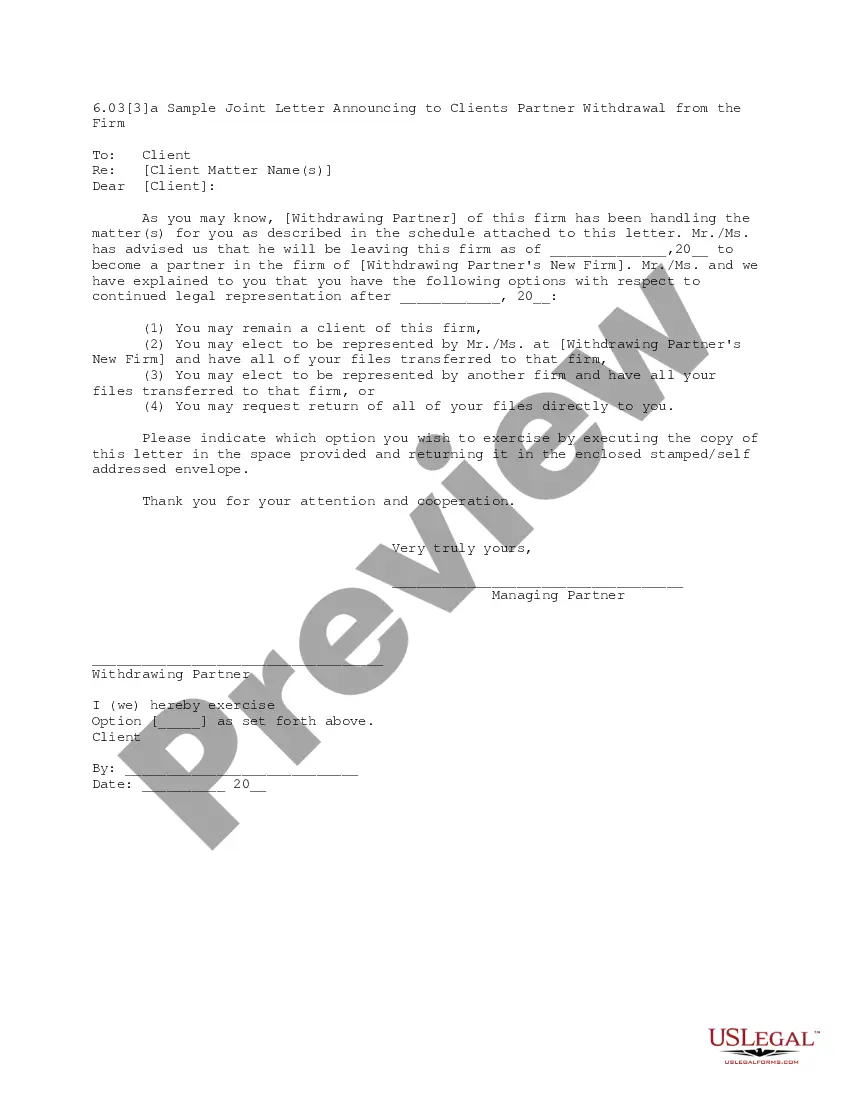

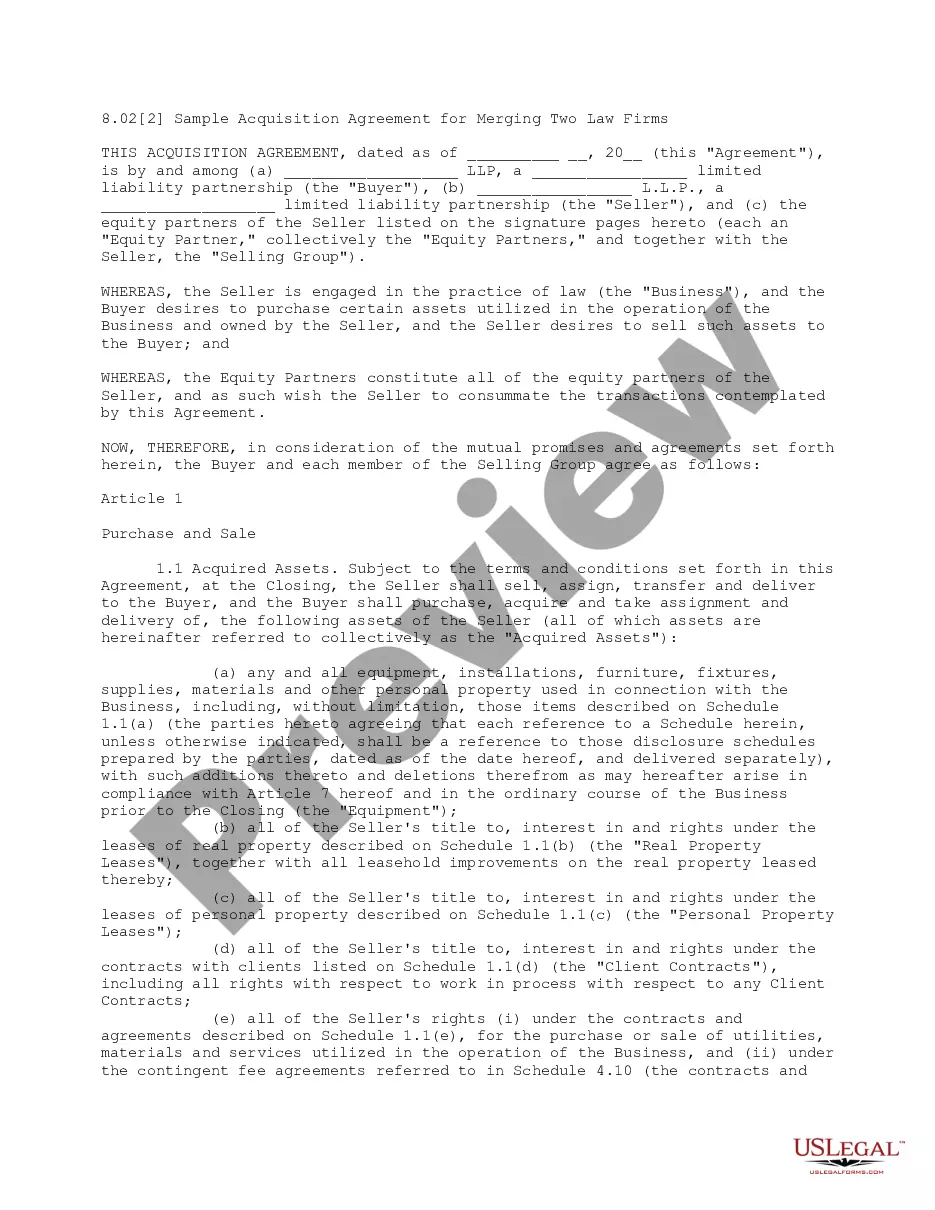

This Plan of Dissolution of a Law Firm covers covers all necessary topics for the dissolution of the firm. Included are: Plan of dissolution, liquidation objectives, surrender of leasehold estates, estimated balance sheet items, termination of personnel, accounts receivable billing and collecting, cash management, professional liability, and indemnity issues.

New Jersey Dissolving a Law Firm

Description

How to fill out Dissolving A Law Firm?

Are you currently in the placement that you will need documents for either company or specific uses just about every day time? There are tons of authorized papers web templates available on the Internet, but finding types you can rely isn`t effortless. US Legal Forms delivers thousands of develop web templates, just like the New Jersey Dissolving a Law Firm, which can be composed to fulfill federal and state specifications.

In case you are currently familiar with US Legal Forms internet site and get an account, just log in. Following that, you can obtain the New Jersey Dissolving a Law Firm design.

If you do not provide an accounts and need to start using US Legal Forms, abide by these steps:

- Get the develop you want and ensure it is to the proper area/state.

- Utilize the Review option to examine the form.

- See the outline to actually have selected the right develop.

- When the develop isn`t what you are trying to find, utilize the Research discipline to discover the develop that suits you and specifications.

- Whenever you discover the proper develop, click Purchase now.

- Choose the rates strategy you want, complete the required information to create your money, and buy your order utilizing your PayPal or Visa or Mastercard.

- Choose a convenient file file format and obtain your version.

Get all of the papers web templates you may have bought in the My Forms menus. You may get a more version of New Jersey Dissolving a Law Firm at any time, if necessary. Just click the needed develop to obtain or print the papers design.

Use US Legal Forms, the most substantial selection of authorized forms, to save time and prevent blunders. The assistance delivers expertly made authorized papers web templates that can be used for an array of uses. Make an account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

Filing accounts and a company tax return with HMRC. You must state that these are the final accounts due to the planned dissolution of the company. Asking HMRC to close down the company's payroll scheme and deregister for VAT. Confirm that the company can, or has, paid any outstanding debts.

It will cost $120 to dissolve a New Jersey Corporation. This includes the $95 dissolution filing fee and the $25 tax clearance fee. If you pay with a credit card, there's an additional $3 processing fee.

Corporations ending business in New Jersey can dissolve, cancel, or withdraw online. Go to njportal.com/dor/annualreports and select ?Close a Business.? Businesses that choose to complete a paper application must submit all of the following: Appropriate dissolution/withdrawal/cancellation form.

Although some people confuse dissolution and termination, dissolution does not terminate an LLC's existence. What it does is change the purpose of its existence. Instead of conducting whatever business it conducted before, a dissolved LLC exists solely for the purpose of winding up and liquidating.

Yes. You will need clearance from the Division of Taxation to dissolve a New Jersey corporation.

While both words are concerned with the end of a business partnership, dissolution refers to the process itself, and usually to the departure (or death) of one or more individuals from the entity, while termination refers to the cessation of all operations, including the disposal of all assets.

A Certificate of Cancellation must be signed by all General Partners. List the name as it appears on the records of the State Treasurer. Provide the 10-digit business entity identification number issued by the State of New Jersey. Enter the date of formation or authorization in New Jersey.

Failure to dissolve the corporation when the corporation has ceased doing business will result in the legal requirement to continue to file Corporation Business Tax returns with the necessary remittance of the minimum CBT tax.