New Jersey Self-Employed Nail Technician Services Contract

Description

How to fill out Self-Employed Nail Technician Services Contract?

Locating the appropriate legal document template can be a challenge. Obviously, there are many templates accessible online, but how do you identify the legal form you require.

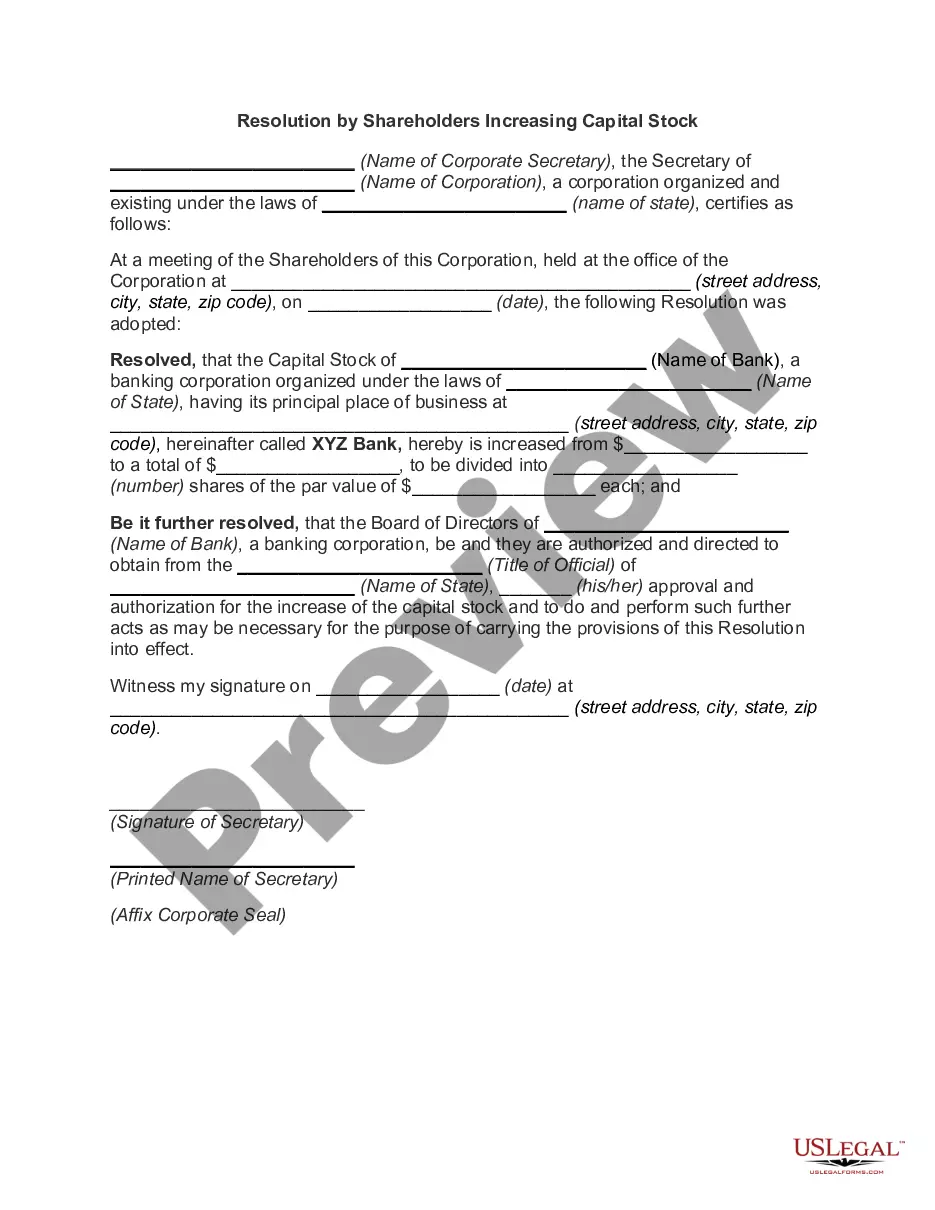

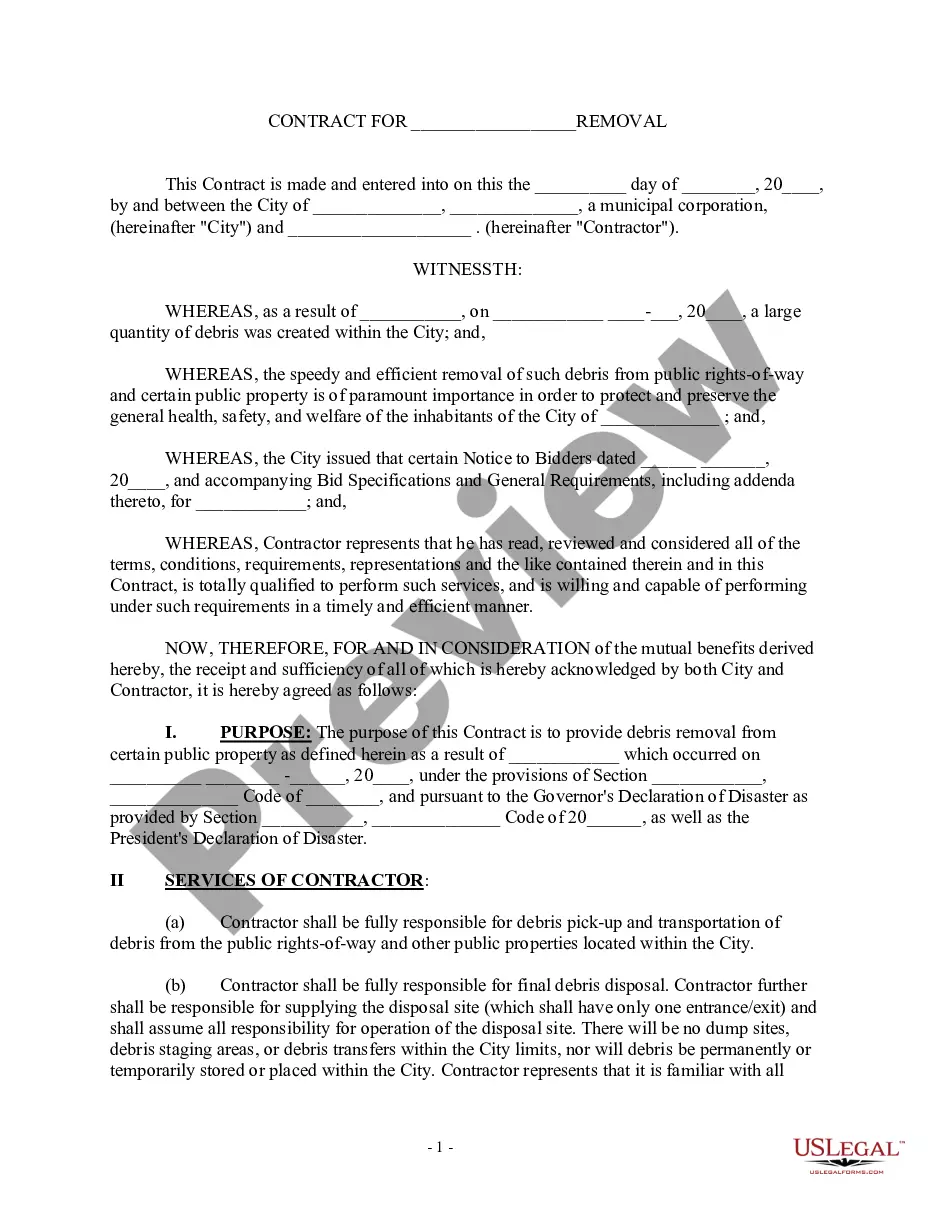

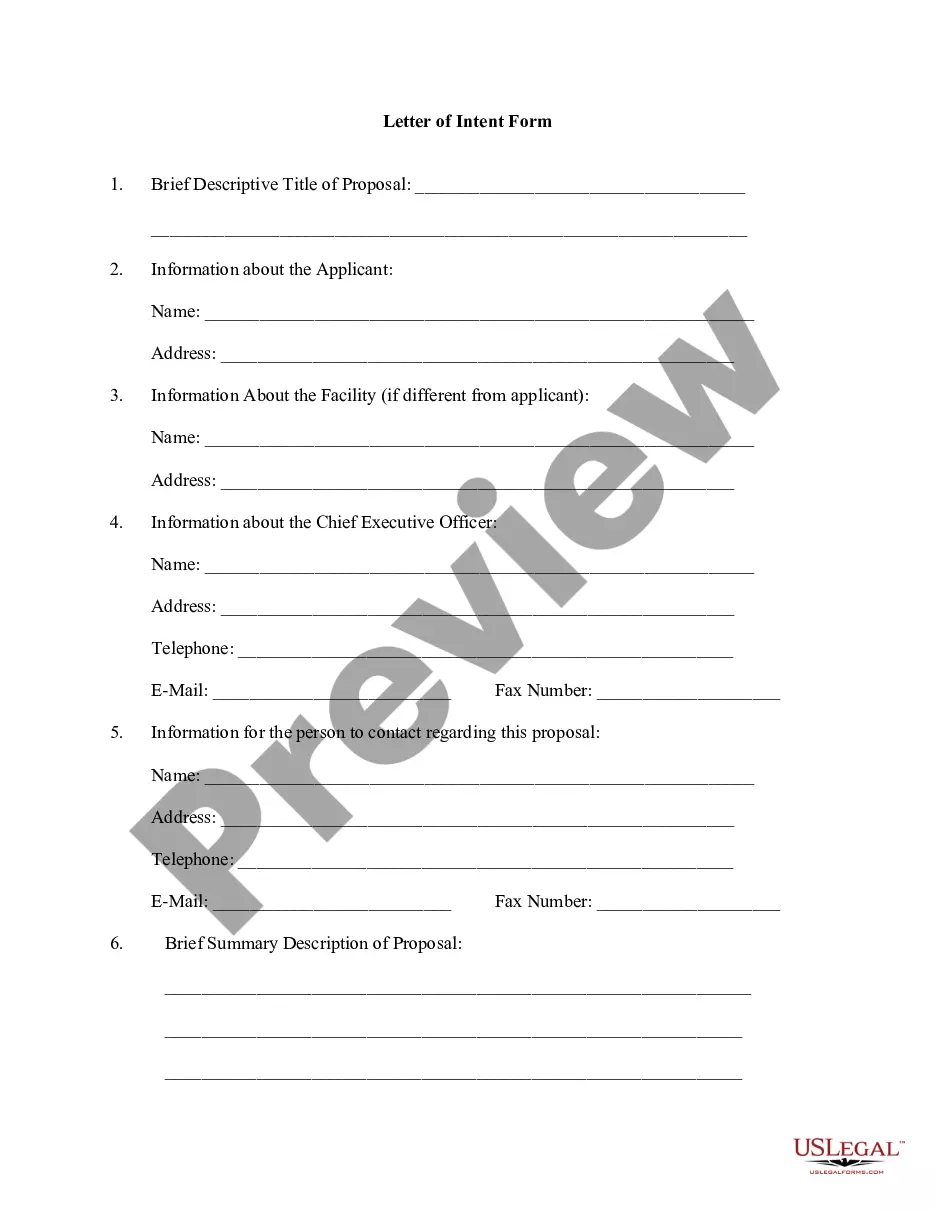

Utilize the US Legal Forms website. The platform offers a wide array of templates, including the New Jersey Self-Employed Nail Technician Services Contract, which you can utilize for both business and personal purposes.

All the forms are vetted by professionals and comply with state and federal regulations.

Once you are confident that the form is accurate, click the Buy now button to acquire the document. Choose your preferred pricing plan and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired New Jersey Self-Employed Nail Technician Services Contract. US Legal Forms is the largest library of legal forms where you can find numerous document templates. Leverage the service to access professionally crafted paperwork that meets state requirements.

- If you already have an account, sign in to your account and click the Download button to obtain the New Jersey Self-Employed Nail Technician Services Contract.

- Utilize your account to browse the legal forms you have previously purchased.

- Go to the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the right form for your city/county. You can review the form using the Preview button and examine the form details to make sure it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to find the correct form.

Form popularity

FAQ

Do You Need A License To Do Nails Uk? A nail tech in the UK does not require formal qualifications in order to do so, but they do have to complete either courses or apprenticeship schemes.

Best-Paying States for Nail Technicians The states and districts that pay Nail Technicians the highest mean salary are Montana ($41,640), New Hampshire ($37,870), Vermont ($37,250), Utah ($35,960), and Washington ($34,650).

"Manicurist" is sometimes used interchangeably with "nail technician." Like nail technicians, manicurists are licensed professionals. Most states reuire nail technicians to pass an exam and complete a training program, 'apprenticeship, or both.

For you individual nail techs, and almost all of you salon owners, you are going to use the cash method of accounting for reporting the revenue and expenses of your business. This means that you will report your revenue when you actually receive it and you will report your expenses when they are actually paid.

As with many small businesses, a nail salon operator can choose between several common business structures. Limited liability companies and sole proprietorships are common. A sole proprietor is an individually owned business with little formal distinction between the business and owner.

In many states, it's the law for salons to use a brand new file for every single client. Unfortunately, this isn't standard in many salons across the U.S. and infections can spread from person to person this way.

The IRS does not let you deduct personal expenses from your taxes. The Court states, expenses such as haircuts, makeup, clothes, manicures, grooming, teeth whitening, hair care, manicures, and other cosmetic surgery are not deductible.

Working for yourself as a nail technician can be rewarding, but being self-employed can also increase your tax burden. When you are self-employed, the Internal Revenue Service considers you to be both the employer and the employee, and that essentially doubles the amount of taxes you pay.

You can fully deduct small tools with a useful life of less than one year. Deduct them the year you buy them. However, if the tools have a useful life of more than one year, you must depreciate them. You can usually depreciate tools over a seven-year recovery period or use the Section 179 expense deduction.

Whether you're a nail technician who operates as a sole trader or you're a mobile operator, you will need insurance to cover such unexpected losses. Nail technician insurance covers many of the risks that standard business insurance covers.