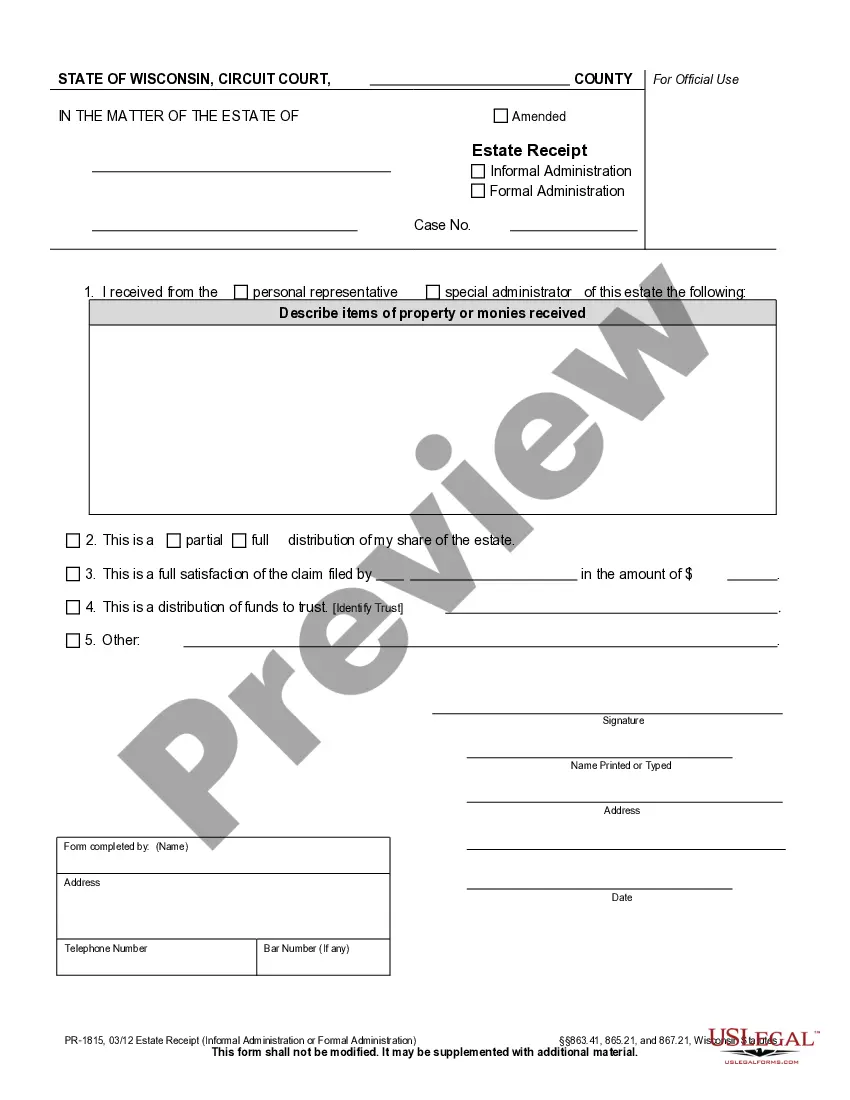

How to fill out Correction To Mineral Deed As To Interest Conveyed?

US Legal Forms - among the largest libraries of legitimate forms in America - offers a wide range of legitimate document themes you are able to down load or print out. Utilizing the site, you may get 1000s of forms for organization and person functions, sorted by types, suggests, or key phrases.You can get the most up-to-date models of forms such as the New Jersey Correction to Mineral Deed As to Interest Conveyed in seconds.

If you have a registration, log in and down load New Jersey Correction to Mineral Deed As to Interest Conveyed in the US Legal Forms collection. The Acquire button will appear on every develop you view. You get access to all formerly delivered electronically forms inside the My Forms tab of your own accounts.

If you wish to use US Legal Forms the first time, listed below are basic instructions to help you get began:

- Be sure to have picked out the best develop for your personal metropolis/area. Click the Preview button to check the form`s articles. Browse the develop explanation to actually have selected the correct develop.

- When the develop doesn`t match your demands, make use of the Lookup discipline towards the top of the monitor to obtain the one that does.

- When you are satisfied with the shape, validate your choice by clicking on the Buy now button. Then, select the pricing strategy you favor and provide your credentials to sign up for the accounts.

- Process the financial transaction. Make use of your credit card or PayPal accounts to perform the financial transaction.

- Select the structure and down load the shape on your own gadget.

- Make adjustments. Fill up, edit and print out and indication the delivered electronically New Jersey Correction to Mineral Deed As to Interest Conveyed.

Each template you included with your account does not have an expiry day and is also your own property forever. So, if you wish to down load or print out an additional version, just visit the My Forms section and click on around the develop you want.

Gain access to the New Jersey Correction to Mineral Deed As to Interest Conveyed with US Legal Forms, by far the most comprehensive collection of legitimate document themes. Use 1000s of expert and state-certain themes that meet up with your company or person demands and demands.

Form popularity

FAQ

Scrivener's Affidavits are sworn statements by the person who drafted a deed. Unlike a Corrective Deed, a Scrivener's Affidavit doesn't correct anything. Instead, it simply adds information to the property records to help clarify something about the prior deed.

A correction deed, also known as a confirmatory or corrective deed, is a legal document used to fix errors on a property title that is recorded. Property owners can use this special type of deed to amend common errors such as misspellings, incomplete names, and other missing information.

The statute contemplates three types of scrivener's errors: (1) An error or omission in no more than one of the lot or block identifications of a recorded platted lot; (2) An error or omission in no more than one of the unit, building, or phase identifications of a condominium or cooperative unit; or.

A Scrivener's Affidavit is a sworn statement written and signed by the person who originally created the deed in question. The Affidavit doesn't correct anything; rather, it adds information to the recorded deed and property information to amend, address, or clarify information on the original deed.

General warranty deed: A general warranty deed is the most common type of deed used to transfer fee simple ownership of a property. Unlike a quitclaim deed, a general warranty deed does confirm a grantor's ownership and a legal right to sell.

Expert-Verified Answer. Option (C) is correct, The grantor is not mentally capable is void a deed meant to convey property.

For Corrective or Confirmatory Deeds which need to be recorded due to typographical, clerical, property description or other scrivener error and the original deed conveyance occurred on or after August 1, 2004, a photocopy of the GIT/REP-1, -2, -3, -4 Form originally filed with the deed is required to be attached for ...

A correction deed, also known as a confirmatory or corrective deed, is a legal document used to fix errors on a property title that is recorded. Property owners can use this special type of deed to amend common errors such as misspellings, incomplete names, and other missing information.

A scrivener's affidavit is an affidavit made by a scrivener or (in more modern terms) the preparer of the deed. In layman's terms, when a deed has certain technical defects or factual inaccuracies, a scrivener's affidavit is a good way to fix those defects and inaccuracies.

How Do I Fill Out a Scrivener's Error Affidavit? The date the clerk recorded the document. The names of all people that signed the original document. The name of the person who prepared the original document and their job title.