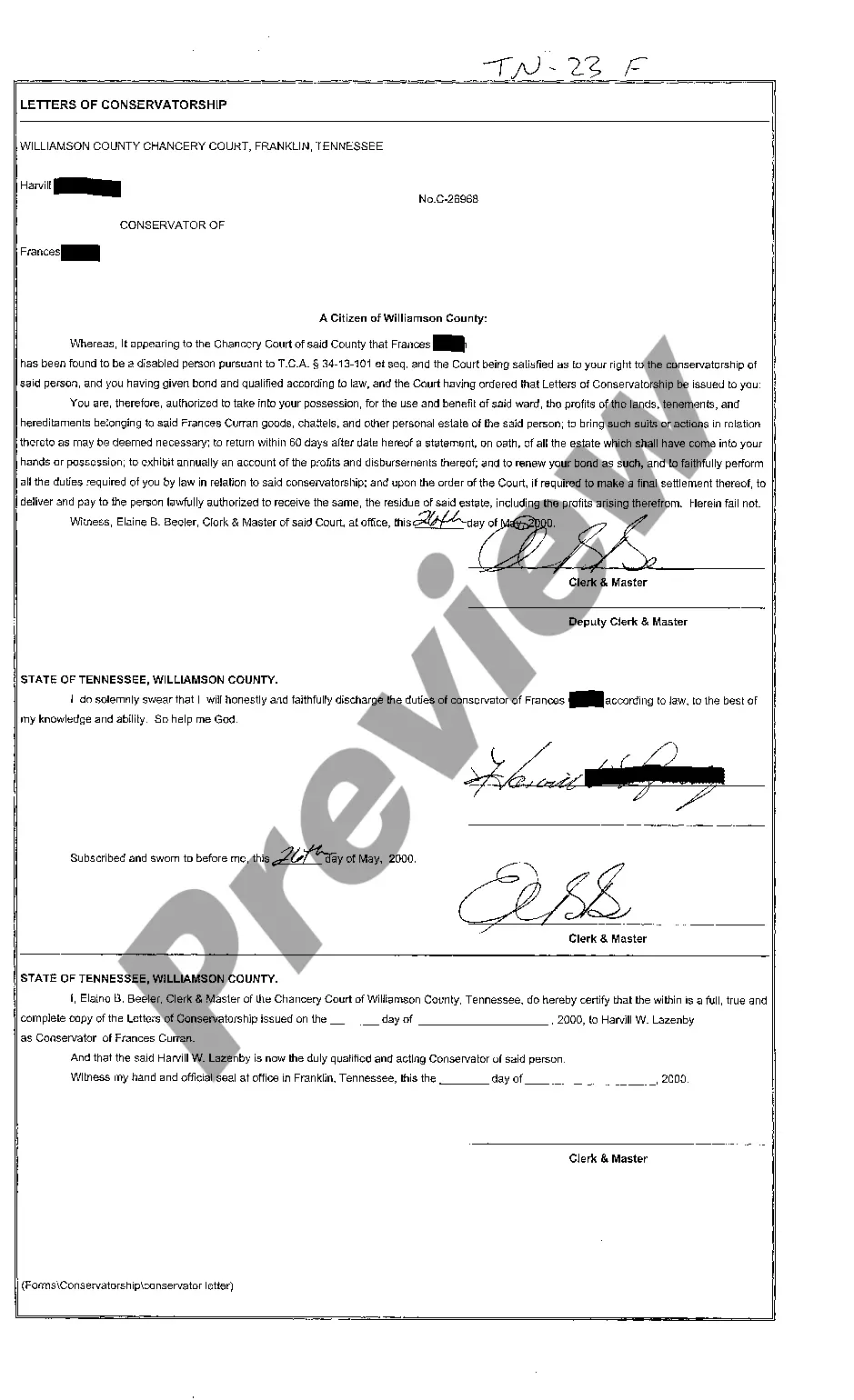

New Jersey Letter for Account Paid in Full

Description

How to fill out Letter For Account Paid In Full?

If you need to total, download, or generate authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the site’s straightforward and convenient search to find the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to locate the New Jersey Letter for Account Paid in Full in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click on the Download button to find the New Jersey Letter for Account Paid in Full. You can also access forms you have previously saved in the My documents section of your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Make sure you have selected the form for the correct state/region. Step 2. Use the Preview option to review the form’s details. Don’t forget to read the description. Step 3. If you are not satisfied with the form, utilize the Search field at the top of the page to find other versions of your legal form template. Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your credentials to register for an account. Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of your legal form and download it to your device. Step 7. Fill out, edit, and print or sign the New Jersey Letter for Account Paid in Full.

- Every legal document template you acquire is yours permanently.

- You have access to every form you saved in your account.

- Click on the My documents section and select a form to print or download again.

- Be proactive and download, and print the New Jersey Letter for Account Paid in Full with US Legal Forms.

- There are numerous professional and state-specific forms you can utilize for your business or personal needs.

Form popularity

FAQ

When you receive a New Jersey Letter for Account Paid in Full, keep it for your records. This letter serves as proof that you have settled your debt, which can be important for future financial transactions. You should store it in a safe place, as you may need it if any disputes arise later. Additionally, consider using the services of US Legal Forms to ensure you have the correct documentation and guidance for any future needs.

To send a New Jersey Letter for Account Paid in Full to credit bureaus, start by drafting the letter clearly stating that the account has been paid in full. Include specific details such as your account number, the date of payment, and any relevant confirmation numbers. Once you have the letter prepared, you can send it via certified mail to ensure it reaches the bureaus securely. Additionally, consider using the services of US Legal Forms to create a professional letter template that meets all legal standards.

A debt settlement letter is a written proposal for you to offer a specific amount of money in exchange for forgiveness of your debt. These letters address why you're unable to pay the debt, how much you're willing to pay now, and what you would like from the creditors in return.

Pay for delete is when a borrower agrees to pay off their collections account in exchange for the debt collector erasing the account from their credit report. Accounts that are sent to collections typically stay on a consumer's credit report for seven years from the date of first delinquency.

Statute of Limitations in New Jersey The statute of limitations on credit card debt and most other debt in New Jersey is six years (it's four years for auto loans). That means that the debt collector has that amount of time to file a lawsuit.

How to Write a Collection LetterKeep it short and to the point; do not use complicated language.Type the letter; do not handwrite it.Use company letterhead.Include a copy of the invoice(s) or a summarized statement if multiple outstanding invoices.More items...?

A pay for delete letter is a negotiation tool to have negative information removed from your credit report. It's most commonly used when a person still owes a balance on a negative account. Essentially, it's a way to ask to remove the negative information in exchange for paying the balance.

A debt collection letter should include the following information:The amount the debtor owes you.The initial due date of the payment.A new due date for the payment, whether ASAP or longer.Instructions on how to pay the debt.More items...?

This letter should include a statement that you fully paid your debt, that you want written acknowledgment from the collection agency, and that they should not take any further action against you. Keep a copy in your records with any other documents associated with the account in case the collector persists.

How to Write a Paid-in-Full LetterWrite the date on the top of the page.Next, include your personal contact details: your name, address, and phone number.Write the creditor or debt collection agency's contact details next.Write the heading of the letter.Write an introduction.Write the body of the letter.More items...?